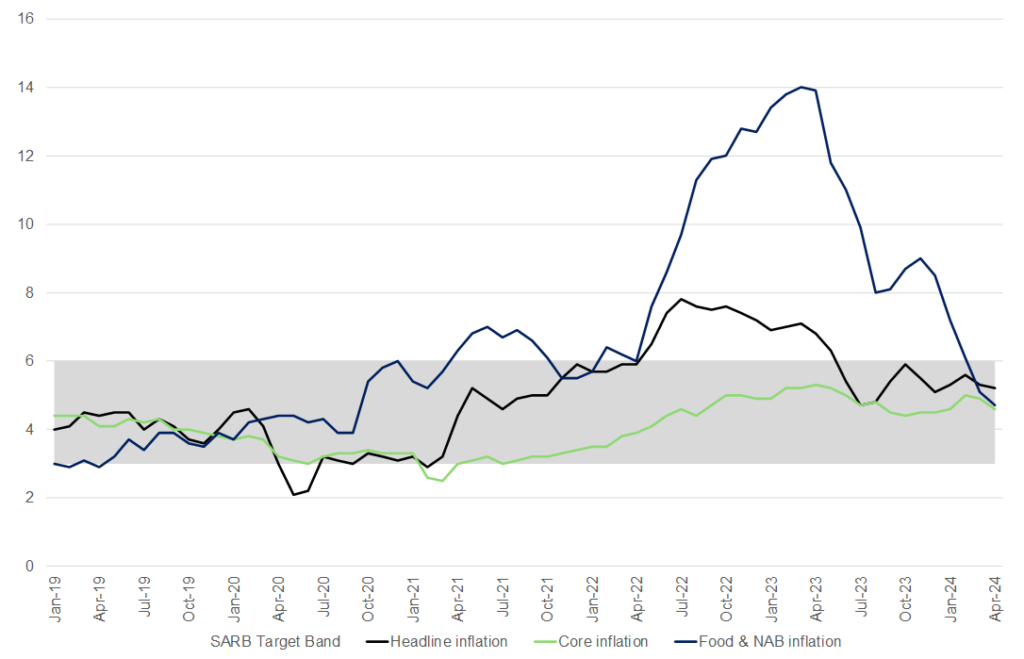

For the second consecutive month, headline inflation, as measured by the Consumer Price Index (CPI), softened – declining to 5.2% YoY in April from 5.3% YoY in March. The headline inflation rate has held its ground between 5% and 6% since September 2023. Core inflation (excluding the more volatile price categories of food, fuel, and electricity) dropped to 4.6% YoY from 4.9% YoY in March. This softening of core inflation was unsurprising, given the subdued demand in the economy, the low exchange rate passthrough, and the relatively minor spillovers from elevated fuel and electricity prices. This latest print means that inflation has moved closer to the 4.5% midpoint of the SA Reserve Bank’s (SARB’s) target band of 3% to 6%, where it prefers to anchor expectations.

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor

Similar to previous months, housing & utilities, miscellaneous goods & services, food & non-alcoholic beverages (NAB), and transport were the main drivers behind the headline rate in April. Of particular importance for SA consumers, inflation for food and NAB moderated further in April to 4.7% YoY, from 5.1% YoY in March- a fifth consecutive monthly decline. Most food & NAB sub-categories, except for vegetables, fruit, and hot beverages, witnessed lower annual rates. On average, vegetable prices increased by 7.4% in the 12 months to April, higher than the 6.0% increase recorded in March. The annual rate for fruit rose from 3.3% in March to 4.5%, mainly driven by higher prices for bananas and apples. As an important consumer staple, bread & cereal inflation continued to slow, declining for a twelfth consecutive month in April. The annual rate eased to 4.3% from 5.0% in March. Bread flour, cake flour, ready-mix flour, white bread, pasta, rusks, savoury biscuits, and maize meal are also cheaper than a year ago. The average price of a loaf of white bread was R18.43 in April.2024, down from R19.07 in April 2023.

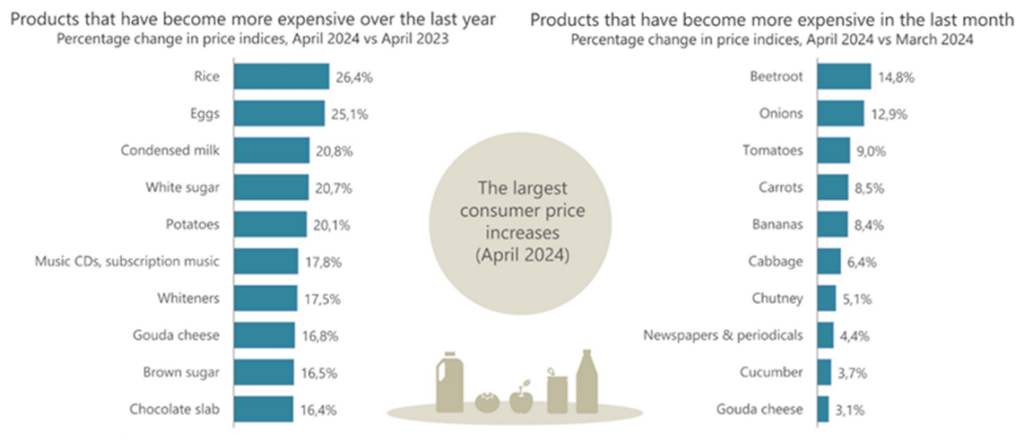

On the other hand, sharp price increases were recorded for rice, pizzas & pies, instant noodles, and sweet biscuits. Annual rice inflation accelerated to 26.4%, the highest reading since May 2009, when the rate was 41.9%. Egg inflation recorded its fifth consecutive month of decline after peaking at 39.9% in November 2023 (amidst the height of the last Avian flu outbreak), then receding to 25.1% in April 2024. Other notable price changes in April include the annual rate for restaurants and hotels, which rose to 7.5% in April from 5.7% in March. Hotel prices jumped by 1.5% between March and April, taking the annual rate for hotels to 10.4%. Unfortunately for consumers, the pinch from transport costs continues to tighten – fuel prices increased by 1.9% MoM, pushing the annual rate to 9.0%.

Figure 2: Products that recorded the most significant annual and monthly price increases in April

Source: Stats SA

Looking ahead, we expect inflation to remain subdued, albeit at levels higher than initially envisioned at the start of this year. Core inflation (particularly that of goods) will likely remain subdued as consumer demand continues to be constrained by the pressures of elevated interest rates. Risks to the outlook appear more entrenched on the supply side – particularly regarding electricity, fuel, and other administered prices. Whilst food inflation has declined significantly over the past two months, the rising costs of maize and wheat (coupled with the effects of a drier season in certain key production regions) could potentially stall this momentum. As a result, we continue to view food prices as a key upside risk given the various ongoing supply shocks, particularly amid the current El Niño weather pattern.

While this latest CPI print is naturally a positive move for the average South African consumer’s increasingly strained wallet, the figure is still some way off from the SARB’s target of 4.5%. It continues to drive the “higher-for-longer” inflation and interest rates narrative. The central bank has remained steadfast in communicating that it will not move the policy rate lower (and thus essentially usher in a rate-cutting cycle) until inflation is under control and sustainably hitting that target. Therefore, interest rates will likely remain on hold when the Monetary Policy Committee (MPC) meets after the national elections next week. Any possible interest rate cuts will likely only materialise towards the end of 2024 and depend on the inflation outlook (locally and abroad) and global interest rate developments as we progress further into this year.