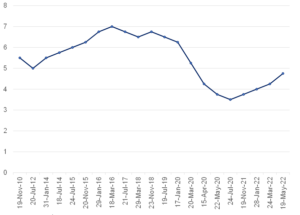

Figure 1: The history of the SARB MPC repo rate changes, %

Source: SARB, Anchor

As expected, and largely already priced in by the market, the South African Reserve Bank’s (SARB’s) Monetary Policy Committee (MPC) broke precedence and hiked rates by 50 bpts on Thursday (19 May), as opposed to the 25-bpt increments that we have seen thus far in the current rate-hiking cycle. As was further expected, the SARB’s headline inflation forecast for this year was revised higher – to 5.9% as a result of the higher food and fuel prices. While food prices will remain high, the central bank forecasts that fuel price inflation should ease in 2023, helping headline inflation fall to 5.0%, despite slightly higher core inflation. Headline inflation of 4.7% is now expected for 2024.

Interestingly, the SARB has actually revised its core inflation forecast lower to 3.9% for 2022 and 3.9% in 2022 (down from the previous forecast of 4.2%) due to lower services price inflation. Consequently, the current domestic inflation and growth forecasts do not necessitate such an acceleration in the interest rate-hiking cycle yet, with the inflation forecasts only temporarily breaching the 6% SARB inflation target ceiling and demand-pull inflation being suppressed by real GDP (which remains below its pre-pandemic peak), a negative output gap, and the weak labour market. Overall, macroeconomic fundamentals indicate that SA does not have the same inflation problems that the US is currently facing and that SA’s economic recovery remains fragile, given that growth is likely to be negatively impacted by slowing output in key trading partner countries, the devastating KZN floods and continued loadshedding. This would support that the MPC continues hiking rates, albeit at a more gradual pace.

Conversely, the SARB is having to contend with a faster pace of accommodation removal in advanced economies, with the MPC citing that capital outflows and market volatility are expected to remain for emerging market assets and currencies. The second-round effects of higher fuel and food prices will also remain a source of concern for the MPC, especially with core inflation approaching the 4.0% handle – though still indicating muted demand pressures, it has sustainably increased from the 3.2% average recorded over the past two years. In a slightly ironic tilt, in the Q& A session that followed, SARB Governor Lesetja Kganyago stated that members of the MPC do not know at this point which inflationary factors are essentially transitory or not.

Thus, it appears that central banks and financial markets alike are struggling to see through the current volatile global environment to find an anchorage point on which to base their forecasts. Nonetheless, looking ahead, we do expect the SARB to revert to 25-bpt increments again after this week’s meeting. However, we also note that this will likely require that key inflation risks ease and that the demand-sensitive inflation categories, as well as 2Q22 inflation expectations, remain benign.

If you have any questions or would like to discuss the subjects raised in this article with someone at Anchor please email us at info@anchorcapital.co.za.