May headline inflation, as measured by the Consumer Price Index (CPI), came in at 5.2% YoY, unchanged from April’s print. Annual rates for four of the twelve product groups remained steady between April and May, including food & non-alcoholic beverages (NAB). Higher rates were recorded for transport, alcoholic beverages & tobacco, and recreation & culture. Inflation was softer for miscellaneous goods & services, communication, clothing & footwear, health and restaurants & hotels. May saw only a slight petrol price increase of ZAc37/litre, contributing a mere 0.1% to the overall CPI inflation outcome. Overall inflationary pressure was modest, with May a relatively low survey month.

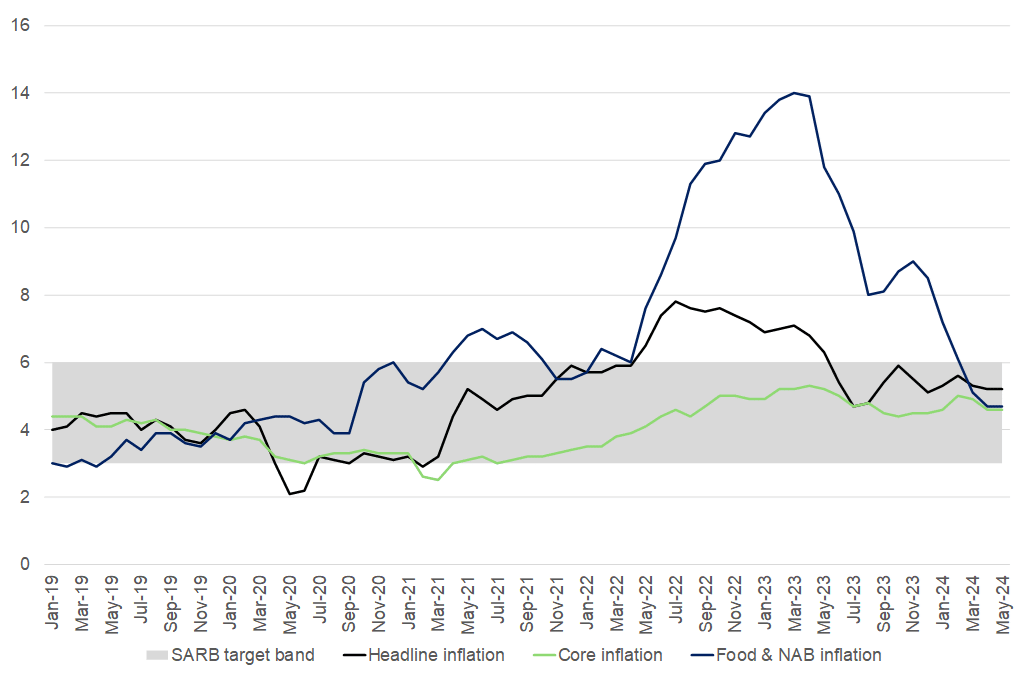

Core inflation (excluding the more volatile price categories of food, fuel, and electricity) remained at 4.6% YoY, as underlying inflationary pressures stayed close to the 4.5% midpoint of the SA Reserve Bank’s (SARB’s) target band of 3% to 6%, where the SARB prefers to anchor expectations. While personal care and restaurant and hotel prices showed a slight downward trend, other categories experienced price increases. Notably, inflation for books, newspapers, and stationery accelerated to 9.1% YoY, and public transport costs rose by 2.0% YoY. Clothing and footwear inflation continued to soften for a second consecutive month. This stability in demand-driven prices aligns with the dampening effect of higher interest rates on consumer demand and the limited exchange rate pass-through. Overall, the headline inflation rate has held its ground between 5% and 6% since September 2023.

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor

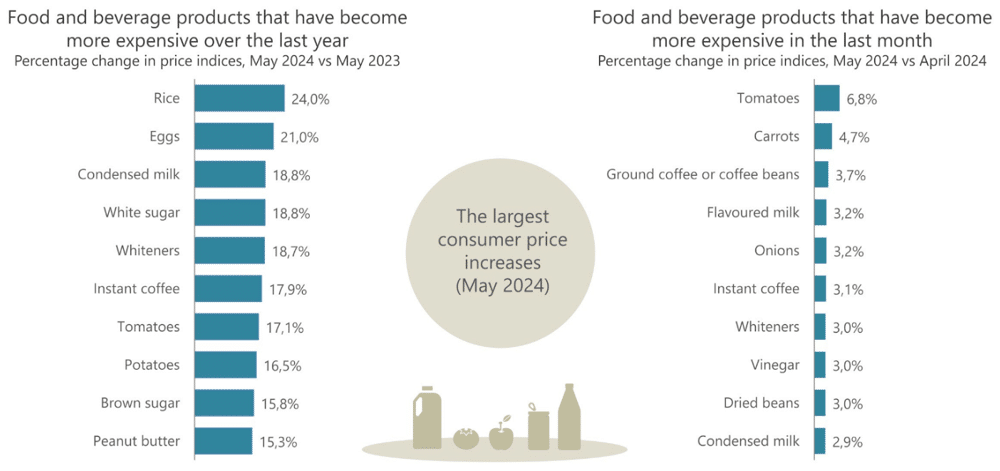

Notably, food inflation was lower than anticipated in May, easing marginally to 4.3% YoY from 4.4% YoY in April and 6% YoY in February – a significant drop from its peak of 14.4% YoY in March 2023. Most food types became more expensive: grain prices increased by 0.8% MoM, fish prices rose by 0.8% MoM, sugar, sweets, and desserts went up by 1.1% MoM, dairy and eggs advanced by 0.4% MoM, fats and oils also increased by 0.4% MoM, and vegetable prices rose by 0.3% MoM. These increases were counteracted by a 6.6% MoM plunge in fruit prices and a 0.2% MoM decline in meat prices. Meat prices were mixed, with some beef products increasing while others remained steady, some chicken products increasing while others fell, pork prices rising, and lamb prices holding steady. Looking ahead, there could still be a modest easing in YoY food inflation, assuming global food prices remain stable and the forecasted La Niña weather pattern materialises. The rise in the probability of La Niña occurrence to over 50% from August 2024 throughout the remainder of the year is a source of optimism for local food producers. The 2024/2025 summer crop season will start in October 2024, and if the current La Niña forecasts hold, SA is set to receive early rains during that period to support the growing season. Collectively, food and & NAB inflation were unchanged from April at 4.7% in May.

Other notable price changes in May include the price for cold & flu medication; as the usual flu season begins to settle in, the price for cold & flu medication witnessed an annual rise of 11.1% YoY. Moreover, fuel costs exerted upward pressure on headline inflation in May, increasing to 9.3% YoY compared to 9.0% YoY in April. However, fuel price growth moderated to 0.6% MoM, down from 1.9% in April. This deceleration reflects a stronger rand and a significant decline in global oil prices. We project an even sharper monthly decrease in fuel prices for June. Fuel prices have already declined markedly in June (petrol prices decreased by R1.24/litre while diesel prices fell by R1.09-R1.19/litre), and a further steep drop is likely in July given the average over-recovery of R0.37-R1.08/litre so far in June (to 19 June).

Figure 2: Food and beverage products that recorded the most significant annual and monthly price increases in May

Source: Stats SA

Overall, the May CPI print did not form a particularly important dataset. The upcoming June CPI data (set to be released in July) holds greater significance as it will include the quarterly survey of rental inflation, a substantial component in the basket. This category carries significant weight and is a crucial barometer for assessing demand-driven inflation pressures.

We expect inflation to remain subdued, albeit at levels higher than initially envisioned at the start of this year. Core inflation (particularly that of goods) will likely be subdued as consumer demand continues to be constrained by the pressures of elevated interest rates. While this latest CPI print is a largely positive move for the average South African consumer’s increasingly strained wallet, the figure is still some way off from the SARB’s target of 4.5%, with inflation proving itself particularly sticky. This will likely keep the SARB’s tone hawkish in any near-term remarks. The central bank has remained steadfast in communicating that it will not move the policy rate lower (and thus essentially usher in a rate-cutting cycle) until inflation is under control and sustainably hitting that target.

Thus, in our view, interest rates will likely remain on hold when the SARB’s Monetary Policy Committee (MPC) convenes on 18 July. However, we foresee potential rate cuts materialising towards the end of 2024, depending on the inflation outlook (locally and abroad) and global interest rate developments as we progress further into this year. At this stage, we expect an initial reduction of 25 bps in November, followed by a further 50- to 75-bp cut in 2025. The subdued demand in the local economy continues to exert downward pressure on core inflation. This, coupled with the anticipated relief in fuel inflation due to a strong rand bolstered by reduced political uncertainty and a potentially less severe El Niño event, could pave the way for a more favourable adjustment in monetary policy. This scenario might expedite the timeline for a rate cut, possibly in September. However, we reiterate that this scenario naturally depends on the inflation outlook (locally and abroad) and global interest rate development in the coming months.