At Anchor, we strive to assist our clients with navigating change on a daily basis. In an article entitled, Invest(ing) In the other 99%, dated 10 July 2019, Anchor Portfolio Manager Darryl Hannington pointed out that, up until a few years ago, local equity investors were handsomely rewarded over a 10-year period, with the JSE achieving annual returns of 18%, including during the GFC. However, over the past 5 years, the JSE has underperformed relative to global markets in US dollar terms and, even more concerning, local market returns were barely beating SA inflation.

The COVID-19 pandemic has placed SA’s economy on an accelerated downward trajectory, further reducing achievable growth on the local equity market. In addition, we have found that most local investors have a significant portion of their wealth exposed only to SA assets given Regulation 28 of the Pension Fund Act, past JSE market opportunities, and the “home-advantage” bias. At Anchor Private Clients, we believe that, as a global investor with an unconstrained global mandate, we are spoilt for choice in terms of offshore investment opportunities. Thus, we spend most of our time in the private client space advising our clients on the importance of becoming offshore growth tourists.

While this conversation on offshore investing has proven to be quite a difficult one to have with our clients, it is essential that it does happen! Generally, we find that those clients who have made their wealth within the constructs of SA and its history over the past 20–30 years, find it extremely difficult to disconnect themselves from their patriotism to the country, as well as from their financial goals, and the legacies they wish to leave their descendants.

In our view, for an investment to have the greatest chance of success, it needs to be backed by a tailwind of economic growth and the ability to gain exposure to relevant and important sectors of a country’s economy. Unfortunately, the local economic and political climate over the past five years has not been favourable for business development and has also been unable to attract the capital required for the local economy to grow. According to the World Bank, SA’s average GDP growth per capita over the past five years has been a negative 0.6% and that was before the COVID-19 pandemic! In stark contrast, the US, India, and China have recorded average growth rates of 1.8%, 5.8%, and 6.2%, respectively, over the same period.

In addition, the world has changed, and the importance of technology has massively increased. At present, we see very few opportunities to leverage off this very important sector in SA, especially given that Naspers is the only exposure to the sector available on the JSE. In contrast, when considering offshore technology exposure, there are innumerable options available to investors including such companies as Alphabet (Google), Amazon, Alibaba, Spotify, etc. Furthermore, Tencent (in which Naspers has a 31% stake) has outperformed its largest shareholder by 183% over the past 5 years. This means that an investor would have benefited significantly more from being invested directly in Hong Kong-listed Tencent rather than in JSE-listed Naspers.

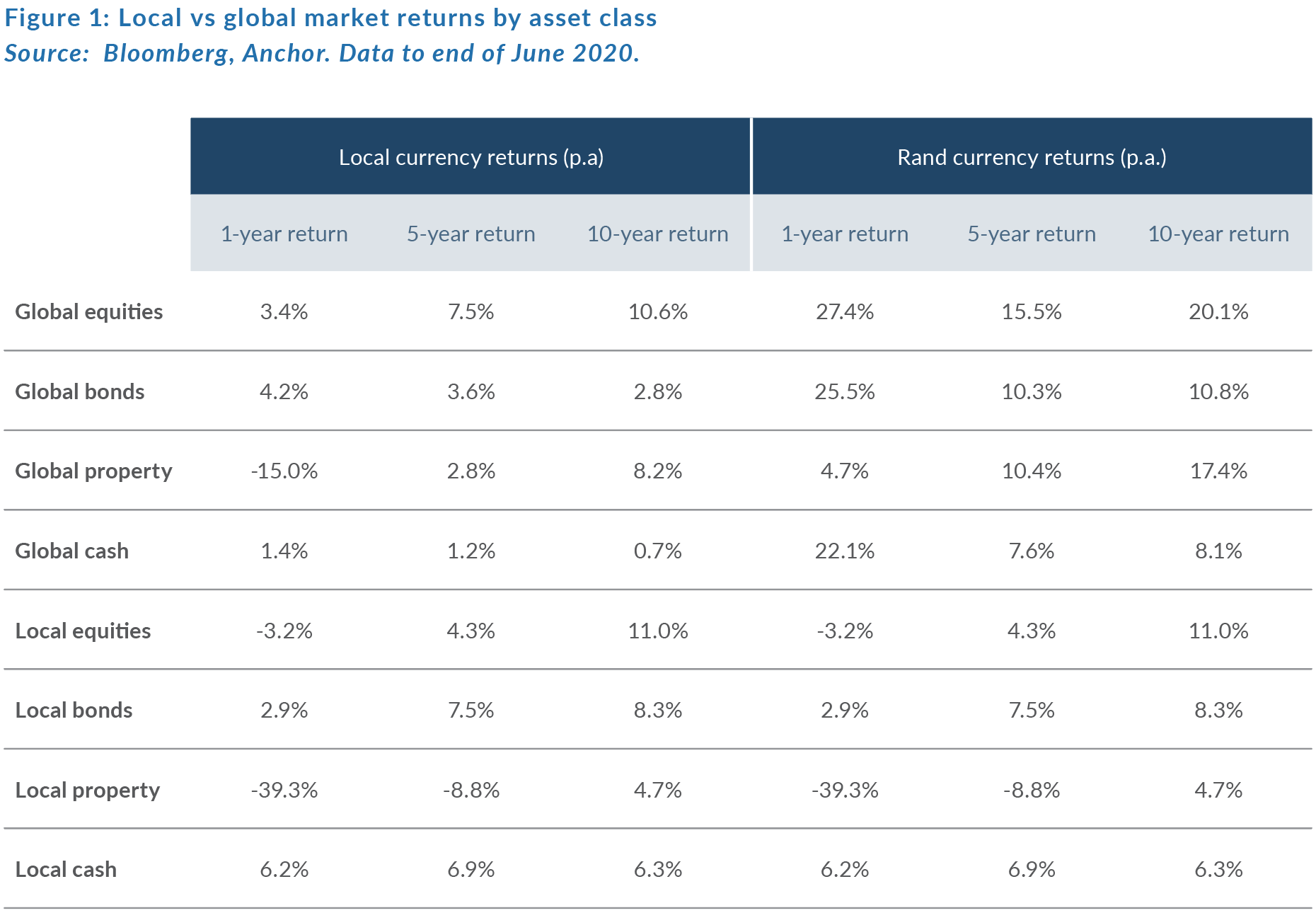

In a recent presentation to the local pension fund industry, Anchor CEO Peter Armitage identified the returns investors achieved locally vs global market returns (see Figure 1). He calculated that, if you were invested in global equities over the past one- and five-year periods, you would have achieved returns of 3.4% and 7.5%, respectively. This compares with a local investor who would have generated -3.2% and 4.3%, respectively, over the same time periods.

While we realise that hindsight is 20/20, and not an indicator of future returns, ultimately SA represents less than 1% of the global investable market, with a large concentration of risk in a few rand-hedge stocks. SA’s position in the MSCI Emerging Market Index has also declined significantly – from 7% in 2015 to the current 4%, with Naspers alone representing 1.3% of that 4% weighting. As such, we see very little motivation for global investors to consider SA for EM growth exposure and our own choices as SA investors become so much vaster when considering a global investable universe. Currently, Anchor’s largest market exposure is to the US, while we also have some exposure to India and China, since we believe that these countries represent the most attractive risk-adjusted market opportunities at present.

Our experience at Anchor has been that we can execute on our core investment philosophy with greater freedom using the broader toolset of an investment universe unconstrained by geography. Consider the high-level investment case for China’s Ping An Insurance (a company we own in our High Street Equity Portfolio). Ping An is a leading Chinese long-term insurer and, much like our local insurers, it has become an integrated financial services business with lines into banking, wealth, and asset management, as well as other consumer-facing financial services products. It also operates in a country with a large emerging middle class and in an industry that provides a necessary service (insurance), which is still underpenetrated when compared to SA. Added to the attractiveness of the growth opportunities inherent in the Ping An investment thesis, is its undemanding valuation, a dividend yield of over 3%, and many years of double-digit growth in operating income ahead.

Unsurprisingly, investing in high-quality companies (such as Ping An) and in industries where there is structural growth (like long-term insurance in China) is an easier decision for a portfolio manager to make than trying to pick a short cycle inflection point (possibly SA) in an underperforming economy or industry. We believe there are many more examples of the scenarios outlines above, for example in companies such as Russian food retailer Magnit compared with Shoprite, or ICICI Bank in India vs Standard Bank. So, while the practicalities of global investing may at first seem daunting to local investors who are new to offshore investing, Anchor will be there to assist you every step of the way, navigating the offshore investment process with you from start to finish.