Setting the scene

Against a backdrop of soaring inflation (reaching levels last seen four decades ago) that has shaped the global investment landscape since 2021, central banks globally have responded with decisive measures. These have included notable reductions in their balance sheets and substantial interest rate hikes, collectively contributing to heightened levels of volatility across asset classes globally over the past 24 months.

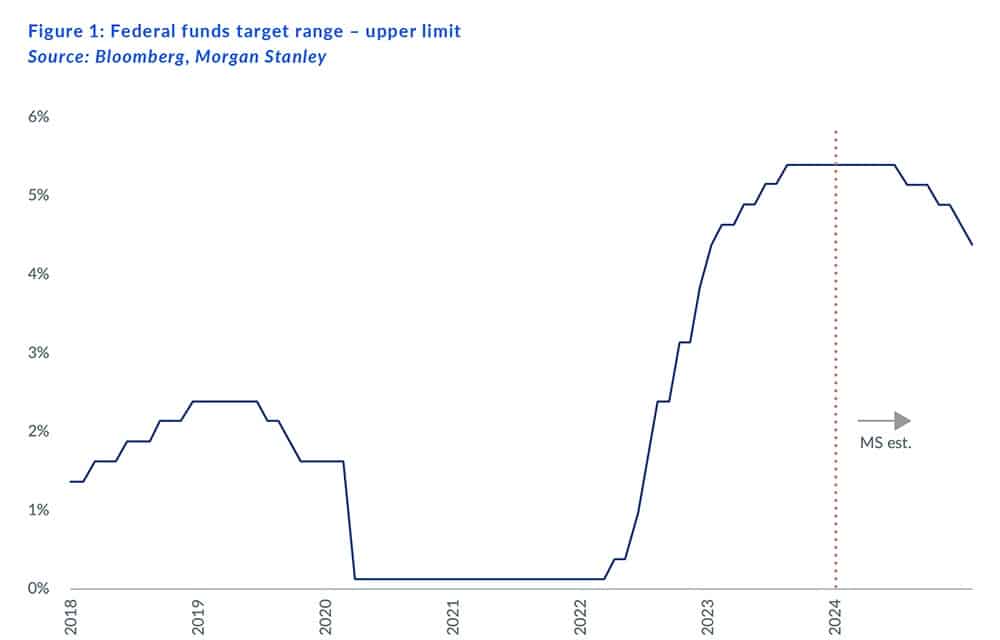

As inflation is widely believed to have reached its peak, the assumption is that central banks are now pivoting away from hiking rates as global growth starts to soften due to the higher interest rate environment. Amid market participants forecasting a slowdown in global growth for 2024 and some anticipating the potential for a shallow recession, attention has shifted toward the prospect of rate cuts. Some participants even anticipate these cuts to begin as early as 1H24. The graph below shows the upper limit of the federal funds target range set by the US Fed’s Federal Open Market Committee (FOMC). Additionally, it includes estimates from the global investment firm Morgan Stanley on its anticipated timing for the US Fed’s first interest rate cut, which is expected to take place in the middle of 2024.

Given these expectations, investors are faced with the crucial task of determining which sectors and individual stocks are positioned to thrive in a decelerating growth environment, potentially leading to a shallow recession and the subsequent declining interest rates. This article explores the historical impact of different interest rate regimes on equity market returns, shedding light on those sectors that have historically outperformed during periods of slowdown, recession, and recovery in the economic cycle, along with decreasing fund rates.

Why stocks thrive as interest rates fall

The rationale behind why stock prices rise as interest rates fall lies in the impact of falling discount rates on the present value of equities. The assumption is that as discount rates decrease, the current value of future cash flows from stocks rises, thereby pushing up stock prices. An illustration of this dynamic unfolded during the COVID-19 pandemic. In response to the economic challenges posed by the pandemic, central banks globally, including the US Fed, swiftly implemented substantial interest rate cuts. This aimed to stimulate economic activity and prevent a prolonged downturn in the global economy.

The consequence of these drastic rate cuts was a significant boost to equity valuations. Investors seeking returns in an environment of lower interest rates turned to stocks as attractive investments. The increased demand for equities and the lowered discount rates contributed to a notable surge in share prices.

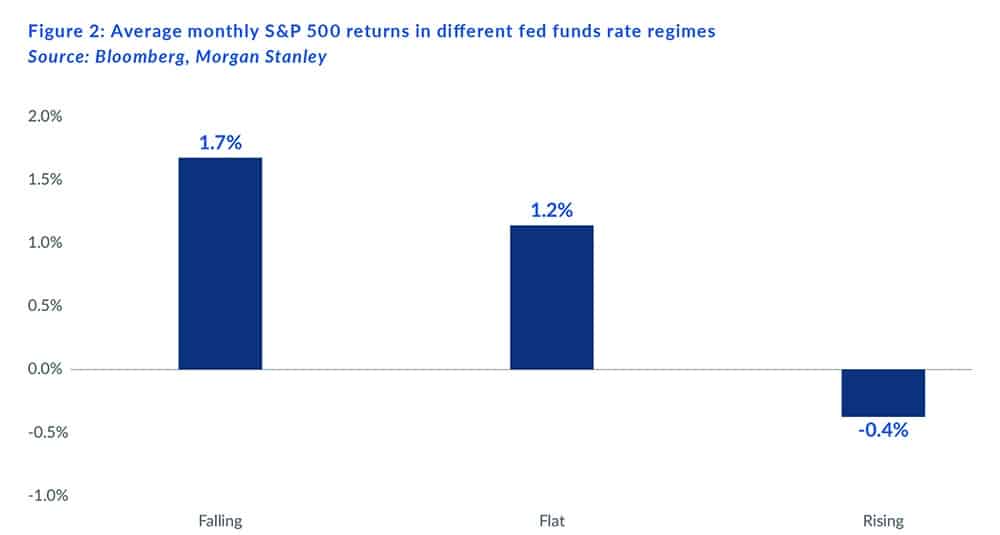

Given historical trends and recent events, the empirical support for the idea that shares tend to perform well when interest rates decline is noteworthy. The following graph, once again from Morgan Stanley, illustrates the average monthly S&P 500 returns during periods characterised by falling, flat, and rising interest rates. The chart illustrates that the S&P 500 experiences an average monthly growth rate of 1.7% during a US Fed rate-cutting cycle. This contrasts with the positive 1.2% growth rate observed in stable or flat rate environments and stands in even starker contrast to the negative return of 0.4% during a rate-hiking cycle.

Performance trends of S&P 500 sectors across the business cycle

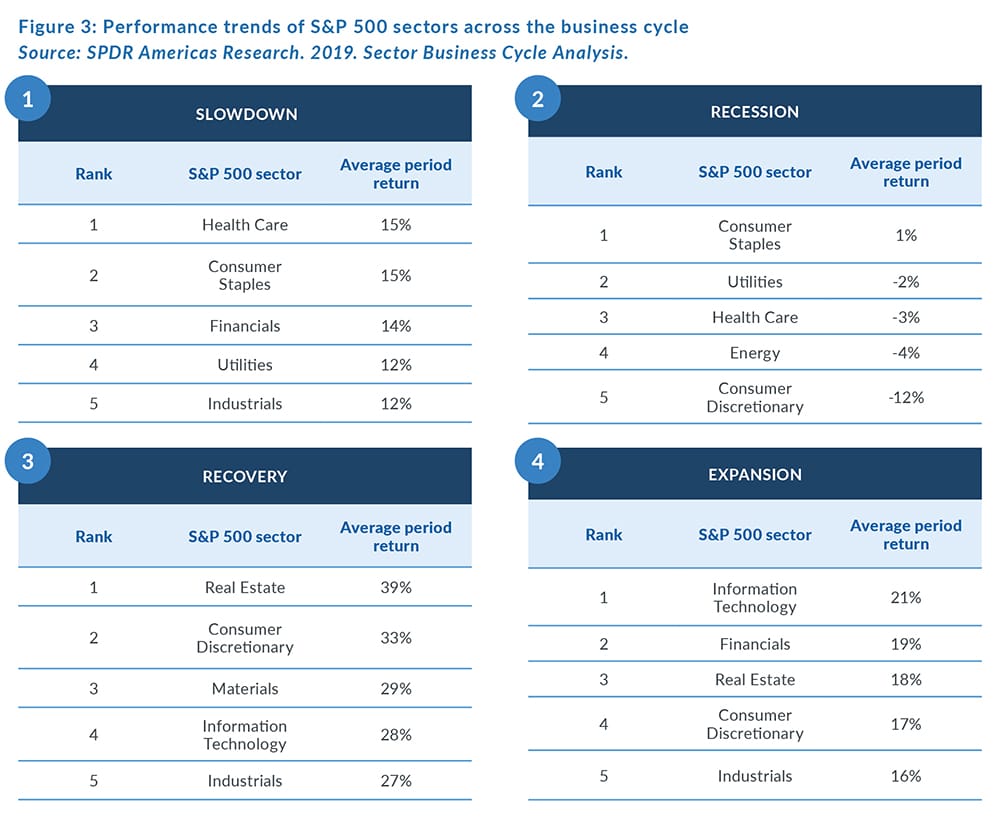

Looking at the performance of various S&P 500 sectors throughout distinct phases of the business cycle since 1960 provides some valuable insights. Recessions, commonly defined as two consecutive quarters of falling GDP, signify a substantial decline in economic activity, reduced outputs, and diminished aggregate demand from consumers and businesses. These periods often witness increased unemployment, low consumer confidence, and a contraction in domestic production, leading to monetary policy interventions to stimulate aggregate demand through interest rate reductions.

Since 1960, seven recessions have occurred. Looking at the average sector returns during these downturns shows that Consumer Staples, Utilities, and Health Care consistently outperformed the overall market by an average of 10% in six of the past seven recessions.

Economic recovery, the subsequent phase following a recession, is characterised by increased economic activity and growth. This period is marked by GDP expansion and a surge in aggregate demand. Consumers show optimism about economic growth, capitalise on low interest rates, and increase discretionary spending, while businesses stop cutting back on commercial activity. Over the past 60 years and across the last seven recovery periods, the Real Estate and Consumer Discretionary sectors have consistently outperformed the market following periods of economic contractions.

Sectors outperforming in falling interest rate environments

Recession and recovery represent distinctive phases in the economic cycle, marked by falling interest rates. As we have seen, specific sectors consistently show strong performances during these business cycle stages, given the defensive nature of their business during recessions and the favourable impact of lower borrowing costs and increased consumer spending during recovery periods. Standout sectors under these conditions include Consumer Staples, Utilities, and Health Care during recessions and Real Estate and Consumer Discretionary during recoveries.

Non-cyclical sectors such as Consumer Staples, Utilities, and Health Care show resilience during economic slowdowns and recessions, as their businesses are not tied to discretionary spending and are less sensitive to economic fluctuations. In the recovery phase, an uptick in the labour market and consumer confidence drives increased discretionary spending on durable goods, restaurants, and travel, which benefits Consumer Discretionary sectors.

Although recessions typically impact the Real Estate market significantly, the subsequent low interest rates and eased monetary policies make real estate acquisition more affordable and accessible. The recovery in commercial activities also enhances the value of commercial real estate and contributes to the sector’s notable outperformance during the recovery phases of the economic cycle.

Conversely, sectors that thrive during a recession — specifically Consumer Staples, Utilities, and Health Care — lose their appeal as the market rebounds. Investors then pivot towards more cyclical sectors to capture opportunities in the market, indicating a shift in preferences as economic conditions improve during the recovery period.

Conclusion

Looking ahead to 2024, there is little doubt that the global economic slowdown is underway. The key question is whether this deceleration will tip the global economy into a recession and when we might start seeing a decline in interest rates. Investors are currently focused on navigating these market dynamics as the landscape evolves in the coming year.

On the one hand, global equity markets grapple with significant macroeconomic risks, and various economists project a slowdown in global growth and anticipate declines in company margins and profit growth. On the flip side, a noticeable shift in investor sentiment has already occurred as inflation retreats from multi-decade highs. There are signs indicating that interest rates have peaked, fueling optimism within global equity markets. With inflation trending downward and the potential for accommodative monetary policies, the outlook for specific sectors and equities looks compelling for investors prepared to ride the wave.