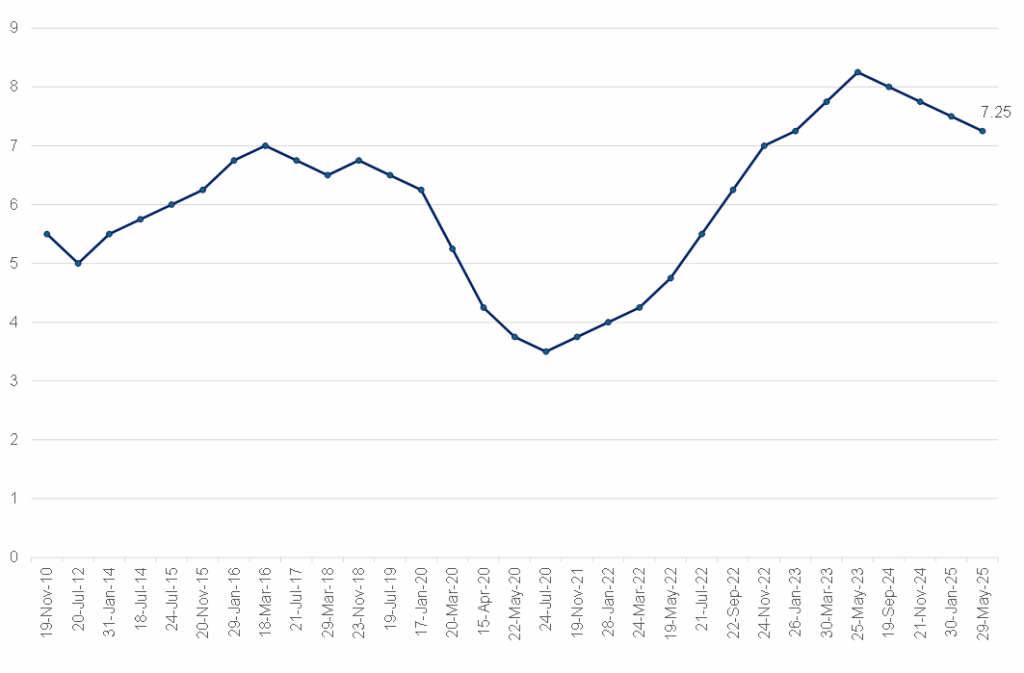

At its 29 May 2025 meeting, the South African Reserve Bank’s (SARB) Monetary Policy Committee (MPC) lowered the repo rate by 25 bpts – in line with expectations. This brings the repo rate down to 7.25%, while the prime lending rate now stands at 10.75%. The decision reflects a dovish stance, underscored by a 5–1 vote split: five members supported the 25-bp reduction, while one member argued for a deeper 50-bp cut. The rate cut was supported by a backdrop of improving domestic and global conditions, notably lower oil prices, a stronger rand, and receding uncertainty, which allowed the MPC to proceed with further policy easing. This latest move brings the total rate reductions to 100 bpts since the current rate-cutting cycle began in 2024. Although the pace of easing has been gradual, the cumulative cuts have provided welcome relief to highly indebted consumers and are expected to continue doing so in the months ahead.

Figure 1: The history of the SARB MPC’s repo rate changes, %

Source: SARB, Anchor

The SARB sharply downgraded its economic growth outlook following the recent series of disappointing high-frequency indicators. Data showed contractions in manufacturing, mining, construction activity, and wholesale trade, along with sluggish retail and vehicle sales — all pointing to a poor first-quarter performance. The Bank now estimates just 0.1% QoQ GDP growth for 1Q25, setting a weak base for the rest of the year. Consequently, the SARB revised its 2025 GDP growth forecast down to 1.2% from 1.7% previously, closer to the IMF’s latest estimate of just 1%. The outlook for subsequent years has also been downgraded: 1.5% in 2026 (from 1.8%) and 1.8% in 2027 (from 2.0%). Importantly, the SARB now sees balanced risks to the growth outlook, a shift from its earlier assessment that risks were skewed to the downside.

In conjunction with the downward revision in growth, the SARB also cut its inflation forecasts. Headline inflation is now expected to average 3.2% in 2025 (down from 3.6%), while projections for 2026 and 2027 have been trimmed to 4.2% and 4.4%, respectively. These updated forecasts suggest that inflation will remain below the midpoint of the target range over the forecast horizon.

Several key factors drove the downward revisions:

- A lower-than-expected starting point for inflation,

- The removal of a proposed VAT hike, which was previously estimated to add 0.13–0.25 ppts to inflation over two years,

- Weaker oil prices, amid expectations of a global supply surplus, and

- A 4.5% YTD appreciation in the rand against the US dollar has helped dampen import-related price pressures.

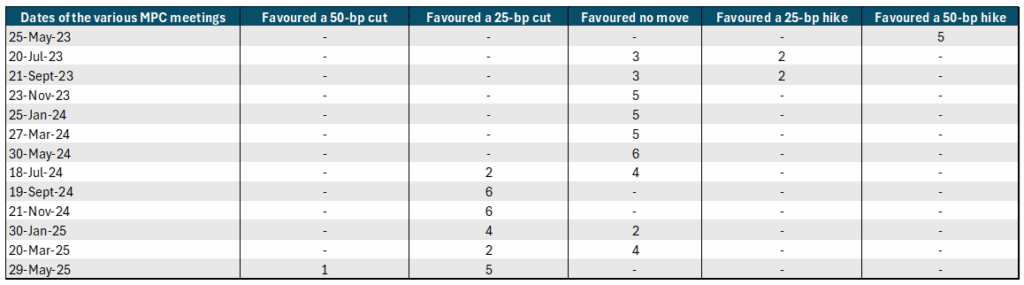

Given the updated inflation trajectory and reduced inflation expectations, the SARB may revise its estimate of the neutral repo rate. Previously understood to be 7.25%, the Bank’s Quarterly Projection Model (QPM) now implies the neutral rate could be closer to 7.0%. The fact that one committee member advocated for a 50-bp cut, combined with inflation forecasts tracking below the midpoint of the target range, strengthens the case for another 25-bp cut later this year.

Figure 2: Shift in MPC member preferences at the 29 May 2025 meeting

Source: SARB, Momentum, Anchor

Perhaps the most notable development in the May MPC statement was the inclusion of a scenario featuring a 3.0% inflation target, indicating the SARB’s growing preference for a lower long-term target. This alternative scenario – part of a broader shift to include scenario analysis in the MPC’s communication – was modelled alongside two “tariff shock” scenarios tied to rising global trade tensions. Under the 3.0% target scenario, headline inflation would average just 3.1% in 2026 and 3.0% in 2027, well below the baseline projections. Such a shift would, according to the Bank’s modelling, allow the repo rate to decline to below 6.0% by 2027, provided that inflation expectations adjust quickly and credibly. However, achieving such a rapid transition will hinge on several critical factors, especially whether Treasury formally adopts the lower inflation target and, if so, how it sequences its implementation. The SARB acknowledged that lowering the target may impose short-term output costs, although these are expected to be minor and temporary. As such, Treasury may prefer a phased approach, particularly given the fragile growth environment. The key assumption, of course, is whether both inflation expectations and actual inflation will respond as precisely and smoothly as the scenario anticipates.

While the SARB appears eager to move toward a lower, more credible inflation target amid favourable inflation dynamics, any announcement will ultimately depend on political timing and the broader macroeconomic context. Nevertheless, the probability of such a move being announced during the current administration remains high, even if it is not imminent.

The 25-bp cut announced on 29 May brings the total monetary policy easing to 100 bpts since the rate-cutting cycle commenced in September 2024. Although the pace of easing has been more gradual and staggered than initially expected (particularly following the last rate hike exactly two years ago), the SARB’s measured approach has still provided meaningful relief to highly indebted South African households. With inflation subdued, economic growth under pressure, and real interest rates still restrictive, the door remains open for further policy support in the months ahead.