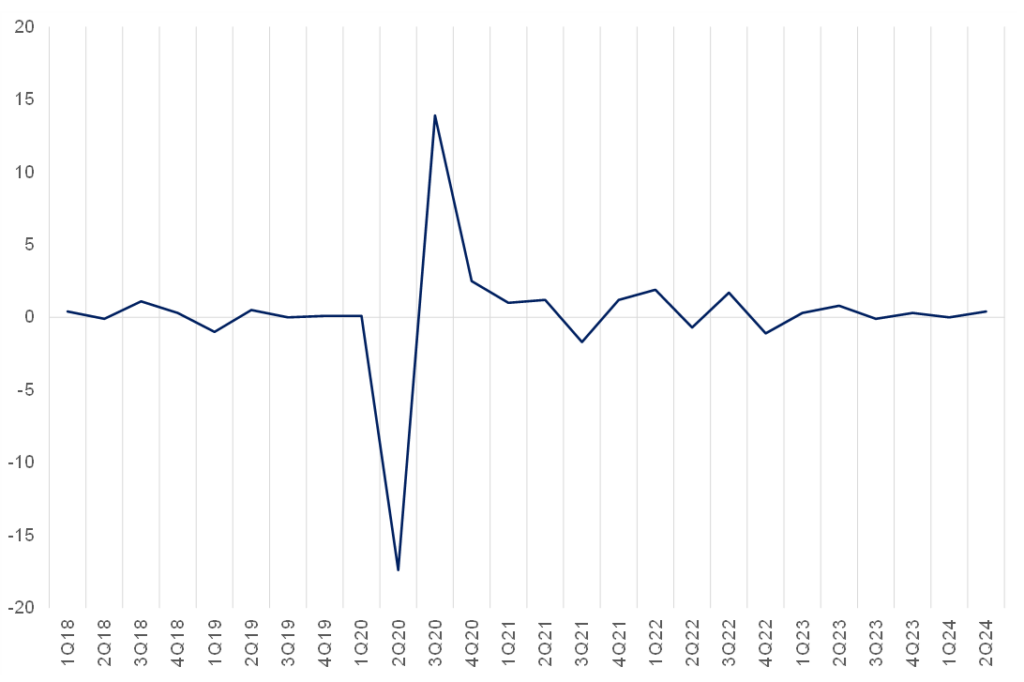

South Africa’s (SA) economy notably started the year on a low note, posting a revised 0.0% QoQ growth rate in 1Q24. The 1Q24 GDP data highlighted the enduring economic vulnerabilities that almost tipped the country into recession in 2023. Entering 1Q24, the erosion of business and consumer confidence, driven by political uncertainty ahead of the 2024 National and Provincial Elections (NPEs) and the ruling ANC’s waning popularity, further dampened the country’s economic prospects. However, in 2Q24, SA’s economy strengthened by 0.4% QoQ. The finance, manufacturing, trade, and electricity, gas & water supply industries drove most of the economy’s production or (supply) side momentum. On the expenditure (demand) side, household consumption, government consumption, and a build-up in inventories contributed favourably to growth. Uncertainty around 2Q24’s print was particularly high, given the projected El Niño damage to summer crops (potentially leading to the agriculture sector’s growth outlook being more volatile than usual and generating a downside surprise). Similarly, large parts of services, including financing, business and personal services, also have no reliable intra-quarter activity data.

Figure 1: SA GDP growth QoQ % change

Source: Anchor, Stats SA

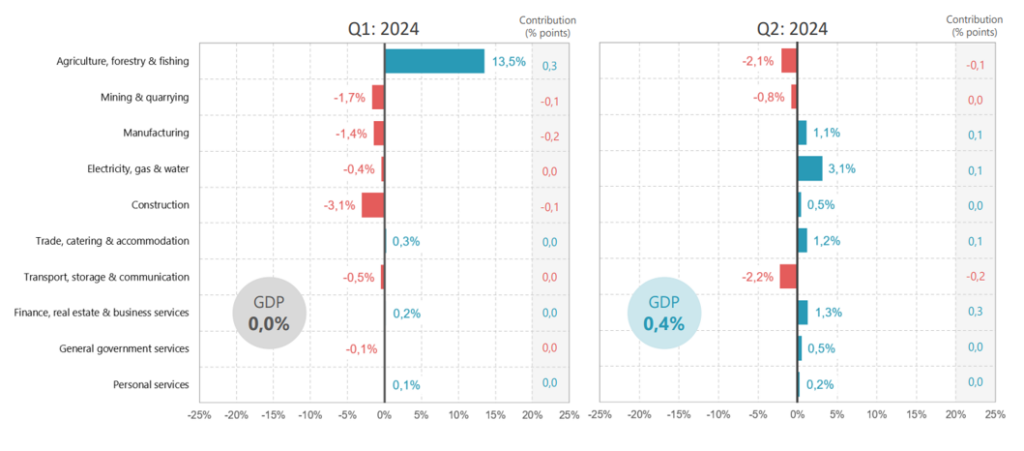

On the production side of the economy, breaking down the latest print to a sectoral level, the finance, real estate, and business services industries had the most significant impact, contributing 0.3% to SA’s economic growth. Other key contributors included manufacturing, trade, and electricity, gas, and water. Manufacturing rebounded with a 1.1% QoQ increase in 2Q24 after contracting in 1Q24, mainly driven by the production of motor vehicles, transport equipment, and food and beverages. Strong economic activity in wholesale, retail, and tourist accommodation boosted the trade, catering, and accommodation industry by 1.2% QoQ.

The absence of loadshedding in the second quarter also positively impacted the electricity, gas, and water supply industry, which grew by 3.1% QoQ, driven by increased electricity generation and water distribution. This growth rate, excluding the volatile economic environment of the 2020 COVID-19 pandemic, marks the most substantial increase since 3Q08, when it also grew by 3.1% QoQ. The construction industry showed signs of recovery after a year of decline, with slight growth in 2Q24, primarily driven by activity in residential and non-residential buildings, despite a slowdown in construction works.

However, not all sectors fared well. Three industries contracted in the second quarter. Transport, storage, and communication saw the largest decline, dropping by 2.2% QoQ and reducing overall GDP growth by 0.2 ppts, primarily due to strike action and a decrease in freight volumes. Agriculture, forestry, and fishing also struggled, facing numerous challenges, including lower-than-expected rainfall in some regions, heavy rains in KwaZulu-Natal (KZN) impacting sugar cane production, and foot-and-mouth disease affecting sheep and pork production. The mining sector recorded a second consecutive decline, with reduced iron ore, coal, diamonds, and gold output contributing to its poor performance.

Figure 2: Comparing sector growth rates in 1Q24 and 2Q24, QoQ % change

Source: Stats SA

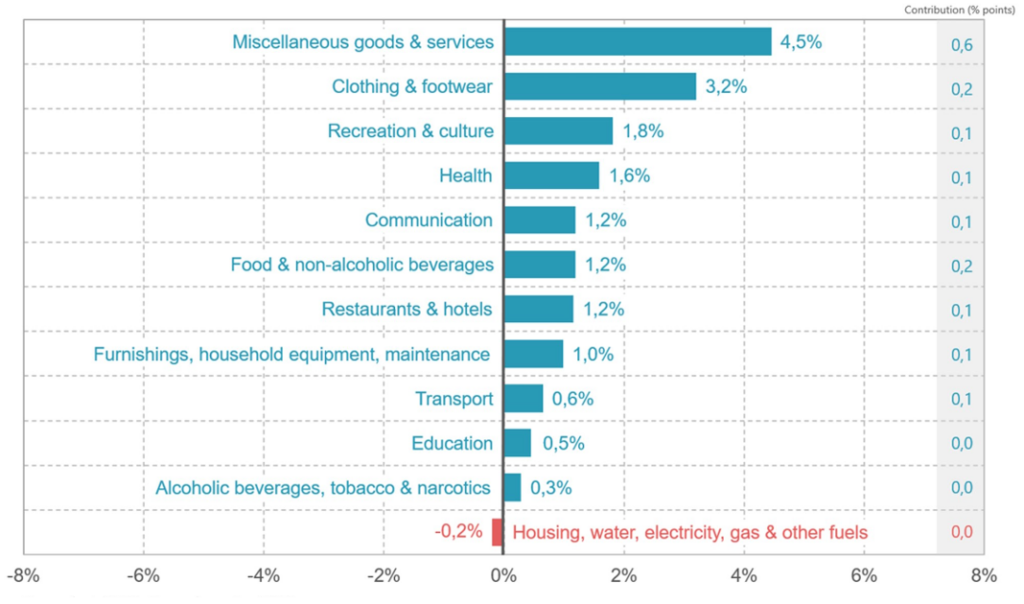

It is important to note that Stats SA also measures the expenditure side of GDP, indicating total demand in the economy. Rising consumer confidence saw household consumption expenditure (HCE) strengthen by 1.4% QoQ – a significant development given household consumption constitutes around 67% of GDP. Unsurprisingly, as a result, household consumption was the largest positive contributor to overall growth on the expenditure side of the economy. Notably, consumers increased their spending across most product categories. The miscellaneous goods & services product group was the largest positive contributor, driven primarily by increased spending on insurance. Given the elevated cost of debt servicing and eroding purchasing power, the anticipated relief stemming from the upcoming interest rate-cutting cycle should boost consumer spending further in the coming months.

Figure 3: HCE by purpose

Source: Stats SA

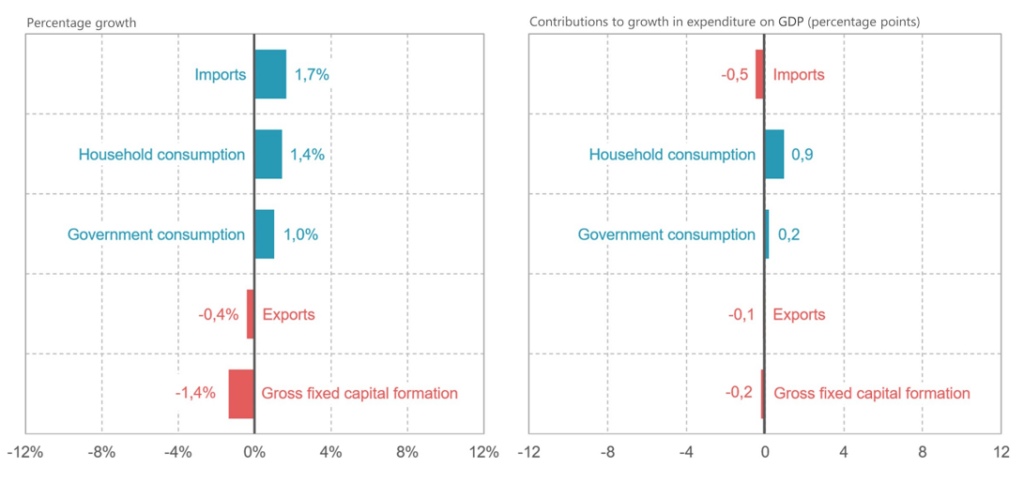

Government consumption also recorded an uptick, driven by increased purchases of goods and services as well as higher compensation for civil servants. Imports rose by 1.7% QoQ, fuelled by stronger trade-in vehicles and transport equipment (excluding large aircraft), vegetable products, mineral products, and textiles. Additionally, inventories grew by R9.6bn in 2Q24, as the supply of goods in the economy outpaced demand, leading the trade, manufacturing, and finance industries to stockpile newly produced goods. However, gross fixed capital formation ([GFCF] covering investments in infrastructure and other fixed assets) disappointed for a fourth straight quarter, declining by 1.4% QoQ. This drop was primarily due to reduced investments in computer software, biological assets, construction works, machinery and other equipment, and transport equipment.

Despite the fleeting optimism of ‘Ramaphoria’ in late 2017, a term used to describe the euphoria which greeted Cyril Ramaphosa’s appointment as ANC president in December 2017 and then country president in February 2018, SA’s investment climate has largely stagnated over the years. Business confidence plunged from 44 to a bleak 30 index points in 1Q24, reflecting policy uncertainty, sluggish growth, and a perceived lack of political will to create a business-friendly environment. Whilst there was a slight improvement to 35 in the 2Q24, business confidence remains far too low to spark a meaningful resurgence in investment activity.

Last year, however, investment saw a sudden spike, but this was mainly driven by energy-related machinery purchases spurred by tax incentives and the urgent need to counter the debilitating effects of loadshedding. This reactive investment was aimed at business survival rather than expansion. While there is cautious optimism about the new Government of National Unity (GNU) and the potential for faster reform implementation, significant challenges persist. High capital costs and the slow recovery of business confidence continue to pose obstacles. Nevertheless, looking ahead, there is hope for a more favourable business environment that could stimulate investment across various asset classes. Notably, exports in 2Q24 also declined, impacted by weaker trade in vegetable products, mineral products, vehicles and transport equipment (excluding large aircraft), and base metals and related products.

Figure 4: QoQ % change in expenditure components and contribution to growth in expenditure on GDP

Source: Stats SA

Looking ahead, we track in line with the SA Reserve Bank’s (SARB) GDP growth forecasts for 2024 and 2025 at 1.1% and 1.5% YoY, respectively. It is important to remember that the government has made significant strides in several reform initiatives. The elimination of energy generation license thresholds has sparked private investment in large-scale energy projects, and the long-anticipated auction of the high-demand telecommunications spectrum has paved the way for the rollout of 5G networks. Furthermore, the Transnet Recovery Plan has led to marked improvements in rail and port efficiency, while the processing times for water-use licenses have been significantly reduced. The recent changes to immigration regulations also promise to simplify access to scarce international skills. These reforms collectively create a more favourable business environment and have the potential to drive economic growth. If economic reforms are implemented faster and private sector engagement increases, our baseline scenario could be upwardly revised. Business and consumer confidence metrics will be key to watch in this regard.

Nonetheless, regardless of the uptick in growth, the average SA consumer is becoming poorer – the latest data from the International Monetary Fund (IMF) indicates that SA’s GDP per capita is now below the average for emerging economies – and at about the same level as in 2005. According to IMF data, SA’s GDP per capita dropped from US$6,680 in 2022 to US$6,190 in 2023 – far below the record-high of US$8,800 recorded in 2012. Additionally, the 2023 domestic GDP per capita is below the US$6,450 average for emerging and developing markets. Notably, this is the same level of GDP per capita as in 2005. Simply put, SA’s expanding population growth, the weakness of the rand and the minimal economic growth means that the country’s population has been getting poorer in real terms. Moreover, in the domestic economy, material job creation has only occurred when GDP growth approaches 3% p.a. Thus, the economy is simply not growing at an adequate rate to sustainably boost long-term employment prospects for South Africans.