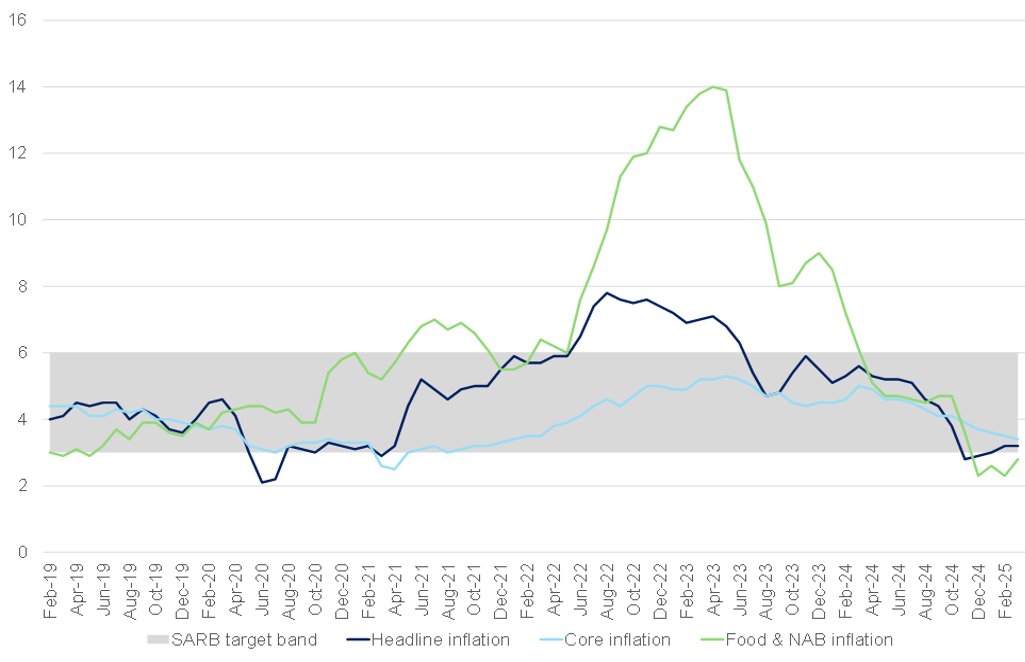

South Africa’s (SA) March headline Consumer Price Index (CPI) inflation data, released on 23 April, surprised on the downside, coming in at 2.7% YoY – below market expectations. The softer print was primarily driven by a continued decline in fuel prices and a lower-than-usual increase in education costs. On a monthly basis, inflation eased to 0.4%, from 0.9% in February, pointing to a broad-based deceleration in price pressures. Core inflation, which strips out volatile components such as food and energy to offer a clearer picture of underlying price dynamics, also moderated. It slowed to 3.1% YoY (0.5% MoM) in March, down from 3.4% YoY (1.1% MoM) in February. This suggests a continued easing in underlying inflationary pressures across the domestic economy. Housing-related services, which had shown signs of reacceleration, remained relatively subdued.

Fuel prices continued to act as a major anchor on headline inflation. Fuel price deflation extended further, with pump prices down 8.8% YoY and 0.4% MoM in March. Looking ahead, this disinflationary trend is expected to deepen in April. A further 2.8% MoM cut in fuel prices at the start of April, and the daily data from the Central Energy Fund (CEF) suggest another decline of around 1.0% for early May. The continued softness in global oil markets (offsetting rand volatility) has been a critical driver of this trend, providing a significant drag on headline inflation and offering some respite to transport and logistics costs across the economy.

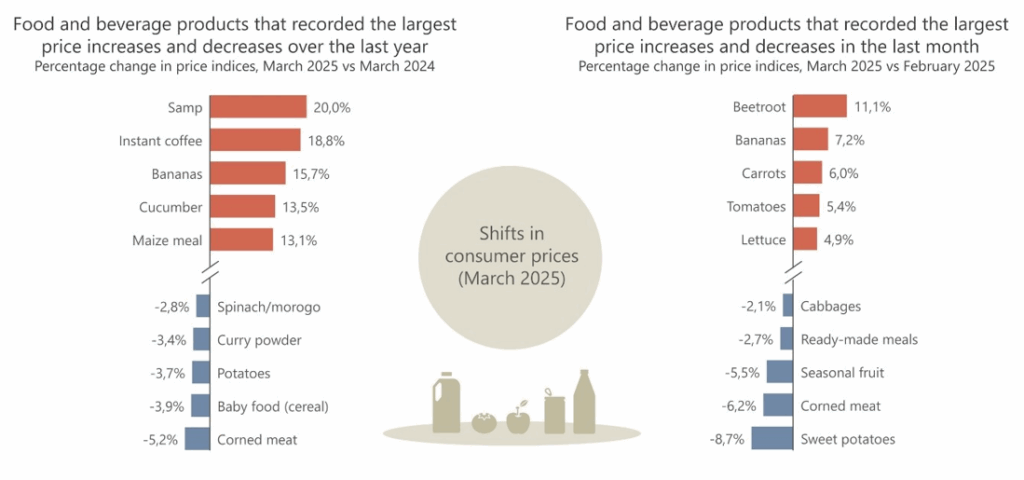

Food and non-alcoholic beverages (FNAB) inflation also edged slightly lower to 2.7% YoY in March, from 2.8% the previous month. Elevated maize prices from late 2024 continued to feed through to cereal-based products, though the pace of increase appears to be stabilising. Second-round effects in meat prices were evident, but MoM gains have started to taper, suggesting a potential peak in pass-through effects. Price gains in fish, vegetables, and fruit provided upward pressure, though overall food inflation remains relatively contained. That said, modest food price pressures are expected to persist through 2Q25, as higher farmgate prices for key staples continue to trickle down to the retail level.

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor

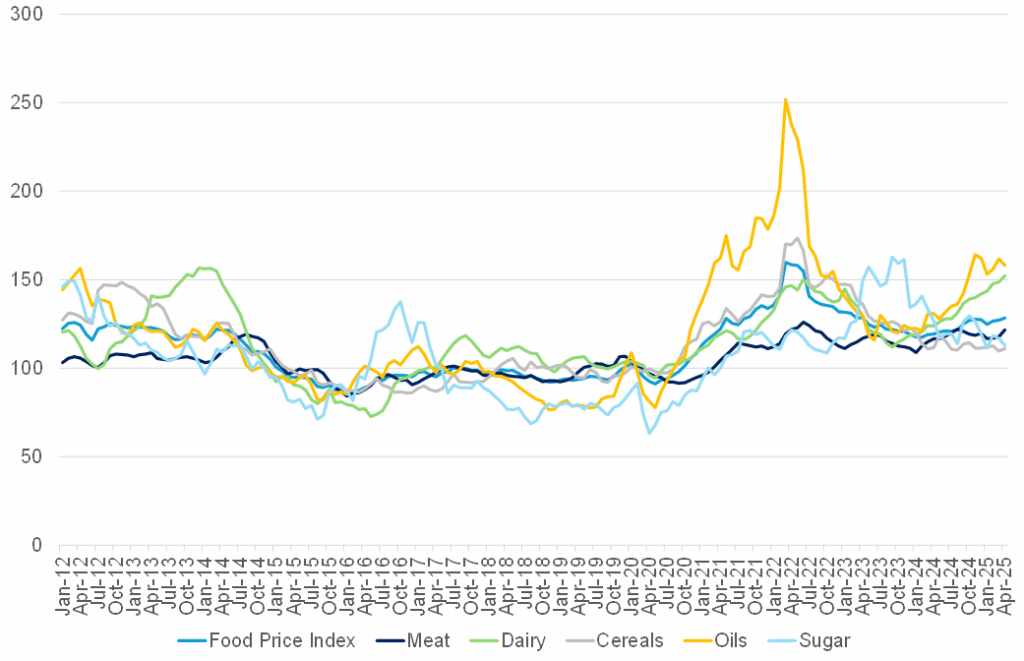

In April 2025, the Food and Agriculture Organization (FAO) of the United Nations reported that its Global Food Price Index (FFPI)—a key gauge of international food commodity prices—averaged 128.3 points. This marked a 1% increase from March’s reading of 127.1 points. Compared to April 2024, the index was up 7.6%, though it remained 19.9% below its peak in March 2022, following Russia’s full-scale invasion of Ukraine. Currency fluctuations have played a significant role in shaping global price trends, while recent adjustments in tariff policies have added to market uncertainty. Since internationally traded commodities are priced in US dollars, shifts in the dollar’s exchange rate directly affect countries’ terms of trade—that is, how much they can import in exchange for a fixed volume of exports. Typically, commodity prices move inversely to the dollar’s value: when it strengthens, prices tend to fall; when it weakens, prices generally rise.

Figure 2: FAO Global Food Price Index, January 2012 to April 2025

Source: FAO, Anchor

On a more commodity-specific basis, global wheat and maize prices declined in April 2025 due to favourable weather conditions and improved crop prospects in key producing countries. The FAO Cereal Price Index fell 2.6% MoM and 1.1% YoY. Wheat benefitted from better growing conditions across the EU, Türkiye, Kazakhstan, and the US. However, factors such as tight Russian supply, exchange rate movements, and Türkiye lifting its import ban (in response to drought) slowed the price decline. Maize prices were pushed lower by strong supply signals, including good rainfall in Brazil, an active harvest in Argentina, and increased planted area in the US. Additionally, weaker demand from China applied further downward pressure. For SA consumers, this is cautiously good news. The 2024 drought caused maize shortages, but the projected 14.7mn tonnes maize harvest for 2025 (a 14% YoY increase) suggests domestic supply will be sufficient to meet the 12mn tonnes demand. This supports stable pricing for maize-based staples like maize meal, which is vital for food security among lower-income households. Despite brief price spikes such as the R6,000/tonne level reached on 22 April, caused by technical trading (not fundamentals), sharp increases in retail maize meal prices are not expected. Futures prices have since stabilised, suggesting calmer markets ahead.

Global meat prices rose slightly (0.9% MoM), led by pork, following the resumption of German exports after regaining foot and mouth disease (FMD) free status. Beef and lamb prices were boosted by Easter-related demand and shrinking US cattle herds. China’s beef demand remains strong, though it is expected to slow, with Brazil, Argentina, and Australia filling the gap. Domestically, while retail meat prices eased, producer prices rose due to tighter supply and rising global benchmarks. Individually quick frozen (IQF) chicken prices edged up, indicating robust consumer demand, even as the market recovers from the 2023 avian flu outbreak. Carcass and weaner calf prices also increased thanks to improved grazing. However, pig and cattle slaughter numbers declined, reflecting lingering supply constraints. Disease outbreaks, such as African swine fever (ASF) in pigs and FMD in cattle, remain a risk to the stable supply. SA households may see some price firmness in meat products, particularly pork and beef, as local supply remains tight and global trends filter through. The increase in producer prices could eventually lift retail prices, especially if animal disease outbreaks disrupt supply chains. However, relatively lower retail inflation for meat so far has helped ease food cost pressures somewhat.

Globally, dairy prices remained mostly stable MoM but were 19.9% higher YoY. Cheese prices declined due to an ample EU supply and weaker demand from Oceania. In contrast, butter and milk powder prices rose, supported by constrained European production and seasonal slowdowns in Oceania. In SA, according to Milk SA’s latest report, SA milk production recorded a 1% MoM increase in producer prices for February. Due to FMD outbreaks in the Eastern Cape and KwaZulu-Natal, local production has come under pressure, leading to the culling of 430 dairy cattle. Although dairy price increases have moderated, the high YoY gains (especially for butter and milk powder) could filter into processed food and dairy product prices in the coming months. The impact of disease outbreaks on milk production may also contribute to marginal price increases for fresh milk and dairy staples.

Fresh produce markets showed more volatility than retail outlets, which typically respond with a lag. Banana volumes have normalised, but prices remain elevated (up 19% YoY), due to earlier supply disruptions from Mozambique. Apple exports rose 3% YoY, but domestic volumes were slow to pick up, though prices are starting to ease. Potato supply rose in March, but the recent rainfall in Limpopo could affect availability and pricing in the April data. Onion prices have dropped 25.7% YoY due to persistent oversupply. As such, SA consumers can expect a mixed range of outcomes in the fresh produce market. Bananas may remain relatively expensive in the short term, though prices could normalise with improved Mozambican supply. Apples may become more affordable soon as supply increases and prices soften. Potatoes will likely stay cheaper than last year unless the Limpopo rainfall significantly disrupts harvests. Onions should remain affordable, though sustained low prices could shift as excess stocks decline.

Figure 3: Food and beverage products that registered notable price changes

Source: Stats SA

Looking ahead, food inflation is expected to rise moderately in the coming months, influenced by uncertainty around US policy direction and its potential impact on global markets and the rand. As with many emerging market (EM) currencies, the rand typically weakens during periods of global instability, an effect compounded locally by concerns over the stability of SA’s Government of National Unity (GNU) amid ongoing budget negotiations. However, the National Treasury’s decision to scrap the proposed VAT increase has removed an immediate risk of added consumer pressure on non-zero-rated goods. Additionally, the expected recovery in summer crop yields should help lower feed costs for livestock producers and ease prices of key staple foods. That said, ongoing outbreaks of animal diseases remain a key risk, particularly for meat and dairy supply and pricing.

While overall price changes across commodities remained relatively modest in April, market participants are closely monitoring fast-moving policy developments, particularly new tariff measures by the US and the potential for retaliatory actions. These shifts in the global trade environment will likely influence broader macroeconomic conditions, including energy prices, currency movements, and economic growth, all carrying further implications for agricultural production and trade.