Over the past few decades, the global flow of personal remittances has emerged as a critical component of the global economy, playing a pivotal role in enhancing the economic stability and development of many nations, particularly those in the developing world. Personal remittances refer to the money sent by individuals working abroad to their families or communities in their home countries. This financial activity supports millions of households worldwide and influences economic growth, poverty reduction, and social development on a larger scale. One of the primary reasons for the significance of personal remittances in the global economy is their sheer volume. According to the latest estimates from the Global Knowledge Partnership on Migration and Development (KNOMAD), remittance flows to low- and middle-income countries (LMICs) increased by an estimated 3.8% YoY to reach US$669bn in 2023. Total global remittance flows are estimated at US$860bn for 2023.

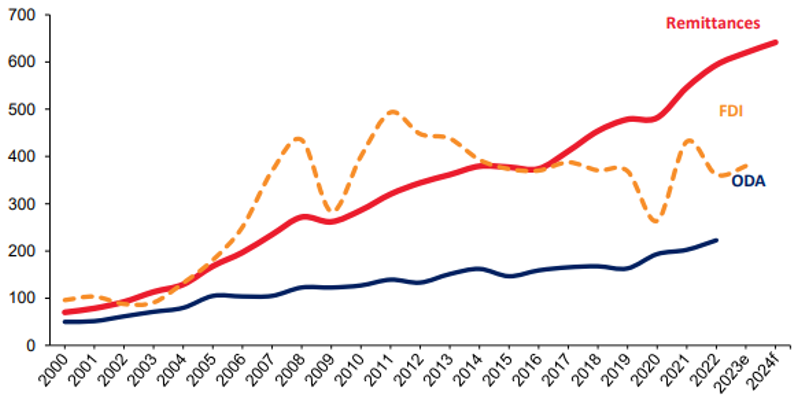

To put it into perspective, the United Nations (UN) states that funds from abroad support at least one in every nine people globally, and half of the amount ends up in rural areas, where some of the world’s poorest people live. This also makes remittances three times more important than international aid. In 2023, remittances remained the leading source of external finance for LMICs, surpassing foreign direct investment (FDI) and official development assistance. Since 2015, excluding China, remittances have consistently been the largest source of external financing for LMICs, outpacing other resource flows.

Figure 1: Remittances, FDI, and official development assistance flows to low- and middle-income countries, excluding China, US$bn

Source: KNOMAD

On a global scale, personal inbound remittances have risen seven times between 2000 and 2023. Notably, the Indian diaspora (measuring nearly 18mn people) collectively sent more than US$125bn back to the country in 2023. Subsequently, India became the first country to ever receive more than US$100bn in personal remittances in 2022. To put this in context, India’s remittances received add up to more than those for the next two countries, Mexico (US$67bn) and China (US$50bn) combined. In 2023, the top recipients of remittances following India were Mexico (US$67bn), China (US$50bn), the Philippines (US$40bn), and Egypt (US$24bn). Among the countries where remittance inflows make up a significant portion of GDP, underscoring their importance in addressing current account and fiscal deficits, Tajikistan (48% of GDP), Tonga (41%), Samoa (32%), Lebanon (28%), and Nicaragua (27%) ranked highest.

Figure 2: The top recipients of remittances among LMICs, 2023

Source: KNOMAD

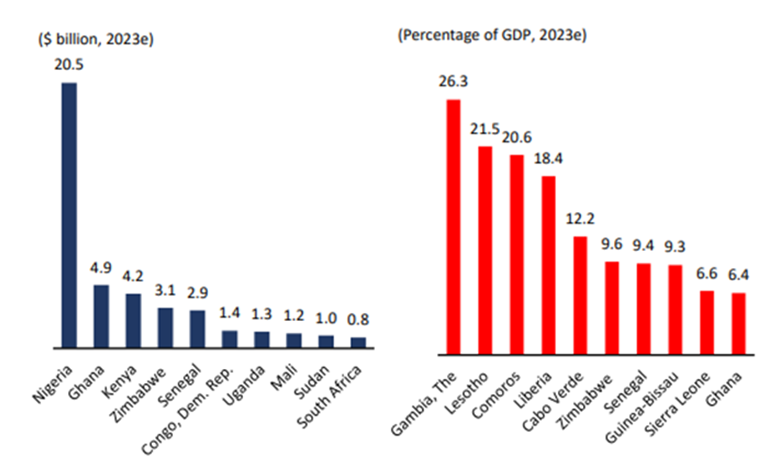

Closer to home, remittances to Sub-Saharan Africa (SSA) grew by 1.9% YoY, increasing from US$53bn in 2022 to US$54bn in 2023, with further growth expected to reach US$55bn this year (2024). The slower growth observed in 2023 is attributed to the sluggish economic expansion in high-income countries where many SSA migrants earn income. Remittances from the US have remained steady, while output in the euro area, despite recovering, is still 2.2% below pre-pandemic projections. Remittances are a vital source of financing for SSA, proving more stable than FDI, which has been notably volatile over the past two decades. In 2023, remittance flows to the region significantly surpassed FDI, though, in 2022 (the latest year for available FDI data), they remained slightly lower than official development assistance (ODA) flows. The largest remittance recipients in the region in 2022, in US dollar terms, were Nigeria, Ghana, Kenya, and Zimbabwe. Regarding remittances as a share of GDP, the Gambia led, followed by Lesotho, Comoros, Cabo Verde, Guinea-Bissau, and Zimbabwe.

Figure 3: Top remittance recipients in the SSA region, 2023

Source: KNOMAD

Globally, this substantial influx of funds provides a stable source of income for many families, often covering essential needs such as food, healthcare, education, and housing. The impact of remittances on poverty alleviation cannot be overstated. For many households in developing countries, remittances form an essential lifeline that helps them escape the vicious cycle of poverty. These funds provide immediate financial relief, allowing families to invest in better living conditions and opportunities.

Studies have shown that countries with higher remittance inflows experience lower poverty rates and improved health and educational outcomes. Moreover, personal remittances contribute significantly to the economic stability of recipient countries. They act as a buffer against economic shocks and financial crises. For example, during periods of economic downturn or natural disasters, remittances often remain resilient, providing a crucial financial safety net. This stability is essential for countries with volatile economies or limited access to international capital markets.

Remittances also play a vital role in fostering financial inclusion. In many developing regions, access to formal banking services is limited. The flow of remittances encourages the use of financial institutions and services, as recipients are more likely to open bank accounts, save, and invest their funds. This increased financial inclusion can stimulate local economies by promoting savings and investments, thus fostering economic growth and development. Furthermore, remittances have a multiplier effect on the local economy. The money received is often spent on goods and services within the recipient’s community, boosting local businesses and generating employment opportunities. This circulation of funds stimulates economic activity and can lead to the development of infrastructure and public services, ultimately contributing to the region’s overall economic growth.

Despite growing calls from leading development and funding agencies to increase private financing to tackle global challenges such as climate change, food insecurity, and fragility, private capital flows to LMICs have steadily declined over the past decade. Conversely, remittances remain one of the few sources of private external finance that are expected to grow in the coming years. With worsening debt indicators and rising sovereign risks in LMICs, attracting diaspora investors could be beneficial, as they may view investment opportunities in their home countries more favourably than institutional investors from developed nations.

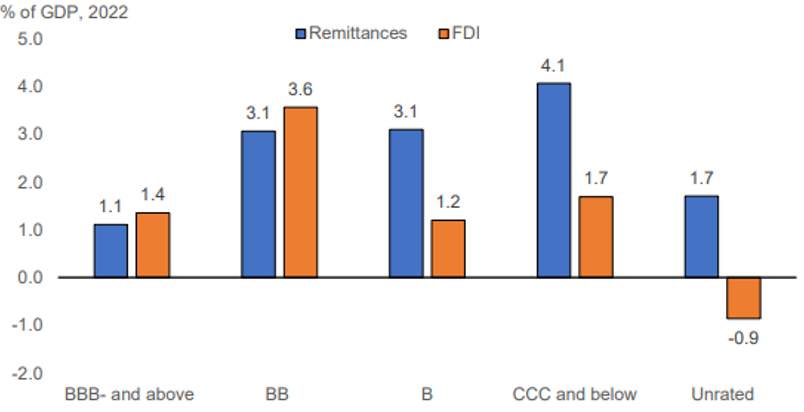

Remittances are often a critical source of external financing for developing countries with limited access to international capital markets. In 2022, countries with credit ratings of B or lower received significantly more in remittances than in FDI. This reliance on remittances was even more pronounced in countries rated CCC or below, particularly in unrated nations.

Figure 4: The reliance on remittances tends to be greater in sub-investment-grade countries

*Note that World Bank staff estimates are based on World Development Indicators (WDI) and S&P. There were 12 countries in BBB- and above, 17 countries in BB, 27 in B, 13 in CCC and below, and 40 unrated countries.

Source: KNOMAD

It is essential, however, to acknowledge the challenges associated with remittance flows. High transaction costs and fees imposed by money transfer operators can significantly reduce the amount of money that reaches recipients. Additionally, there are concerns about the dependence of some economies on remittances, which can create vulnerabilities if these flows were to decline. Nonetheless, the global flow of personal remittances remains a crucial element of the global economy, particularly for developing nations. These funds provide essential financial support to millions of households, contributing to poverty alleviation, economic stability, and social development. While challenges exist, the positive impact of remittances on economic growth and financial inclusion underscores their importance in fostering a more equitable and resilient global economy.