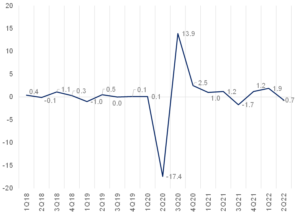

Following two consecutive quarters of growth, South Africa’s (SA’s) 2Q22 GDP decreased by 0.7% QoQ seasonally adjusted, printing slightly better than expectations. YoY, GDP increased by only 0.2%. While SA had a solid start to the year with GDP growth of 1.9% QoQ seasonally adjusted in 1Q22, flood damage in KwaZulu-Natal (KZN) and extensive bouts of loadshedding weighed on activity across different parts of the economy during the quarter. The weakness was broad-based, with most sectors contracting QoQ in 2Q22. However, the weakness was most pronounced in the goods-producing economic sector, with significant negative contributors to growth recorded in manufacturing, agriculture, trade, and mining. It is important to remember that Eskom implemented electricity outages for over half of the days in 2Q22, adding to the record blackouts in the financial year through March that hobbled local economic output.

Figure 1: SA GDP growth, QoQ seasonally adjusted % change

Source: StatsSA, Anchor

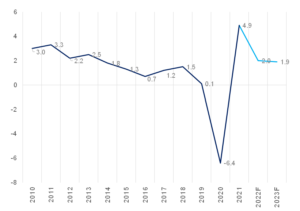

Figure 2: SA GDP growth (including 2022 and 2023 SARB forecasts), YoY % change

Source: SARB, Anchor

Looking ahead, growth in 2022 is expected to slow to a meagre 2% YoY. Typically, in the local economy, material job creation has only occurred when GDP growth approaches 3% p.a. Thus, the SA economy is simply not growing at an adequate rate to sustainably boost long-term employment prospects for South Africans. Furthermore, the slowdown in global output, rising interest rates, and surging fuel and food prices caused by extreme weather and the war in Ukraine are likely to weigh on economic growth and job creation going forward. Overall, as the global economy continues to be buffeted by one crisis or another, consumers’ resilience during the COVID-19 pandemic is now being put to a longer test.