Stats SA released two important economic data points this week – the latest inflation data and the 2Q22 Quarterly Labour Force Survey (QLFS). Below we look at both sets of data and the implications for the South African (SA) consumer and for SA’s overall macroeconomic outlook.

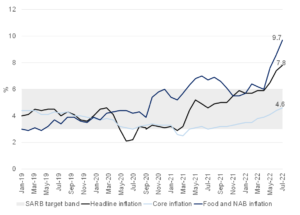

Printing directly in line with expectations, July annual consumer price inflation, released on 24 August, came in at 7.8%, up from 7.4% in June 2022. Once again, the main contributors to the higher annual inflation rate were food and non-alcoholic beverages, housing and utilities, and transport categories. Thus, high food and petrol prices are still stinging consumer pockets. However, bear in mind that fuel prices increased by 9.9% MoM in July, and the higher food inflation reflects the delayed effects of sharply higher crop prices. The introduction of higher electricity rates from municipalities – which took effect in July – also contributed to the higher number.

Notably, July’s core CPI has crept up to 4.6%, from 4.4% the month before, as second-round effects start pulling through to the greater CPI basket, an issue that remains a prime concern for the SA Reserve Bank (SARB). Looking ahead, the SARB will also be concerned about the acceleration in wage settlements recorded by the quarterly Andrew Levy Employment survey, and it importantly still regards monetary policy as very accommodative based on the forward-looking real repo rate. Consequently, we forecast another 100 bpts of interest rate hikes over the remaining two SARB Monetary Policy Committee (MPC) meetings for this year.

Figure 1: SA inflation, YoY

Source: SARB, Anchor

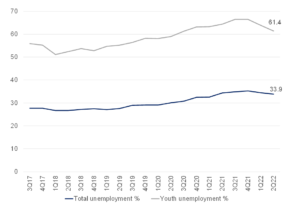

Whilst the 2Q22 QLFS, released on 23 August, indicates that SA’s official unemployment rate decreased marginally by 0.6 of a percentage point from 34.5% in 1Q22 to 33.9% in 2Q22, we remain concerned about the overall unemployment rate in the country. Despite these positive decreases, at the end of the day, SA’s official unemployment rate remains the highest on a list of 82 countries monitored by Bloomberg. In addition, strict labour laws, stagnant productivity, bureaucratic hurdles, and a skills shortage have reduced South African companies’ ability to hire additional workers.

Figure 2: SA unemployment, YoY

Source: StatsSA, Anchor

Furthermore, we continue to be concerned about the general reliability of SA’s employment data. Statistics SA is meant to collect data on the employment status of 33,000 households – which is extrapolated to determine the jobless rates for around 40mn adults in the country. However, last year it contacted fewer than 14,300 households. The interviews were also done telephonically – not face-to-face as before the pandemic (at the start of this year, in-person interviews resumed).

In addition, despite SA’s economy rebounding quicker than expected from the COVID-19 pandemic last year, growth in 2022 is expected to slow to a meagre 2%. Typically, in the local economy, material job creation has only occurred when GDP growth approaches 3% p.a. Thus, the SA economy is simply not growing at an adequate rate to sustainably boost long-term employment prospects for South Africans. Consequently, the recovery in the unemployment rate may be short-lived as a record number of electricity outages forecast for this year, the ongoing devastating flooding in KwaZulu-Natal, a slowdown in global output, rising interest rates, and surging fuel and food prices caused by extreme weather and the war in Ukraine are likely to weigh on economic growth and job creation going forward.

Overall, as the global economy continues to be buffeted by one crisis or another, consumers’ resilience during the COVID-19 pandemic is now being put to a longer test. Looking ahead, the economic outlook for the average SA consumer in 3Q22 looks bleak, with high levels of consumer financial vulnerability in the short- to medium-term likely to persist, leading to increasing structural imbalances, downside risks, political as well as social instabilities, higher poverty and inequality.

If you have any questions or would like to discuss the subjects raised in this article with someone at Anchor please email us at info@anchorcapital.co.za.