“Like sands through the hourglass, so are the days of our lives”, many of us will recognise this as the iconic words welcoming viewers to the US daytime soap opera, Days of Our Lives, which has aired more than 14,000 episodes since its debut in 1965. These words compare the passage of time to sand slipping through one side of an hourglass and it highlights one of the most important elements that contextualise risk and influence performance in the world of investing … time.

Time: The killer and the healer

The time horizon of an investment is the period over which an investor is expected to hold an investment to achieve a desired outcome or return. Often the mistake investors make is not aligning the timeline of their financial goals with the appropriate investment type. The time horizon of an investment should inform an investor of their risk profile and guide them in determining the degree of risk to which any given investment portfolio should be exposed. Typically, investors should seek more stable assets for short-term investing while riskier assets are more suitable for a longer-term investment. This allows more time to compound returns in periods of outperformance while also allowing enough time for such investments to recover during periods of underperformance. This is largely motivated by the fact that, overall, markets tend to trend upwards given that equities are financial assets that are exposed to the real economy and therefore can ride out the ebbs and flows of inflation, especially over the long term.

So, for investors looking to achieve above-inflation (real) investment growth by investing in riskier assets, the longer the time horizon, the more likely they will achieve their expected investment return. The longer time horizon allows those investors to be more relaxed when they encounter periods characterised by economic uncertainty and market volatility, such as the very period in which we find ourselves presently.

The economic disruption caused by the COVID-19 pandemic seems to be only just beginning to loosen its grip on the global economy with supply chains still struggling to catch up from the backlogs created by shuttered factories and transport routes during the pandemic. At the same time, Russia’s war on Ukraine has added economic complexity by seriously disrupting the supply of food and energy commodities. Central banks around the world are scrambling to rein in high inflation and economists fear that aggressive interest rate hikes could trigger a global recession.

At the time of writing (1 July), the average Nasdaq share has declined by approximately 49% and about 54% of S&P 500 companies are below their pandemic highs. With the JSE, S&P 500, and the Nasdaq all down c. 10%, 23%, and 31%, respectively, for the year to end June, there has been nowhere to hide in the current turbulent market environment. During times such as these, investors may be tempted to consider overhauling their entire investment strategy, especially when faced with prolonged spells of negative investment returns. Yet, despite this, the adage “it is not about timing the market, but time in the market” still holds. This seemingly wildly optimistic outlook may offer some perspective in soothing investors’ concerns.

Tough times never last

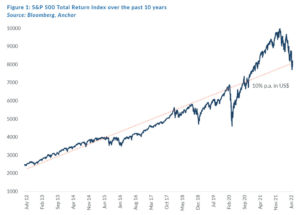

The S&P 500 Total Return Index over the past ten years shows that, despite periods of significant volatility and uncertainty, high-quality global equities have proven to be the best asset class to be in over time through almost any meaningful investment horizon. Investors that have been able to stomach the volatility over the past ten years have been rewarded with an average US dollar return of 10% p.a. For those investors that have cautiously sat on the sidelines during this most recent momentous drawdown in global equities, we would argue that we are steadily approaching an opportune time in the market. Looking at the S&P 500 forward P/E multiple, currently at just below 20x, and bearing in mind that a multiple of c. 15x has translated to a bargain in US equities over the past decade, we propose, with good reason, that now may be the time for investors to consider building a position in high-quality global shares.

On time and timing …

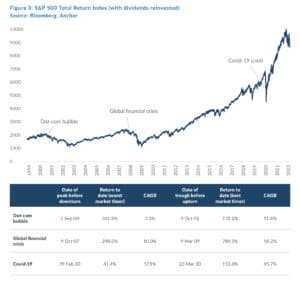

A discussion about timing the market vs time in the market may be of obvious concern to both investors that have been bruised by the market turbulence of the past eight months or so and those that have cautiously sat on the sidelines attempting to time the elusive bottom of this bear market before investing. Taking a step back and considering the most recent three major US stock market crashes – the dot-com bubble of the early 2000s, the 2008 GFC, and the COVID-19 crash of early 2020 may offer some useful insights. Looking once again at the S&P 500 Total Return Index (with dividends reinvested) through each of these market crashes, two observations can be made:

- First, over a relatively short period, markets did indeed recover and, in all three cases, to levels around their previous highs.

- Our second observation, which is probably the most striking, is that in each of these instances, while the best market timer (i.e., an investor able to successfully invest at the bottom of these crashes) would have obviously achieved outstanding results, surprisingly the worst market timer (i.e., an investor that unfortunately invested at the peak of the market before the downturn that led to these crashes), also managed to record excellent long-term returns. To put this into perspective, while the best market timer during the dot-com bubble (i.e., the hypothetical investor that invested at the trough in October 2002) would have achieved a compound annual growth rate (CAGR) of 11.8% over the c. 20-years since then, the worst market timer (i.e., the hypothetical investor that invested at the peak in September 2000) would have achieved a CAGR of 7.3% over the c. 22 years since then. While the best market timer during the GFC (i.e., the hypothetical investor who invested at the trough in March 2009) would have realised a CAGR of 18.2% over the 13-plus years since then, the worst market timer (i.e., the hypothetical investor that invested at the peak in October 2007) would have realised a CAGR of 10.0% over the c. 15 years since then. Finally, while the best market timer during the COVID-19 crash (i.e., the hypothetical investor who invested at the trough in March 2020) would have achieved a CAGR of 45.7% in the 2-plus years since then, the worst market timer (i.e., the hypothetical investor that invested at the peak in February 2020) would have still achieved a CAGR of 17.9% in the 2-plus years since then.

As market volatility continues to be a key theme dominating headlines, investors may be tempted to succumb to the general negative sentiment around equity markets, yet compelling empirical evidence shows that time in the market beats timing the market. For those investors that have remained cautiously on the sidelines, as valuations approach attractive levels while earnings growth projections look strong for the next few years, the case for investing in high-quality global equities is once again back for deliberation.