After five consecutive months of gains, most major global markets, except for a few outliers, ended April in the red (MSCI World -3.7% MoM/+5% YTD). Persistent inflation continues to point to elevated price pressures and, simultaneously, a robust US economy and the US Federal Reserve’s (Fed) narrative of “higher-for-longer” rates weighed on investor sentiment as market participants now expect only one rate cut this year. On Tuesday (30 April), the US Labor Department also reported higher-than-expected 1Q24 employment cost growth, which measures wages and benefits. The index rose 1.2% YoY in 1Q24 – above consensus economist estimates.

Among the major US averages, the Dow Jones retreated by 5.0% (its worst monthly performance since September 2022), while the S&P 500 slid 4.2% and the tech-heavy Nasdaq lost 4.4%. All three indices snapped a five-month winning streak. Still, despite the April setback, the Dow, S&P 500, and the Nasdaq are up 0.3%, 5.6% and 4.3% YTD, respectively.

In US economic data, March headline inflation, as measured by the Consumer Price Index (CPI), disappointed, rising 3.5% YoY (its highest level since September) vs February’s 3.2% YoY print. March core CPI, excluding the erratic food and energy components, was steady at 3.8% YoY. MoM, headline, and core inflation advanced 0.4% – unchanged from February. March US retail sales rose by 0.7% MoM (well-above expectations of a 0.3% increase) compared to February’s upwardly revised 0.9% MoM rise. March’s core personal consumption expenditure ([PCE], a key inflation barometer for the Fed), which excludes food and energy, increased by 2.8% YoY – unchanged from February and still above the Fed’s 2% goal. MoM, March core PCE rose 0.3%, unchanged from February. US gross domestic product (GDP) grew by 1.6% in 1Q24, far lower than the 2.4% consensus economists’ forecasts had predicted and below 4Q23’s 3.4% rise. Consumer spending increased 2.5% YoY in 1Q24, down from a 3.3% gain in 4Q23. US consumer confidence also hit its lowest level since July 2022 in March (with a reading of 97 – below the downwardly revised 103.1 in February) as consumer concerns grew over employment and elevated price levels, especially for food and gas.

In Europe, major equity markets closed lower in April as a raft of disappointing earnings weighed on investor sentiment. Germany’s DAX was down 3.0% MoM (+7.0% YTD), while France’s CAC closed 2.7% lower (+5.9% YTD). In economic data, March euro area inflation slowed to 2.4% from 2.6% YoY in February, while EU annual inflation came in at 2.6% in March, also down from 2.8% in February, according to Eurostat. Germany’s March inflation rate eased to 2.3% YoY vs February’s reading of 2.7%, while France’s March inflation slowed to 2.4% YoY vs February’s 3.0% print.

April was a good month for the UK stock market (another outlier among major markets), with the blue-chip FTSE-100 Index rising 2.4% (+5.3% YTD) and repeatedly breaking all-time highs during the month. The index reached its highest level of 8,147.03 on 29 April. In March, UK inflation eased to 3.2% YoY vs February’s 3.4% YoY print as food price growth recorded a slowdown. This was the UK’s lowest inflation rate since September 2021, bringing it closer to the Bank of England’s target.

China’s equity markets also surprised on the upside as a series of measures announced by the government since mid-April to support the mainland and Hong Kong stock markets saw the Hang Seng and Shanghai Composite indices closing higher in April. The Hang Seng surged 7.4% MoM (+4.2% YTD), emerging as the best-performing major index in the world, having rebounded c. 10% from a YTD low reached on 21 March, while the Shanghai Composite jumped 2.1% MoM (+4.4% YTD). In market policy guidelines issued in April, China’s securities watchdog said it wanted to improve listing company quality and enhance shareholder returns. The regulator announced measures to prop up the Hong Kong market, including efforts to increase the types of products available. China’s improving economic landscape, cheaper valuations andmainland investors putting money into Hong Kong to protect their portfolios from a weakening yuan combined to help resuscitate Chinese markets. China’s official April Manufacturing PMI printed at 50.4, down from 50.8 in March (the 50-point mark separates expansion from contraction) but maintaining two consecutive months of expansion. The official non-manufacturing PMI, measuring business sentiment in the services and construction sectors, expanded at a slower pace of 51.2 in April from 53.0 in March. Bad weather disrupted construction and services businesses in China’s southern region, likely contributing to this decline.

Japan’s equity market had a volatile month, with the benchmark Nikkei closing April 4.9% lower, although the index is still up 14.8% YTD. Japan’s March headline CPI decelerated to 2.7% YoY vs February’s 2.8% print, but the inflation rate has now exceeded the Bank of Japan target rate for two years. Core inflation, excluding food prices, was 2.6% in March compared with 2.8% in February.

Commodity prices were generally firmer in April, with gold again the star attraction. While the gold price dropped to a one-week low on 30 April ahead of the US Fed meeting, it remained on course for a third consecutive MoM gain – up 2.5% (+10.8% YTD). The oil price recorded a fourth month of gains (+0.4% in April/+14.0% YTD), albeit at a slower pace, as geopolitical tensions seemed to ease slightly with Israel-Hamas peace talks moving forward and the US showing healthy crude output and exports. Platinum rose 2.9% MoM (-5.5% YTD), but palladium declined 6.0% (-13.1% YTD). Iron ore recorded a turnaround soaring 14.5% MoM, although the price is still down 17.6% YTD.

In South Africa (SA), the JSE continued its March momentum in April as the FTSE JSE All Share Index rose by 2.1% MoM (it is still down 1.1% YTD). However, the FTSE JSE Capped SWIX, which gained 2.9% MoM, has now eked out a 0.6% YTD advance. Resources counters (Resi-10 +7.0% MoM/+6.5% YTD) were again the best performers on the local bourse, especially gold and platinum shares, which recorded solid gains for a second consecutive month, as share prices were bolstered by their perceived safe-haven status in an uncertain global environment. The SA Listed Property Index ended April 2.3% lower but is up 1.5% YTD. The Fini-15 gained 0.5% MoM (-7.2% YTD) while the Indi-25 rose 1.0% (+1.3% YTD), buoyed by the performances of its largest constituents, Prosus and Naspers (up 6.7% and 7.4% MoM, respectively). Prosus/Naspers’ biggest underlying investment, Chinese tech giant Tencent (+14% MoM), rallied as it benefitted from the strong turnaround in China’s equity market. Highlighting the April performances of the biggest JSE-listed shares by market cap, the largest company on the exchange, BHP Group, declined 3.4% MoM following its rejected takeover offer for Anglo American (Anglo). The second and fourth-biggest shares – Anheuser-Busch InBev and Richemont also fell by 1.5% and 8.3% MoM, respectively. The rand strengthened slightly against the US dollar, up 0.5% MoM, but YTD, the local unit is down 2.2% against the greenback.

In economic data, SA’s March headline CPI printed softer at 5.3% YoY after February’s four-month high of 5.6% YoY. MoM, CPI rose 1.0% in March – unchanged from February. Core inflation (excluding food, fuel, and electricity) dropped to 4.9% YoY from 5% YoY in February. This latest print means that inflation has moved closer to the 4.5% midpoint of the SA Reserve Bank’s (SARB’s) target band of 3% to 6%, where it prefers to anchor expectations. The depressed SA consumer environment saw retail trade sales decrease 0.8% YoY in February, following a revised contraction of 2.0% YoY in January. This reflects most local consumers’ financial constraints, compounded by the typical post-festive season burden of elevated spending.

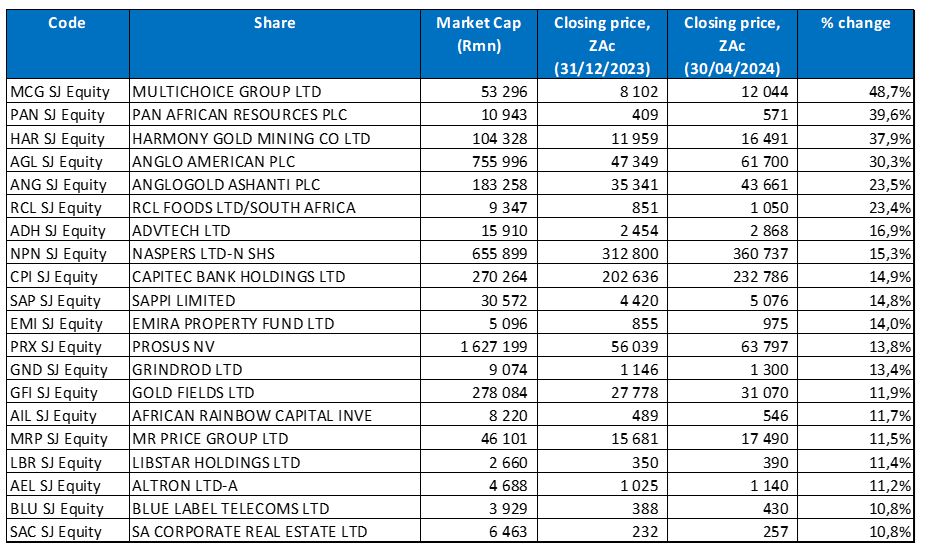

Figure 1: April 2024 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Industrial equipment and services Group, Barloworld, was April’s best-performing share soaring 41.4% MoM. In mid-April, the company released a cautionary announcement stating that it had entered discussions, which, if successfully concluded, may have a material effect on its share price. Barloworld did not elaborate on the nature of the talks but advised shareholders to exercise caution when dealing in the company’s securities until a full announcement was made. Barloworld’s share price rose 10.3% on the day of the announcement (15 April) – its biggest one-day gain since September 2021.

Barloworld was followed in second place by Anglo American (Anglo; +32.6% MoM). On 25 April, Anglo confirmed that it had received a US$39bn takeover offer from BHP Group in an all-share offer. According to the offer terms, Anglo shareholders will receive 0.7097 BHP shares for every 1 Anglo share owned. In addition, Anglo’s SA platinum and iron ore companies, Anglo American Platinum (Amplats) and Kumba Iron Ore (Kumba) will be spun off to Anglo shareholders before BHP acquires Anglo (Anglo has a 78.6% stake in Amplats and a 69.7% stake in Kumba). On 26 April, Anglo said it rejected BHP’s proposal as it significantly undervalued the company. The Anglo share price ended the day at R620.90/share, still at a premium to BHP’s rejected proposal and Anglo closed April at R617.00/share. BHP has until 22 May to make a binding bid with market participants expecting it to increase its offer.

Diversified mining and minerals company African Rainbow Minerals Ltd (ARM) came in third with a 19.3% MoM gain. In early April, ARM announced that it had entered into a subscription agreement for private placement financing with Surge Copper Corporation to acquire 15.0% of its issued and outstanding common shares for a consideration of CAD3.80mn.

ARM was followed by real estate investment trusts (REITs) Accelerate Property Fund and Emira Property Fund, which recorded share price increases of 16.7% and 12.3% MoM, respectively. In April, Emira announced that it and its wholly owned subsidiaries have agreed to dispose of 13 predominantly industrial and office properties situated in the Western Cape to Spear for R1.15bn. Emira said in a statement that the move was part of its strategy to recycle capital, and the net proceeds will initially be used to reduce debt and fund new acquisitions.

Afrimat, which supplies a wide range of products, including construction materials, industrial minerals, and bulk commodities, gained 11.3% in April. In a trading update for the year ended 29 February 2024, Afrimat said that it expects HEPS to be between 21.0% and 26.0% higher YoY than the ZAc457.6 recorded in the prior year. Afrimat will release its results on or about 15 May.

Capitec Bank was a standout performer in April. The share price gained 11.1% MoM after the bank released strong FY24 results, which showed that Group headline earnings grew 16% YoY from R9.2bn to R10.6bn, with a ROE of 26%. Group net interest income rose to R16.5bn from R14.2bn posted in FY23, while its diluted EPS increased by 15.5% YoY to ZAc9,137.0. Capitec’s active client base also grew by 10% YoY to 22mn.

Rounding out April’s ten best-performing shares were Nampak, Northam Platinum, and supermarket Group Spar, with MoM gains of 10.9%, 10.8%, and 9.4%, respectively. Like the other platinum group metal (PGM) counters, Northam’s share price has been buoyed by the stronger platinum price over the past two months. In a 1H24 trading update for the period ended 15 March, Spar said that its turnover increased 8.8% YoY, and total wholesale sales rose 5.7% YoY, impacted by a weaker-than-expected grocery business performance. Spar’s combined core grocery and liquor turnover rose 6.0% YoY. The Spar grocery wholesale business saw sales increase 5.0% YoY. Its pharmaceutical business delivered impressive turnover growth of 17.7% YoY, driven by increased loyalty from Pharmacy at Spar retailers and growth in Scriptwise revenue. Spar will release its results on 12 June 2024.

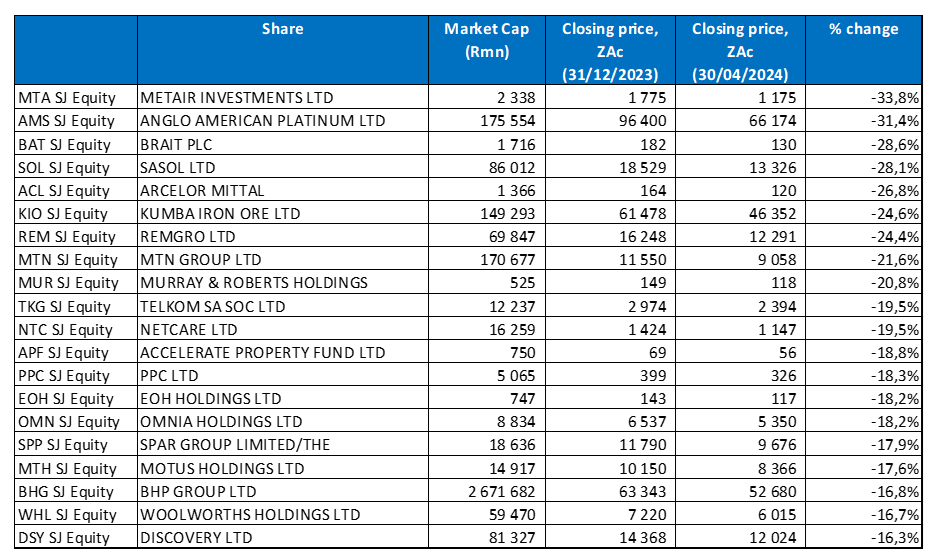

Figure 2: April 2024 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Telkom was April’s worst-performing share, with a MoM decline of 20.2%. It was followed by Amplats (-13.9% MoM) and Metair Investments (-12.2% MoM), which came in third. Amplats’ share price slumped after it reported lower production and flat PGM sales in its 1Q24 production update. The platinum miner also revealed that its total PGM production declined by 7.0% YoY to 834,100 ounces, while PGM sales volumes (from production, excluding sales from trading) were broadly flat at 707,500 ounces.

Battery and vehicle component manufacturer Metair said in April that it has deployed the help of specialist debt advisers to help it deal with its R4.8bn debt pile, turn around its Hesto Harnesses (Hesto) business, and stabilise Mutlu Akü in Türkiye. The Metair CEO said the focus in the short to medium term would be on bringing the Hesto debt down to reasonable levels while also fixing its Turkish operations. Hesto accounts for c. R1.8bn of total Group debt. It has faced design and engineering challenges because of changes required in connection with the Ford Ranger. Due to this complexity, which required higher-than-expected upfront costs, labour and line capacity, and inventory, Hesto incurred operating losses of R711mn in 1H23. Mutlu Akü, which falls under the Group’s energy storage vertical, has been impacted by the challenging macroeconomic and geopolitical environment in which it operates, including hyperinflation in Türkiye. Last year, it faced additional challenges, including a shortage of contract workers and loss of material export volumes, resulting in a drop in profit, high debt levels and increased working capital.

Metair was followed by Omnia Holdings, Hammerson Plc, and Sasol, with MoM share price losses of 9.4%, 9.1%, and 9.0%. Sasol’s share price plunged after it reported a 9.0% YoY drop in 3Q24 production due to reduced equipment availability and operational instability at its Secunda operations. Despite this drop in 3Q24, production for the nine months rose 3%. Still, Sasol indicated that it would not reach the mid or upper point of its previous production guidance, saying, “As a result, the production volumes in [in 2024] are expected to be between 6.9-7.1mn tonnes, lower than the guidance of 7.0mn to 7.3mn tonnes…” Sasol has maintained its guidance for liquid fuel sales at 51mn to 54mn barrels.

The luxury goods sector has been under pressure recently, with brands like Kering and Burberry reporting poor results earlier this year. Although LVMH’s results, released in April, were decent, they were not good enough to change investor sentiment towards the sector, as concerns mount that weakening consumer sentiment would impact demand for global luxury brands. Added to that, there has been an increase in product returns of luxury brands in one of their largest markets – China. All these factors weighed the Richemont share price, down 8.3% in April.

Vodacom (-8.2% MoM), Blue Label Telecoms (-8.1% MoM), and Italtile Ltd (-8.1% MoM) rounded out the ten worst-performing shares. Blue Label is Cell C’s biggest shareholder, and its shares have been under pressure over the past few years due to Cell C’s financial woes. Piling debt levels have left Cell C technically insolvent and unable to service its debt, defaulting on bond payments and undergoing a second debt recapitalisation. Last year, Blue Label began taking control of the cell phone provider, planning to move from a 49.53% to a c. 53% stake with requisite applications having been made. In April, the Competition Commission gave Blue Label the go-ahead to take a controlling stake in Cell C.

Figure 3: Top-20 best-performing shares, YTD

Source: Anchor, Bloomberg

YTD, the best-performing shares featured eleven of the year-to-end March’s best performers, with nine shares entering the best performers club in April – Anglo, Naspers, Capitec, Emira Property Fund, Prosus, ARC, Libstar, Altron, and SA Corporate Real Estate. Most new entrants are companies that performed well in April, buoyed by a strong gold price and corporate action.

YTD, Multichoice again took the top spot with a 48.7% gain after its share price rose by a further 6.0% in April. Back in February, French broadcaster Canal+, which at that stage owned a 35.01% stake in Multichoice, submitted a non-binding offer (a cash consideration of R105/share) to acquire all of MultiChoice’s issued ordinary shares that it does not already own (subject to obtaining the necessary regulatory approvals). However, MultiChoice rebuffed the offer as undervaluing the business before asking Canal+ to sweeten the deal. Canal+ then raised its offer to R125/share on 5 March, valuing the deal at c. R35bn. Canal+ bought a further 3.7mn shares in April, increasing its Multichoice stake to 40.8%. The current Canal+ offer at R125/share is with the MultiChoice board and is awaiting approval.

Multichoice was followed by Pan African Resources and Harmony in second and third place, respectively, with YTD gains of 39.6% and 37.9%. Both shares tracked the gold price, which has hit record highs this year. This and a weaker rand (-2.2% YTD) will likely significantly enhance the gold companies’ bottom lines.

The BHP takeover offer for Anglo (+30.3% YTD; discussed earlier) saw it enter the YTD best performers grouping in fourth place. It was followed by another gold miner, AngloGold Ashanti (+23.5% YTD), buoyed by the stronger gold price and its perceived safe-haven status.

RCL Foods (+23.4% YTD) remained in sixth place and was followed by private education provider ADvTECH (+16.9% YTD), Naspers (+15.3% YTD), and Capitec (+14.9% YTD; discussed earlier). In April, ADvTECH’s acquisition of Monash SA became unconditional following approval by the Competition Tribunal and fulfilment of all conditions precedent. The acquisition will increase ADvTECH’s tertiary student complement to more than 43,000. Meanwhile, investment conglomerate Naspers (+7.4% MoM) entered the top-ten best performers YTD list as its largest underlying holding in Tencent (+14% MoM) buoyed its share price. Tencent rallied as it benefitted from strong momentum in Chinese shares and after announcing an earlier-than-anticipated start date of 21 May for one of the year’s most eagerly awaited mobile games (Dungeon & Fighter). This release is expected to refresh its ageing pipeline, draw in new users, and affirm China easing its stance on game releases following several years of regulatory tightening.

Rounding out the top-ten YTD performers was Sappi, with a gain of 14.8%.

Figure 4: Bottom-20 worst-performing shares, YTD

Source: Bloomberg, Anchor

YTD, there was also an overlap between the March worst-performing shares and the worst-performers to the end of April, with fourteen shares remaining and six new entrants to the worst-performers grouping, including Telkom, Netcare, Omnia, Motus, BHP, and Discovery. Industrial products company Metair Investments (-33.8% YTD) was the worst-performing share after another poor share price performance in April when it fell by a further 12.2% MoM (discussed earlier). Metair was followed by Amplats (-31.4% YTD) in second place and Brait Plc (-28.6% YTD) in third. Investment holding company Brait Plc, which was March’s worst-performing share, recorded a further share price drop of 5.1% in April.

Brait was followed by Sasol, Arcelor Mittal (AMSA), and Kumba Iron Ore, with YTD declines of 28.1%, 26.8%, and 24.6%, respectively. AMSA’s share price rebounded in April, gaining 7.14% MoM, which moved it from the top spot of worst-performing shares YTD it had occupied in March. In April, the steel major explained the impact of the mooted wind-down of its long steel business on local economies, particularly Newcastle, which accounts for more than R10.0bn of the Group’s annual procurement. In February, AMSA deferred suspension of its long steel business for up to six months based on commitments made by the government and Transnet, which AMSA said had bought these operations some time.

Kumba was followed by investment holding company Remgro (-24.4% YTD), MTN Group (-21.6% YTD), and Murray & Roberts (-20.8% YTD), with Telkom (-19.5% YTD) rounding out the YTD worst-performing shares. In its 1H24 results, Remgro reported that revenue rose to R25.41bn from R24.16bn posted in 1H23, while its diluted loss per share stood at ZAc432.0, vs EPS of ZAc701.0 recorded in the previous corresponding period. Despite MTN being ranked as SA’s most valuable brand by Brand Finance last month, its share price has been under pressure since the start of 2024. In March, MTN released FY23 results, which showed a sharp drop in earnings as Nigerian naira volatility had eaten into its profitability. The results were also weighed down by higher inflation, increased costs, and a stretched consumer, especially in its three largest markets (Nigeria, SA, and Ghana). It reported HEPS of ZAc315 – down 72.3% YoY from a restated ZAc1,137). Its largest business unit was hit by a Nigerian naira that has lost more than 90% of its value, reducing MTN’s full-year earnings for 2023. Earnings before interest, tax, depreciation, and amortisation (EBITDA before once-off items retreated by 0.5% YoY to R90.5bn.