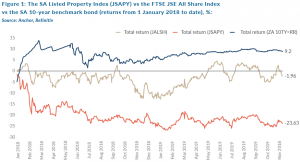

Once seen as an attractive combination of yield-producing assets with capital- growth potential, SA property shares have plummeted from their respective pedestals since the end of 2017. As a brief reminder, up to that point SA listed property had outperformed the local equity market, bonds and cash over 3-, 5- and 15-year periods. However, since then the listed property sector has significantly underperformed a misfiring SA general equity market and also missed out on the relative safe haven that bond yields and income- producing assets have provided.

SO , WHAT HAS CAUSED THIS DRAMATIC FALL FROM GRACE?

There can be little doubt that, to some extent, returns generated in the sector, particularly post the global financial crisis (GFC) until 2018, were the result of the ability of highly rated counters to raise equity capital well below their cost of debt and, therefore, their overall cost of capital. This had the immediate impact of enhancing returns via the ability to invest money raised at say 5% (the share’s dividend yield), into property assets that yield 8%-9%. Companies that could do this were in a virtuous cycle that made investing in these businesses compelling, particularly in a small and concentrated sector where momentum and index inclusion generally equate to alpha generation and a fear of missing out for underweight asset-allocation positions.

This ended abruptly in early 2018. An initial catalyst was information that began to swirl around an interconnected property group (the Resilient stable), which comprised of four listed companies with crossholding ownership structures. This grouping accounted for over 40% of the JSAPY at the time. The result was Financial Sector Conduct Authority (FSCA) and independent investigations into share dealings by these companies, which had the effect of an emergency brake being applied to their respective operating models. This, in turn, spilled over into the entire property sector.

More fundamental reasons were also emerging that would challenge the sector at this time, subsequent to the optimism experienced after the ANC Elective Conference, which was held in December 2017, when Cyril Ramaphosa emerged victorious as ANC president. Currently, as the Resilient stable’s problems start to dissipate, these macro headwinds are still ongoing:

- The SA consumer remains under pressure: This has manifested in slowing retail sales and the disappointing results from key anchor tenants such as Shoprite, Woolworths, Mr Price and others.

- Online sales: While online sales are less of a threat locally than in the UK and Europe where retail- focused property companies have been severely affected it is still a business risk to shopping centres.

- Oversupply in the office-space category: Statistics from the South African Property Owners Association (SAPOA) show that office vacancies (at 11.3%) are at a ten-year high, as B-and C-grade offices are vacated in Sandton and Rosebank, given the construction activity there.

- All of the above factors demonstrate that the property sector is not immune to economic conditions and, unfortunately, the SA economy remains stuck in its longest downward trend since 1945. According to the SA Reserve Bank’s (SARB’s) latest Quarterly Bulletin (released late last month), SA entered the 70th month of this weakening cycle in September. GDP growth has not exceeded 2% p.a. in any calendar year since 2013.

SA property companies have become accustomed to tenants signing leases, generally for long periods of time, where rentals escalate at rates in excess of inflation (5% to 6%). Rental reversion conversations between a landlord and tenant, when the lease came up for renewal, were generally comfortable due to tenants trading well. However, this environment has changed markedly, and for the worse.

- Leases signed are getting shorter. Uncertainty and the lack of confidence in the business environment mean that tenants, and indeed landlords, are not keen to commit for long periods of time.

- Rental reversions are under pressure. Most property companies are now reporting negative renewals i.e. rentals are falling when leases are signed for new periods of tenancy.

- Property owners are having to incentivise tenants to sign or renew leases in various ways. This often means increased capex and maintenance spend.

The picture painted is therefore bleak. Nevertheless, it is important to know that this is all now historical. As we seek to navigate markets going forward, what determines our asset- allocation strategy and decision on property assets?

The two main valuation building blocks in the sector have been, and remain, the following:

- The yield received by investors via distributions paid by property companies; and

- growth in these distributions paid.

To the extent that growth is strong, investors are comfortable with lower yields than benchmark interest rates such as 10-year government bonds, because those instruments pay a coupon which does not offer growth potential. The total return equation has thus been modelled on yield + growth = total return (TR).

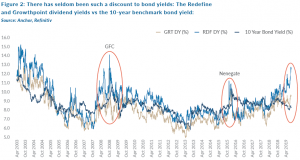

Whilst we are cognisant of the fact that fundamental SA economic conditions have deteriorated, the yield component of this equation is attractive. Twenty- seven stocks, or 90% of the SA equity universe, now yield above the R186 (excluding offshore focused property companies, which have a different cost of capital) and 15 stocks offer a yield above 12%. Figure 2 below shows two bellwether SA property companies – Growthpoint and Redefine – which, together, own over 700 SA property assets.

Even if the SA Property Index yield (including offshore-focused companies) continues to trade at a 170-bpt discount to the R186, and growth in distributions is forecast at 2% YoY – well below inflation – then the total return equation should yield 10.5% as per the formula in Figure 3 below.

It is difficult to predict when economic conditions in SA will turn and GDP growth will be restored. In addition, the traditional way property shares have been used by SA investors – to provide good yield with capital upside – may well have been structurally affected by the investor experience over the past two years. Consequently, the sector may not attract income fund investors who are not prepared to stomach some volatility, as SA-listed property trends towards a higher correlation with the equity market, similar to property shares in US, European and Asian markets. But, in our view, some mitigating fundamentals are being ignored:

Vacancies are rising, but not dramatically.

Escalations are still being signed at above inflation. In this context, it is important to note that SA consumer price inflation (CPI) is now running at 4.5% compared to 5%-6% previously. In general, property escalations are still between 5% and 8% p.a.

Reversions are often negative because escalation clauses mean that, at expiry, properties are over-rented. We believe that this trend will continue until tenants experience better conditions, but it can be viewed currently as a quid pro quo situation.

Valuations of physical assets, which constitute the portfolios of the listed property companies, are at lower cap rates than listed shares’ dividend yields. This means that listed shares are effectively trading at a discount to their sum of the parts. Sceptics may point out that independent valuators will adjust their cap rates higher (bringing property valuations lower) in accordance with economic conditions. In some cases, this may be true, but the discrepancies between the listed and physical markets are very wide in many instances. Evidence of physical property transactions for 2019 YTD, do not point to a fire sale of SA properties.

Property investors are often reminded that the nature of the investment is long term. Currently this may sound like “your portfolio has seriously underperformed in the short term, now you have to keep it for the long term.” However, we believe the present valuations make for a compelling case, and we are certainly closer to the bottom than the top of the current property cycle. Where companies can stem the tide of falling income statements, carry on investing in and improving their properties, and keep their loan-to-value ratios at reasonable levels, these firms will prove to be very good investments at current levels.