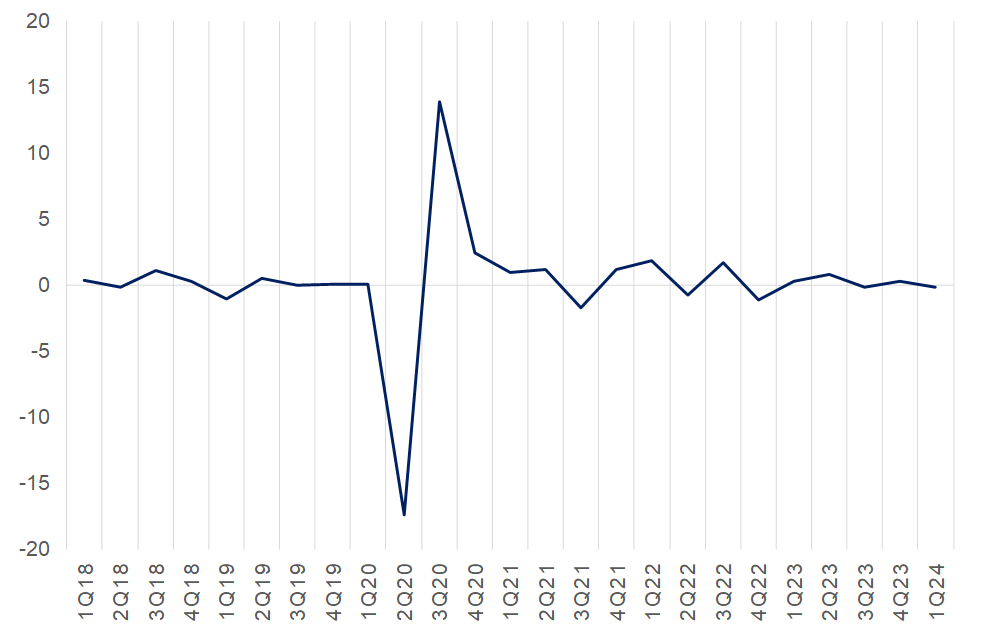

South Africa’s (SA) anaemic economy again finds itself in negative territory after narrowly dodging a recession by growing 0.3% QoQ in 4Q23 after shrinking in 3Q23. Surprising slightly on the downside, SA 1Q24 gross domestic product (GDP) print contracted by 0.1% QoQ. Weaker manufacturing, mining and construction drove much of the economy’s downward momentum on the production (supply) side, while the expenditure (demand) side witnessed a decline across all components.

Figure 1: SA GDP growth QoQ % change

Source: Anchor, Stats SA

Breaking down the latest print to a sectoral level, the Agricultural sector notably rallied in 1Q24, expanding 13.5% QoQ off the back of a buoyant horticulture sector. Unfortunately, it was not enough to keep overall GDP growth in positive territory. Six of the ten industries on the production side of the economy performed poorly in the first quarter. Manufacturing was the largest negative contributor, declining by 1.4% QoQ and pulling GDP growth down by 0.2 of a percentage point. Mining output contracted by 2.3%, with platinum group metals (PGMs), coal, gold and manganese ore the largest drags on growth. Construction continued a downward trend, recording a fourth consecutive quarterly decline. The industry shrank by a further 3.1% in 1Q24, pulled lower by weaker economic activity related to residential buildings and construction works.

Figure 2: Comparing sector growth rates in 4Q23 and 1Q24, QoQ % change

Source: Stats SA

It is important to note that Stats SA also measures the expenditure side of GDP, indicating total demand in the economy. Government consumption, household consumption, investment (gross fixed capital formation [GFCF] and changes in inventories), exports and imports decreased in 1Q24. Exports fell by 2.3%, lowering GDP growth by 0.7 percentage points. This decline was primarily driven by weaker exports of precious stones and metals, vehicles and transport equipment (excluding aircraft), chemical products, base metals, and mineral products. However, there was a positive note with exports of vegetable products increasing in the first quarter, highlighting the agriculture sector’s strong performance.

Imports also decreased, mainly due to reduced trade in mineral products, vehicles and transport equipment (excluding aircraft), and vegetable products. GFCF, encompassing investments in infrastructure and other fixed assets, remained weak for a third consecutive quarter, dropping by 1.8% QoQ. Lower investments in machinery and equipment, residential buildings, and construction works drove this decline. Additionally, household final consumption expenditure decreased in 1Q24, with consumers cutting back on spending, especially on clothing and footwear, transport, miscellaneous goods and services, alcoholic beverages, tobacco and narcotics, and recreation and culture.

Figure 3: QoQ % change in expenditure components and contribution to expenditure on GDP

Source: Stats SA

Overall, the SA economy’s gloomy start to 2024 compounds the concern around the longer-term trajectory for the country. The average SA consumer is becoming poorer – with the latest data from the International Monetary Fund (IMF) indicating that SA’s GDP per capita is now below the average for emerging economies – and at about the same level as in 2005. According to IMF data, SA’s GDP per capita dropped from US$6,680 in 2022 to US$6,190 in 2023 – far below the record-high of US$8,800 recorded in 2012. Additionally, the 2023 domestic GDP per capita is below the US$6,450 average for emerging markets. Notably, this is the same level of GDP per capita as in 2005. Simply put, SA’s expanding population growth, the weakness of the rand and the minimal economic growth means that the country’s population has been getting poorer in real terms. Moreover, in the domestic economy, material job creation has only occurred when GDP growth approaches 3% p.a. Thus, the economy is simply not growing at an adequate rate to sustainably boost long-term employment prospects for South Africans.

Looking ahead, we anticipate that the near-term prospects for growth will remain lacklustre. Moving beyond 2023 and into 2024, we foresee that SA’s growth trajectory will persistently show weakness. Aside from the many structural problems present in the South African economy, the impact of elevated interest rates is expected to strain household disposable incomes, thereby restricting growth in consumer spending.

Moreover, uncertainty around the eventual national election outcome will further exacerbate investor uncertainty about key policy direction on the part of government authorities. Unfortunately, this mediocre economic performance will likely continue in 2Q24, as early high-level economic indicators reveal election uncertainty has diminished demand across various sectors, including manufacturing and retail. Overall, we track in line with the SA Reserve Bank’s (SARB) GDP growth forecast for 2024 and 2025 at 1.2% and 1.3% YoY, respectively.