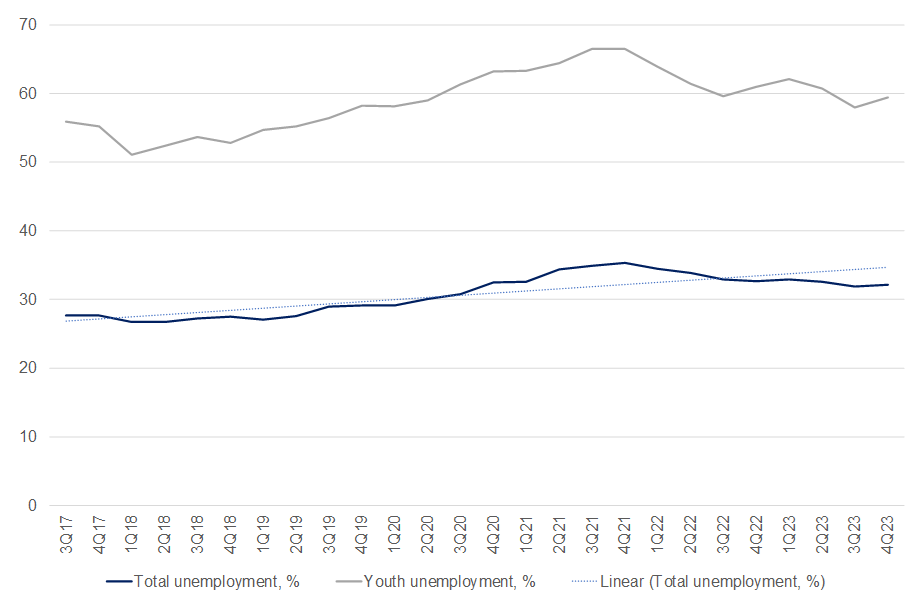

South Africa (SA) faces a significant unemployment problem that continues to pose challenges for the country’s economic and social development. The unemployment rate has remained stubbornly high for many years, with a complex range of factors contributing to the issue. A combination of structural deficiencies, such as a lack of skills, limited access to quality education and training, and inadequate job creation, has resulted in a large portion of the population being unable to find gainful employment. According to the latest Quarterly Labour Force Survey (QLFS) data from Stats SA, SA’s official unemployment rate increased to 32.1% in 4Q23 from 31.9% in 3Q23. Interestingly, both the absorption rate and the labour force participation rate decreased by 0.2 of a percentage point to 40.8% and 60.0%, respectively – indicative of the growing pessimism amongst SA’s workforce. The largest industry employment losses were recorded in community and social services (171,000), construction (36,000), and agriculture (35,000). Meanwhile, the largest industry employment gains were recorded in finance (128,000), transport (57,000), and mining (37,000).

Figure 1: SA quarterly unemployment rate, 3Q17-4Q23

Source: Stats SA, Anchor

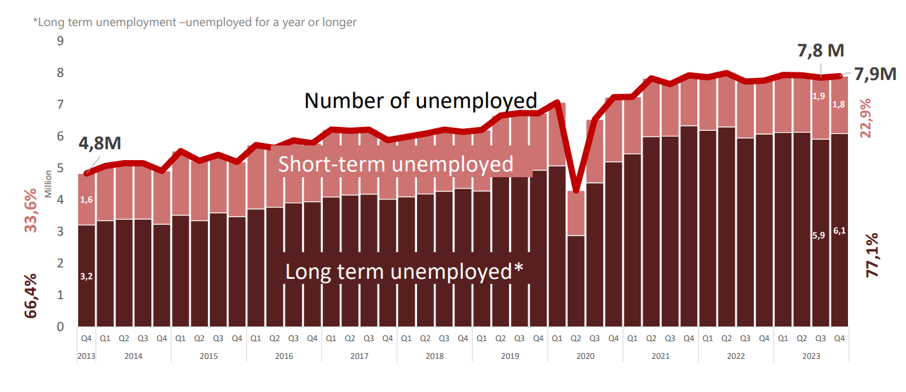

The unemployment rate, according to the expanded definition (which includes those discouraged from seeking work and thus more reflective of the actual number of unemployed South Africans), continues to sit at 41.1% – concerningly high. This points to longer-term, structural issues within the local economy as it is difficult to reincorporate and entice discouraged work seekers back into the labour force. Of further concern is the long-term unemployment rate (i.e., those unemployed for a year or longer), which has steadily increased over the past decade – from 65.5% in 1Q13 to 77.1% in 4Q23. Moreover, SA’s unemployment problem remains particularly acute among the youth, where high levels of unemployment hinder their prospects and exacerbate social inequalities. As such, the youth unemployment rate has risen again to 59.4%.

Figure 2: SA long-term unemployment (unemployed for a year or longer)

Source: Stats SA

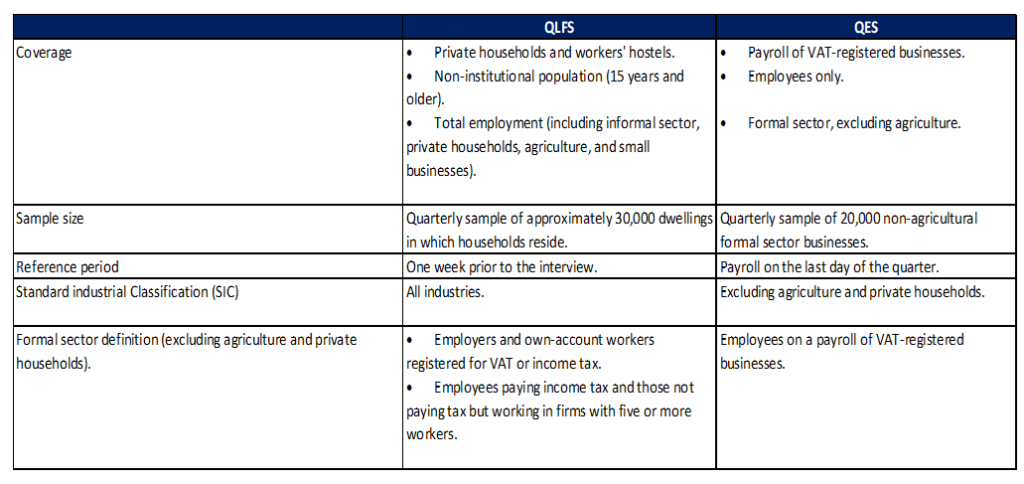

This latest increase in unemployment does not come as much of a surprise, as the apparent strength in employment growth witnessed during 2Q23 and 3Q23 was never reflected in the consumer spending data. Real household consumption spending shrunk for two consecutive quarters in 2Q23 and 3Q23. High-frequency data from 4Q23 also suggest that consumer demand remained muted in the final quarter of last year. Overall, employment data from the QLFS survey (a household-based survey of labour market dynamics covering the formal, informal, and agricultural sectors) in recent months has diverged sharply from data reported in the Quarterly Employment Statistics (QES), an enterprise-based labour market survey that only reports on the formal sector – thus gaining a more transparent, more holistic picture of unemployment in SA is becoming increasingly difficult.

Figure 3: Key differences between the QLFS and the QES

Source: Stats SA, Anchor

Regardless of the exact data, we maintain that the official headline unemployment numbers do not fully reflect the true extent of the unemployment crisis in the country. How unemployment is measured tends to overlook specific segments of the population, such as discouraged workers who have given up searching for jobs and are, therefore, not considered part of the active labour force. Additionally, the official statistics do not adequately capture informal and underemployed workers. Furthermore, the official unemployment rate might not fully account for the quality of jobs available or the degree of job security. Many individuals in SA are trapped in low-skilled and precarious employment, leading to underemployment and persistent poverty.

Moreover, in the domestic economy, material job creation has only occurred when GDP growth approaches 3% p.a. Currently, businesses remain under significant pressure from the ongoing effects of loadshedding, which also weighs on jobs and the unemployment data. Thus, the economy is simply not growing at an adequate rate to sustainably boost long-term employment prospects for South Africans. At the end of the day, SA’s unemployment problem is a complex and multifaceted issue that requires sustained and coordinated efforts from all sectors of society to create inclusive and sustainable employment opportunities for all South Africans.