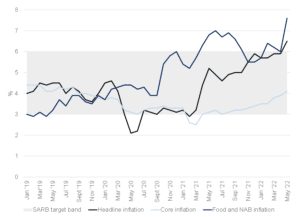

Figure 1: SA inflation, January 2019 to date (YoY % change)

Source: Stats SA, Anchor

Printing at 6.5% YoY in May (vs 5.9% YoY in April), the latest headline CPI print has now officially breached the upper limit of the South African Reserve Bank’s (SARB’s) 3%-6% target band. This latest print was also above consensus expectations, with the upside surprise stemming largely from food and fuel prices, with core inflation matching the consensus forecast (of 4.1% YoY). From a monetary policy perspective, it is important to note that this latest inflationary overshoot was driven once again by food and fuel prices, with the upward drift in core and services inflation still gradual as expected. Transport and food and non-alcoholic beverages (NAB) accounted for just over half of the annual rate, with sharp price increases recorded in both categories. Fuel, in particular, continues to be a major contributor – if the impact of fuel is removed from the May CPI reading, the headline rate falls to 5.1% from 6.5%. To place it in further perspective, diesel prices jumped 8.1% between April and May, taking the annual rate to a 45%-plus increase. The average price of a litre of diesel in May 2021 was R16.20 – meaning it costs R729 to fill a 45-litre tank. Twelve months later, with the average price at R23.67/litre, filling the same tank costs R1,065. Interestingly, petrol prices moderated between April and May, edging lower by 0.7%. Despite this decline, petrol is almost 27% more expensive than it was in May 2021.

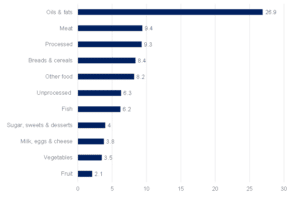

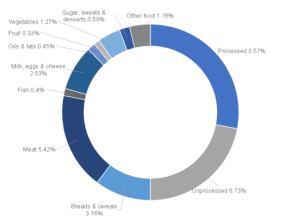

Higher agricultural commodity price pressures saw the food price inflation rate rise to 7.8% YoY in May, contributing 0.4% to the overall 0.7% MoM lift in the CPI. Whilst SA produces enough food locally to hold a comfortable level of food security, the country remains an agricultural price-taker – thus international food prices are a key driver of domestic food prices. These global food price dynamics have been at play for several months now, but in some cases have also deteriorated. The reasons for this include China’s zero-COVID policy (which continues to disrupt manufacturing and global logistics), Russia’s invasion of Ukraine (which has heightened concern around global supply at a time when stock levels had been declining for several consecutive years), and persistent concerns around weather conditions, which could curtail the supply response and policy actions in response to surging prices in some major producing countries. This includes a ban on palm oil exports from Indonesia, its largest global exporter, which will drive already high vegetable oil prices up further, and India’s ban on wheat exports. Weather conditions in the US have also delayed plantings of summer grains and oilseeds, which further supported price gains. These persistent increases in agricultural commodity prices globally have filtered into the SA market, supporting high prices amongst major grains and oilseeds, despite the expectation of another bumper crop, which should ease any concerns around availability and ensure that commodity prices continue to trade at export parity levels. Global factors have also contributed to rising meat prices, notably the continuation of intermittent Avian influenza outbreaks and supply constraints emanating from a prolonged period of high feed prices. However, several domestic factors also contributed, such as reduced slaughter volumes.

Figure 2: SA food inflation May 2022 by component, YoY % change

Source: Stats SA, Anchor

Figure 3: SA food inflation basket weights

Source: Stats SA, Anchor

June’s CPI data (to be released in July), which will include the quarterly (2Q22) survey of the weighty rental inflation category, usually regarded as a barometer of demand-pull inflation, will be particularly important from a monetary policy perspective. Should the June print pull higher still, coupled with further rand weakness, there will be a strong case for greater front-loading of interest rate hikes – in this case, a hike of 75 bpts in the July SARB Monetary Policy Committee (MPC) meeting could well be plausible. However, based on this latest print and its respective drivers alone, we believe that the SARB will likely hike rates by 50 bpts in July, followed by two more rate hikes in increments of 25 bpts in the September and November meetings. This would take the repo rate to c. 5.75% by year-end. At the end of the day, the SARB has to be cognisant of the detrimental impact of a hiking cycle that is too severe on SA’s already strained economy- the average South African consumer remains under increasing price pressures along with sustained high unemployment. Poor consumer spending will in turn dampen economic growth, along with many other idiosyncratic factors. However, we cannot discount the various inflationary upside risks at this point, which would lead to further front-loading of the interest rate cycle.