Introduction

South African investors are increasingly diversifying their investment portfolios away from SA and into global markets. This shift is driven by the desire to access a broader investment universe and to diversify away from the challenges of the struggling local economy. Furthermore, investors can benefit from a depreciating rand, as weakness in the local currency will enhance their rand returns. As part of this process, investors must externalise their rand for hard currency, typically the US dollar, and the rate at which this transaction occurs will ultimately impact their returns in rand – a stronger rand at the time of the initial investment will enhance investor returns. In contrast, a weak rand will reduce returns. Consequently, many investors perceive the initial exchange rate as crucial to their long-term return profile, often opting to wait for the rand to strengthen before executing this type of transaction. This is especially true in an election year, where investors may view SA’s national election as a potential catalyst for rand strength. However, this decision has an opportunity cost, as investors may miss out on the performance of the underlying offshore investment.

This begs the question: Is it prudent to wait for the rand to strengthen in the short term before investing in offshore markets? This article examines four key aspects of this decision.

- How likely is the rand to weaken once you have externalised your investment?

- How has the rand performed after previous national elections?

- What are the historical worst-case scenarios when externalising your money?

- What is the most likely outcome?

How often does the rand strengthen?

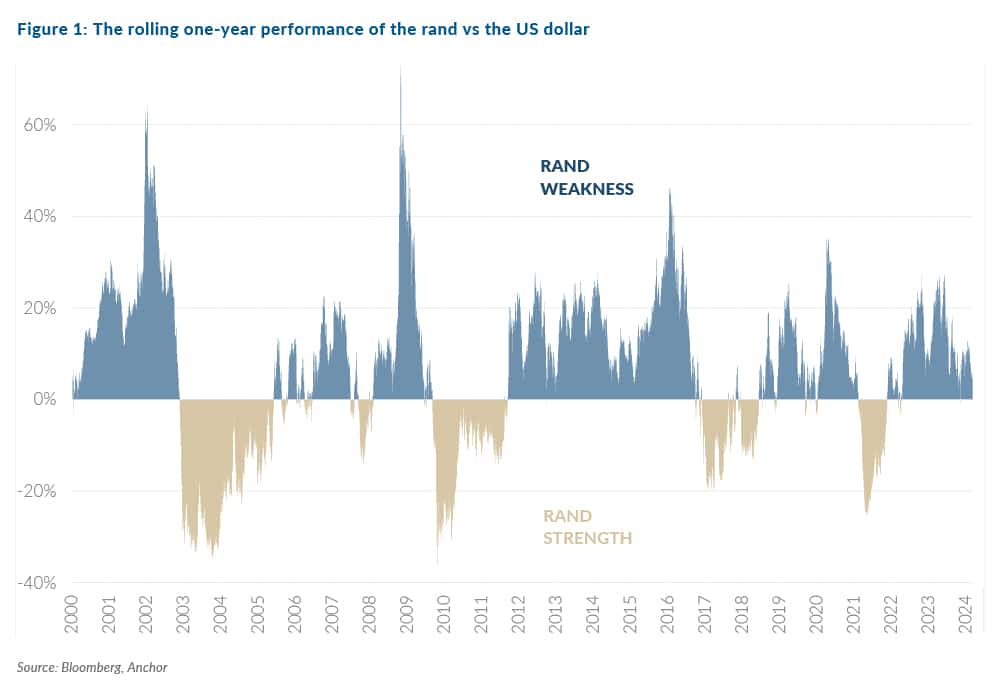

Simply put, the rand is more prone to weakening than strengthening over time. For example, the exchange rate began in the 2000s at R6.15/US$1 and ended at R19.20/US$1 in February 2024, indicating a 4.8% p.a. depreciation rate over that period. Analysing the rolling one-year performance of the rand from January 2000 to February 2024 reveals that the local unit depreciated relative to the US dollar on approximately 67% of the measured days over one year. This likelihood increases significantly over longer periods, reaching 77% and 82% over three and five-year rolling periods, respectively. These statistics suggest that, historically, the rand has been more likely to weaken than strengthen, reinforcing the notion that history is on your side when externalising your funds.

How has the rand performed after previous national elections?

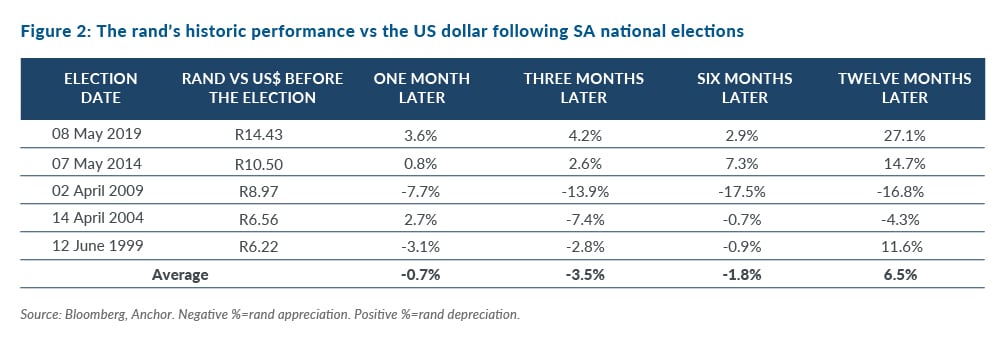

Many investors may be especially inclined to wait for the rand to strengthen in 2024, as the South African national election presents a potential catalyst. The table in Figure 2 below highlights the rand’s performance after past national elections.

The table above shows a wide disparity in the rand’s performance following a national election. The 2009 election was the only year we saw meaningful rand strength from which investors could benefit. However, this move likely had little to do with the South African election but was probably driven by the rand’s mean reversion after significant weakness due to the global financial crisis (GFC). Subsequently, there is little historical evidence for rand strength in an election year.

What are the historical worst-case scenarios?

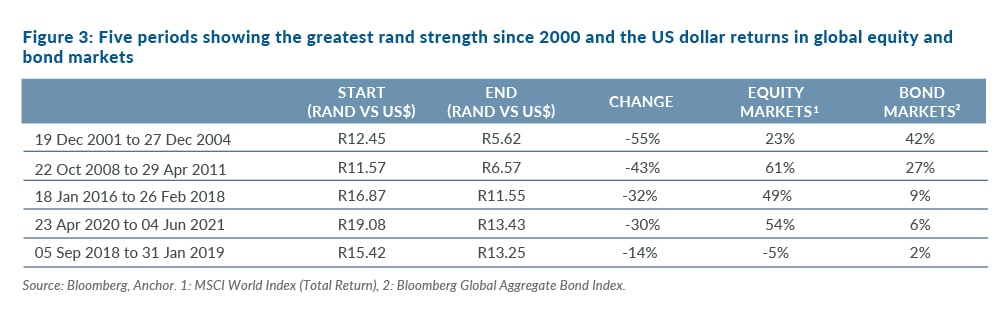

Despite the rand’s tendency to weaken over time, there have been periods of material rand strength. The worst-case scenario for an investor would be externalising their investment at the start of one of these periods. However, this outcome can only be evaluated by considering the underlying asset’s performance (generally equities or bonds). The table below outlines five periods characterised by the greatest rand strength since 1 January 2000 and the US dollar returns for both global equity and bond markets over those same periods.

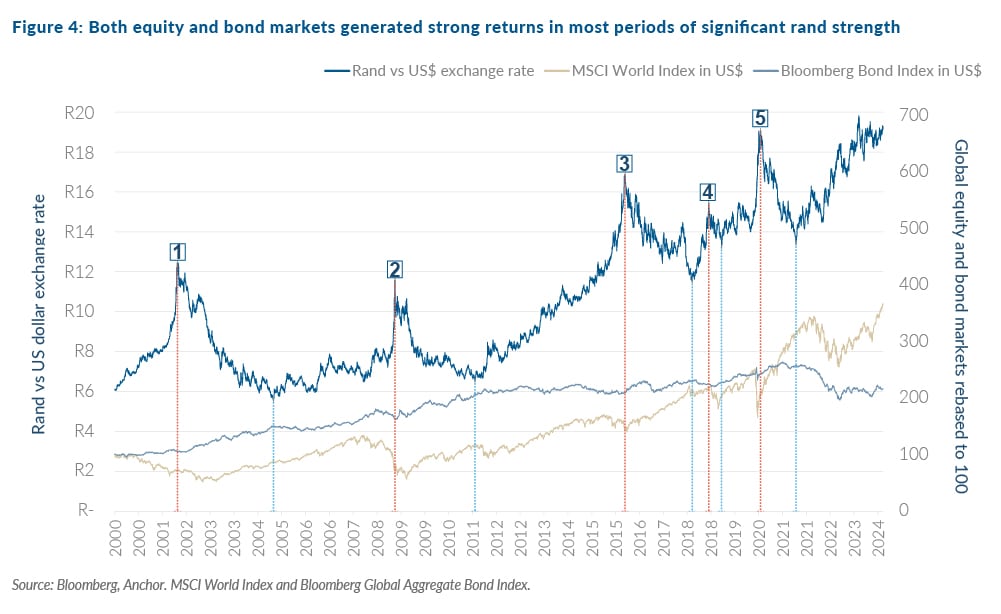

Notably, equity and bond markets generated strong returns in most periods of significant rand strength. Subsequently, investors caught on the wrong end of the rand strength were hedged to a certain degree. This can be seen in the chart (Figure 4) below, where the start of each period is indicated by an orange vertical line and the end of the drawdown by a light blue line. As an EM currency, the rand is likely to strengthen during those periods when there is a positive investment sentiment, and global markets are also highly likely to perform well.

A further takeaway from Figure 4 is that the five periods highlighted in the table (Figure 3) were initiated by severe rand weakness over a short period due to the following events, all of which were very significant at the time:

- The 9/11 terrorist attacks against the US.

- The GFC.

- The firing of Nhlanhla Nene as finance minister.

- The firing of Pravin Gordhan as finance minister.

- The COVID-19 pandemic.

Outside of these periods, a negative outcome becomes far less likely.

What is the most likely outcome?

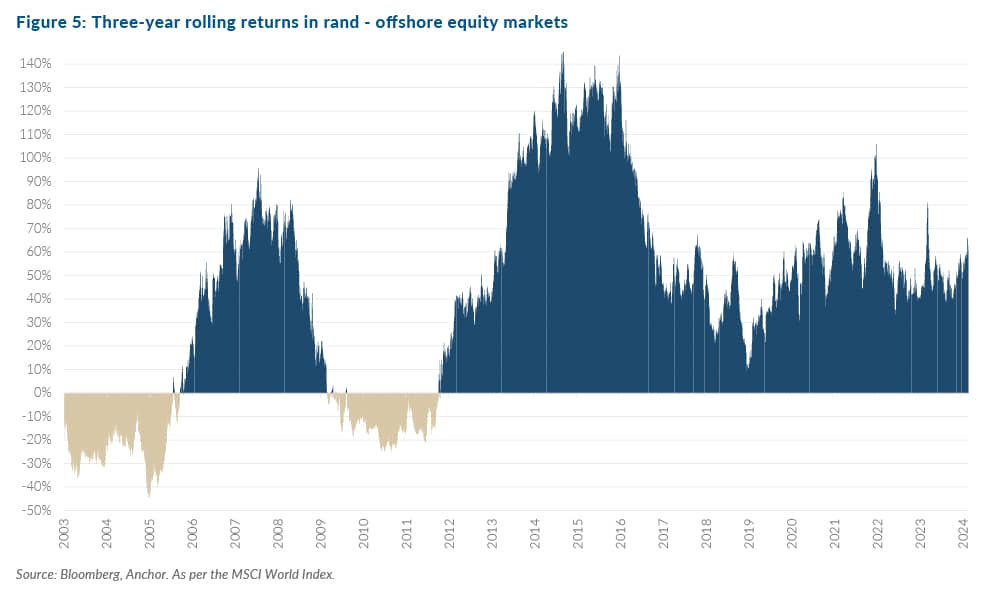

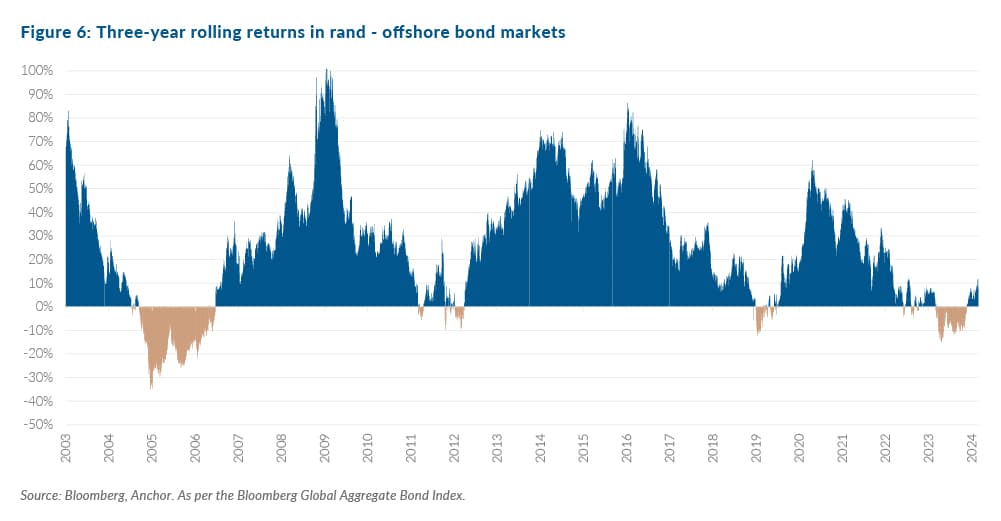

Lastly, one must consider the most likely outcome over the long term, not only the worst-case scenario over the short term. After all, most South African investors who choose to invest offshore are doing so with a long-term time horizon. Figures 5 and 6 below show the three-year rolling returns in rand for offshore equities and bonds since 1 January 2002. Over this period, investors would have received a positive rand return in 75% of the scenarios when invested in global equity markets and 83% for global bond markets over three years. Consequently, if investors extend their view well beyond short-term currency fluctuations, their return on the offshore investment will likely be positive for both equity and bond portfolios.

Conclusion

Investing in offshore markets can be daunting, especially for first-time investors. For many, the first step in this undertaking is the foreign exchange transaction, and often, an investor will pause the process at this step to wait for a favourable movement in the exchange rate.

At this point, it is important to look at the big picture and remember the following:

- The rand is historically more likely to weaken over the next year than it is to strengthen.

- Even if the rand strengthens significantly after investors have traded, this is likely to be offset to a degree by the strong performance of the underlying investment.

- Investors may miss out on performance in offshore markets if they opt not to trade as they wait for the rand to strengthen.

- The most likely outcome in the long term is a positive return.