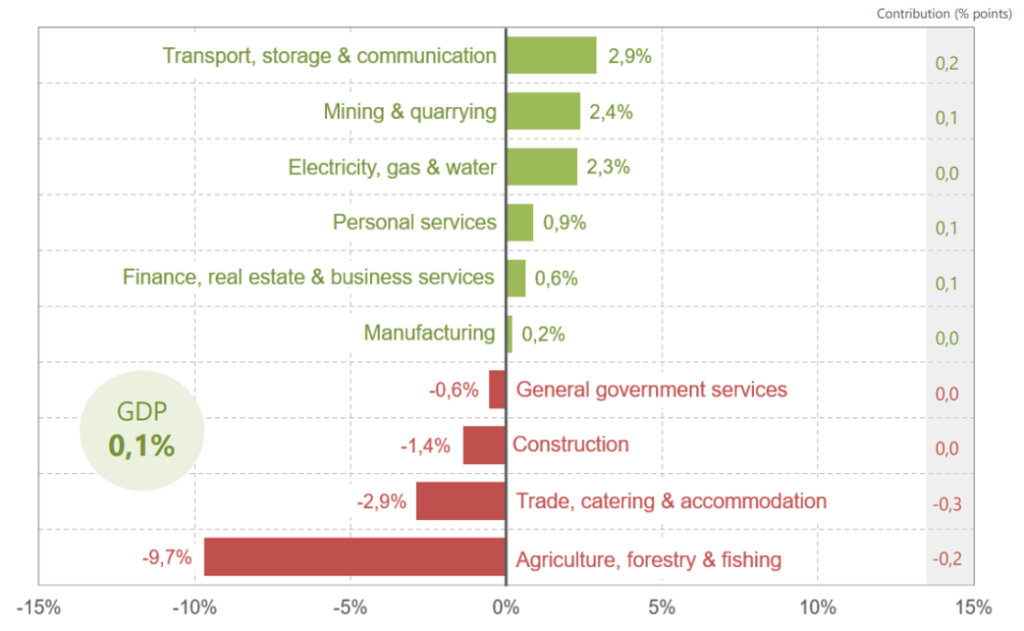

In line with expectations, South Africa’s (SA) 4Q23 gross domestic product (GDP) print increased by just 0.1% QoQ, thereby narrowly dodging a technical recession after loadshedding improved in the final quarter of last year. Six industries recorded positive growth between 3Q23 and 4Q23, with transport, storage, communication, mining and quarrying and the electricity sectors posting the strongest gains. The transport, storage & communication industry made the biggest positive impact, expanding by 2.9% QoQ and contributing 0.2 of a percentage point to GDP growth. Increased economic activity was reported for all transport services across the industry. Mining activity was up 2.4% QoQ, pushed higher by stronger production figures for platinum group metals (PGMs), chromium ore, coal and diamonds. Conversely, the traditional heavyweights of iron ore and gold were down in 4Q23. On the downside, trade, agriculture, construction, and government were also weaker.

Agriculture, forestry & fishing had a notably turbulent quarter, shrinking by 9.7% QoQ. This was primarily driven by weaker production data for field crops (most notably, grain sorghum, hay, wheat, sugarcane and chicory root), horticulture products (most notably, viticulture and citrus fruits) and animal products (most notably, slaughtered pigs, poultry and eggs). The agricultural sector, in particular, is unfortunately positioned to struggle significantly under the prevailing structural issues facing the domestic economy. Loadshedding continues to hamper growth in the industry, given how reliant the sector is on energy. The Bureau for Food and Agricultural Policy shows that roughly one-third of SA’s farming income depends directly on irrigation, which naturally requires power. Furthermore, deteriorating roads, collapsing water infrastructure, poor performance at our key trading ports, and rising crime form additional barriers to the sector functioning effectively and efficiently.

Figure 1: 4Q23 Industry growth rates, QoQ

Source: Stats SA

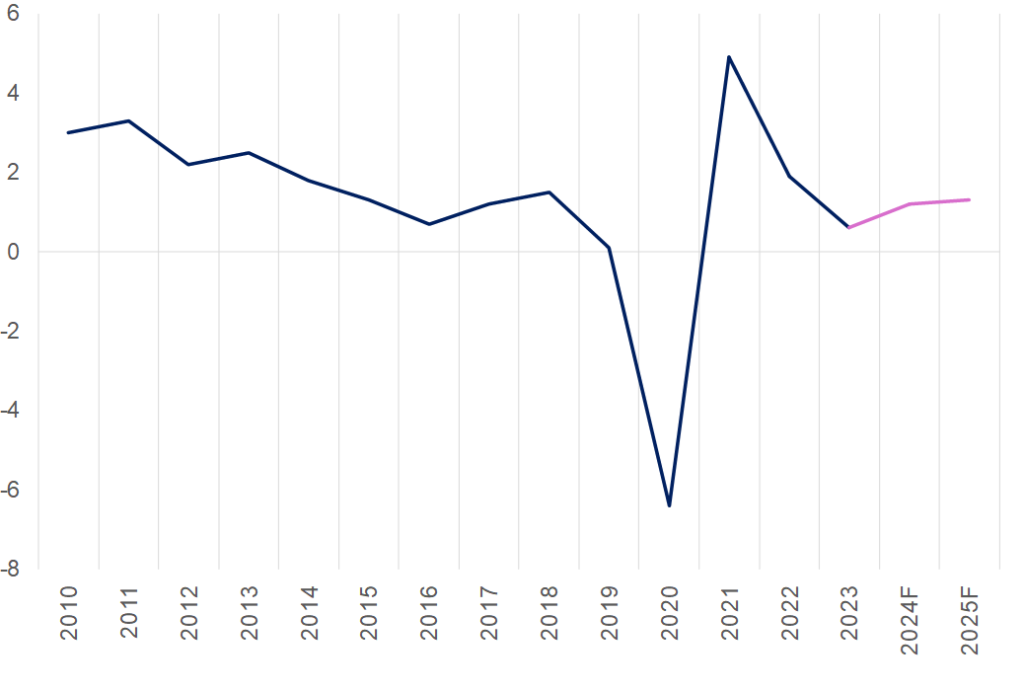

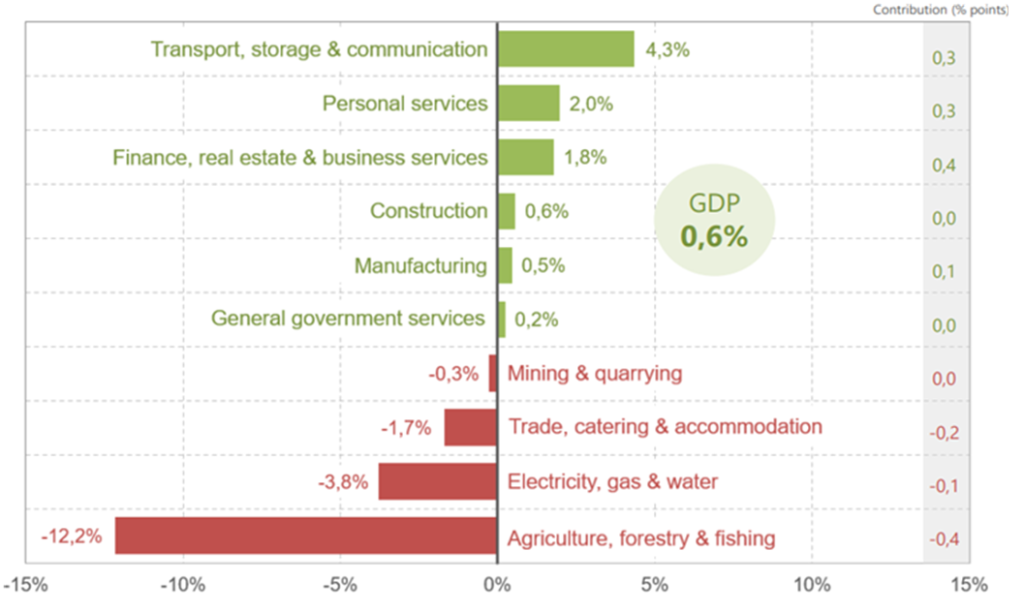

On an annual basis, GDP grew by 0.6% in 2023, primarily due to higher economic activities in finance, real estate, and business services; transport, storage, and communication; personal services; and manufacturing. While 2023 GDP was higher than pre-pandemic growth of 0.3% in 2019, excluding the pandemic years, it was the worst growth print since 2009.

Figure 2: SA GDP growth, YoY % change

Source: Stats SA, SARB, Anchor

The agriculture, forestry, and fishing, trade, catering and accommodation; electricity, gas, and water; and mining and quarrying divisions recorded negative growth in 2023. Construction saw its first positive year since 2016, expanding by 0.6%. Both mining and electricity, gas & water, were down for the second year in a row. Agriculture recorded its first annual contraction since 2019, shrinking by 12.2% YoY. This is the biggest annual drop in agriculture production since 1995 (-19.9% YoY).

Figure 3: Annual industry growth rates in 2023

Source: Stats SA

Whilst a positive GDP print (albeit a marginal one) seemingly appeared unattainable at the start of 2023 amidst record-high loadshedding, it is no cause for celebration. Such minimal growth rates do not lead to meaningful improvements in the economic reality for most South Africans. The average SA consumer is becoming poorer – with the latest data from the International Monetary Fund (IMF) indicating that SA’s GDP per capita is now below the average for emerging economies – and at about the same level as in 2005. According to IMF data, SA’s GDP per capita dropped from US$6,680 in 2022 to US$6,190 in 2023 – far below the record-high of US$8,800 recorded in 2012. Additionally, the 2023 domestic GDP per capita is below the US$6,450 average for an emerging and developing market. Notably, this is the same level of GDP per capita as in 2005. Simply put, SA’s expanding population growth, the weakness of the rand and the minimal economic growth means that the country’s population has been getting poorer in real terms.

Looking ahead, we anticipate that the near-term prospects for growth will remain lacklustre. Moving beyond 2023 and into 2024, we foresee that SA’s growth trajectory will persistently show weakness. The ongoing issues related to electricity supply will likely continue to be a significant limiting factor on economic activity and confidence. Moreover, the impact of elevated interest rates is expected to strain household disposable incomes, thereby restricting growth in consumer spending. We track in line with the SA Reserve Bank’s (SARB) GDP growth forecast for 2024 and 2025 at 1.2% and 1.3% YoY, respectively.