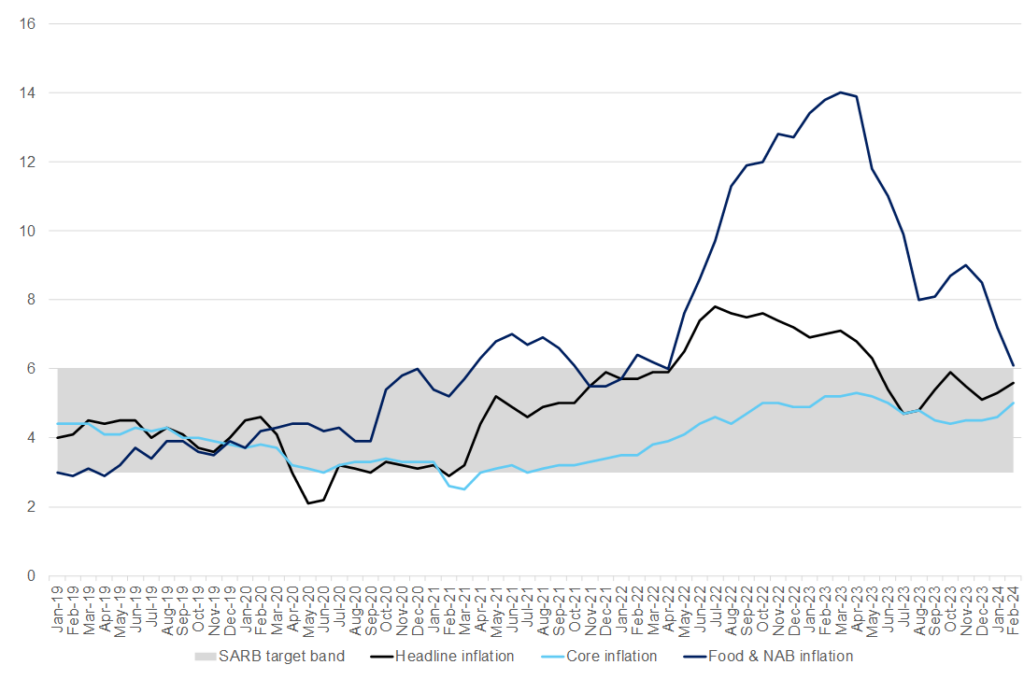

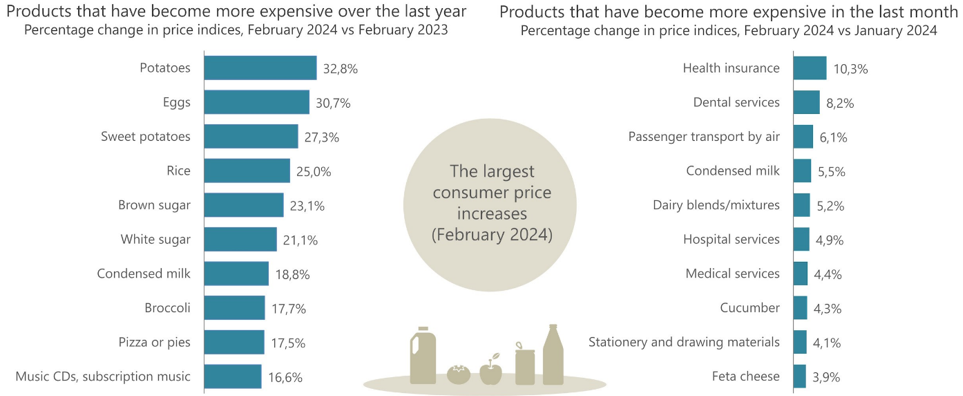

Unfortunately, for South African (SA) consumers, the February headline inflation rate climbed to a four-month high – printing at 5.6% YoY from 5.3% YoY in January. Product categories that drove much of the upward momentum include housing & utilities, miscellaneous goods & services (most notably, insurance), food and non-alcoholic beverages (NAB) and transport. The February CPI release includes the bi-annual survey of medical health insurance costs, which account for 7.1% of the CPI basket. Subsequently, the 10.3% MoM increase in medical aid premiums (in the miscellaneous goods & services category) took the annual rate for health insurance to 12.9% YoY. Premiums for all types of insurance have increased by 9.5% over the past year. In a further dent to consumers’ pockets, the transport category registered an annual rise of 5.4%, driven mainly by increases in vehicle and fuel prices. More positively, however, inflation for food & NAB slowed to 6.1% in February, with most food price categories recording lower annual rates. Notably, meat and egg prices are recovering from the impact of avian influenza, while the fruit and vegetable segment is rebounding from past challenges with harvests and quality, exacerbated by irrigation difficulties linked to power outages.

Core inflation (excluding the more volatile price categories of food, fuel, and electricity) increased to 5% YoY from 4.6% in January as rising health insurance costs filtered into the data. Overall, the unfortunate rise in core inflation is indicative that recent headline pressures are becoming more entrenched in the greater inflation basket. This latest print means that inflation has now moved further away from the 4.5% midpoint of the SA Reserve Bank’s (SARB’s) target band, where it prefers to anchor expectations. It is, however, still within the central bank’s 3% to 6% range.

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor

Figure 2: Products that recorded the most significant annual and monthly price increases in February

Source: Stats SA

Looking ahead, inflation is likely to rise over the short term (off the back of increasing fuel costs, base effects, and the weak rand exchange rate), although we believe that the general trend for this year will be downward. This month (March) has recorded an additional petrol price increase to February’s R1.21/litre rise, which will exert some marked upward pressure on the next inflation reading. Overall, fuel prices have been adding to volatility in the inflation figures. As it currently stands, April is on course for only a small petrol price hike, of around ZAc14/litre, as the international Brent crude oil price has dropped in rand terms. Nonetheless, we anticipate some moderation in consumer prices driven by a continued easing in food prices, which should help counterbalance the projected uptick in fuel costs. Moreover, core inflation (particularly that of goods) will likely remain subdued as consumer demand continues to be constrained by the pressures of elevated interest rates.

However, we continue to view food prices as a key upside risk given the various ongoing supply shocks, particularly ahead of the forecast El Niño weather pattern and amid relatively large swings in crucial commodity prices (including oil) and the rand exchange rate. Overall, risks to the inflation outlook have deteriorated – geopolitical tensions have worsened, and the deteriorating performance at our key ports adds uncertainty to the future inflation path. Due to these various risk factors, we believe the SARB’s Monetary Policy Committee (MPC) will not rush to cut the repo rate. Any possible interest rate cuts will likely only materialise towards the end of 2024 and depend on the inflation outlook (locally and abroad) and global interest rate developments as we progress further into this year.