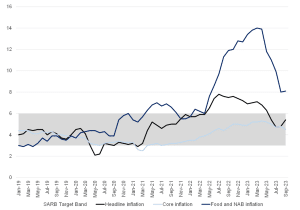

Inflationary pressures have fallen continuously in South Africa (SA) since peaking at 7.8% YoY in July 2022. However, although inflation has bottomed out, it has started to rise mainly because of statistical factors linked to the comparison against falling fuel prices a year ago, as statistical base effects have begun to bottom out. This, in addition to the fact that fuel prices rose 3.1% MoM in September as Brent crude oil prices rose (the local petrol price increased by R1.71/litre and diesel rose by R2.80/litre), led inflation as measured by the Consumer Price Index (CPI), to increase by 5.4% YoY, from 4.8% YoY in August. The outsized impact of much higher fuel costs was evident in core CPI (which strips out the impact of food and energy prices) printing at just 4.5% YoY in September (vs 4.8% YoY in August). The upward pressure of the aforementioned base effects will continue for the remainder of this year and likely until January 2024.

Figure 1: SA inflation, YoY % change

Source: StatsSA, Anchor

Looking ahead, the conflict in Israel poses a further risk of rising oil prices. Given that the conflict is still in the very early stages, there is no certainty on how the current situation will unfold. However, the longer the conflict lasts, the more likely it is that other key countries in the Middle East, such as Iran or Saudi Arabia, might be drawn into it, either directly or indirectly. As such, the current concern revolves around the timeline for resolving the conflict. If it were to escalate further, we anticipate that the strain on oil markets would significantly escalate, potentially leading to even more pronounced market disruptions. Nonetheless, these pressures would take time to feed into the South African economy, and the latest data from the Central Energy Fund (CEF) suggest petrol prices could be cut by about R1.90/litre in November, while diesel prices might be lowered by between ZAc69 and ZAc75/litre.

Overall, ongoing rand weakness remains an inflationary risk, as does rising oil prices. Notably, in the SA Reserve Bank’s (SARB) recent bi-annual Monetary Policy Review, the central bank highlighted that the upside risks to inflation had strengthened over the past months, heightening uncertainty about a precise path for inflation. The central bank further noted that the rise in oil prices, dry weather conditions, and elevated inflation expectations negatively impacted the inflation outlook. As such, the expected rise in CPI in September further cements the view that domestic interest rates will probably remain higher for longer, with a 50/50 chance of a further 25-bp hike in the last SARB Monetary Policy Committee (MPC) meeting of the year, which is due to be held on 23 November.