Despite South Africa’s (SA) gradual economic recovery, the country is grappling with a relentless rise in unemployment, casting a shadow over the country’s recovery efforts. While key economic indicators show a positive trajectory, this progress has not yet trickled down to many South Africans in the form of job opportunities. Structural challenges, such as a skills gap, labour market rigidities, and the lingering impact of the COVID-19 pandemic, have exacerbated unemployment rates, especially among the youth. As the economy expands, the persistent lack of jobs threatens to widen the inequality gap, undermining social stability and eroding the gains of recent economic advancements.

A combination of structural deficiencies, such as a lack of skills, limited access to quality education and training, and inadequate job creation, has resulted in a large portion of the population being unable to find gainful employment. According to the latest Quarterly Labour Force Survey (QLFS) data from Stats SA, released on 13 August, SA’s official unemployment rate increased to 33.9% in 2Q24 from 32.9% in 1Q24.

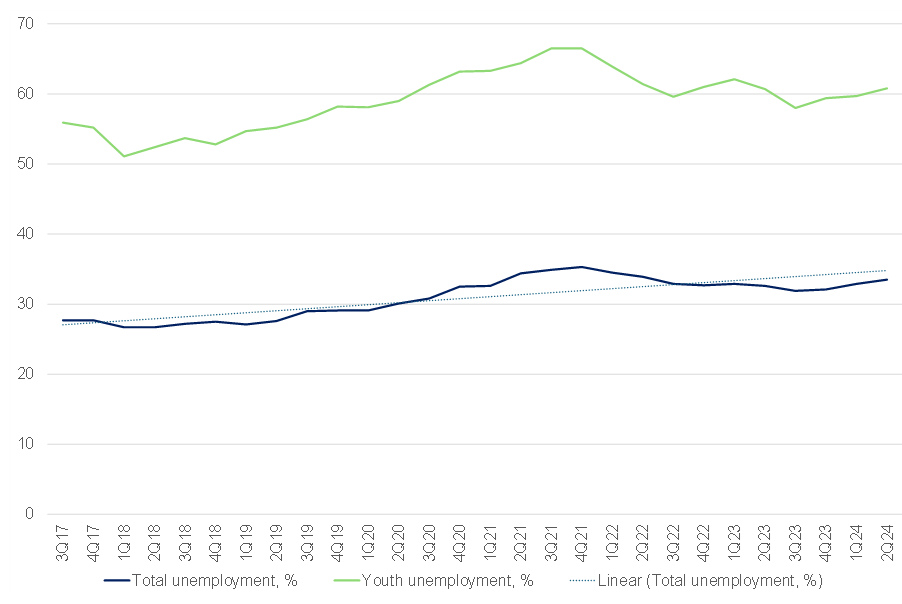

Figure 1: SA quarterly unemployment rate, 3Q17-2Q24

Source: Stats SA, Anchor

The latest (2Q24) increase is the third consecutive quarter that the official unemployment rate has risen, taking it closer to the record high above 35% reached in 2021 during the height of the COVID-19 pandemic. On average, joblessness in SA has increased by about 10 ppts in the three decades since the ANC came to power. The unemployment rate, according to the expanded definition (which includes those discouraged from seeking work and thus more reflective of the actual number of unemployed South Africans), rose further to 42.6% – concerningly high. This points to longer-term, structural issues within the local economy as it is difficult to reincorporate and entice discouraged work seekers back into the labour force.

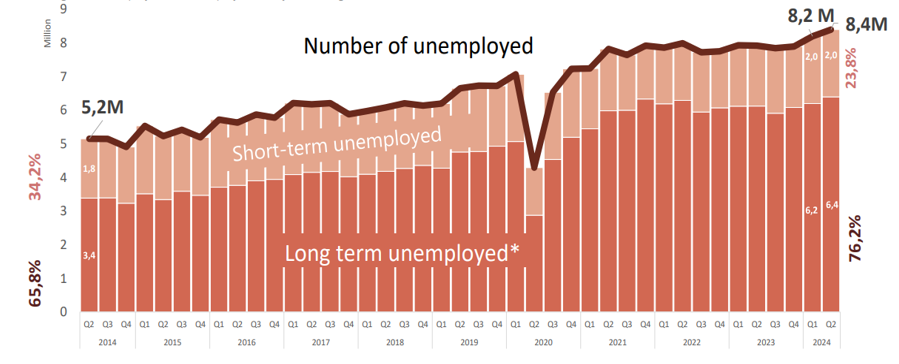

Of further concern is the long-term unemployment rate (i.e., those unemployed for a year or longer), which has steadily increased over the past decade – from 65.5% in 1Q13 to 76.2% in 2Q24. Moreover, SA’s unemployment problem remains particularly acute among the youth, where high levels of unemployment hinder their prospects and exacerbate social inequalities. As such, the youth (age 15-24) unemployment rate has risen again (to 60.8%).

Figure 2: SA long-term unemployment (unemployed for a year or longer)

Source: Stats SA. *Long-term unemployment = unemployed for a year or longer.

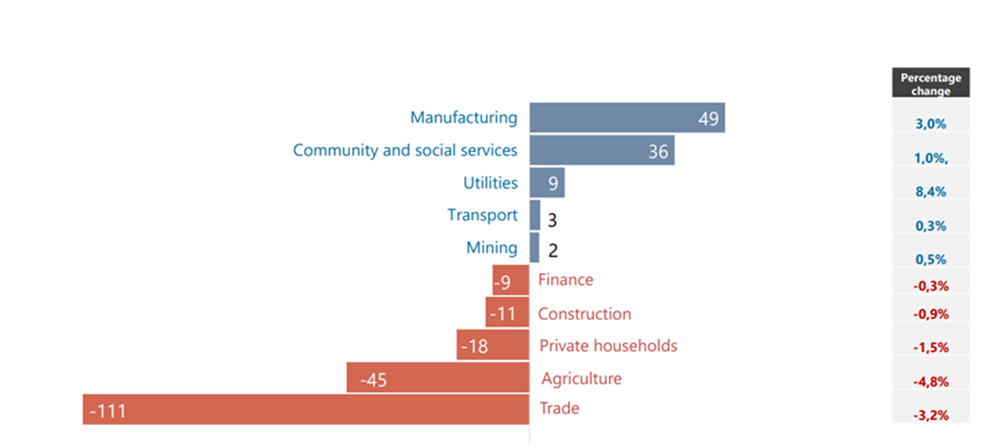

On a sectoral basis, employment decreases were seen in the following industries: Trade (-111,000), agriculture (-45,000), private households (-18,000), construction (-11,000) and finance (-9,000). However, increases in employment were mainly recorded in manufacturing (+49,000), Community and social services (+36,000) and utilities (+9,000). Prolonged weak consumer demand, frequent power cuts and logistics constraints at SA’s freight-rail system and ports have unsurprisingly taken a toll on companies’ profits and, thus, their ability to generate further meaningful employment opportunities.

Figure 3: QoQ % change in employment by industry (1Q24 vs 2Q24)

Source: Stats SA

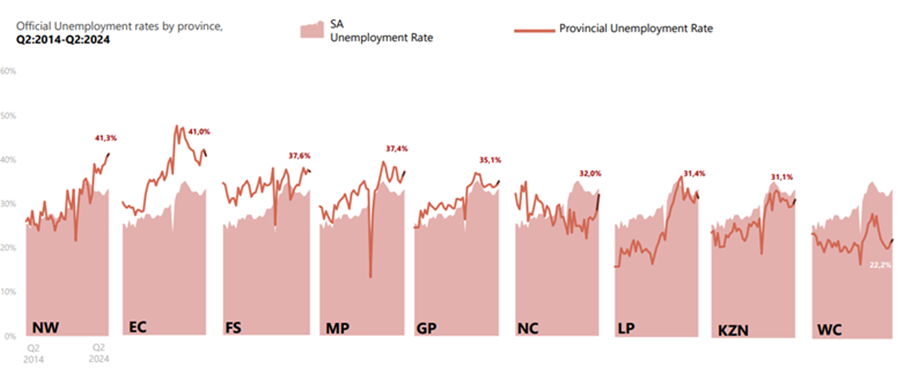

On a provincial level, it is interesting to note that while the unemployment rates in the Western Cape (WC) and KwaZulu-Natal (KZN) have consistently been below the official unemployment rate in SA for the past ten years, the unemployment rate in the Eastern Cape (EC) has continuously exceeded it. Employment prospects in SA have traditionally been better in the WC and KZN due to their diverse economies, strong tourism and agriculture sectors, well-developed infrastructure, and strategic governance. These provinces benefit from economic hubs like Cape Town and Durban, which attract investment and create jobs. Additionally, higher education and skill development levels in these regions make them more attractive to employers, contributing to more robust job markets than other parts of the country.

Figure 4: Official unemployment rates by province (2Q14-2Q24)

Source: Stats SA

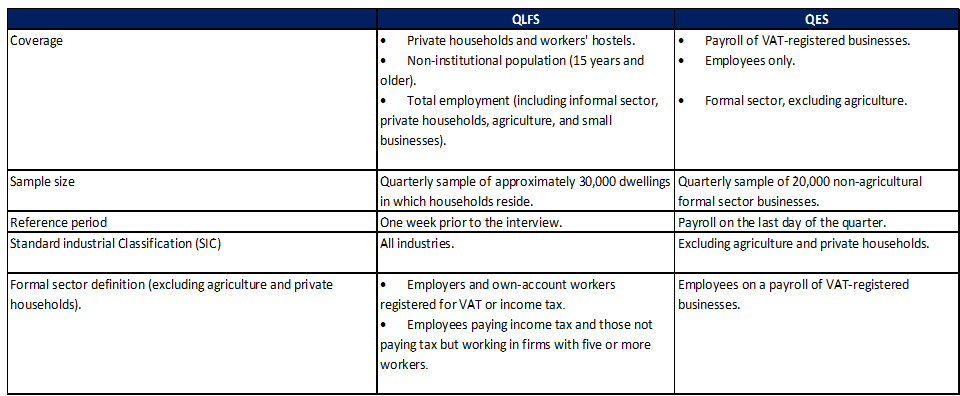

It is worth bearing in mind, however, that employment data from the QLFS survey (a household-based survey of labour market dynamics covering the formal, informal, and agricultural sectors) have diverged sharply in recent months from the Quarterly Employment Statistics (QES) data, which is an enterprise-based labour market survey that only reports on the formal sector. Thus, gaining a more transparent and holistic picture of SA unemployment is becoming increasingly difficult.

Figure 5: Key differences between the QLFS and the QES

Source: Stats SA, Anchor

Regardless of the exact data, we maintain that the official headline unemployment numbers do not fully reflect the true extent of the unemployment crisis in the country. How unemployment is measured tends to overlook specific segments of the population, such as discouraged workers who have given up searching for jobs and are, therefore, not considered part of the active labour force. Additionally, the official statistics do not adequately capture informal and underemployed workers. Furthermore, the official unemployment rate might not fully account for the quality of jobs available or the degree of job security. Many individuals in SA are trapped in low-skilled and precarious employment, leading to underemployment and persistent poverty.

Moreover, in the domestic economy, material job creation has only occurred when GDP growth approaches 3% p.a. Currently, businesses remain under significant pressure from the ongoing effects of loadshedding, which also weighs on jobs and the unemployment data. Thus, the economy is simply not growing at an adequate rate to sustainably boost long-term employment prospects for South Africans. At the end of the day, SA’s unemployment problem is a complex and multifaceted issue that requires sustained and coordinated efforts from all sectors of society to create inclusive and sustainable employment opportunities for all South Africans.