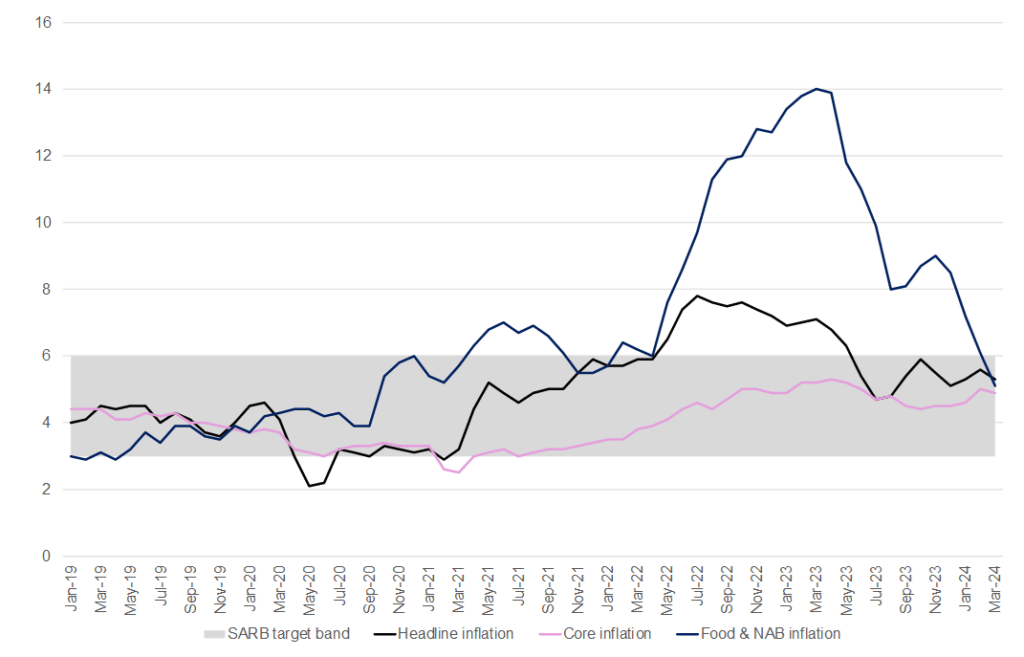

Following two consecutive monthly increases, headline inflation, as measured by the Consumer Price Index (CPI), softened to 5.3% YoY in March from 5.6% YoY in February. The rate has held its ground between 5% and 6% since September 2023. Core inflation (excluding the more volatile price categories of food, fuel, and electricity) dropped to 4.9% YoY from 5% YoY in February. This softening of core inflation was unsurprising, given the subdued demand in the economy, the low exchange rate passthrough, and the relatively minor spillovers from elevated fuel and electricity prices. This latest print means that inflation has moved closer to the 4.5% midpoint of the SA Reserve Bank’s (SARB’s) target band of 3% to 6%, where it prefers to anchor expectations.

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor

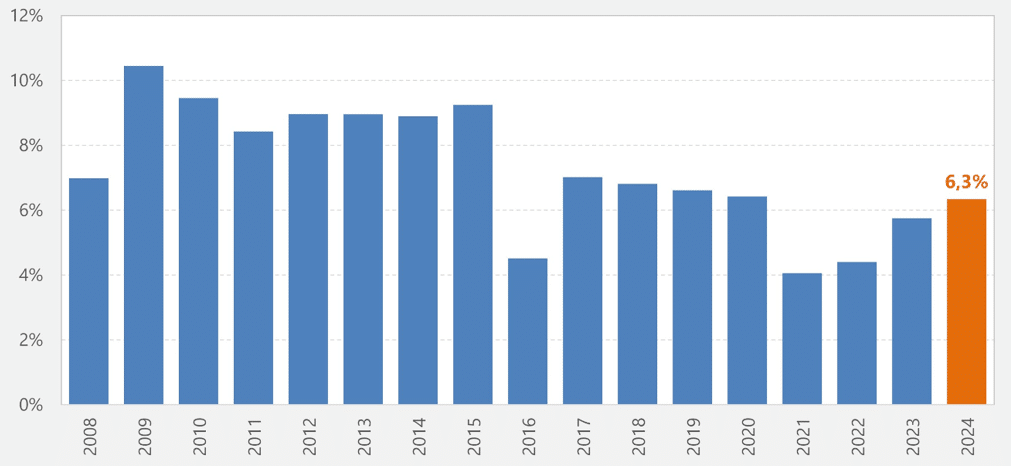

The categories with the highest annual price changes in March were miscellaneous goods & services (+8.5%), education (+6.3%), health (+6.0%), and housing & utilities (+5.9%). Notably, education fees are only surveyed once a year in March. According to Stats SA, overall education was 6.3% more expensive in 2024 than in 2023. This exceeds the 5.7% annual increase in 2023 and is the highest since 2020 when the rate was 6.4%.

Figure 2: Annual % change in education fees*

Source: Stats SA. *Note that education fees are measured once a year in March.

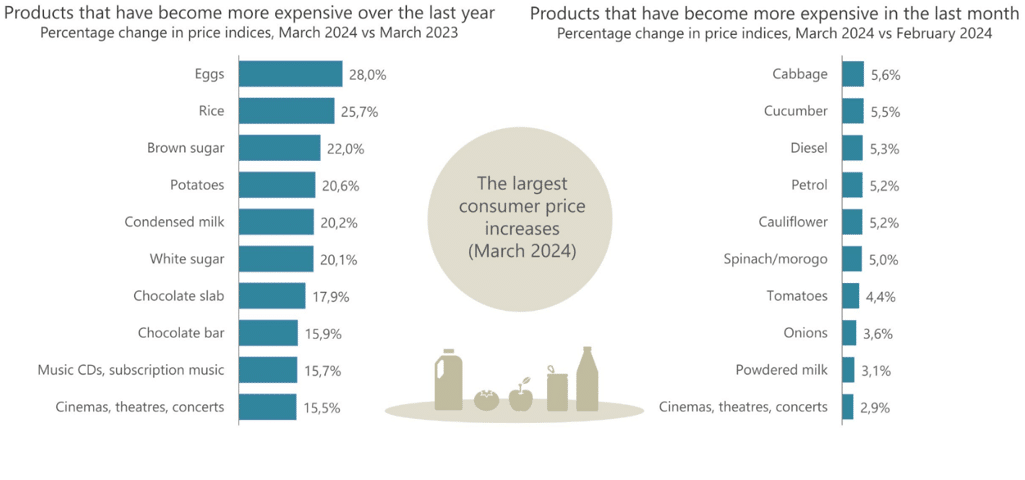

Of particular importance for SA consumers, food and non-alcoholic beverages (NAB) inflation slowed to 5.1% in March from 6.1% in February. This is down from its recent peak of 14.0% in March 2023 and the lowest annual increase since September 2020, when the rate was 3.8%. Food inflation now sits at a three-and-a-half-year low. Looking ahead, whilst the extreme heat and related damage to agricultural production in February and March have shown only a small impact thus far at the Producer Price Index ([PPI], the prices that producers receive for goods and services), agricultural food price level, March’s readings are expected to show a greater impact when released on 25 April. However, given the lags between PPI and CPI, these latest data have yet to feed through to CPI food price inflation.

Other notable price changes in March include inflation for alcohol & tobacco, fuelled by the annual increases in excise taxes effective from March, as outlined in the February budget. The index increased by 1.9% MoM in March. This is the highest monthly rise since March 2023, when excise tax increases led to a 2.2% MoM increase. Prices rose by 4.5% overall in the 12 months to March 2024.

Figure 3: Products that recorded the most significant annual and monthly price increases in March

Source: Stats SA

Looking ahead, we expect inflation to remain subdued, albeit at levels higher than initially envisioned at the start of this year. Core inflation (particularly that of goods) will likely remain subdued as consumer demand continues to be constrained by the pressures of elevated interest rates. Risks to the outlook appear more entrenched on the supply side – particularly with regard to electricity, fuel, and other administered prices. Whilst food inflation has declined significantly over the past two months, the rising costs of maize and wheat (coupled with the effects of a drier season in certain key production regions) could potentially stall this momentum. As a result, we continue to view food prices as a key upside risk given the various ongoing supply shocks, particularly ahead of the current El Niño weather pattern and amid relatively large swings in crucial commodity prices (including oil) and the deteriorating rand exchange rate.

Overall, risks to the inflation outlook remain elevated, with geopolitical tensions worsening -most notably in the Middle East. Due to these various risk factors, we believe the SARB’s Monetary Policy Committee (MPC) will not rush to cut the repo rate. Any possible interest rate cuts will likely only materialise towards the end of 2024 and depend on the inflation outlook (locally and abroad) and global interest rate developments as we progress further into this year.