In positive news for South African (SA) consumers, September’s inflation, as measured by the Consumer Price Index (CPI), continued its disinflationary trend, with headline inflation easing to 3.8% YoY, down from 4.4% YoY in August. This marks the lowest inflation rate since March 2021, when it stood at 3.2%. A major factor behind this slowdown was softer transport inflation, notably lower fuel prices, which pushed the transport category into deflation for the first time in 13 months. The annual transport inflation rate dropped from 2.8% in August to -1.1% in September. Fuel prices have now declined for four consecutive months, averaging 9.0% lower than the previous year. A litre of 95-octane petrol in inland areas cost R22.19 in September, the lowest price since February 2023 (R21.68/litre). Vehicle price increases have also slowed, with an annual rise of 3.6% in September 2024 compared to 8.4% in September 2023.

Core inflation, which excludes volatile food and energy prices and reflects underlying inflation pressures, was unchanged from August at 4.1% YoY in September, indicating continued easing in price pressures. The September CPI release notably includes the quarterly survey of housing costs, which has a weight of 16.49% in the overall basket and traditionally forms a sticky component of core price pressures. The annual rate for actual rentals was 3.3% in 3Q24, up from 3.2% in 2Q24.

Figure 1: SA inflation, YoY % change

Source: Stats SA, Anchor

Annual inflation for food and non-alcoholic beverages (NAB) remained at 4.7% in September, unchanged from August. Softer annual inflation rates were noted in categories such as hot beverages, meat, bread and cereals, sugar, sweets and desserts, and oils and fats. Despite slowing, hot beverages continued to show the highest inflation rate among all food and NAB categories at 15.8%, down from 17.5% in August. In contrast, vegetables, fruit, cold beverages, and fish saw higher inflation rates in September, while milk, eggs, and cheese inflation remained stable. MoM, the food and NAB price index rose by 0.6% in September compared to August, the highest monthly increase since January 2024, which also recorded a 0.6% rise. The alcoholic beverages and tobacco category saw its annual inflation rate increase to 4.7%, up from 4.3% in August. Beer prices climbed by 5.2%, spirits by 4.3%, and wine by 4.0% over the 12 months to September.

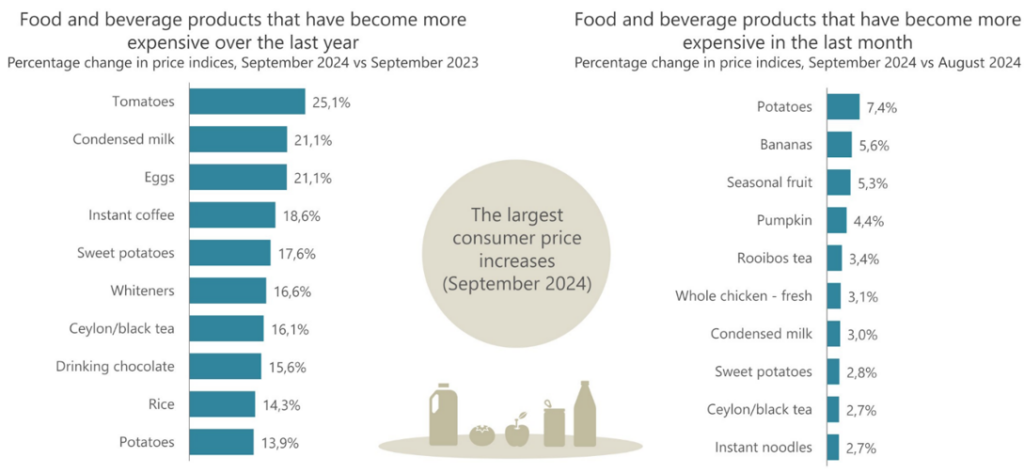

Products like tomatoes, condensed milk, eggs, and instant coffee continued to experience significant annual price increases. In September 2024, the UN Food and Agriculture Organization’s (FAO) Global Food Price Index (FFPI), the benchmark for global food commodity prices, experienced its fastest increase in 18 months (see our note entitled, Slow climb: SA food prices on the rise amid global shifts, dated 10 October 2024). Prices rose across all five of the FFPI’s commodity group price indices, with sugar leading the surge. While food inflation is expected to remain stable over the short term, meat prices could rise towards the end of this year due to increasing demand for the festive season.

Figure 2: Food and beverage products that recorded the most significant annual and monthly price increases in September

Source: Stats SA

Looking ahead, we expect inflation to bottom out in October, likely nearing the lower end of the South African Reserve Bank’s (SARB) 3%-6% target range, as the recent rise in oil prices and the rand’s depreciation partially reverse previous disinflationary trends. These inflationary pressures from oil and currency shifts justified the SARB’s cautious approach when it opted for a 25-bp rate cut instead of the 50-bp cut some investors had hoped for. We have long-held the view that the Monetary Policy Committee (MPC) would avoid sharp 50-bp cuts, as the SARB typically favours gradual reductions to maintain market stability and predictability. This cautious approach reflects the SARB’s commitment to managing expectations and avoiding sudden market shocks. The central bank can adjust based on evolving economic conditions by opting for a data-dependent, incremental strategy. This method minimises the risks associated with large, rapid rate cuts, such as heightened market volatility or misaligned signals. It also ensures smoother transitions in financial markets, allowing for a more measured and adaptive response to inflationary pressures and economic performance.

Looking ahead, one key point from the latest SARB MPC statement in September is that its forecast sees rates moving towards neutral next year, stabilising slightly above 7%. This confirms our base case of 100-125 bps of cuts this cycle. It is worth noting that the SARB’s Quarterly Projection Model (QPM) previously saw the repo rate ending at 7.25% but now signals a further 25-bp cut in 2025/2026. This will take the repo rate to a steady state of 7%, which aligns with our stated base case. Regarding market reaction, the specific timing or structure of these rate cuts seems relatively unimportant. Assuming the full magnitude of the cuts is ultimately delivered, markets are likely to respond in a relatively neutral manner, similar to the reaction after the MPC rate-cut announcement on 19 September. This suggests that investors are more focused on the overall trajectory of monetary policy rather than the nuances of individual rate decisions. Regardless, we believe that the SARB will cut rates further by a further 25 bps in the last MPC meeting for 2024, which is scheduled for 21 November.