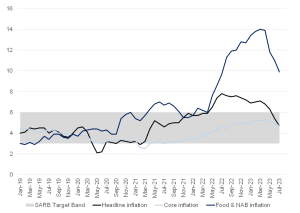

Positively, South Africa’s (SA) headline inflation, as measured by the consumer price index (CPI), eased by more than expected in July, coming in at 4.7% YoY from 5.4 YoY in June, as fuel prices continue to decline. Since peaking in July 2022, fuel prices have begun to ease, dropping from R26.74 per litre of inland 95-octane petrol in July 2022 to R22.46 per litre in July 2023. The annual rate for fuel was -16.8% in July 2023, which dragged the transport category down into negative territory for the first time since January 2021. Importantly, food and non-alcoholic beverages, one of the key upward drivers of inflation over the previous few months, has dropped back down to single digits, printing at 9.9% YoY for July vs June’s 11% YoY print. This latest decrease in local food prices is driven partly by base effects and the continued cooling of global prices. Despite increasing by 1.3% MoM in July, the FAO Global Food Price Index (FFPI), which measures the monthly change in the international prices of a basket of food commodities, remains 11.8% below its July 2022 level. The index has fallen by as much as 22.1% from this all-time high. However, this moderation in global food prices is taking longer to filter through to the local market, as SA’s rand depreciation has offset much of this global decline.

Overall, this latest CPI print is the lowest reading since the 4.6% print in July 2021, and inflation is now close to the midpoint of the South African Reserve Bank’s (SARB) inflation target range of 3% to 6%. Looking ahead, however, as base effects fade out, the inflation outlook will be vulnerable to new shocks, including concerns around the El Niño Southern Oscillation ([ENSO], which typically means below-average rainfall for SA) and renewed uncertainties surrounding the Russian Federation’s decision to terminate the implementation of the Black Sea Grain Initiative which saw the withdrawal of Russian security guarantees for navigation in the North-Western part of the Black Sea.

Nonetheless, the impact of interest rate hikes since November 2021 may limit the upside as consumer demand wanes, particularly for discretionary goods and services. Furthermore, it is important to note that Stats SA also surveys municipal tariffs every year in July and August (it is featured in this latest print), indicating that housing and utility costs increased by 2.8% between June and July. On average, households are paying 14.5% more for electricity. Water tariffs increased by 9.6% and property rates by 2.9%. However, the final picture will emerge in the August CPI release with the completion of the survey.

Despite this better-than-expected print, we believe that the SARB will remain steadfast in its determination to see inflation return sustainably to the midpoint of the target. The Monetary Policy Committee (MPC) has notably not yet formally declared a peak as food inflation remains high and at risk of keeping inflation expectations elevated, in turn risking broader inflationary pressure. Any further shocks that threaten to push, delay or even derail the return of inflation to the midpoint could lead to further hikes. As such, we still believe there is a chance for a further 25-bp rate hike at either the September or November MPC meetings.

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor