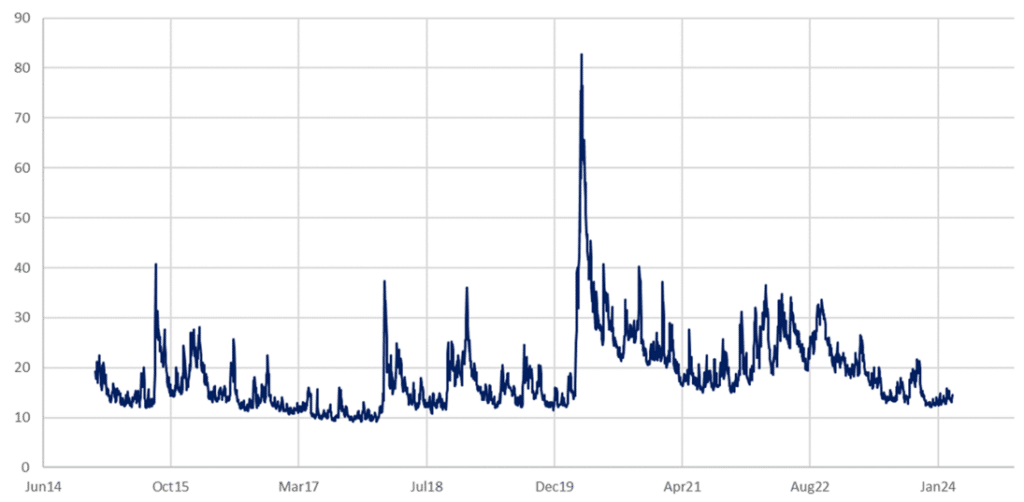

As we move into 2024, the global risk landscape remains volatile, with 2023 uncertainties persisting into this year and likely beyond. Nonetheless, there are glimmers of a positive trajectory emerging. Throughout 2023, concerns over the global economic outlook, geopolitical tensions, and questions surrounding the functionality of the US government amplified market volatility. While many of these concerns have somewhat subsided, others, particularly in geopolitics, have evolved. The Chicago Board Options Exchange Volatility Index (VIX) measures the expected volatility of the US stock market. In general, VIX values of greater than 30 are considered to signal heightened volatility from increased uncertainty, risk, and investor fears. VIX values below 20 generally correspond to more stable, less stressful market periods. Whilst the VIX Index has predominantly stayed below 15 YTD, there is a lingering potential for heightened global uncertainty, potentially leading to increased market volatility in the months ahead. Furthermore, predicting commodity market behaviour continues to be challenging, influenced by the enduring strength of the US dollar and geopolitical tensions. Nevertheless, there is cause for a cautious level of optimism around a more favourable outlook for global market risk sentiment in 2024.

Lower interest rates, notably in developed markets (DMs) such as the US, may mitigate rate volatility. However, uncertainties in the general global macroeconomic environment are poised to maintain them at relatively heightened levels for the foreseeable future. Market attention towards potential rate cuts could amplify volatility in the shorter end of the yield curve, given the uncertainty surrounding the timing and extent of such measures, especially amidst persistent inflationary pressures and a robust US labour market. As such, these multifaceted factors hint at a potential improvement in risk appetite as we advance into the latter half of 2024, with anticipated declines in US Treasury yields and a weakening US dollar, potentially opening avenues in local emerging market (EM) debt.

In recent years, EM sovereign bonds have witnessed substantial outflows due to swift rate hikes by the US Federal Reserve (Fed), resulting in relatively subdued investor positioning. Although current valuations seem somewhat inexpensive, monitoring higher growth rates and fiscal discipline will be crucial, leading to bolstered fundamentals to justify narrower spreads and increased returns. As credit quality improves, this is also likely to translate into upgrades in sovereign credit ratings.

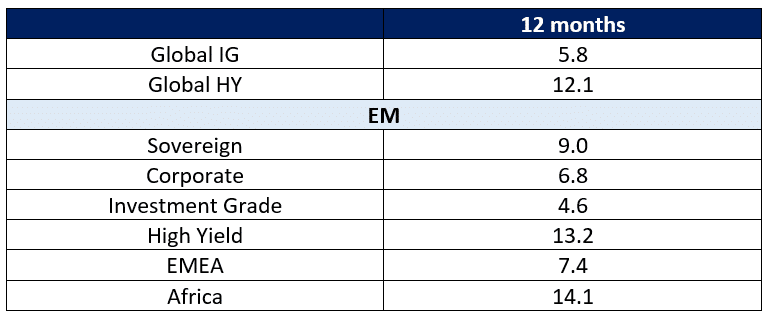

Still, EM credit has seen significant activity this year, marked by record-breaking issuance levels, notably in January, where EM debt issuance soared to an unprecedented US$68bn. This surge has been led by investment-grade sovereigns, boasting oversubscribed benchmark bond offerings, while speculative-grade sovereign credit offerings have also enjoyed robust demand. January 2024 witnessed the most substantial influx of new EM debt issuance since April 2020. In terms of performance, high-yield (HY) bonds have outpaced investment-grade (IG) bonds over the past 12 months. Interestingly, EM HY bonds have outperformed their global counterparts within the HY category.

Figure 1: Credit returns, (%) as of the end of February 2024

Source: RMB, Anchor.

Figure 2: Global volatility as measured by VIX edges higher

Source: Reuters, Anchor

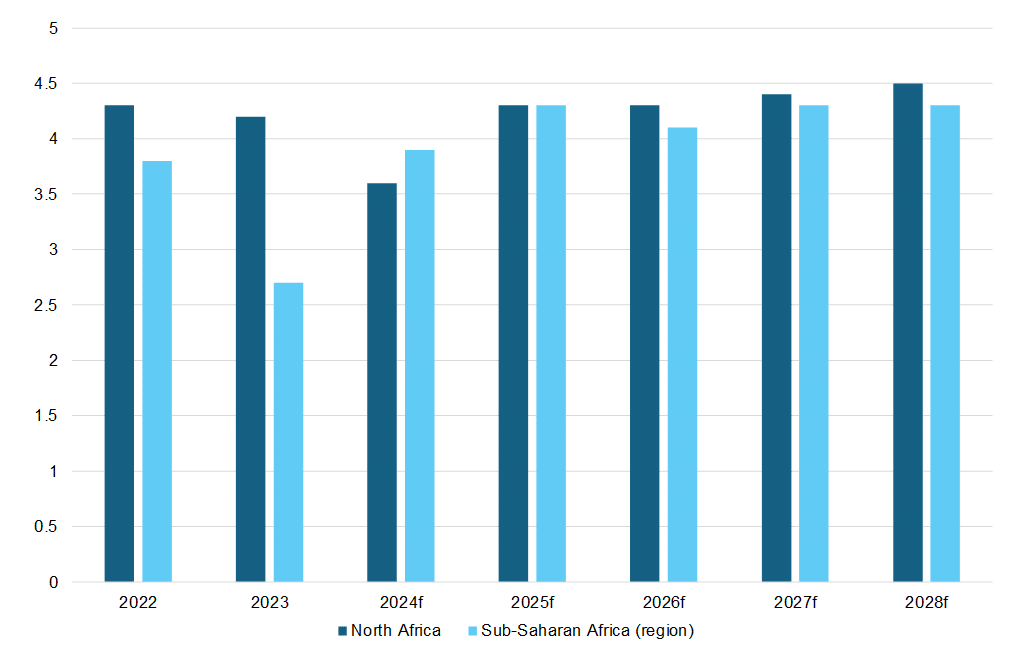

In Sub-Saharan Africa (SSA), the International Monetary Fund (IMF) expects growth to rise from an estimated 3.3% in 2023 to 3.8% in 2024 and 4.1% in 2025 as the adverse effects of earlier weather shocks subside and supply issues gradually improve. However, the 2024 growth forecast is 0.2 ppt lower than the IMF’s previous forecasts (released in October 2023), which mainly reflects a weaker projection for South Africa (SA) on account of increasing logistical constraints, including those in the transportation sector, on economic activity.

Figure 3: GDP growth North Africa vs SSA, YoY % change

Source: IMF, Anchor

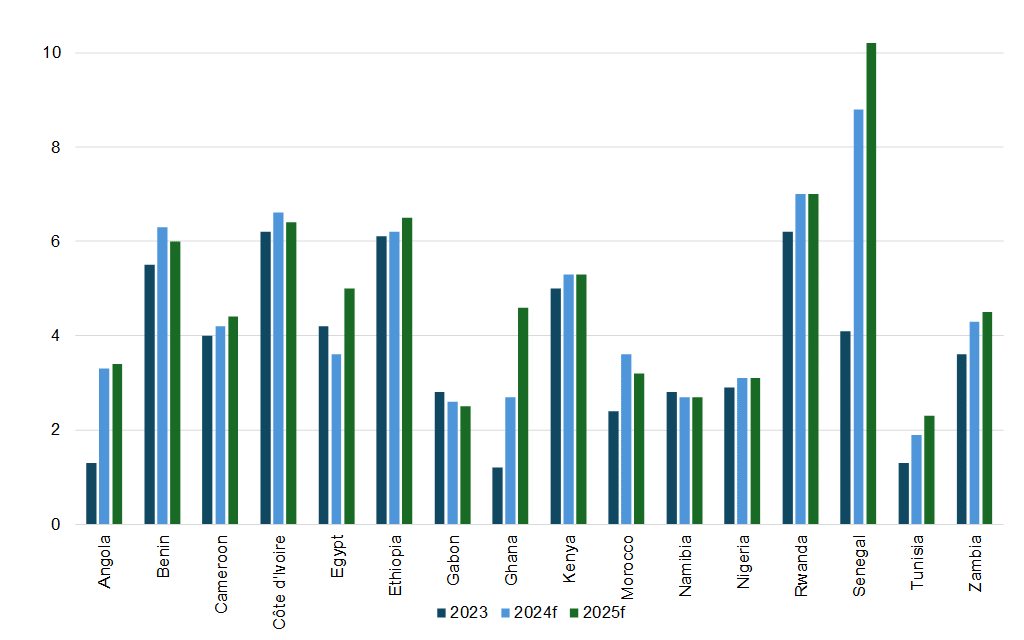

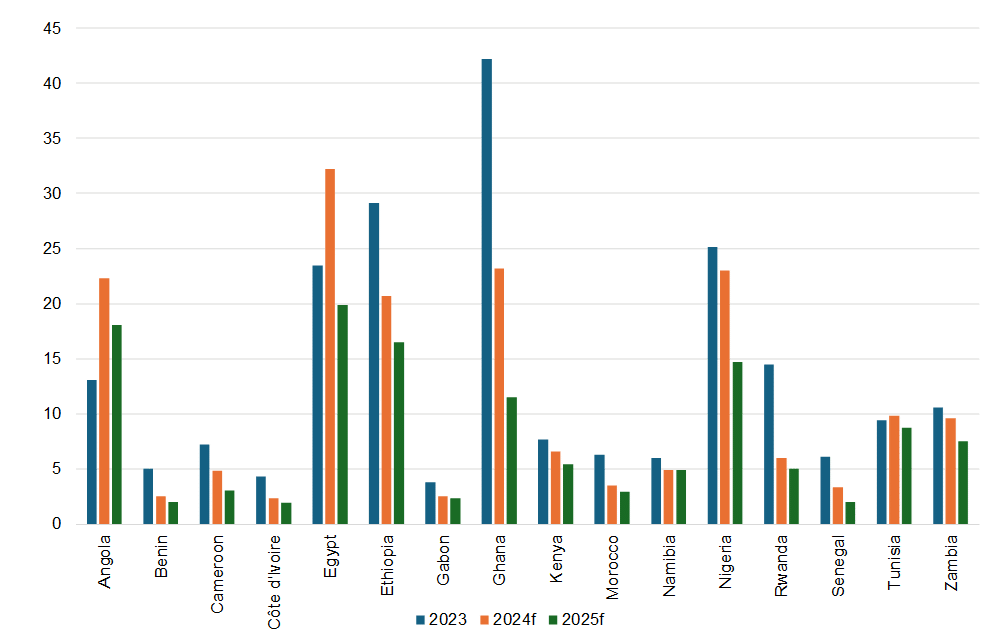

Figure 4: GDP growth in key African markets, YoY % change

Source: IMF, Anchor

In 2023, several key African markets saw a decline in consumer price inflation towards the latter part of the year. Nevertheless, global pressures from food and energy prices persisted, exacerbated by currency devaluations in certain countries, intensifying inflationary strains. Across the continent, broad expectations are for a moderation in inflation over the coming months, albeit remaining structurally above its long-term average. In 2024, Angola, Egypt, Ghana, Nigeria, and Zambia are projected to continue to grapple with double-digit inflation. Nonetheless, most countries across the continent are forecast to start experiencing disinflation at some point during 2024, with Ghana already displaying signs of this trend. In countries with already high inflation rates (and expected to rise further, such as Nigeria and Egypt), there is an expectation for additional monetary tightening in the early months of 2024. Most countries are expected to peak their rate-hiking cycles in 1H24, barring further inflationary shocks. Kenya, Namibia, Mozambique, and Botswana have already seen inflation return to their target ranges.

Figure 5: Inflation rates in key African markets, YoY % change

Source: IMF, Anchor

On the fiscal front, market expectations are for policy to remain constrained, primarily due to high funding costs and lingering debt vulnerabilities. Many countries strive to enhance revenue generation, which is somewhat of a challenging endeavour amid less-than-optimal economic growth conditions. Nonetheless, subsidy reforms in nations like Angola, Egypt, Kenya, Nigeria, and Zambia are expected to provide some fiscal relief. Concerns regarding debt sustainability persist, highlighted by the increasing debt-service obligations faced by numerous markets – much like in SA. Given financial limitations and the pace of fiscal reform, a gradual fiscal consolidation is the more likely outcome. This consolidation is projected to help stabilise debt-to-GDP ratios across most countries.

In 2024, the market broadly anticipates Ghana and Zambia to undergo restructuring of their foreign-currency debt. However, the debt restructuring process under the Common Framework (CF) may encounter further delays in both cases. Multilateral funding will remain a crucial support mechanism throughout the region. Although Côte d’Ivoire successfully issued US$2.6bn in eurobonds in January, along with US$1.5bnn by Kenya and US$750mn by Benin in February, access to the eurobond market may be limited for sovereigns with lower credit ratings until later in the year when global financial conditions are set to improve. Expectations are for Nigeria, Angola, and Senegal to come to the market this year.

Overall, African economies faced a notable growth slowdown last year, influenced by factors such as a sharp increase in living expenses, subdued international demand, and strict global financial conditions, which impeded the post-pandemic recovery efforts across several countries. Similar to trends observed in DMs and broader EMs, broader market expectations point to a disparity in GDP growth among African nations in 2024 (albeit an overall improvement compared to 2023). Looking forward, it will be crucial to closely monitor commodity price movements both globally and on the continent throughout the year. Besides potential geopolitical shocks that could lead to supply disruptions and escalate commodity prices, particularly 2the oil price, the risk of price volatility in food commodities remains ever-present. This risk is partly attributed to the El Niño weather phenomenon, which poses a potential threat that could spark a resurgence in inflation, as witnessed in Zambia and West Africa.

As we progress into 2024, our medium-term outlook remains positive for most key African markets, primarily fuelled by the improving macroeconomic conditions. Despite prevailing global uncertainties, we see opportunities to embrace some level of risk throughout 2024, particularly in the current environment of market volatility, where there may be a need to seize more tactical opportunities. As 2024 has been dubbed the “year of elections”, the African continent has not been exempt from this phenomenon. Across the continent, presidential and/or general elections will take place in Botswana, Ghana, Mozambique, Namibia, SA, Senegal, Algeria, Mauritania, Tunisia, Mauritius, Rwanda, and South Sudan. As a result, throughout 2024, it will be vital to keep close track of the electoral proceedings across the continent to identify any potential shifts in policy and signs of deviation from various governments’ fiscal consolidation plans.