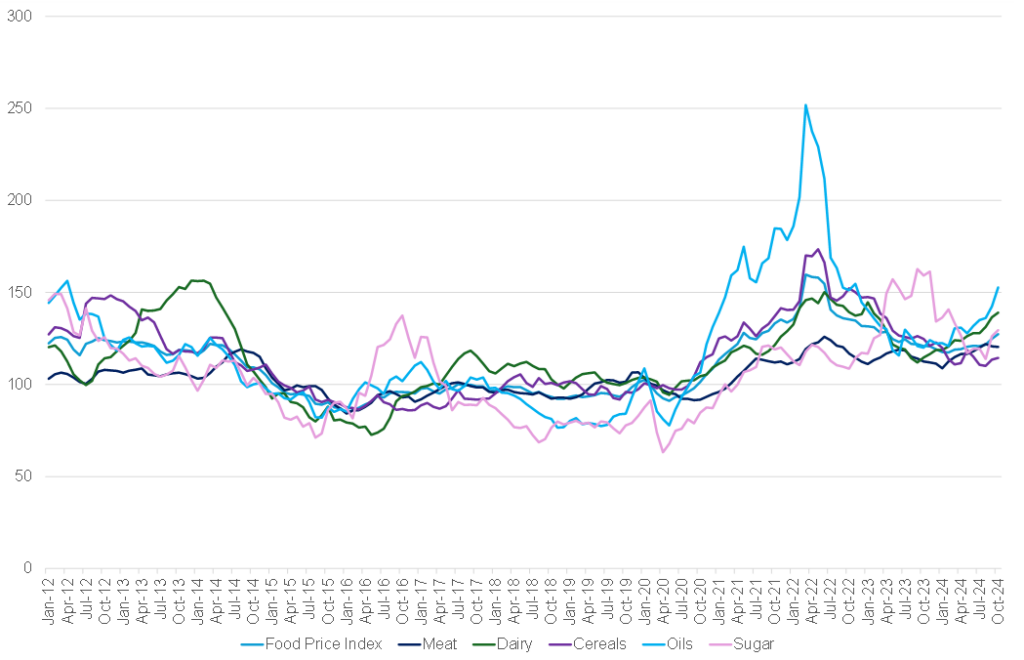

In October 2024, the UN Food and Agriculture Organization’s (FAO) Global Food Price Index (FFPI), a key measure of global food commodity prices, averaged 127.4 points. This marked a 2.0% MoM increase and a substantial 5.5% YoY rise. However, the index remained 20.5% below its peak recorded in March 2022. The FAO Vegetable Oil Price Index surged by 7.3% MoM in October, reaching its highest level in two years. The increase was primarily driven by increased quotations for palm, soy, sunflower, and grapeseed oils, mainly due to concerns over production. The rise in the FAO Cereal Price Index by 0.9% MoM reflected higher export prices for wheat and maize. Global wheat prices were impacted by adverse weather in major Northern Hemisphere exporters, the reintroduction of an unofficial price floor in Russia, and escalating tensions in the Black Sea region. Maize prices also climbed, fuelled by strong domestic demand and transportation challenges in Brazil caused by low river levels.

In contrast, the FAO All Rice Price Index fell by 5.6% MoM, as indica rice quotations dropped in anticipation of intensified competition among exporters following India’s removal of export restrictions on non-broken rice. The FAO Sugar Price Index increased by 2.6% MoM, driven by ongoing concerns about Brazil’s 2024/2025 production outlook after prolonged dry conditions. Rising global crude oil prices also played a role, redirecting more sugarcane toward ethanol production. However, the depreciation of the Brazilian real against the US dollar tempered the increase. The October FAO Dairy Price Index climbed by 1.9% MoM and 21.4% YoY, respectively. This rise was mainly attributed to higher international prices for cheese and butter, while milk powder quotations declined. In contrast to the overall upward trend, the October FAO Meat Price Index dipped by 0.3% MoM, primarily driven by lower pig meat prices, reflecting higher slaughter rates in Western Europe amid weak domestic and international demand. Poultry prices slightly declined for the month, ovine meat prices remained steady, and bovine meat prices rose modestly, supported by increased international demand.

Figure 1: FAO Global Food Price Index, January 2012 to October 2024

Source: Stats SA, Anchor

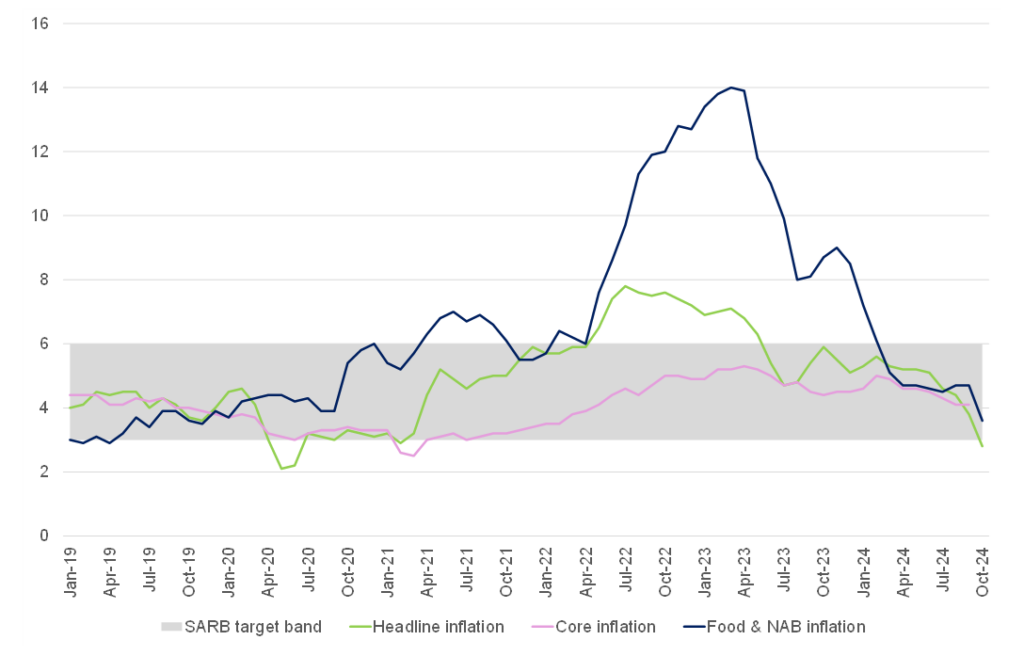

On the local side, October inflation, as measured by the Consumer Price Index (CPI), revealed a continuation of the disinflationary trend, with headline inflation printing at 2.8% YoY. This represents a sharp decline from the 3.8% YoY recorded in September. October’s print is the lowest since June 2020 (during the COVID-19 pandemic), when the rate was 2.2%. Falling fuel prices remain the key driver behind the recent slowdown. Core inflation (which excludes volatile food and energy prices to reflect underlying inflationary pressures) eased to 3.9% YoY in October, down from 4.1% in September, signalling weaker demand across most categories. The drop in core inflation, now below target, underscores the persistent financial strain on households. Inflation in food and non-alcoholic beverages has slowed significantly, easing to 3.6% YoY in October from 4.7% in September. Overall food inflation dropped to 2.8%—its lowest level since May 2019—as the effects of the El Niño phenomenon diminished. This decline was widespread, with notable decreases in categories such as sugar, sweets, desserts, bread and cereals, and meat, which had previously driven prices higher.

Figure 2: SA inflation, January 2019 to October 2024 (YoY, % change)

Source: Stats SA, Anchor

Looking at specific commodities in more detail, global wheat prices rose by 7% MoM for a second consecutive month, driven by concerns over unfavourable weather conditions affecting winter crop planting in key Northern Hemisphere exporters, including the EU, the Russian Federation, and the US. Additional factors driving prices included escalating Black Sea tensions and Russia’s reinstatement of an unofficial price floor. Maize prices grew by 6.3% MoM, reflecting strong domestic demand in Brazil and transportation challenges caused by low river levels. Stable demand for Ukrainian maize and dry weather hampering planting in Argentina further supported the increase.

In South Africa (SA), maize prices have continued to reflect international trends. Yellow maize rose 8.2% MoM and 15.9% YoY, while white maize increased by 2.8% MoM and 39.4% YoY. Tight domestic supplies and high demand pushed prices upward, compounded by a 23% decline in maize production compared to 2023, as reported by the Crop Estimates Committee. While planting intentions indicate a stable maize area for the next season, favourable weather remains critical for normal yields. Until the new harvest, the domestic market relies on a combination of stocks and imports. Yellow maize imports for 2024/2025 totalled 278,000 tonnes, primarily from Argentina, helping ease supply pressures in coastal regions. Regional demand for SA maize added pressure, particularly on white maize prices. Southern Africa’s largest maize supply deficit since 2016/2017 has left most countries, except SA and Tanzania, reliant on imports. SA is expected to meet the needs of the BLNE countries (Botswana, Lesotho, Namibia, and Eswatini) and Zimbabwe, while Tanzania supports Malawi, the DRC, and Zambia.

Global pig meat prices fell by 1.2% MoM in October, influenced by higher slaughter rates in Western Europe and weak demand. Poultry prices dipped slightly (-0.4% MoM) due to increased export supplies, while ovine meat prices edged down (-0.1% MoM) as high seasonal supply offset growing demand. Bovine meat prices rose by 0.9% MoM, supported by stronger international demand. In SA, meat prices were mixed. Poultry and pork prices rose, supported by higher feed costs and increased demand. Poultry prices for individually quick frozen (IQF) pieces climbed 3% MoM, while pig carcass prices increased 0.8%. Beef prices softened (-2.4% MoM) due to a stronger rand, while weaner calf prices rose by 1.1%, reflecting abattoir demand ahead of the festive season. Sheep meat prices declined by 1.5% MoM, reflecting softer local demand.

In the domestic fresh produce market, potato volumes increased by 16% YoY in October, causing prices to drop by 20% YoY. Onion volumes rose 6%, with prices up 2% YoY. Tomato prices, typically volatile, have increased by 17% YTD due to lower August and September volumes caused by cold weather in Limpopo. In the fruit category, orange volumes fell by 13% in October, pushing prices up by 30% YoY due to reduced supply and higher global juice prices. Avocado exports increased, with local prices trending upward. Most major fruits traded at higher prices YoY, driven by lower volumes and strong demand. Global sugar prices rose by 2.6% MoM in October due to concerns over Brazil’s production outlook amid persistent dry conditions and rising crude oil prices. However, improved rainfall in southern Brazil and the depreciation of the Brazilian real limited the price surge.

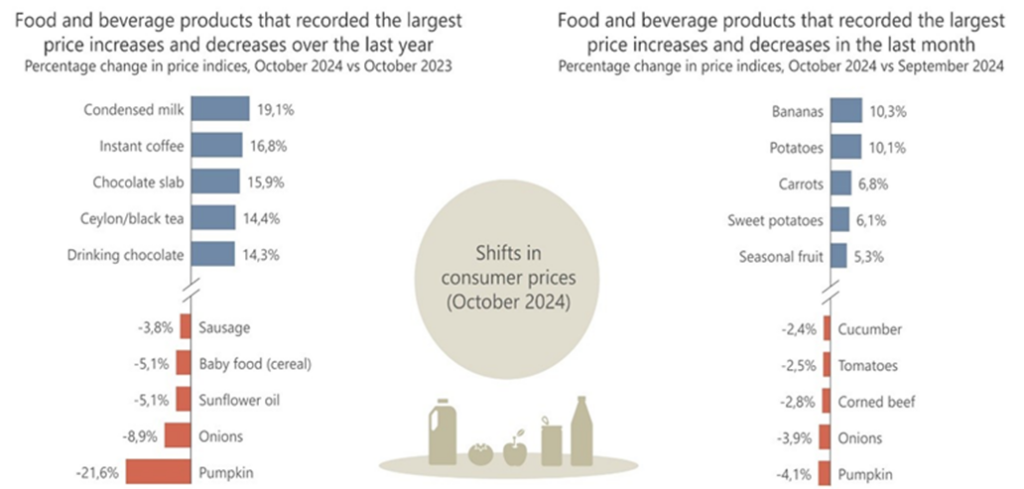

Figure 3: Food and beverage products that recorded the most significant price changes in October

Source: Stats SA

Overall, SA’s current food inflation environment is influenced by various factors, including agricultural commodity prices and cost structures throughout the value chain. A key driver among these is the exchange rate, which is affected by domestic and international dynamics. The rand’s appreciation supported the recent decline in food inflation, particularly in October 2024. However, following the US election results, the rand has weakened. While projections for 2025 suggest a stronger rand compared to 2024, the current short-term depreciation, combined with the sharp rise in white maize prices over the past month and the typical increase in festive season demand, may lead to a slight uptick in food inflation over the near term. Demand is also expected to be bolstered by consecutive interest rate cuts, which could support higher consumption of products such as meat during the festive period. Still, elevated costs for electricity and labour remain a concern. If the rand stabilises and strengthens as anticipated, we could see slightly lower food inflation in 2025. The expected rebound in summer crop production should ease maize prices and reduce input costs for livestock sectors. Additionally, further interest rate cuts could stimulate demand, contributing to a more favourable overall food inflation outlook.

Regardless, SA’s risk outlook requires a cautious approach – hence the moderate 25-bp rate cut on the part of the SA Reserve Bank (SARB) in the latest Monetary Policy Committee (MPC) meeting. Furthermore, looking ahead, we view the October headline CPI print as marking the low point in this inflation cycle. While inflation is expected to remain subdued over the next three months, the trajectory will likely trend upward thereafter. High base effects from last year will continue to influence the data over the near term, keeping inflation readings relatively muted despite a gradual increase. However, beyond this period, several factors could shift the inflation landscape. The weakened rand is expected to play a growing role, particularly as it increases the cost of imports. Additionally, pressures in the food sector are intensifying. Below-average harvest estimates for key crops raise concerns about price increases for staples such as bread and cereals. This, in turn, could lead to higher meat prices, amplifying inflationary pressures across the broader food basket. Energy prices also remain a critical area to watch. Eskom’s proposed 36.15% electricity tariff hike poses a significant risk to administered prices, potentially fuelling inflation. Meanwhile, ongoing volatility in global fuel markets adds further uncertainty. The rand’s sensitivity to global risk aversion remains a persistent challenge, especially in the context of geopolitical tensions or shifts in international monetary policy. Together, these factors suggest a more complex future inflationary environment, requiring careful monitoring of domestic and global developments.