Over the past few weeks, a sustained upward trend in the oil price has raised concerns about South Africa’s (SA) deteriorating near-term domestic inflation outlook. In a brief respite, the oil price plummeted by over 10% during the week of 2 October, falling below the US$85/bbl mark, temporarily alleviating concerns surrounding the inflation outlook. Unfortunately, this relief proved to be short-lived. On Saturday (7 October), the Palestinian militant group Hamas launched a surprise, multi-front coordinated assault and its largest attack on Israel in decades, resulting in hundreds of deaths and Hamas capturing over 100 hostages. In what some have likened to Israel’s version of 9/11, the attack triggered a swift response from Israel. Israeli fighter jets launched airstrikes on parts of the Gaza Strip, resulting in significant Palestinian casualties. This renewed and severe escalation in the longstanding conflict between Israel and Hamas carries the ominous prospect of escalating into a broader regional Middle East conflict, potentially involving major oil-producing nations such as Saudi Arabia and Iran. The concerns around this potential of renewed conflict in the Middle East have naturally filtered through to financial markets, from soft commodities to energy and fixed income.

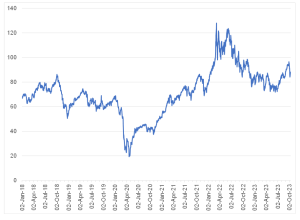

Crude oil prices were the first to spike higher, jumping as much as 4.1% in the early trading sessions on Monday (9 October), reaching a high of US$88.15/bbl, up from the close of US$84.58/bbl on Friday (6 October). At the time of writing (10 October), crude oil prices were sitting at c. US$87.58/bbl. The jump still leaves Brent contracts below the levels that prevailed for most of last week and the recent one-year high of US$97.69/bbl, reached on 28 September.

Figure 1: Brent crude oil price, US$/bbl

Source: Thomson Reuters, Anchor

At this point, we believe the surge in crude oil prices will likely be a temporary, reactionary response. To exert a prolonged influence on oil markets, there will need to be a sustained disruption in oil supply or transportation. Neither Israel nor the Palestinian territories play a significant role in global oil production. However, the proximity of the conflict to a crucial oil-producing and exporting region raises concerns. A major worry for the oil market lies in the potential involvement of oil-rich Iran. If Western nations officially establish a connection between Iranian intelligence and the Hamas attack, Iran’s oil supply and exports may face immediate downward pressure due to stricter sanctions enforcement. Iran’s oil exports were constrained following re-imposed sanctions after the US withdrew from a nuclear accord in 2018 under former President Donald Trump. However, with Iran seemingly evading sanctions and US President Joe Biden’s administration discreetly enforcing them in the interest of better relations, Iran managed to significantly increase its oil production and exports between late 2022 and mid-2023.

The ongoing conflict may further complicate the Biden administration’s efforts to facilitate a reconciliation between Saudi Arabia and Israel, potentially impacting the kingdom’s willingness to increase its oil production. As the Israeli government pledges an unprecedented response, it becomes increasingly challenging to see how diplomatic talks aimed at normalising relations between Saudi Arabia and Israel can proceed concurrently with a vigorous military counteroffensive and the inevitable civilian casualties that will follow. Undoubtedly, elevated energy expenses will add further complexity to the already tricky global and local inflationary environment, intensifying the challenges central banks face worldwide. The current concern revolves around the timeline for resolving the conflict. If the conflict were to escalate further, it is anticipated that the strain on oil markets would significantly escalate, potentially leading to even more pronounced market disruptions.

Naturally, higher energy costs will complicate the picture when looking at global and local inflationary pressures, making the work of the world’s central banks much more difficult. The question now is how quickly the conflict can be brought under control. Should the conflict spread, the expectation is that the pressures on oil markets will increase substantially, causing further market dislocations. Given that the conflict is still in the very early stages, there is no certainty on how the current situation will unfold. However, uncertainty and heightened risks are likely bullish for crude oil prices.