Discussing getting older is never easy and the possibility of not having enough assets to provide for your twilight years is just plain frightening.

It may be for these reasons that family retirement discussions often get postponed (in some cases indefinitely).

There may also be another factor at play – the silent change in the pension fund industry that has fundamentally altered how employees retire today. Whatever the reason may be, early retirement planning is an important part of any life.

Where did my guaranteed retirement go?

Retirement planning currently is very different from how your parents and grandparents prepared for their retirement. The main consideration for earlier generations was making sure you were with a good company that provided a solid pension plan for its employees. The next step was to stay with the company for as long as possible to maximise the benefits at retirement. So what has changed?

Defined benefit vs defined contribution funds

A defined benefit fund is a fund where the benefits are stated in the rules of the fund. The benefits are usually guaranteed and don’t depend on the underlying investment returns of the fund. A defined benefit fund, for example, could pay a percentage of the employee’s final salary for life (and a smaller percentage could continue to pay the spouse on the death of the retiree). In this scenario, the employer bore the risk of making sure the employee had a secure retirement.

A defined contribution fund places the risk on the employee – if the investment returns are poor, or the employee lives longer than expected, they run the risk of not having enough income in their later retirement years.

Defined benefit funds were the norm at large firms in South Africa for many years. Today the closing of defined benefit funds has become a global trend with multinational companies moving away from guaranteed benefits for employees. This has given rise to the prominence of defined contribution funds – and increased uncertainty for retirees. The outcome for defined contribution fund members is that you now have to secure your own retirement as your employer is not going to do it for you. Planning and managing capital drawdowns over time is now the primary focus of most retirement planning.

The impact of longevity

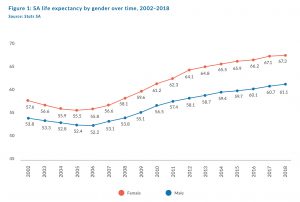

We are living longer today than previous generations which is exciting, and a bit daunting as well. The life expectancy of a female South African has increased by 10 years since 2002 (see Figure 1). This means that a girl born today will statistically live 10 years longer than a girl born in 2002.

The trend of living longer is increasing internationally with improved access to medical care and the improved quality of medical treatment.

A longer lifespan is something we need to factor in when planning for retirement – you may fall short if you are only projecting retirement income to age 80. What if you live to be 85 or 90? Do you have sufficient capital to provide for over 30 years’ worth of living expenses in retirement?

Living longer also means there will be a need to cover increased medical expenses down the line. Managing these requirements through your retirement takes careful planning, discipline and an ongoing review process to keep you on track.

The different stages of retirement

Retirement is often thought of as a single event for which we need to prepare. However, retirement is in fact a phase of life that can be broken down into two main stages – each with its own unique requirements and expectations.

The early years:

The first years of retirement tend to be mainly activity and travel focused for many retirees. Think of it as the time to tick those remaining items off your bucket list. Always wanted to travel to Paris? Fancy a world cruise? This is the time to do it (while your health and energy levels are still good). Planning and implementing these goals will usually consume most of the time and financial focus in this stage of retirement.

The later years:

As retirees get older there is a tendency to be more locally based and travel reduces drastically. Medical expenses increase at this stage and start to take up a greater portion of an individual’s overall income.

The foundations of a secure retirement

Now that we know what retirement typically looks like, let’s start with a few basic rules for peace-of-mind retirement:

- Pay off your debt. Ideally all debts should be paid off by the time you reach retirement age.

- Own your own home, one that preferably will take you through the different stages of retirement (this can be a stand-alone property or a retirement village etc.).

- Have a good medical aid. Medical expenses ramp up the older you get. Make sure you are covered for any unexpected medical needs.

- Have enough assets/income to provide for your retirement needs.

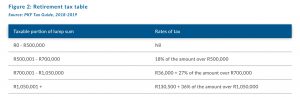

Pension funds, provident funds, preservation funds and retirement annuities all have one thing in common – the capital portion not taken in cash must be used to purchase an annuity. Provident funds allow for a withdrawal of up to 100% at retirement, while the other funds allow for a maximum withdrawal of one-third. You can decide on how much to withdraw based on your needs and the tax payable. Tax is paid according to the retirement tax table (Figure 2 below). Please double check with your tax practitioner as personal circumstances and fund specifics may change the tax treatment of your withdrawal.

Once you have taken your cash, the next step is to decide on how to provide for your retirement income.

Selecting your annuity

There are three options available for the remaining capital in your retirement fund. .

Defined benefit pension

The Government Employees Pension Fund (GEPF), for example, is a defined benefit fund that will allow you to calculate your actual income in retirement depending on years of service, the withdrawal amount etc. Once you have made your selection this will be implemented for you and can’t be amended down the line – so choose carefully!

Fixed/guaranteed annuity

These annuities are similar to defined benefit funds as you make a selection at retirement that can’t be changed down the line. In effect, you give up the capital in exchange for a promise from the insurer to guarantee you income for life. When you die there is no inheritance for your family. Therefore, if you have a spouse, it is advisable to look at a joint annuity that will provide guaranteed income for both of your lives. You may also want to consider a guarantee term that will ensure that the income is paid for a minimum number of years to your dependents (if both of you die soon after starting the annuity).

Living annuity (the flexible option)

A living annuity is a structure that allows you to decide how to invest your retirement savings in a tax-free environment. You must choose between 2.5% and 17.5% of the capital as an income every year, which can be paid monthly, quarterly or annually.

The trick with a living annuity is to draw an income that will be sustainable for the rest of your life – draw too much and you run the risk of running out of money. The Association for Savings and Investment South Africa (ASISA) table (see Figure 3 below) provides some guidance on drawdown percentages in retirement, based on different investment return assumptions.

A general rule would be to keep income drawn to a maximum of 5% p.a. but this will depend on various factors including retirement age and personal circumstances.

In summary

Retirement should be viewed as a process rather than a once-off event. It is well worth your while to engage with an experienced advisor/planner to help you navigate the various choices and options specific to your own retirement plan. General principals will only take you so far – the most advantageous solution is the one that will best cater to your ongoing retirement needs.

Disclaimer: The contents of this article is for information purposes only and the accuracy, completeness, timeliness, or correct sequencing of any of the information contained herein cannot be guaranteed and should thus not be construed as investment advice. Readers should thus only act thereon after having consulted their financial adviser.