Global trade has faced renewed setbacks in recent months due to disruptions at two crucial shipping routes. Attacks on vessels in the Red Sea area have hampered traffic flow through the Suez Canal, the primary maritime passage between Asia and Europe, responsible for approximately 15% of global maritime trade volume. Consequently, numerous shipping companies have opted to reroute their vessels around the Cape of Good Hope, extending delivery times by an average of 10 days or more, adversely affecting businesses with limited inventories. Meanwhile, on the other side of the globe, a severe drought at the Panama Canal has compelled authorities to implement restrictions, significantly reducing daily ship crossings since last October. This slowdown has impeded maritime trade through another vital chokepoint, typically accounting for about 5% of global maritime trade.

The Suez Canal and the Panama Canal are indisputably vital waterways that play crucial roles in global trade and, by extension, the greater global economy. Both canals provide significant shortcuts for ships, reducing transit times and costs. The Suez Canal connects the Mediterranean Sea to the Red Sea, providing a shortcut between Europe and Asia. The Panama Canal connects the Atlantic with the Pacific Ocean, providing a crucial passage between the east and west coasts of the American continent and East Asia. By avoiding lengthy and often hazardous routes around continents, ships save time, fuel, and operational expenses. This efficiency benefits trade by making goods more accessible and affordable to consumers worldwide. As a result, these canals play a significant role in integrating global supply chains. They enable just-in-time manufacturing processes by reducing transportation times, allowing companies to operate with leaner inventories and respond more quickly to changing market demands. Consequently, closure or disruptions in these canals can significantly impact shipping routes and costs. For example, the temporary closure (for six days) of the Suez Canal in 2021 due to the grounding of a large container ship, the Ever Given, caused significant disruptions to global trade and highlighted the canal’s importance.

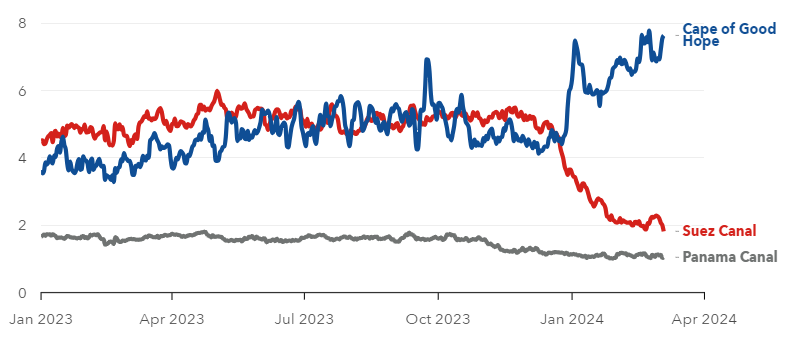

As a result of the recent spate of attacks in the Red Sea and the severe drought at the Panama Canal, the latest IMF data indicate that in the first two months of this year, trade volume passing through the Suez Canal plummeted by 50% YoY. Conversely, the volume of trade circumventing the Cape of Good Hope surged by an estimated 74% YoY. Simultaneously, transit trade volume through the Panama Canal declined by c. 32% YoY. The IMF further indicates that in January and February 2024, there was a 6.7% YoY decline in port calls to the 70 ports they track in sub-Saharan Africa. The European Union (EU), the Middle East, and Central Asia experienced corresponding declines of 5.3% YoY. These reductions are likely attributed to the temporary impacts of extended shipping durations.

Figure 1: Daily transit trade volume (in mn metric tonnes, seven-day moving average)

Source: IMF

Should these disruptions persist, they have the potential to impede certain supply chains in affected nations temporarily and contribute to upward inflationary pressures, partly driven by increased shipping expenses. Furthermore, the Suez Canal, in particular, is vital for transporting oil and gas from the Middle East to markets in Europe and North America. Disruptions in this canal can lead to fluctuations in energy prices, affecting both businesses and consumers worldwide. In the broader market context, disruptions at major trade routes like the Suez Canal and Panama Canal can create uncertainty in global financial markets. Investors may become wary of the potential impact on companies’ supply chains and trade volumes, leading to market volatility and fluctuations in asset prices.

In the context of these shipping disruptions, it is also important to remember that the accuracy of official statistics on recorded imports and exports (typically based on customs records) may be compromised due to the temporary rerouting of ships. This will pose challenges in assessing the underlying momentum of global trade and economic activity over the coming months. For example, merchandise trade reports for January in various countries across Africa, the Middle East, and Europe may indicate a slowdown in import growth, as some imports that would typically have been recorded in January were only delivered in February. Similarly, many low-income countries that rely on import duties (and export taxes) for a significant portion of their fiscal revenues may report lower-than-expected fiscal revenue for January.

Regardless, the Suez Canal and Panama Canal are critical arteries of global trade, providing efficient and cost-effective routes for the movement of goods between major regions of the world. Overall, disruptions at the Suez Canal and Panama Canal can ripple through the global economy, affecting various sectors and leading to widespread economic consequences. Maintaining the smooth operation of these key waterways is essential for ensuring the stability and efficiency of global trade.

From a local perspective, South Africa (SA) relies heavily on maritime trade for imports and exports. Any disruptions at these key shipping routes can lead to delays in the delivery of goods, affecting both inbound raw materials and outbound finished products. This impacts various sectors of the local economy, particularly manufacturing, agriculture, and mining. As mentioned, rerouting ships around the Cape of Good Hope due to disruptions at the Suez Canal and Panama Canal can increase transportation costs and lead to higher prices for imported goods. As SA is a net importer of most major consumer goods, this has the potential to contribute further to domestic inflationary pressures in the coming month – affecting consumers and businesses alike.

However, trade disruptions could have some positive effects on the local economy. As a major regional maritime trade hub, SA generates significant revenue from port activities, including fees and tariffs. Disruptions at the Suez Canal and Panama Canal have led to increased traffic through local ports as shipping companies opt to reroute their vessels around the Cape of Good Hope. This should theoretically result in an increase in revenue for port authorities and related industries.

Nonetheless, these disruptions will most likely result in a net negative effect on the SA economy, impacting trade flows, costs, revenues, supply chains, and investor confidence. It is, therefore, essential that policymakers and businesses monitor the situation closely and implement measures to mitigate the impact of such disruptions.