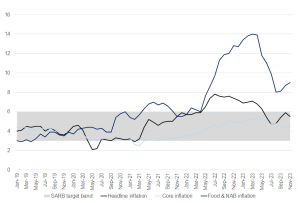

Headline consumer inflation, as measured by the consumer price index (CPI), cooled to 5.5% in November from 5.9% in October, marking its first contraction since July. MoM, CPI declined by 0.1%. The decline was mainly driven by a monthly decrease of 5.5% in the fuel price index, which drove the annual rate for fuel lower to 1.8% in November from 11.2% in October. This, in turn, led to a drop in the annual rate for transport, which decreased to 4.3% from 7.4%. Core inflation (which strips out the more volatile price categories of food and energy costs) increased slightly to 4.5%, from 4.4% in October, which is notably still at the midpoint of the South African Reserve Bank’s (SARB) target range.

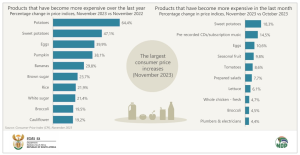

Unfortunately for the average South African, consumer prices for food and non-alcoholic beverages accelerated to 9% – its highest level in four months. The recent Avian influenza outbreak (more commonly called bird flu) continues to filter through to chicken and egg prices, disrupting the poultry market at large. Egg prices were almost 40% higher YoY in November. The annual rate for individual quick-frozen (IQF) chicken was 7.3% higher in November, up from 5.5% in October. Non-IQF frozen chicken recorded an annual increase of 9.1% in November.

Figure 1: SA inflation rate, YoY % change

Source: Stats SA, Anchor

Other notable price changes in November included household maintenance services (comprising rates for plumbers and electricians) surveyed in May and November each year. This category registered an annual rate increase of 7.4% in November – the highest rate since the current CPI series began in 2008. Pharmaceutical products recorded an annual price rise of 7.5%. Non-prescription medicine products that registered high inflation rates include vitamin and mineral supplements (up 13.2% YoY), heartburn medication (up 12.6% YoY), pain killers (up 12.3% YoY) and cough syrup (up 10.3% YoY). Overall, the price categories that included the biggest increases both on a monthly and an annual basis remained mainly food items. The bar charts in Figure 2 below show the products that recorded the most significant YoY and MoM price increases in November.

Figure 2: Products that recorded the most significant annual (Lhs) and monthly (Rhs) price increases in November

Looking ahead, we believe that inflation will continue to moderate gradually. However, the outlook faces significant upside risks, particularly regarding food prices. The emergence of the El Niño-Southern Oscillation (ENSO), which typically implies below-average rainfall for SA, poses a risk of higher food prices. At the same time, renewed geopolitical tensions in the Middle East raise the risk of oil prices staying elevated for longer. Furthermore, the rand will face headwinds from the expected deterioration in the government’s fiscal position and growing uncertainty as the country enters a precarious political environment ahead of next year’s national election.

Nonetheless, the cumulative 475-bp increase in interest rates since November 2021 is starting to dampen demand, as evidenced by slowing household consumption of interest rate-sensitive goods. As the year draws to a close, we continue to maintain that rates have reached their peak and will remain at current levels for some time. The forward-looking real interest rate is already high enough for the prevailing economic backdrop, with inflation forecasts remaining inside the target range and demand-driven and wage inflation remaining modest. Any possible interest rate cuts will likely only materialise towards 2H24 and will naturally depend on the inflation outlook (locally and abroad) and global interest rate developments as we progress into the new year.