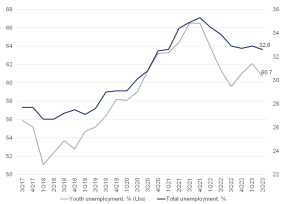

According to the latest Quarterly Labour Force Survey (QLFS) data from Stats SA, released on Tuesday (15 August), South Africa’s (SA) official unemployment rate declined by 0.3% from 32.9% in 1Q23 to 32.6% in 2Q23. The unemployment rate, according to its expanded definition (i.e., including discouraged work seekers and thus more reflective of the whole picture), decreased by 0.3% to 42.1% in 2Q23 vs 42.4% in 1Q23. The total number of employed people in SA now stands at 16.3mn, almost at pre-COVID-19 levels when it stood at 16.4mn. Interestingly, the number of people who were not economically active for reasons other than discouragement rose by 93,000 to 13.3mn, which may have skewed these data to an extent.

Overall, employment data from the QLFS survey (a household-based survey of labour market dynamics covering the formal, informal, and agricultural sectors) has, in recent months, diverged sharply from data reported in the Quarterly Employment Statistics (QES) survey. The QES is an enterprise-based labour market survey that only reports on the formal sector. Thus, gaining a more transparent and holistic picture of the unemployment picture in SA is becoming increasingly difficult.

Furthermore, the QLFS suffered data collection challenges through the COVID-19 pandemic, but these appear to have normalised over the past few quarters. Still, it does continue to make it difficult to interpret the extent of the increase in job growth as reported in the QLFS – which percentage reflects ‘real’ jobs and how much is merely statistical noise/rebalancing. However, with the QLFS data collection rates seemingly back to normal levels, it was unsurprising to see the pace of job growth slowed markedly (the number of employed persons increased by 154,000 in 2Q23, compared to a rise of 258,000 employed persons in 1Q23), which is reflective of the weak underlying growth environment.

Figure 1: SA quarterly unemployment rates. 3Q17 to 2Q23

Source: Stats SA, Anchor

Regardless of the exact data, we maintain that the official headline unemployment numbers do not fully reflect the true extent of the unemployment crisis in the country. How unemployment is measured tends to overlook specific segments of the population, such as discouraged workers who have given up searching for jobs and are, therefore, not considered part of the active labour force. Additionally, the official statistics do not adequately capture informal and underemployed workers. Furthermore, the official unemployment rate might not fully account for the quality of jobs available or the degree of job security. Many individuals in SA are trapped in low-skilled and precarious employment, leading to underemployment and persistent poverty. Overall, the unemployment problem in SA remains a significant and complex challenge. The country’s unemployment rate has persistently been one of the highest in the world, with a disproportionate impact on the youth population. Tackling this multifaceted problem requires comprehensive and sustainable strategies encompassing education reform, job creation, and inclusive economic growth.

Irrespective of the exact details in these data, typically, in the SA economy, material job creation only occurs when GDP growth approaches 3% p.a. Therefore, despite the seemingly resilient nature of the domestic economy to the various structural constraints present, simply put the economy is currently not growing at an adequate rate to sustainably boost long-term employment prospects for South Africans as a whole.