Introduction

Having powered our world for over six decades, uranium is poised to play a vital role in transitioning from fossil fuels to cleaner, sustainable sources. In this article, we explore the uranium market, its journey from a natural element to a powerful energy source, its role in nuclear power, global demand, leading uranium producers, and potential risks and rewards of investing in this resource.

What is uranium, and how does it work?

Uranium, a dense metal, is found in rocks and oceans at low concentrations, making it as abundant as metals like tin. Discovered by Martin Heinrich Klaproth in 1789 and named after Uranus, uranium originated from supernovae 6.6bn years ago. Melting at 1,132°C and denoted by ‘U’ on the periodic table, uranium is experiencing increased demand due to its crucial role in clean energy generation through nuclear power.

Is nuclear energy clean power?

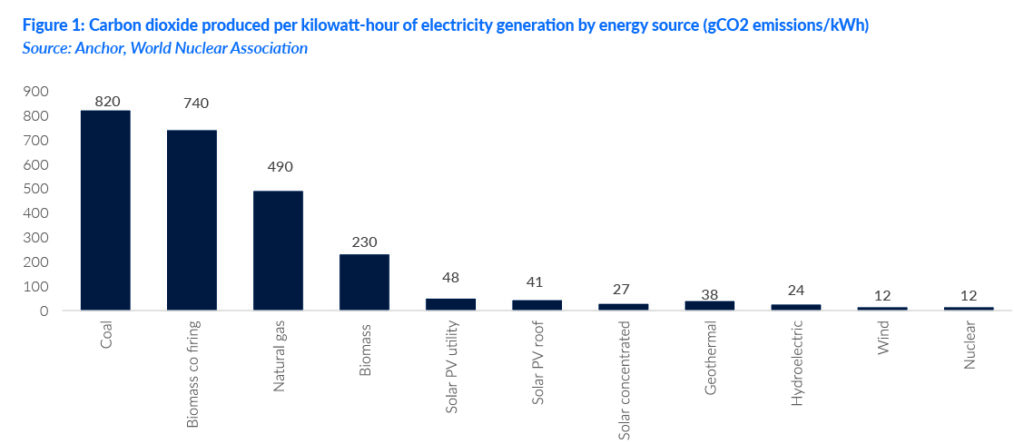

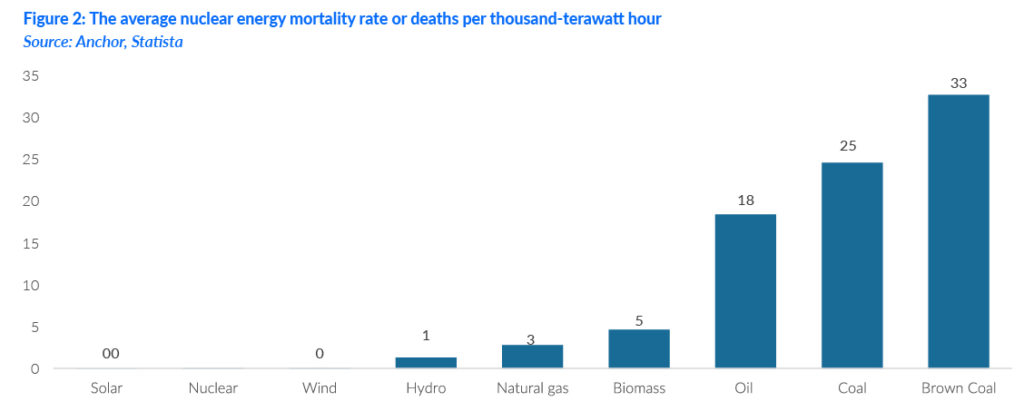

Nuclear power generates electricity with little carbon output compared to other sources. It is a clean form of electricity generation and is considered the safest. On a life-cycle basis, nuclear power emits just a few grammes of CO2 equivalent per kWh of electricity produced. A median value of 12g CO2 equivalent/kWh has been estimated for nuclear power—similar to wind and lower than all types of solar.

Is nuclear power safe?

Nuclear energy has a low death rate, even after nuclear catastrophes like Chornobyl and Fukushima.

The nuclear fuel cycle process

Uranium’s journey to being a nuclear energy source is a complex and meticulously controlled transformation. It starts with mining, where uranium is extracted from the earth and processed into a concentrated form. This concentrated uranium is crafted into small pellets, loaded into metal tubes to form fuel rods, grouped into bundles, and placed inside a nuclear reactor. In the reactor’s core, the uranium atoms are bombarded with neutrons, causing them to split in a process known as fission. This fission generates immense heat, which is used to boil water, creating steam that turns turbines to produce electricity.

After c. three years of energy generation, uranium fuel becomes less efficient and is termed ‘spent’. This spent fuel is carefully removed from the reactor and initially stored in pools of water on-site to cool down and decrease its radioactivity. Depending on a country’s nuclear policy, this spent fuel can be reprocessed to extract usable materials for new fuel or be prepared for permanent disposal. If reprocessing is not an option, spent fuel is encapsulated in robust, long-lasting containers and buried deep underground in geological repositories, ensuring safe and secure isolation from the environment for thousands of years. Careful management of uranium from extraction to disposal/recycling is essential for the sustainable and responsible use of nuclear energy.

Global uranium demand

With about 436 operational nuclear reactors worldwide and c. 173 in the pipeline, uranium demand is rising. The US, China, and France collectively represent c. 58% of global uranium demand. Given the current demand, there is still a supply shortage, with uranium projected to face a persistent supply-demand imbalance, with a cumulative gap of c. 680k metric tonnes by 2040. Reactivating inactive mines is vital to increasing short-term uranium supply, as new mines can take 10–15 years to become fully operational. Based on current resources and consumption rates, uranium mines can supply fuel for nuclear reactors for over 200 years. Nuclear power plants are initially licensed for 40 years, with possible extensions allowing operation for 80 or even 100 years, depending on maintenance and technological updates. Technologies like uranium extraction from seawater and fuel-recycling reactors could extend this to 60,000 and 30,000 years, respectively.

Who uses nuclear power?

Around 10% of the world’s electricity is generated from uranium in nuclear reactors. There are 436 nuclear reactors with a total output of 390,000 megawatts (Mwe) operating in 32 countries, and c. 60 more reactors are under construction. Belgium, Bulgaria, the Czech Republic, Finland, France, Hungary, Slovakia, Slovenia, Sweden, and Ukraine all get 30% or more of their electricity from nuclear reactors. The US has about 90 reactors, supplying 20% of its electricity, while France gets c. 70% of its electricity from uranium.

Uranium producers

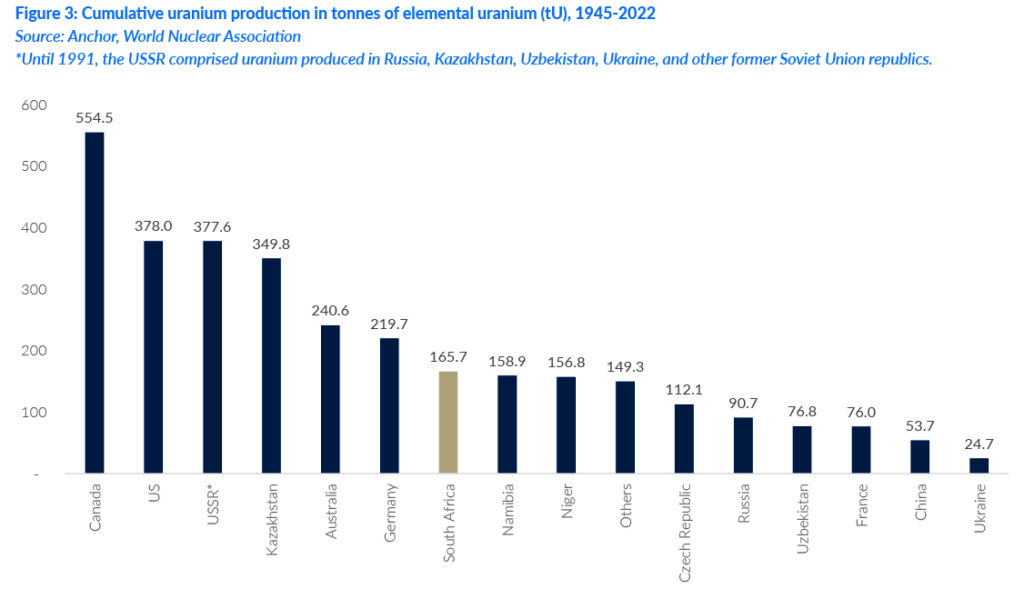

The Journal of Nuclear Fuel Cycle and Waste Technology summarises the history of uranium production into four main periods:

- Military era (1945 to mid-1960s): Initially driven by military needs, uranium production surged in the 1950s for nuclear weapons, leading to a peak and subsequent decline by the mid-1960s as demand decreased.

- Civil nuclear power growth (the mid-1960s to mid-1980s): With the rise of civil nuclear power, uranium production rose to meet the growing number of reactor orders, reaching its zenith in 1980 and fulfilling annual reactor needs until 1985.

- Market contraction (the mid-1980s to 2002): Post-1985, nuclear construction slowed as the market was oversupplied due to pre-signed contracts and uranium from the former Soviet Union entering the market in 1993, leading to lower production and mine closures.

- Market fluctuations (the early 2000s to the present): The early 2000s saw a price surge due to expected nuclear sector growth, which peaked in 2007. It declined after the 2011 Fukushima accident, resulting in some of the lowest uranium prices in history.

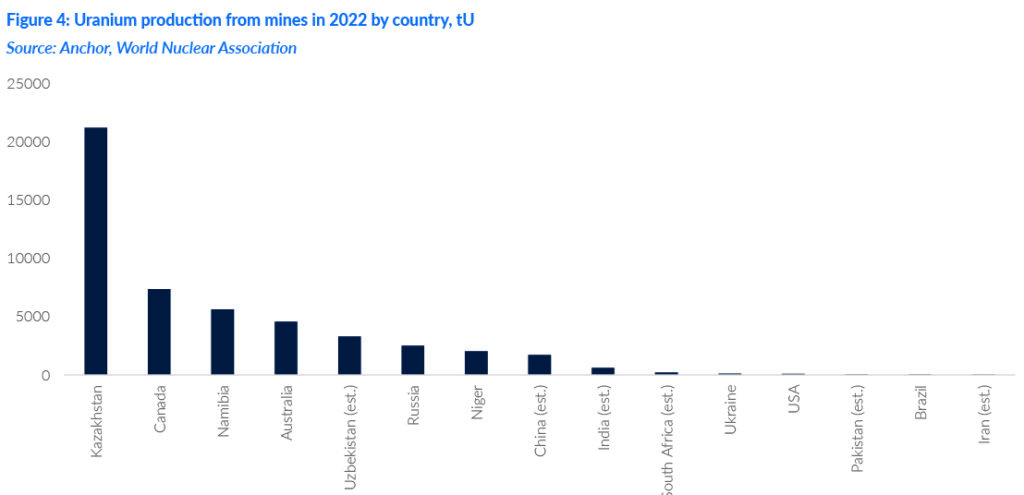

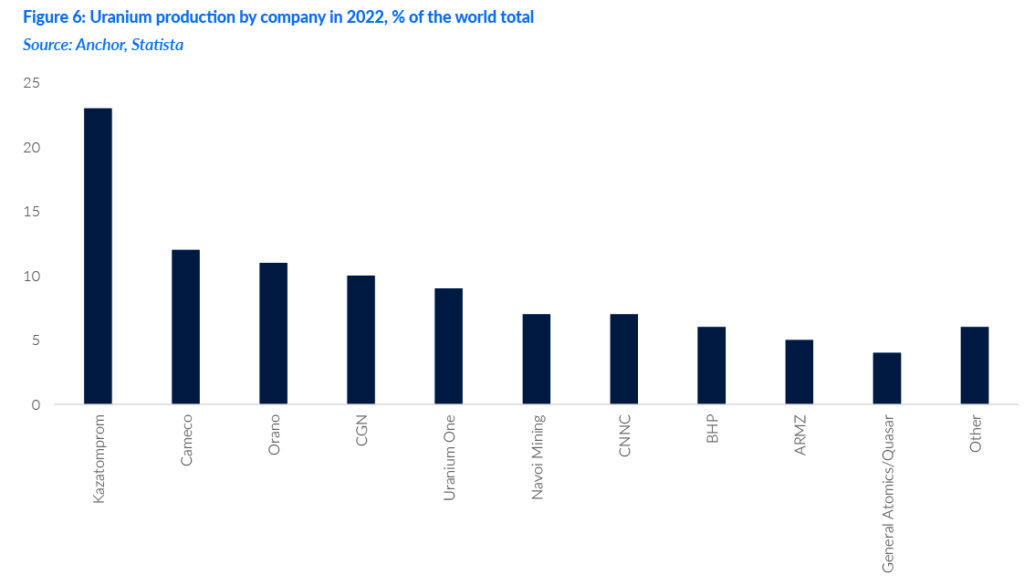

Kazakhstan, Canada, Namibia, and Australia accounted for over 70% of global uranium production in 2022. However, recent geopolitical developments threaten disruptions in the uranium supply chain, including sanctions on Russian uranium and related services, risks of supply interruptions in Kazakhstan due to transportation routes passing through Russia, and a halt in Niger’s uranium exports following coups. Still, uranium demand for nuclear reactors is projected to escalate over the next decade, rising 28% by 2030 and nearly doubling by 2040, as governments scale up nuclear power capacity to achieve zero-carbon targets.

Nuclear power: Back in focus

Nuclear power is increasingly becoming part of the solution to achieve carbon neutrality, with a baseload source of energy available 24/7 with little direct carbon emissions. It is increasingly becoming a part of national energy security strategies, providing stable, baseload power to underpin renewable generation. With thousands of cumulative reactor years of safe power production, it is recognised by the EU, the UK, South Korea, and Canada taxonomies as green. Japan has approved a nuclear energy U-turn, with plans including restarting idle reactors, extending its current fleet, and constructing new reactors. Over 20 countries pledged to triple their nuclear output by 2050 at the 2023 United Nations Climate Change Conference (COP28).

Market pricing

Mineral commodity markets are cyclical. However, these fluctuations are typically overlaid on a downward trend in real prices over the long term, thanks to technological advancements that lower mining costs. Uranium stands out because, after a period of high prices in the late 1970s, it suffered through prolonged low prices in the 1980s and 1990s, with spot prices often falling below production costs, except for the most cost-efficient mines. Although spot prices recorded a resurgence from 2003 to 2009, they remained relatively weak after that. Until c. 2007, quoted spot prices were relevant only for immediate, small-scale trading and constituted a minor fraction of the overall supply. However, since 2008, this has grown to about one-quarter. The bulk of trade happens through term contracts ranging from 3 to 15 years, where producers sell directly to utility companies at prices above the spot market, ensuring a stable supply. Nonetheless, contract prices are often influenced by spot prices at delivery time.

In 2000, the primary participants, including utilities and producers, comprised 95% of the spot market. This dropped to two-thirds by 2005 and one-third by 2011, stabilising at 30% to 40% in subsequent years. The financial sector, including traders and financiers, has taken over the remainder of the market share, introducing more liquidity and efficiency.

The journey of uranium prices

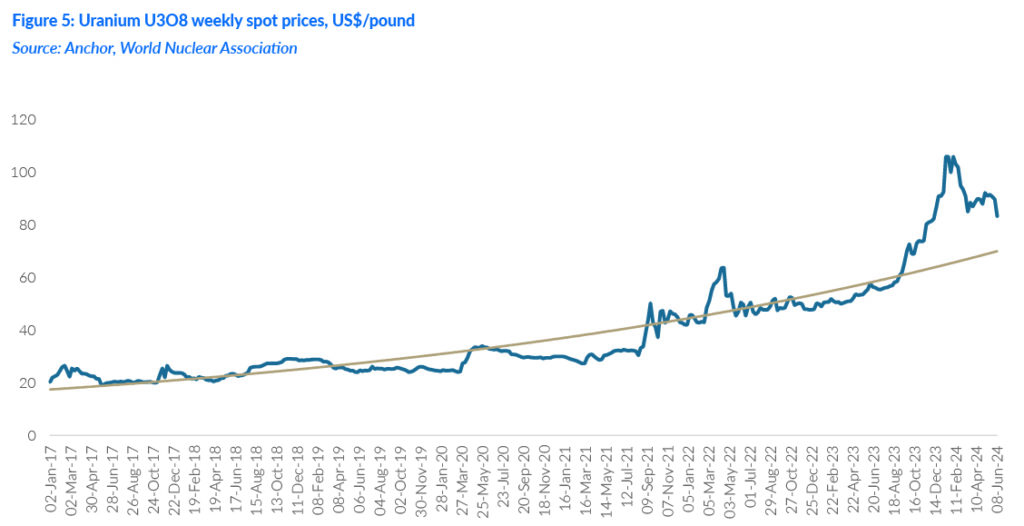

Ux U3O8 spot includes conditions for delivery timeframe (less or equal to 3 months) and quantity (greater than or equal to 100,000 pounds U3O8). Weekly-on-Monday prices update on a one-day delay, and history is limited from 2 January 2017 to the present.

Uranium prices have been tumultuous, mainly influenced by the Fukushima disaster in March 2011. Japan, which accounted for 13% of world uranium demand, had 54 reactors that generated c. 30% of its electricity. The accident led to the shutdown of these reactors and prolonged safety inspections, with 12 reactors permanently closed, causing investor interest to dry up. Meanwhile, Kazakhstan, the largest and lowest-cost producer, continued to ramp up supply. The world’s largest listed uranium company, Cameco, brought significant supply online into an oversupplied market in 2014. Despite being protected by long-term contracts, producers were slow to make the necessary cuts, and weak demand led to increased secondary supply from enrichment companies. There has been a persistent global supply shortage since, with demand growing at 5% p.a. The gap between global production and consumption remains substantial, contributing to the price increase.

Factors influencing uranium prices

Uranium prices typically reflect shifts in nuclear energy generation, especially when a country embarks on constructing/reactivating nuclear power plants or after significant nuclear mishaps. International political developments, such as the US imposing sanctions on a uranium-exporting country like Russia, also influence prices. Moreover, the global economic climate crisis plays a role in uranium pricing. Energy providers may opt for more economical fuel options in times of financial distress or impending challenges. Currently, natural gas is a more affordable choice, leading to lower power and uranium prices. Still, even without a global economic downturn, cost-effective energy alternatives can reduce uranium demand.

The top uranium producers

Figure 6 shows the leading uranium-producing companies based on production (in metric tonnes) in 2022.

Potential risks to uranium prices

Russia’s ongoing war on Ukraine has disrupted the uranium trade, contributing to supply concerns and price increases. Excess supply or decreased demand due to shifts in energy policies or market preferences can lower prices, but this is unlikely. If uranium production rises, it could lead to oversupply and push prices down. Breakthroughs in nuclear technology could lead to more efficient use of uranium, decreasing demand. The growth of renewable energy sources like wind and solar could displace nuclear power, reducing the need for uranium.

The emergence of small modular reactors (SMRs)

Unlike traditional large reactors, SMRs can be built in factories and assembled on-site, significantly reducing construction costs and timelines. SMRs are called “modular” because they can be scaled up by adding more units, providing flexibility in power generation capacity. SMRs have advanced safety features, such as passive safety systems requiring no active intervention in an emergency. The US, Canada, and the UK are actively developing SMRs, with companies like NuScale, X-energy, TerraPower and Rolls-Royce, among others. These projects receive government support to mitigate the risks associated with first-of-a-kind ventures.

Our preferred uranium sector share pick: UEC Uranium

Uranium Energy Corp. (UEC) transitioned from exploration to production in 2023, positioning itself to capitalise on rising uranium prices. As the fastest-growing North American uranium company, UEC boasts a diverse portfolio of projects across the US, Canada, and Paraguay. Despite reporting no revenues and a loss in 3Q24 due to unsold uranium inventory and higher operating expenses, its share price is up c. 85% over the past year, reflecting investor confidence and willingness to pay more for potential upside. UEC’s strategic uranium purchases have strengthened its balance sheet and increased marketing flexibility. It plans to restart production at its operations in Wyoming in August 2024 and is well-positioned to capitalise on rising uranium prices, making it a promising investment in the sector.

Final thoughts

Given the increasing global demand for clean and reliable energy sources, investing in uranium presents a unique opportunity. As countries shift away from fossil fuels towards nuclear power as an alternate source, uranium demand is expected to rise. Moreover, supply constraints and geopolitical factors make the uranium market more attractive for investors. However, like any investment, it comes with its own set of risks, including regulatory changes and public sentiment towards nuclear energy. Therefore, a thorough understanding of market dynamics and careful risk management are crucial for success in uranium investing. This exciting space warrants careful consideration for any diversified investment portfolio.