On Wednesday (26 October), Finance Minister Enoch Godongwana delivered his second Medium-Term Budget Policy Statement (MTBPS), which painted a positive story, with only part of the latest revenue windfall allocated to increased expenditure, followed by a clear indication from the National Treasury (NT) that for any permanent additions to expenditure, there would need to be an equivalent permanent increase in revenue (or cut in existing expenditure). However, NT acknowledges that significant risks remain on the horizon, particularly amid growing concerns about downside global and local growth risks.

Nonetheless, gross tax revenues are now expected to be around R83.5bn higher in FY22/FY23 than forecast in the February 2022 Budget, with total revenues pencilled in at R106bn higher (higher than even the most optimistic of forecasts). Whilst this may be reachable, depending on how the macroeconomic background unfolds, a level of caution is warranted given the aforementioned growing concerns about downside global and local growth risks. Locally, the economy is dealing with domestic energy and logistics crises, limiting growth over the next 12 to 18 months, and the political uncertainty surrounding the upcoming ANC elective conference in December. Positively, however, this estimated fiscal outperformance has been used prudently – the revenue overrun has largely been used to reduce the use of cash balances.

It is concerning, though, how little detail has been provided on the growing stress around the state-owned enterprises (SOEs), despite Transnet and Denel receiving cash injections to restabilise the troubled entities. Interestingly, there is no formal provision for additional support for Eskom yet, beyond a vague indication that relief should be between one-third and two-thirds of Eskom’s debt. A sizeable unallocated reserve is set aside as a buffer, but this cannot fully cover these spending pressures if they materialise.

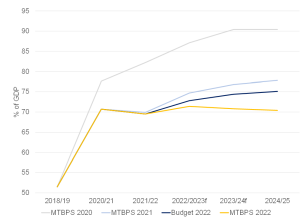

However, the key positive fiscal story remains a continued downward trend in South Africa’s (SA’s) debt trajectory. Looking at the forecasts of government debt in the MTBPS 2020 and 2021 and this year’s budget speech, we see a significant downward trend in the debt forecasts as a percentage of GDP, as indicated by Figure 1 below. The MTBPS 2020 forecast that in 2024/25, government debt would be 90.4% of GDP. This has since been adjusted significantly downward to the latest projections from the 2022 MTBPS, which now forecasts 2024/25 government debt at 70.4% – a material downward revision. Nevertheless, due to the recent volatility in both local and global financial markets, interest costs have been pushed higher – the cost of repaying this debt will be almost R6bn higher than was expected in February.

Figure 1: SA government debt forecasts

Source: National Treasury, Anchor

Overall, whilst financial markets initially reacted positively to the MTBPS, the optimism will likely be curbed by the persistent adverse risks looming on the horizon. Regardless, SA’s fiscal position remains relatively sound, having avoided a fiscal cliff in 2021, largely thanks to the recent surge in global commodity prices and subsequent increased export revenue earnings. Investors will be encouraged by the many reasonable steps and realistic decisions taken on the part of the NT. Still, they will likely see the deficit and debt trajectories as tentative, given the persistent risks that remain unresolved, both locally and internationally.