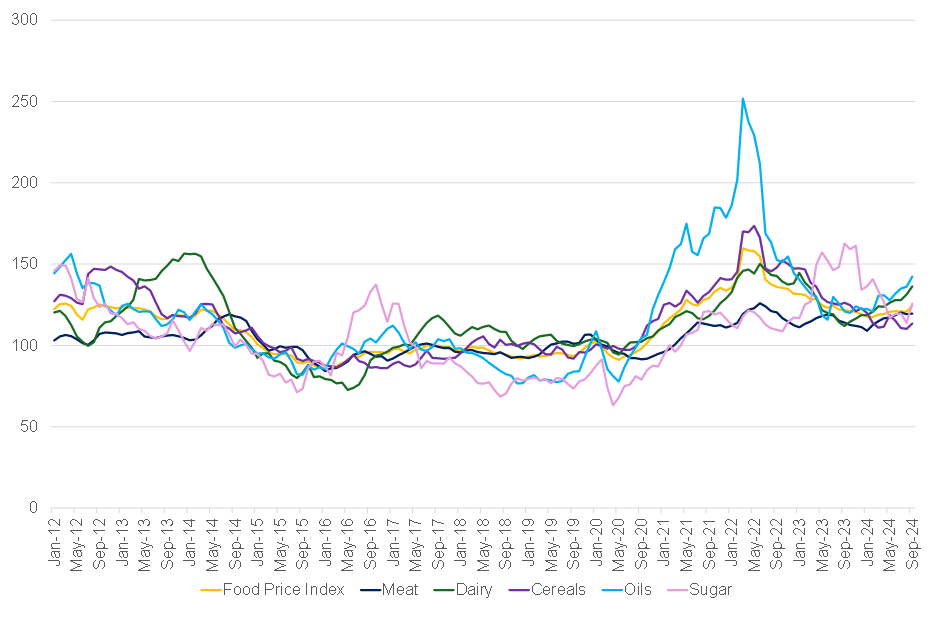

In September 2024, the UN Food and Agriculture Organization’s (FAO) Global Food Price Index (FFPI), the benchmark for global food commodity prices, experienced its fastest increase in 18 months. Prices rose across all five of the FFPI’s commodity group price indices, with sugar leading the surge. The FFPI averaged 124.4 points for the month, marking a 3.0% increase from August and a 2.1% YoY rise. The FAO Sugar Price Index saw the most significant jump, climbing 10.4% MoM. This spike was driven by worsening crop conditions in Brazil and concerns that India’s decision to lift restrictions on sugarcane for ethanol production might reduce its sugar exports. The FAO Cereal Price Index rose 3.0% MoM, mainly due to higher wheat and maize prices. International wheat prices have increased, primarily due to excessively wet conditions in Canada and the EU, though competitive supplies from the Black Sea region offset some of the pressure. Low water levels on major transportation routes along Brazil’s Madeira River and the Mississippi River in the US influenced maize prices. Meanwhile, the FAO All Rice Price Index dropped by 0.7% MoM, reflecting quieter trading activity. The FAO Vegetable Oil Price Index rose by 4.6% MoM, with palm, soy, sunflower, and grapeseed oils all seeing higher prices. Palm oil prices were buoyed by lower-than-expected production in major Southeast Asian producers, while soy oil prices rebounded due to lower-than-expected US crushing volumes. The FAO Dairy Price Index increased by 3.8% MoM, with higher quotations for whole and skim milk powder, butter, and cheese. The FAO Meat Price Index edged up 0.4% MoM, driven by more robust demand for Brazilian poultry meat. Bovine and pig meat prices remained stable, while ovine meat prices decreased slightly from August.

Figure 1: FAO Global Food Price Index, January 2012 to September 2024

Source: FAO, Anchor

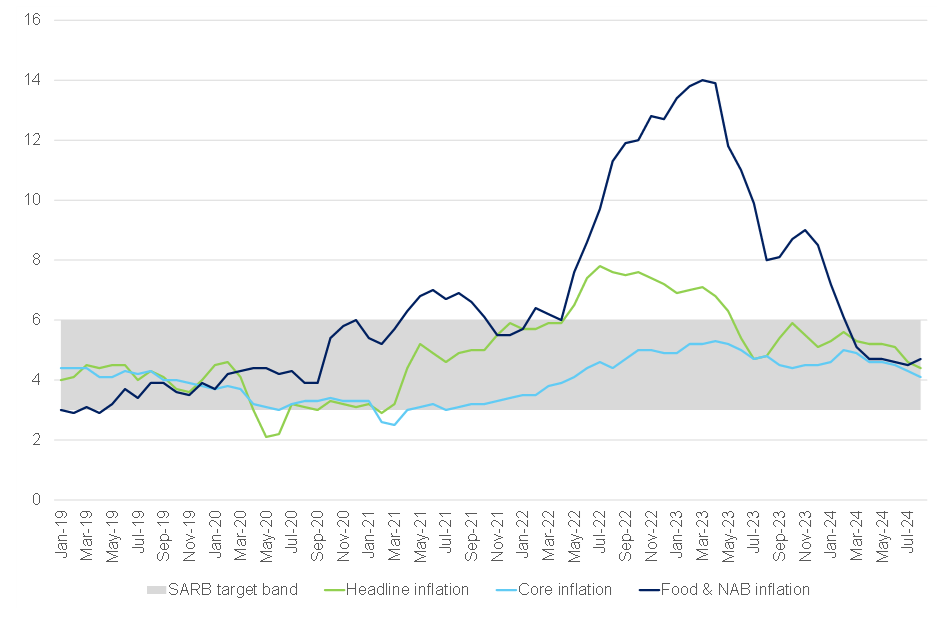

Amid a streak of positive developments for South Africans, August inflation, as measured by the Consumer Price Index (CPI), revealed a continuation of the disinflationary trend, with headline inflation decelerating further to 4.4% YoY from 4.6% YoY in July. In addition, the print came in slightly below consensus economists’ expectations and is the lowest inflation rate since April 2021, when it also printed at 4.4%. The easing of price pressures appears widespread, with a notable slowdown in energy prices, which fell from 12.1% YoY in the previous month to 11.5%. However, inflationary pressures persist in certain areas, as seen in the slight uptick in categories such as food and alcoholic beverages and tobacco products. After an eight-month decline, annual food & NAB inflation rose to 4.7% in August from 4.5% in July, putting upward pressure on the headline inflation rate. Most food categories saw higher annual rates, including bread & cereals, meat, fish, milk, eggs & cheese, oils & fats, and vegetables. In contrast, lower rates were recorded for fruit, sugar, sweets & desserts, and hot and cold beverages.

Figure 2: SA inflation, January 2019 to February 2024 (YoY, % change)

Source: Stats SA, Anchor

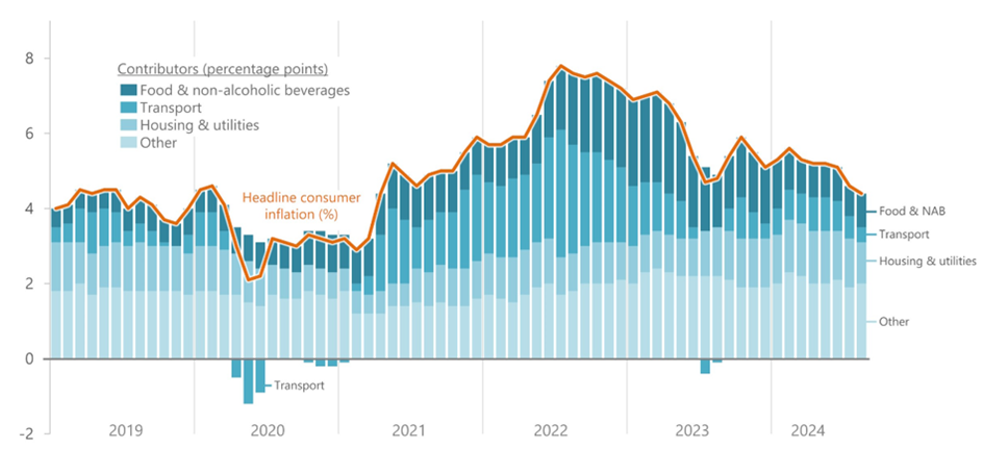

Figure 3: What drives consumer inflation? Major contributors to the headline rate (January 2019 to August 2024)

Source: Stats SA

Yellow maize prices increased by 2.6% MoM in the SA maize market, while white maize rose by 1.4%. Compared to August 2023, prices remain significantly higher, with yellow maize up 11.9% and white maize surging 48%, from R3,616/tonne to R5,357/tonne in 2024. The sharp rise is due to drought-related production declines, particularly in white maize, which is grown in drought-hit areas. White maize prices are also supported by strong domestic demand and in neighbouring countries affected by the drought. White maize is expected to trade at a premium of over R1,000/tonne above yellow maize this year, though this premium is likely to disappear in the 2024/2025 season as surplus crops are expected.

In the vegetable oil market, soybean prices fell by 2.2% MoM and 7.8% YoY, continuing a downward trend from earlier in the year. The drop reflects lower global soybean meal and oil prices despite a 36% YoY decline in SA’s soybean production. Sunflower prices decreased by 1.8% MoM but are 2.4% lower YoY, showing resilience against drought conditions.

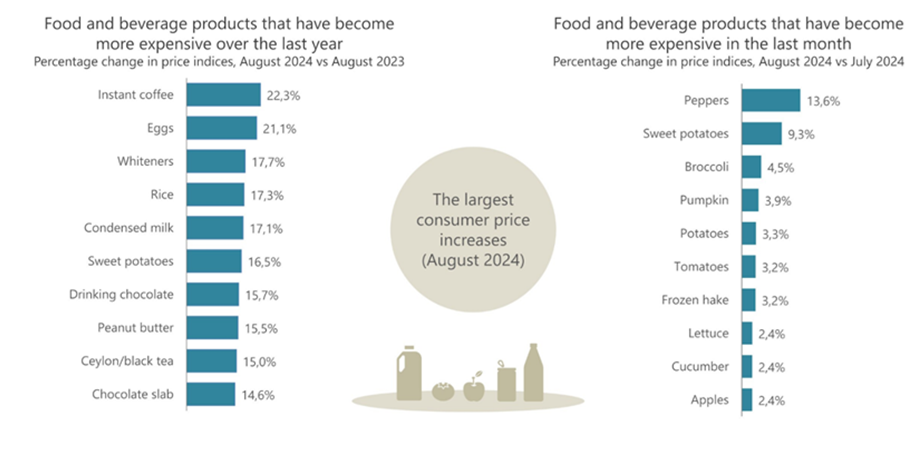

In the dairy market, August 2024’s YoY inflation was the highest for condensed milk (+18.3%), with modest inflation for fresh milk (+3.5%) and cheese (+2.29%). Most dairy products saw stable prices despite high production costs.

In the meat market, beef carcass prices dropped slightly in August (by 0.8% MoM) but remained 5.2% higher YoY, driven by increased exports and stable market conditions. Pork prices grew modestly by 1% MoM, while poultry prices remained stable, rising by 0.7% MoM. Prices dropped by 14% YoY as production recovered post-avian flu outbreak.

Fresh produce inflation rose slightly in August, with fruit inflation at 1.9% and vegetable inflation at 4.4%. Oranges and papayas saw the most significant price increases, while bananas experienced a price drop due to higher traded volumes. Vegetable prices were driven by lower tomato production, while higher onion volumes eased prices in the local market.

Figure 4: Food and beverage products that recorded the most significant annual and monthly price increases in August

Source: Stats SA

Overall, as at August 2024 (the latest available data), South African maize prices remain elevated due to a reduced summer crop, with significant price decreases anticipated only when the 2025 harvest arrives. Strong demand from SA and neighbouring Southern African countries further boosted white maize prices. The vegetable oil market showed mixed results, with soybean prices falling, reflecting lower import parity prices for soybean oil and protein meal. Dairy prices increased, particularly for whole milk powder and butter, driven by strong global demand. In the meat market, beef prices dipped slightly but remained higher than the previous year, supported by increased cattle slaughter and export activity. Fresh produce inflation was notable, especially for oranges and papayas, while bananas saw deflation due to higher trading volumes.

While food inflation is expected to remain stable over the short term, meat prices could rise towards the end of this year due to demand for the festive season. Additionally, the appreciation of the rand, following September’s 50-bp interest rate cut in the US and 25-bp cut in SA, could help lower inflation on imported food products.