At Anchor we have always had an entrepreneurial spirit, with solution-focused problem solving encouraged. This is the way Anchor portfolio and wealth managers think when proposing investments and structures (where applicable) to clients. It is not a case of product-pushing or square pegs in round holes – rather we pride ourselves on providing the best, and most appropriate, financial solutions for our clients’ needs, even if these occasionally require out-of-the-box thinking.

From the first meeting with a new client to the ongoing communication, we continually consider risk tolerance and appetite, time horizon, asset allocation, cashflow requirements and any special requirements (e.g. Sharia compliance or a client wanting a portfolio without mining stocks). Again, we tailor our investment decisions to each client’s individual needs and focus on building a relationship with the client from day one, to ensure that we always understand a client’s personal needs.

We place significant importance on maintaining this relationship because, simplistically, we believe there are two aspects to successfully managing private client funds – returns and service. As much as we like to think they are, returns are not always within our control. For example, if the Chinese government suddenly decides to limit time spent on mobile games for children (as they did in 2018), Naspers, with its c. 30% shareholding in China-listed Tencent, will be taking some pain and, consequently, because of Naspers’ huge weighting on the JSE, so will our market. Service, however, is completely within our control and we take it incredibly serious.

One aspect of servicing clients is ensuring they are (as mentioned above) in the best and most appropriate investment for their particular set of circumstances. Another is keeping clients close to the investment process and educating them on why we are making the decisions we are. Experience has taught us that an informed client is a happy client and we achieve this through the frequent publication of research and ideas, as well as ongoing communication. Again, we place a great deal of emphasis on building relationships and trust with clients.

Below we highlight a few examples of options available to cater to unique client needs:

Example 1 – Maximising Tax Efficiency:

Given the recent market volatility, certain investors are understandably nervous about financial markets and have opted to leave their surplus funds in cash. When discussing this with potential or existing clients, we make mention of what we believe to be a more elegant solution than leaving cash in a bank and earning taxable interest. While still respecting the client’s risk-averse stance, we have proposed investing their cash in the low-risk Anchor BCI Flexible Income Fund within the Hollard Endowment structure, where the tax rate on income and capital gains is 0%. The outcome is a marginally higher-risk profile compared to cash in the bank but, potentially, significantly higher returns over a 5-year period.

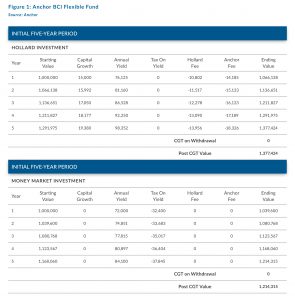

In Figure 1, we illustrate that our alternate solution could potentially yield a return 13% higher over 5 years than cash in the bank, where the interest earned is liable for income tax.

We have assumed the following:

- The BCI Flexible Income Fund has a yield of 7.5% p.a. and capital growth of 1.5% p.a.

- After fund fees of 1.3% p.a. and the Hollard Endowment platform fee of 0.99% p.a, the expected return is 6.7% p.a.

- In a money market account, investors earn 7.2% p.a. but will have to pay 45% p.a. income tax on this interest.

We note that the underlying investment can be changed, should the client’s risk appetite return – a client can go from the cash alternative described above to 100% equity exposure within a few days. In current market conditions, we believe being nimble and creative can yield tangible results.

Example 2 – Large Single Stock Exposure:

The Steinhoff accounting scandal, which broke in December 2017, serves as a timely reminder of those risks associated with having large exposure to a single share. We often come across clients who have significant single-stock exposure where they have accrued large rand gains. This could be, for example, due to them having worked at a listed company for many years or, as in the case with a stock like Naspers, benefiting from a share’s compounding returns over a long period. The client has the option to transfer a portion (or all) of the concentrated stock position into a single unit trust or a combination of funds that give them the desired and appropriate risk/return profile, as well as local/offshore split.

Section 42 of the Income Tax Act provides for rollover relief in certain share-for-share transactions, such as the transfer referred to above. The original base cost of the share(s) carries forward and the client becomes liable for capital gains tax (CGT) on the sale of the units in the unit trust(s) at a certain date in the future.

Practically, the process is fairly simple. A client exchanges the shares (e.g. Naspers) in their Anchor Stockbroking account for units in a fund held with Boutique Collective Investments. Both the cost and market value of the position are transferred into the fund position.

As the saying, made famous by US economist Harry Markowitz goes, “diversification is the only free lunch” in finance.

Example 3 – Global Diversification:

On the topic of diversification, we urge clients to externalise funds where possible – this is not only from an overall asset allocation perspective but also because the investible universe is that much greater globally, thus providing opportunities we may not have in the local market. In addition, it has never been easier to externalise clients’ hard-earned South African rand.

There are three ways in which an investor, in their personal capacity, can take funds offshore:

- Through utilising their discretionary allowance of R1mn per calendar year;

- Through applying to the SA Revenue Service for tax clearance up to a maximum of R10mn per calendar year; or

- Through an asset swap, where a company (e.g. Anchor) externalises funds on the client’s behalf. While the client has direct offshore currency exposure, the funds are essentially still viewed as rand-denominated. When the client disinvests, their foreign currency will be converted back to rand. This is more commonly used by trusts and companies to externalise funds.

Akin to a Section-42 transfer, this process is relatively simple. For clients using their allowance or going via tax clearance, they open a South African Corporate Cash Manager (CCM) account. Once the funds are transferred into this account, Anchor’s forex desk does the conversion from rand into the desired currency (e.g. US dollar). The forex trade takes two days to settle, at which point we transfer the funds to the client’s offshore stockbroking account. Clients utilising an asset swap follow the exact same process, except the initial rand investments are transferred to Anchor’s CCM account.

Once the funds arrive in the client’s offshore stockbroking account, those funds are invested in a share portfolio, unit trust, or combination of these. Where appropriate, we propose that clients use life wrappers when investing abroad. We make use of the Old Mutual International or Sanlam Glacier offerings. We note that Anchor does not receive any rebates from these providers but believe they are useful for South African investors, with specific reference to estate planning and situs tax.