Following a dreadful first half of the year, most major global markets rebounded last month (MSCI World +8.0% MoM), South Africa (SA) included. In the US, major indices capped off their best month YTD as market expectations for interest rate increases eased on the hope that recent gloomy US economic data releases might have convinced the US Federal Reserve (Fed) to slow its aggressive monetary tightening. In addition, we also saw some robust earnings from several big US tech and energy companies (two of the largest US oil companies, Exxon Mobil and Chevron, posted record revenue numbers on 29 July).

The US blue-chip S&P 500 jumped 9.1% in July (-13.3% YTD), its most significant MoM rise since November 2020, buoyed by better-than-expected earnings, while the Dow ended July 6.7% higher after declining by 6.7% in June (YTD the Dow is down 9.6%). The tech-heavy Nasdaq rose 12.4% MoM (-20.8% YTD) as investors rushed back into tech counters which have been pummeled most in the current bear market (MoM, Amazon +27.1%, Apple +18.9%, Microsoft +7.9%, Alphabet +6.8%). This was the Nasdaq’s best monthly gain in c. 26 months.

On the US economic data front, June inflation (released in July) soared by a worse-than-expected 9.1% YoY (vs 8.6% YoY in May), hitting a new four-decade high as prices rose broadly across the economy, with gas prices outpacing other categories. Excluding the volatile food and energy prices categories, core CPI advanced 5.9% YoY vs May’s 6.0% print. Core inflation seems to have peaked in March this year at 6.5% and has been going down ever since. MoM, headline inflation was up 1.3% vs May’s 1.0% increase. US 2Q22 GDP disappointed for the second consecutive quarter declining by 0.9% QoQ annualised vs 1Q22’s 1.6% drop. While two consecutive quarters of negative growth is considered a recession in most countries, the official US definition of a recession (according to the National Bureau of Economic Research) involves other factors, including conditions of employment, so it is unlikely that the US is officially in a recession given its strong labour market. The Fed’s preferred inflation gauge, core personal consumption expenditure (PCE), which strips out the volatile food and energy categories, rose 4.8% YoY in June – up slightly from May. Soaring inflation saw the US Fed’s Federal Open Market Committee (FOMC), at its 26-27 July meeting, again hike rates by 0.75%, largely in line with expectations. In the press conference following the announcement, Fed Chair Jerome Powell highlighted that 3.25%-3.50% was probably the right place to stop, which is in line with where investors anticipate the benchmark rate to be pushed.

In Germany, the DAX closed the month 5.5% higher (-15.1% YTD), while in the eurozone’s second-biggest economy, France’s CAC Index ended July 8.9% in the green (-9.8% YTD). In economic data, June eurozone headline inflation reached a new record high of 8.6% YoY vs May’s 8.1% print as the cost of living continued to soar. This was the twelfth consecutive rise in inflation for the region. Germany’s July inflation rate declined for a second successive month, coming in at a 7.5% YoY increase vs June’s 7.6% YoY rise. However, it remains at the c. 50-year highs, first reached in May 2022. Official data showed that energy prices soared more than 35% YoY, remaining the biggest driver of inflation in Europe’s largest economy. France and Spain experienced new inflation records, with France’s CPI reaching a new record high of 6.1% YoY and Spain’s inflation rate surpassing 10% for the first time in c. 37 years amid the higher energy and food prices. Soaring inflation saw the European Central Bank (ECB) hiking rates in July by a higher-than-expected 0.5%. Over the course of the next three meetings to end-2022, expectations are for an additional 1.0% of ECB rate hikes. This rate hike ends 8 years of negative rates, while a hike in September will take rates above zero for the first time in a decade. The message from ECB President Christine Lagarde was sombre, and she was bearish about the region’s prospects for inflation and economic growth.

In the UK, the blue-chip FTSE-100 Index ended July 3.5% higher (+0.5% YTD). In economic data, June UK inflation, released last month, came in at another high of 9.4% YoY (vs May’s 9.1% YoY print) – the highest level since February 1982. On the political front, Boris Johnson resigned as prime minister after more than 50 ministers quit, and his allies in government abandoned him.

China’s markets disappointed in July, a volatile month which saw Hong Kong’s Hang Seng Index posting an MoM loss of 7.8% (-13.9% YTD), while the Shanghai Composite Index retreated 4.3% MoM (-10.6% YTD). This, as lingering uncertainty continued in the tech space and the country’s leaders indicated that China’s strict zero-COVID policy would remain a top priority. On the economic data front, the official manufacturing PMI contracted to 49.0 in July (the lowest reading in three months) compared with June’s 50.2 print and Reuters consensus expectations of 50.4. The official non-manufacturing PMI, which measures business sentiment in the services and construction sectors, fell to 53.8 in July vs 54.7 in June (the 50-point mark separates expansion from contraction).

Elsewhere, Japan’s benchmark Nikkei jumped 5.3% MoM in July (-3.4% YTD). On the economic front, July manufacturing activity grew at the slowest rate in 10 months, with output and new orders contracting. Services sector activity also expanded at a slower rate indicating subdued local demand.

Oil prices slipped for a second month in July as signs of a possible demand-reducing global recession fed through to financial markets. Nevertheless, while the price of Brent crude was down 4.2% MoM (+41.4% YTD) at US$110/bbl, it remains well above the US$100/bbl level and is one of the key inflation drivers this year, having risen to 14-year highs amid sanctions on Russia. Iron ore continued to slump (-8.0% MoM/-6.8% YTD), while the gold price was down 2.3% MoM (-3.5% YTD), ending July at US$1,765.94/oz. Platinum advanced 0.3% MoM but is down 7.2% YTD, while palladium soared 9.8% MoM (+11.9% YTD) – its first positive monthly performance since April 2022. This was likely on the back of concerns that Russia might squeeze palladium supply to the West as it has with the supply of gas.

July saw the local equity market stage an impressive turnaround, with the JSE ending strongly, as SA’s FTSE JSE All Share Index closed the month 4.1% higher (-6.5% YTD), and the FTSE JSE Capped SWIX rose 2.8% MoM (-1.9% YTD). The SA Listed Property Index was July’s outperformer, gaining 8.6% MoM (-8.3% YTD). It was followed by the Indi-25, which rose by 5.8% MoM (-12.0% YTD), buoyed by good share price gains in market heavyweights such as Prosus (+2.4%) and Richemont (+14.5% MoM), although Naspers’ (-0.5% MoM) performance disappointed. The Fini-15 rose 3.9% MoM (+3.1% YTD) and the Resi-10 eked out a 0.8% MoM advance (-9.5% YTD). Highlighting July’s best-performing shares by market cap, Richemont soared 14.5%, Glencore rose 6.6%, FirstRand gained 5.1%, and Anheuser Busch InBev ended the month 1.4% higher. BHP Group, the largest company on the JSE by market cap, advanced by 0.8% MoM. The rand continued to retreat in July, weakening by 2.1% against the greenback (-4.3% YTD).

On the local economic data front, annual headline inflation, as measured by the consumer price index (CPI), printed at 7.4% YoY in June vs 6.5% YoY in May. The main contributors to the annual inflation rate rise were food and non-alcoholic beverages, housing and utilities, transport, and miscellaneous goods and services – all of the usual suspects. Core inflation (excluding the volatile categories of food and energy costs) remained moderate at 4.4% YoY vs May’s 4.1% YoY print. Core CPI inflation is modest by historical standards, and, importantly, it remains below the mid-point of the SA Reserve Bank’s (SARB’s) target range. The SARB surprised markets somewhat following its latest Monetary Policy Committee (MPC) meeting on 21 July by front-loading the current interest rate hiking cycle and increasing the repo rate by 75 bpts to 5.5%. This was the sharpest rate hike in c. 20 years and ahead of market expectations (the market had largely priced in a more moderate hike of 50 bpts). May retail sales rose by a lacklustre 0.1% YoY vs April’s revised 4.3% YoY increase.

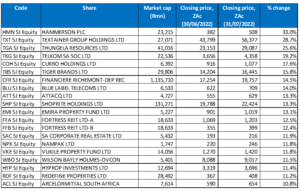

Figure 1: July 2022’s 20 best-performing shares, % change

Source: Bloomberg, Anchor

JSE-listed, UK-based property Group, Hammerson Plc, which owns premium retail properties and venues in Europe, delivered strong profits as footfall at its malls returned to close to pre-COVID-19-pandemic levels. This saw the share price soar by 33.0% MoM – the best performing share on the JSE in July, after recording a 29.7% share price decline in June. The company said last week that it recorded a footfall return to 90% of 2019 levels as it made a 1H22 (to end-December 2021) profit of GBP50.3mn (c. R1.02bn), in part due to like-for-like net rental income rising, as well as lower admin and financing costs. Hammerson said it will pay out an interim dividend of GBP0.02/share (c. ZAc41/share) and offer shareholders an enhanced scrip dividend alternative, subject to shareholder approval.

Textainer (+28.7% MoM) was July’s second best-performing share, followed by Thungela Resources (+ 25.6% MoM) in the third spot as rising coal prices following Russia’s invasion of Ukraine continued to drive the share price.

Telkom’s (+19.2% MoM) share price skyrocketed after MTN announced in July that it is in talks to buy out the state-affiliated, fixed-line operator to bolster its fibre asset base. Ratings agency S&P said that MTN’s potential takeover of Telkom could improve the credit rating of both telecom operators. However, it warned that completing such a deal could prove to be “a prolonged and complex process”.

In a trading statement last week, Curro Holdings (+17.6% MoM) said it expects its 1H22 EPS to increase by between 19.4% and 34.1% YoY, as compared with the ZAc21.70 reported in 1H21, while it expected HEPS to be between 33.5% and 50.0% higher vs the ZAc19.40 reported in the corresponding period of the previous year.

Tiger Brands and Richemont posted MoM gains of 15.8% and 14.5% in July. Last month, luxury goods firm, Richemont released its 1Q23 trading update (for the quarter ended 30 June 2022), which showed that YoY constant currency revenue growth came in ahead of expectations at 12% vs 10.7% expected. Richemont reported higher sales in the US and Europe which offset a 37% YoY drop in revenue for mainland China. Total 1Q23 sales came in at EUR5.26bn – 12% YoY growth in constant currency terms. Europe reported much stronger-than-expected results, despite the lack of Chinese tourists. At the same time, revenue for the Americas region, of which the US accounts for 87%, was also much more robust than expected. China was much weaker than expected, and, even in June, once the lockdown restrictions under that country’s zero-COVID policy had been removed, sales were still 12% weaker YoY, so there were no signs of 2 months’ worth of pent-up spending being unleashed. The result from its online distributor’s division (consisting mainly of YNAP) was disappointing – growing only 2% YoY. YNAP is loss-making, and management has decided that it does not fit within the Group, but the process of selling it had taken disappointingly long, and the poor results are making it more difficult to spin it out of the rest of the Group.

Meanwhile, SA’s smallest mobile player, Cell C’s largest shareholder, Blue Label Telecoms’ share price (+14.0% MoM), has been buoyed by progress on the recapitalisation of Cell C’s debt. Recently, Cell C’s secured lenders voted in favour of a compromise cash-out offer, taking an 80% loss on their debt to save the beleaguered mobile operator, which has to restructure c. R7.3bn in debt.

Rounding out July’s ten best-performing shares are Attacq Ltd and Shoprite, with both posting MoM gains of 13.3%. In its FY22 operational update, Shoprite revealed that its revenue had increased by 9.6% YoY to R184.1bn. The Group’s core business, Supermarkets RSA, contributing 80% to Group sales, achieved sales growth of 10.1% YoY. The Supermarkets Non-RSA segment’s sales increased by 10.4% YoY, while its furniture segment, contributing 3.7% to Group sales, reported a 1.4% YoY decline in sales. The Other operating segment sales increased by 8.5% YoY for the period, contributing 7.0% to total Group sales.

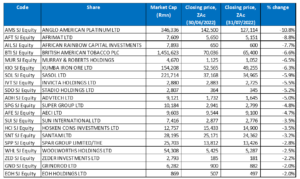

Figure 2: July 2022’s worst-performing shares, % change

Source: Bloomberg, Anchor

Anglo American Platinum (Amplats), an Anglo American subsidiary, was July’s worst-performing share, with the share price plummeting 10.8% MoM after Amplats, the world’s biggest platinum group metals (PGM) miner, reported a 43% YoY drop in its 1H22 profit. It also recorded R86bn in revenue and declared an interim dividend of R81/share – significantly less than the R175/share dividend it declared in 1H21. This was due to a combination of weaker metal prices and lower production (-20% YoY) compared with record sales the company reported a year ago.

Amplats was followed by building materials and mining firm, Afrimat (-8.8% MoM) in second place. Regarding share price performance, Afrimat recorded its worst day in more than two months on 28 July. This followed its after-market announcement on 27 July of an R680mn bookbuild to fund the growth of its new manganese and rare-earth minerals interests. This equated to c. 5% of its market cap, and the issue price of R50.85/share represented a 7.2% discount to its closing price on 27 July, with its share price dropping 4.5% on the day (28 July). The funds will be primarily used to fund two long-life projects, but Afrimat added that it would continue to explore other opportunities. African Rainbow Capital Investments (ARC) came in the third spot, with a 7.7% MoM share price decline.

ARC was followed by cigarette manufacturer, British American Tobacco (BAT; -6.6% MoM). In its 1H22 results, BAT reported that its revenue had advanced by 5.7% YoY to GBP12.87bn, while diluted EPS stood at GBp80.80, compared with GBp141.60 recorded in the corresponding period of 2021. BAT also posted a 30% YoY drop in pre-tax profit as its operating costs rose (+49% YoY) due to the challenging macroeconomic environment, which has been exacerbated by the war in Ukraine. BAT was also impacted by a GBP1bn (c. R20bn) impairment charge due to the Group exiting Russia. However, BAT did see strong growth in its New Categories segment, which recorded a revenue jump of 45% YoY. BAT was followed by construction firm Murray & Roberts, with a share price drop of 6.5% MoM.

The downward trend in metal prices also hit Kumba Iron Ore (Kumba; -6.3% MoM), another Anglo subsidiary. Kumba’s profit fell 50.5% YoY to R15.15bn, with revenue down almost one-third and headline EPS at R36.13 vs R72.78 recorded in 1H21. Heavy rains also disrupted production at its Sishen and Kolomela mines in the Northern Cape, but the biggest driver of the decline is the iron ore price, which has dropped by 26% in the first six months of this year. The 2021 average iron ore price of US$161/tonne was the second-highest price going back to 2011. Kumba said production for the half year was also 13% lower than in 1H21 due to the aforementioned heavy rains and equipment and logistics availability, coupled with safety initiatives that impacted operations. Production dropped by 13% YoY to 17.8mn tonnes, with equipment reliability issues prompting increased safety stoppages. Kumba cut its dividend by 61% to R28.70/share.

Last month, Sasol (-5.9% MoM), SA’s largest fuel producer, declared force majeure after delays in crude oil shipments shut down its Natref refinery (the company owns c. 64% of Natref while Total owns 36%) on 15 July. Still, Sasol said that, at this stage, it does not expect fuel shortages.

Rounding out July’s ten worst-performing stocks were Invicta Holdings, Stadio Holdings and education company ADvTECH with MoM losses of 5.5%, 5.2% and 5.0%, respectively.

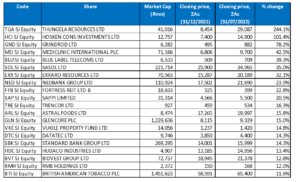

Figure 3: Top-20 July 2022, YTD

Source: Anchor, Bloomberg

Sixteen out of July’s top-20 YTD best-performing shares also featured among the top-20 performers for the year to end June, with Astral Foods (+15.8% YTD), Glencore Plc (+15.0% YTD), Vukile Property Fund (+14.8% YTD), and Datatec (+14.3% YTD), replacing Kumba, Omnia, Irongate Group, and Accelerate Property Fund.

Thungela Resources (+244.1% YTD) remained at the top spot for the sixth month running after recording a further 25.6% MoM share price jump in July. With Russia’s invasion of Ukraine and the ensuing sanctions creating an energy crisis in Europe, coal generation will play an increasingly important role in ensuring regional power stability. This has resulted in many EU nations recommissioning or delaying the closure of coal plants to avoid outages, and the EU will likely be unable to secure adequate coal supply from Russia (imports of Russian thermal coal has banned by the EU from 1 August), thus opening the door for continued higher coal prices which will be hugely beneficial to Thungela. In addition, it was reported last week that Glencore will supply thermal coal to Japan’s Nippon Steel Corp on an annual basis at US$375/tonne through to March 2023 (three times the price of similar deals done last year), further supporting the price of coal as this deal could be used as the benchmark price for other annual supplies by thermal coal users in Asia, increasing the cost of power generation for homes and businesses.

Hosken Consolidated Investments Ltd (HCI; +101.4% YTD) remained in second place, although the HCI share price did lose some ground in July – down 3.5% MoM. Grindrod (+78.2% YTD) also remained in the third spot for a third month.

Healthcare Group, Mediclinic’s share price surged c. 8.6% on 7 July (and is up 7.7% MoM and 42.5% YTD) as the company’s board considered the latest offer by the Remgro and Mediterranean Shipping Company (MSC) consortium. After rejecting three offers, Mediclinic’s board said in July that a fourth offer that values the private hospital group at US$4.44bn (c. R74.1bn) appears attractive to shareholders. The consortium initially made an unsolicited cash offer to acquire Mediclinic on 26 May, which its board rejected on 9 June on the basis that it significantly undervalued the business. Remgro is Mediclinic’s majority shareholder with a 44.6% stake.

Mediclinic was followed by Blue Label Telecoms, Sasol (both discussed earlier), and Exxaro Resources with YTD gains of 39.3%, 35.0% and 32.1%, respectively. In July, Exxaro said in a trading update that the average coal price for 1H22 was US$270/tonne – nearly twice the average price during the comparative period in 2021, with the price support largely coming from Europe.

Rounding out the YTD 10 best-performing shares were Nedbank, Fortress REIT Ltd -B-, and Sappi with YTD gains of 23.9%, 22.8% and 20.5%, respectively. In its 1H22 trading update, released in July, Nedbank said that it expects its basic EPS to come in between R13.84 and R14.38, compared with R10.81 posted in 1H21, while its HEPS is forecast to be between 23.0% and 28.0% higher YoY.

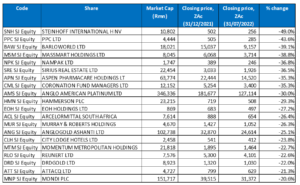

Figure 4: Bottom-20 July 2022, YTD

Source: Anchor, Bloomberg

Among the YTD worst-performing shares, 15 of the 20 shares for the year to end-July were also among the 20 worst performers for the year to end-June. Amplats (-30.0% YTD), Murray & Roberts (-26.3% YTD), Momentum Metropolitan Holdings (-22.7% YTD), Reunert (-22.6% YTD), and DRDGold (-22.0% YTD) were the newcomers last month, replacing Telkom, WBHO, Richemont, Curro, and Life Healthcare.

For a fourth month running, Steinhoff (-49.0% YTD) emerged as the worst-performing share YTD, although it did manage to eke out a slight MoM gain of 0.8% in July. Steinhoff was followed by PPC (-43.6% YTD) in the second spot, with Barloworld (-39.1%) the third worst-performing share for the year to end-July.

Barloworld was followed by Massmart Holdings (-38.8% YTD), Nampak (-36.8% YTD), Sirius Real Estate (-36.5% YTD), and Aspen Pharmacare (-35.3% YTD). Packaging Group, Nampak is still down YTD, despite its impressive share price performance in July (+11.8% MoM). The share price was buoyed after Nampak said that its lenders had pushed back by c. six months (to April 2023) the repayment of R1bn in debt, buying it additional time to avoid a rights issue. Nampak’s push into Africa has resulted in the company racking up a debt pile that stood at R5bn at the end of March. However, last year Nampak’s lenders gave it a reprieve when they pushed back the date to complete the repayment of part of it by nine months to the end of September 2022.

Coronation Fund Managers, Amplats (discussed earlier), and Hammerson Plc (July’s best performer and discussed earlier) rounded out the ten worst-performing shares with YTD losses of 35.3%, 33.6%, and 30.0%.