Recently, there has been a noticeable increase in Japanese Government Bond (JGB) yields, coinciding with signals that Japan’s central bank, the Bank of Japan (BOJ), may be moving towards ending its yield curve control (YCC) policy. YCC stands as one component within the BOJ’s more than two-decade-long extensive monetary policy framework approach, which encompasses various unconventional monetary policy tools, including quantitative easing (QE), forward guidance, and the negative interest rate policy (NIRP), all designed to boost inflation. Despite maintaining negative interest rates, the BOJ has gradually relaxed its control over long-term interest rates in several instances over the past few years. The recent shift in the central bank’s YCC approach will likely have a notable impact on global bond markets, primarily due to Japan’s status as the largest foreign holder of US government bonds and the world’s biggest creditor.

What is YCC?

Central banks across various economies primarily use the policy interest rate as their primary tool to steer monetary policy. Changes to the policy interest rate (constrained by a zero lower bound [ZLB] policy) by a country’s central bank to achieve economic objectives are known as conventional monetary policy. In response to the global financial crisis (GFC) and the subsequent severe recession many economies experienced, central banks in advanced economies lowered their policy interest rates to near-zero levels. Despite these aggressive interest rate cuts, economic growth in these developed economies remained sluggish, accompanied by persistently low inflation. Consequently, interest rates remained at near-zero levels in these economies. Facing the challenge of stimulating inflation, growth, and lending, many central banks resorted to unconventional monetary policy measures. Unconventional monetary policy occurs when central banks use tools other than changing the policy interest rate to achieve their economic objectives. These unconventional tools include asset purchases, forward guidance, and NIRP.

Asset purchases involve the direct purchase of assets (generally government bonds) by the central bank from the private sector. Typically, when a central bank undertakes asset purchases, it can either set a target for the number of assets it will purchase (at any price) or a target for the price of an asset (buying whatever quantity of assets necessary to achieve that price); for a bond, the relevant price is its yield. The concept of conducting quantity-targeted asset purchases is known as QE, whereas specifying a targeted price for asset purchases is termed YCC. In a broader definition, YCC represents a monetary policy strategy where the central bank concentrates on a longer-term yield, pledging to buy whatever volume of the long-term government bond is necessary to prevent the yield from exceeding a predetermined target. This action effectively caps the long-term government bond’s yield to the target yield (or targeted price).

Compared to QE, YCC is not a widely used monetary policy tool. Since the 1940s, three notable instances of YCC have been employed by various global central banks. These are:

- The US Federal Reserve (Fed) during and after World War II.

- The BOJ since 2016.

- The Reserve Bank of Australia (RBA) during the COVID-19 pandemic.

Forward guidance relates to the central bank’s public communication to the market regarding the likely future path of its policy rate – the stance of monetary policy can either be time-based or contingent on the state of the economy.

NIRP is a monetary policy measure where the central bank sets the policy interest rate at a negative level.

What policy steps have the BOJ taken over the years?

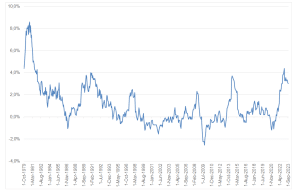

Figure 1: Japan’s headline inflation rate since 1979, YoY

Source: Thomson Reuters, Anchor

Following the start of the stock market crash in 1989 (the Japanese asset bubble) and the banking crisis in the 1990s, Japan faced persistent challenges in stimulating inflation (see Figure 1). Inflation in Japan has remained low since the early 1990s. Inflation turned into deflation (negative inflation, i.e., declining prices of goods and services) in the early 2000s and again during the COVID-19 pandemic.

Between 2000 and 2015, the BOJ tried various monetary easing measures to boost Japan’s inflation rate. These measures included lowering the policy interest rate to near-zero levels, implementing QE, and introducing a broadened asset purchasing programme whereby the BOJ started purchasing risky assets, including corporate bonds.

After years of extensive asset purchases, mainly JGBs, by the BOJ, which did not ignite inflation, the central bank introduced NIRP in January 2016. The policy interest rate was set at -0.1%. This imposed charges on financial institutions for excess reserves they placed with the central bank. NIRP is designed to encourage lending.

After the ineffectiveness of NIRP in stimulating lending, growth and inflation, the BOJ implemented YCC in September 2016. YCC was aimed at addressing two primary concerns:

- Resolve the negative Japanese government yield curve, which resulted in negative returns for financial institutions; and

- Managing the pace of JGB purchases.

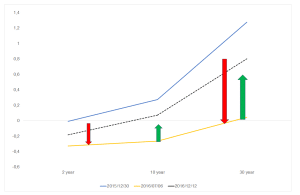

Figure 2: Japanese government yield curve over various periods, %

Source: Thomson Reuters, Anchor

A yield curve is a plot of yields for bonds of the same quality but with different maturities. Figure 2 shows the Japanese government’s yield curve before NIRP (30 December 2015), after NIRP (6 July 2016) and after YCC was implemented (12 December 2016).

Upon implementing a negative policy interest rate in January 2016, the Japanese government yield curve turned negative and flattened. The BOJ aimed to maintain short- to medium-term bond yields at negative/low levels while allowing longer-term bond yields to rise. To achieve this objective, the BOJ adopted YCC in September 2016, introducing a 0% yield target for 10-year JGB and the -0.1% policy interest rate. The strategic approach of combining NIRP and YCC allowed the central bank to control the yield curve effectively, thereby suppressing short- to medium-term rates, which incentivised commercial bank lending, household spending and corporate borrowing while ensuring that longer-term yields increased and did not result in depressed returns for financial institutions, such as pension funds, commercial banks and life insurers.

During the period of QE and the broader asset purchase programme, the BOJ accumulated a substantial amount of JGBs. The pace of annual JGB purchases peaked in 2016, with the central bank acquiring c. JPY100trn worth of JGBs that year. At that point, the BOJ had acquired around 35% of the JGB market, posing challenges for the central bank to sustain the purchase pace without distorting market trading volumes. Implementing YCC allowed the BOJ to purchase only the necessary bonds to maintain its targeted 0% yield for the 10-year JGB. YCC reduced the pace of the BOJ’s annual JGB purchases, tapering it down to c. JPY70trn by 2019.

Since adopting YCC, the BOJ has made several adjustments to its YCC policy, moving from price targeting to band targets and eventually adopting the more recent “reference points” approach. Concerns regarding market liquidity, price distortions, rising inflation, and a depreciating yen prompted these YCC regime alterations. Moreover, the surge in inflation has provided investors with cause to drive up 10-year JGB yields, testing the target yield on multiple occasions and exerting further pressure on the BOJ to alter YCC regimes.

In July 2018, the BOJ modified the YCC approach, transitioning from a price target to a band target – allowing the 10-year JGB yield to move 0.1% above or below the 0% target, ultimately creating a -0.1% to a 0.1% target band. Over time, the BOJ widened this target band, expanding it to a range of 0.5% above and below the 0% yield target by December 2022 as it grappled with a depreciating yen, rising inflation, rising JGB yields, reduced trading volumes, price distortions and emerging signs of illiquidity in Japan’s debt market (the world’s third-largest debt market). To contextualise the illiquidity, after decades of bond purchases, the BOJ had crowded the market by owning more than 50% of the total JGBs and more than 95% of in-issue 10-year JGBs. Following further adjustments in the YCC approach, in October 2023, the BOJ transitioned again, shifting from the target band to a reference point strategy. The central bank departed from its cap by considering the upper band of 1% for the 10-year JGB yield as a reference point. This shift implies the BOJ’s readiness to tolerate the 10-year JGB yield drifting higher and surpassing the 1% level.

Why are rising JGB yields and the likely ending of YCC important for global bond markets?

Japanese institutional investors are among the largest capital exporters in the world. Over decades, Japan has consistently purchased substantial amounts of US government bonds, European bonds, and bonds in other foreign markets. This trend stems from the prolonged period of ultra-low domestic interest rates, which has incentivised yield-seeking Japanese investors to allocate their savings abroad in pursuit of better returns. To contextualise the size of foreign bonds bought, we note that Japan is the largest foreign holder of US government debt. As of August 2023, Japanese investors owned US government bonds worth over US$1.1trn. Similar positions are assumed for German, French, and Australian government bonds.

Despite elevated global bond yields, Japanese investors’ appetite for overseas debt has diminished over the past two years due to the rising costs of foreign exchange (FX) hedging. In contrast to the absence of domestic interest rate hikes for Japanese investors, the surge in global interest rates has increased the cost of FX hedging. Investing overseas (cross-border investing) comes with a lot of exchange-rate risks.

To illustrate cross-border investing, let us consider a scenario where a Japanese investor aims to purchase US government bonds. Initially, they must convert their Japanese yen into US dollars to acquire the US government bond. As the US government bond yields provide US dollar returns, the investor needs to convert these US dollar returns into yen. This conversion back to yen exposes the investment’s returns to fluctuations in the US dollar vs Japanese yen currency pair, potentially impacting the investment positively or negatively. To fully mitigate or partially eliminate the exchange-rate risk, the Japanese investor will generally enter a short US dollar vs Japanese yen position using a derivative, typically an FX forward, to secure yen-equivalent returns. This practice is called FX hedging. Generally, investors hedge the FX risk over 3 to 12 months. Today, Japanese investors face significant challenges in their overseas investments owing to a notable surge in FX hedging costs.

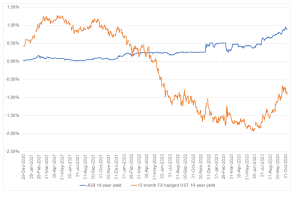

Figure 3: The 12-month fully FX-hedged 10-year UST yield vs 10-year JGB yield

Source: Thomson Reuters, Anchor

Figure 3 compares yields on a 12-month FX-hedged 10-year US government bond and a 10-year JGB. Starting from mid-2022, the yield of a 12-month fully FX-hedged, 10-year US government bond has been lower than those from 10-year JGBs. Today, the hedged 10-year US government bond yields approximately -1%, while the 10-year JGBs offer a +0.8% return. It is a similar picture for German, French and Australian 10-year government bonds (see Figure 4).

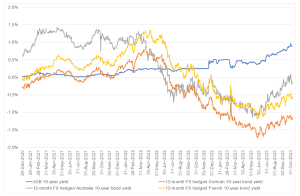

Figure 4: The 12-month, FX-hedged, Australian, German and French 10-year government bonds’ returns vs the 10-year JGBs

Source: Thomson Reuters, Anchor

Since JGBs offer more attractive returns than overseas bonds, Japanese investors will likely shift away from foreign bonds by selling them and purchasing the more appealing domestic bonds. Such a rotation will likely exert significant upward pressure on global bond yields.

Conclusion

Japanese investors are among the largest capital exporters in the world, currently holding substantial volumes of US government bonds, European bonds, and many other bonds from foreign markets. The high costs associated with FX hedging have diminished returns from foreign bonds for Japanese investors. Consequently, Japanese investors’ demand for overseas debt has declined over the past two years. The combination of elevated Japanese inflation, a depreciating yen, and continuous adjustments to the YCC strategy by the BOJ indicate that this demand will likely remain weak as yields on JGBs continue to rise. Consequently, JGBs are poised to become even more appealing for Japanese investors than overseas bonds. Considering Japan’s significant holdings of foreign bonds, an accelerated rotation from lower-yielding FX-hedged foreign bonds toward higher-yielding domestic bonds could exert upward pressure on global bond yields. This shift may impact various government bonds, including those from the US, Germany, France, and Australia.