An investor’s ability to select those shares with a high probability of receiving healthy portions of a company’s profit , on a sustainable basis, has always been an attractive and sought-after quality. Higher dividend yields (as measured by the dividends paid per share/share price) have often been described as “defensive”, and sometimes even as an indicator of “value” with an overlay of “quality.”

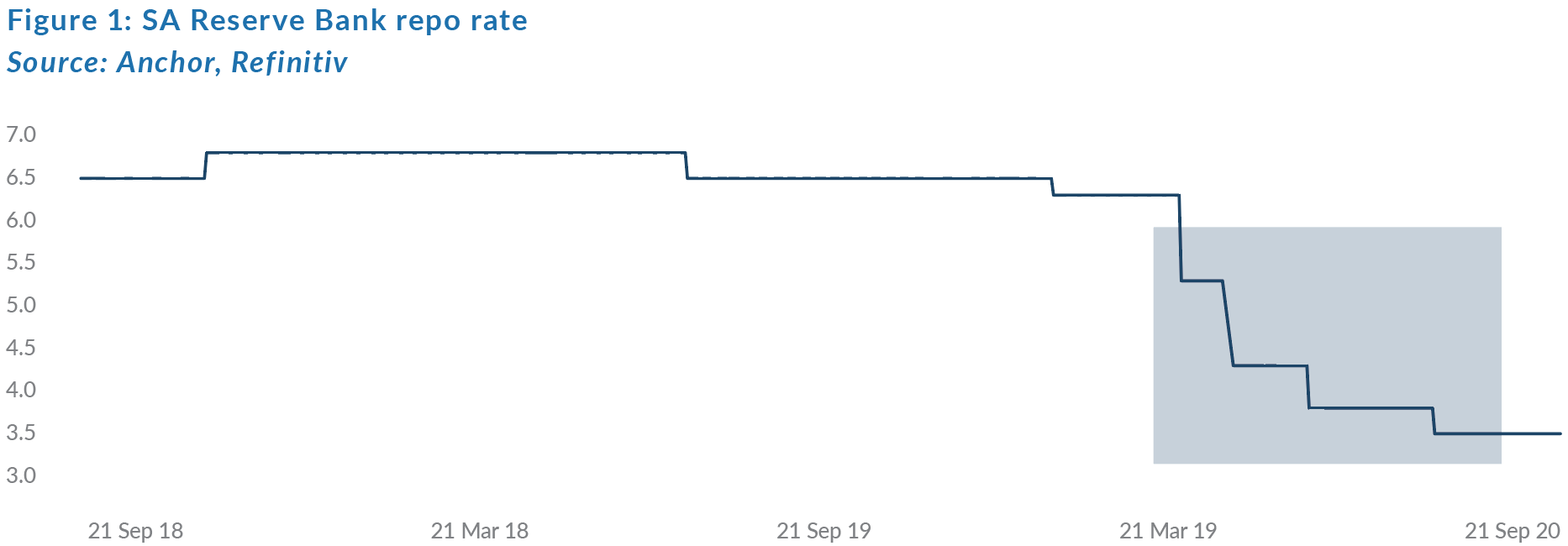

However, the COVID-19 pandemic has had a marked impact on global investment markets, and SA is no exception. Investors’ risk-free income streams have been dramatically reduced because of the multiple interest rate cuts announced by the SARB.

This means that the search for yield has reached our shores for the first time in many years, as short-term interest rates have fallen, with the average money market collective investment scheme (CIS) return now at an annualised 4.5% and the income taxed at relevant rates in the hands of the investor. Although longer-term SA government bonds are still offering decent yields (the SA 2030 bond offers 9.45%), fiscal deficits have ballooned, and IMF loans are being utilised for the first time. All of the above also means that risk of capital loss does exist if the situation worsens and/or the SA government has to keep issuing debt. In our view, the consequence of this is that the widest possible available range of instruments and assets should be on the radar of those investors requiring an income.

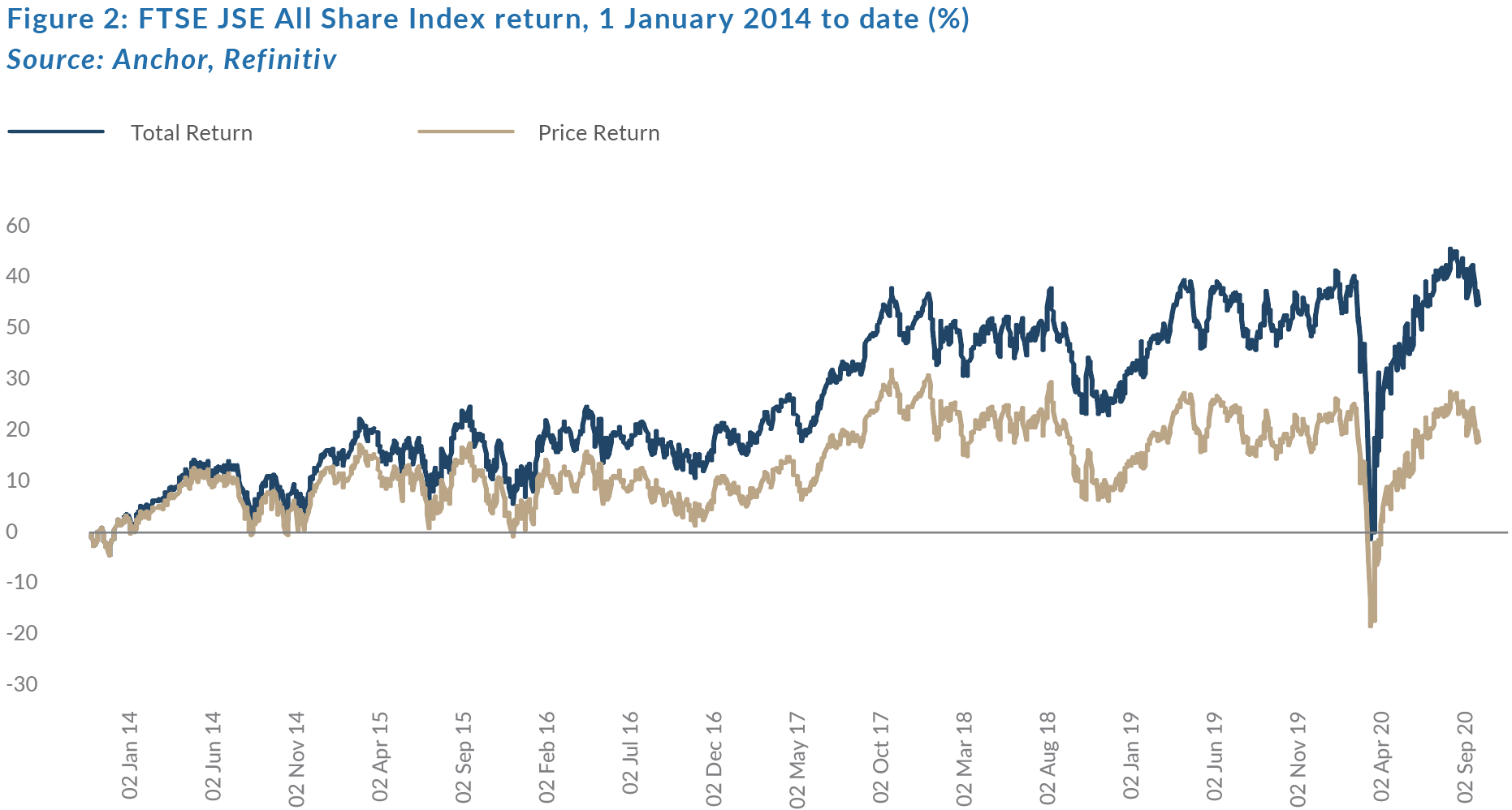

At an overall equity market level, dividend yields have supplied a fairly surprising portion of total returns to local investors. In SA, as measured by the FTSE JSE All Share Index, 60% of total returns have been gained through dividend payments over the past c. 7 years.

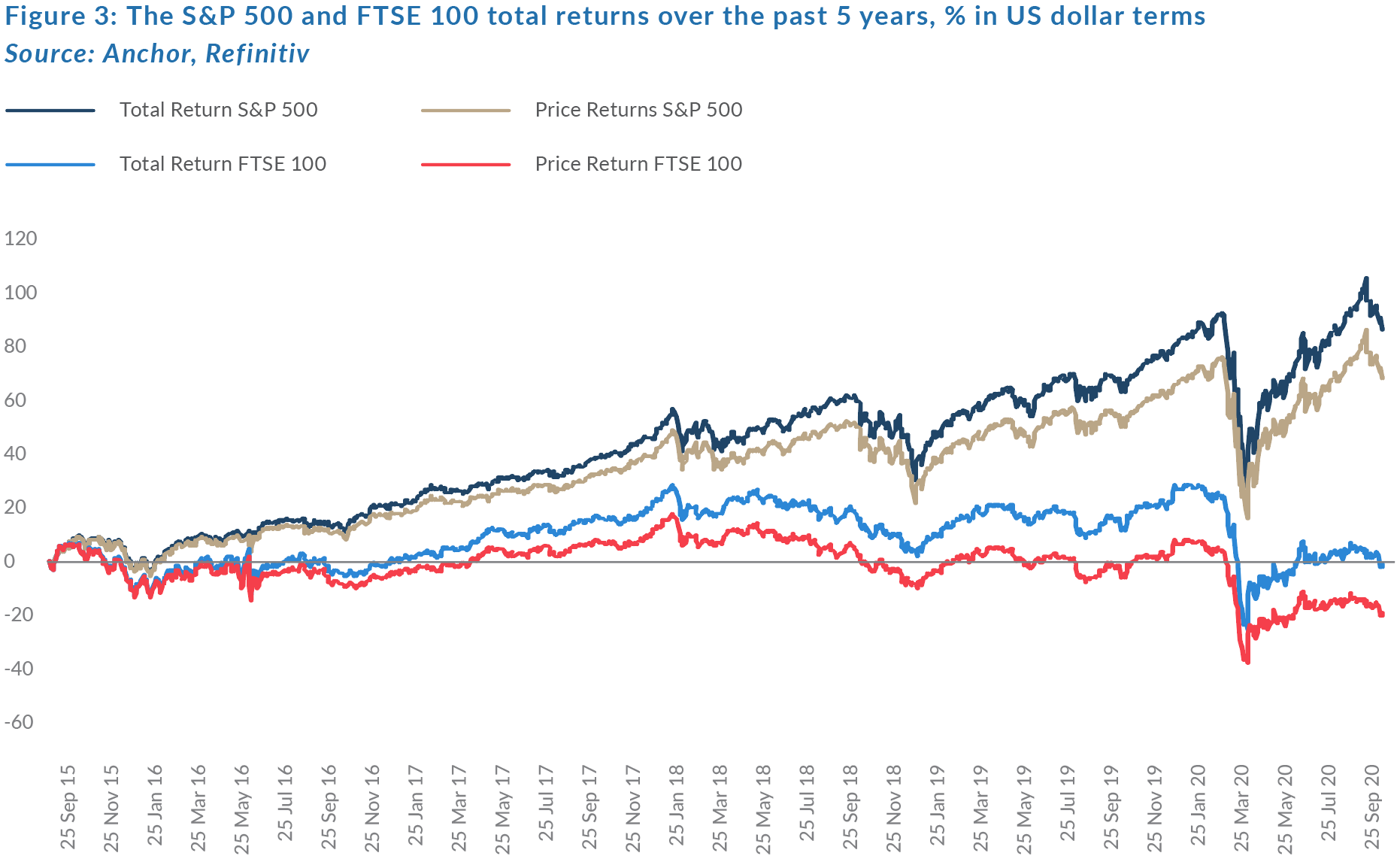

However, when looking at offshore markets, although their respective dividend contributions are proportionately less than that of the JSE, they remain important.

We highlight that, where the S&P 500 Index recorded good returns, the dividend component was less. Conversely, where returns were less impressive, the dividend component acted as a defensive buffer in the total return equation. This is illustrated by the FTSE 100 Index in Figure 3 where, over the past 5 years, the return is a negative 4.3% on annualised basis, but only a negative 0.4% p.a. once dividend payments have been considered.

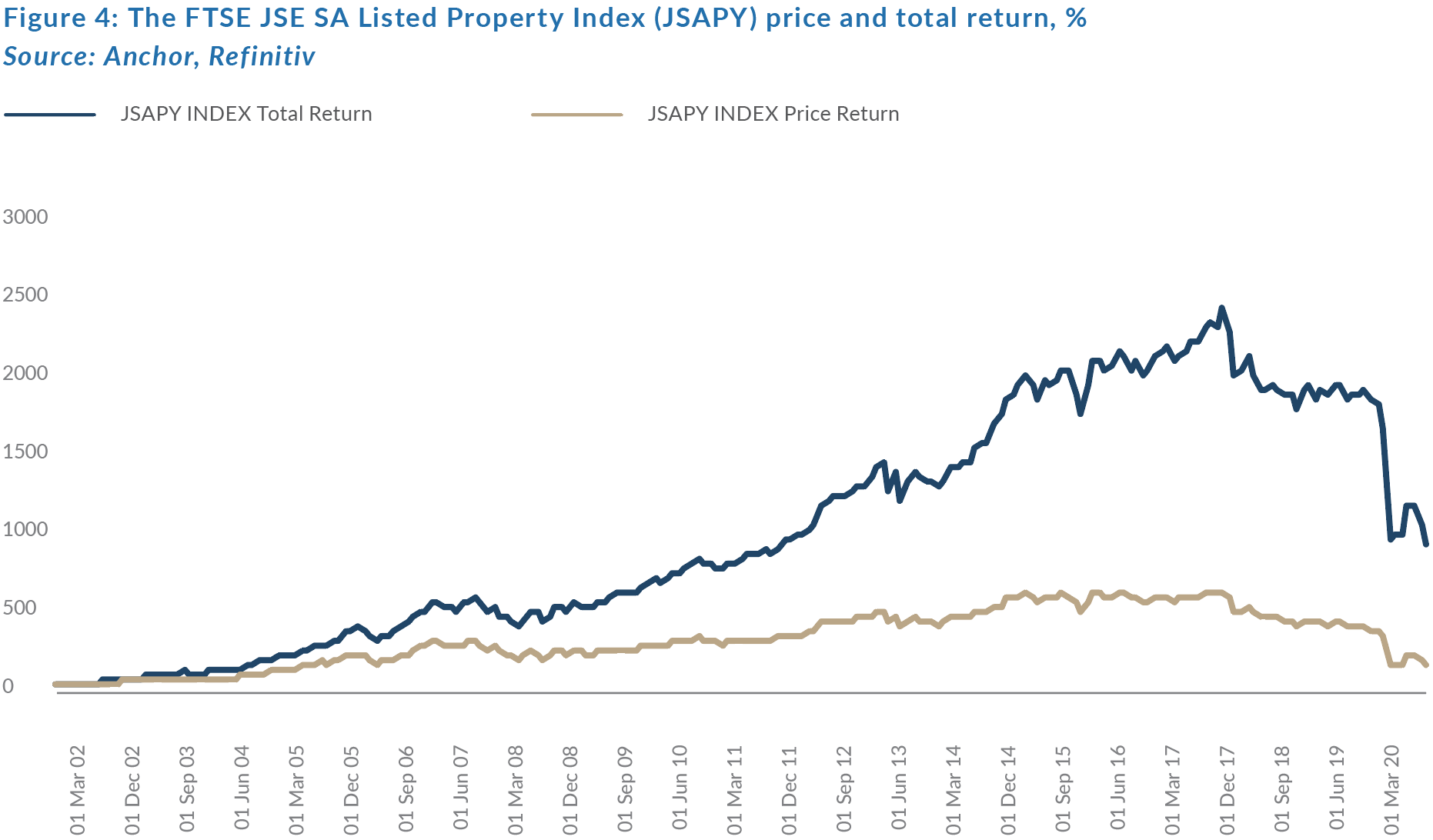

Certain sectors, with companies that pay out relatively large portions of their net profit as dividends, have historically been well supported by investors seeking income and the prospect of capital growth, which is less apparent in fixed-coupon paying, debt instruments issued by sovereigns, SOEs, and corporates. In this regard, we highlight the performance of the SA listed property sector. Investors poured into this sector from the mid-2000s, based on good yields. This was accentuated by the regulatory requirement that property companies pay out at least 75% of their earnings if they wanted to be classified as REITs, and rental income growth, which led to these companies’ share prices re-rating.

Nevertheless, the correction that has since transpired, based in part on the hubris in the sector during the period and in part by this year’s COVID-19 pandemic, has shown the importance of maintaining continuous cash flows, and how investment cycles can quickly change this outcome.

The points highlighted above help to frame the outline of investing for dividend income which, at Anchor, has three pillars:

1. Reliability of income, based on forecastable earnings

Companies are unlikely to pay dividends if they have no free cash flows available. This means the probability of our earnings forecasts being met for the investable universe which we analyse is of critical importance. As bonds are categorised by the quality of the bond issuer, we seek to do a similar exercise for equities.

2. The highest yield does not necessarily equal the highest reward – the risks of a de-rating

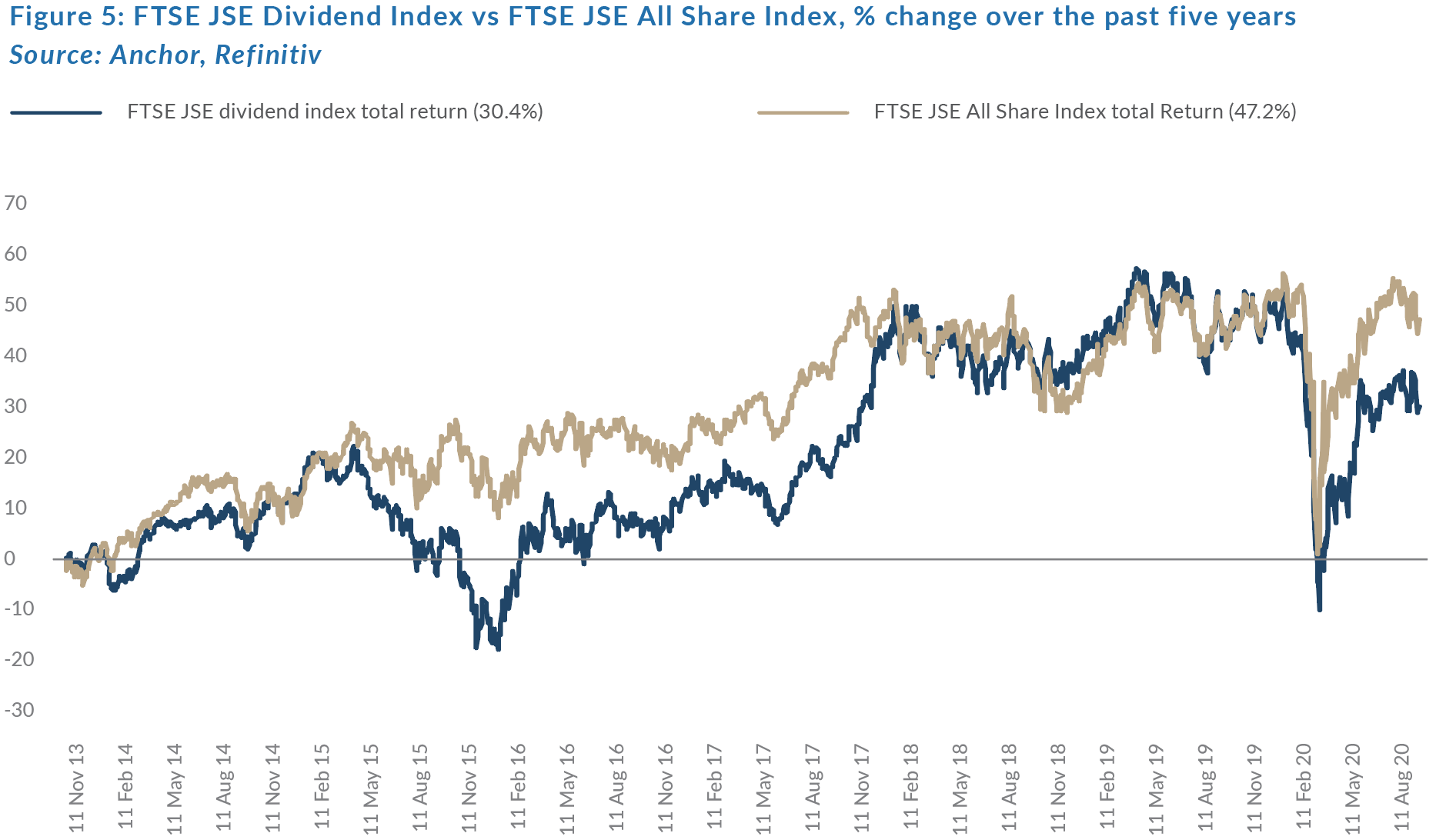

High-quality companies that can grow earnings over time and have a consistent payout policy will be the best-performing companies in the equity yield space. Very often, the highest forecast dividend yields are for those companies which are perhaps likely to experience lower dividends. In SA, the method for constructing the FTSE JSE Dividend Index (FTJ259) is through ensuring that those stocks with the highest forecast dividend yields also have the largest weightings in the index. This has often led to this benchmark being more volatile than the FSTE JSE All Share Index as high forecast yields failed to materialise, leading to an underperformance by the index.

3. Understanding cash flows

How a company generates and expends cash is important. To identify quality companies in this regard, the analysis needs to include a deep dive into what genuine cash earnings are, and how this cash is utilised. Cash in minus cash out is a simple but pragmatic method of quantifying what is available to be paid to shareholders and builds a base for continuing success.

On the macro level, the construction of any income- and dividend-focused portfolio is equally important to the fundamental bottom-up qualities.

Below, we highlight the most important factors in this regard.

Asset Allocation

Dividends and income can come from multiple sources. The traditional method of portfolio construction is to allocate to assets that combine some certainty in income earned, with the prospect of capital growth. Based on their risk profile, these broad asset categories (higher-risk to lower-risk) are:

- Equities

- Equity hybrid products;

- Property;

- Bonds issued by corporates and SOEs;

- Bonds issued by sovereigns;

- Cash.

Risk Mitigation

Because dividends are usually associated with

companies paying dividends from earnings at various stages of the investment cycle, even stocks seen as defensive or consistent dividend yielders may underperform, sometimes appreciably (equity risk). In our opinion, it is often prudent to allocate some capital in a portfolio towards looking to derive an income, and to combine select shares to take advantage of capital growth, over time.

In this regard, stock weightings and a diversified portfolio are the key foundations of a dividend- and income-based portfolio.

Stock Selection and Weighting

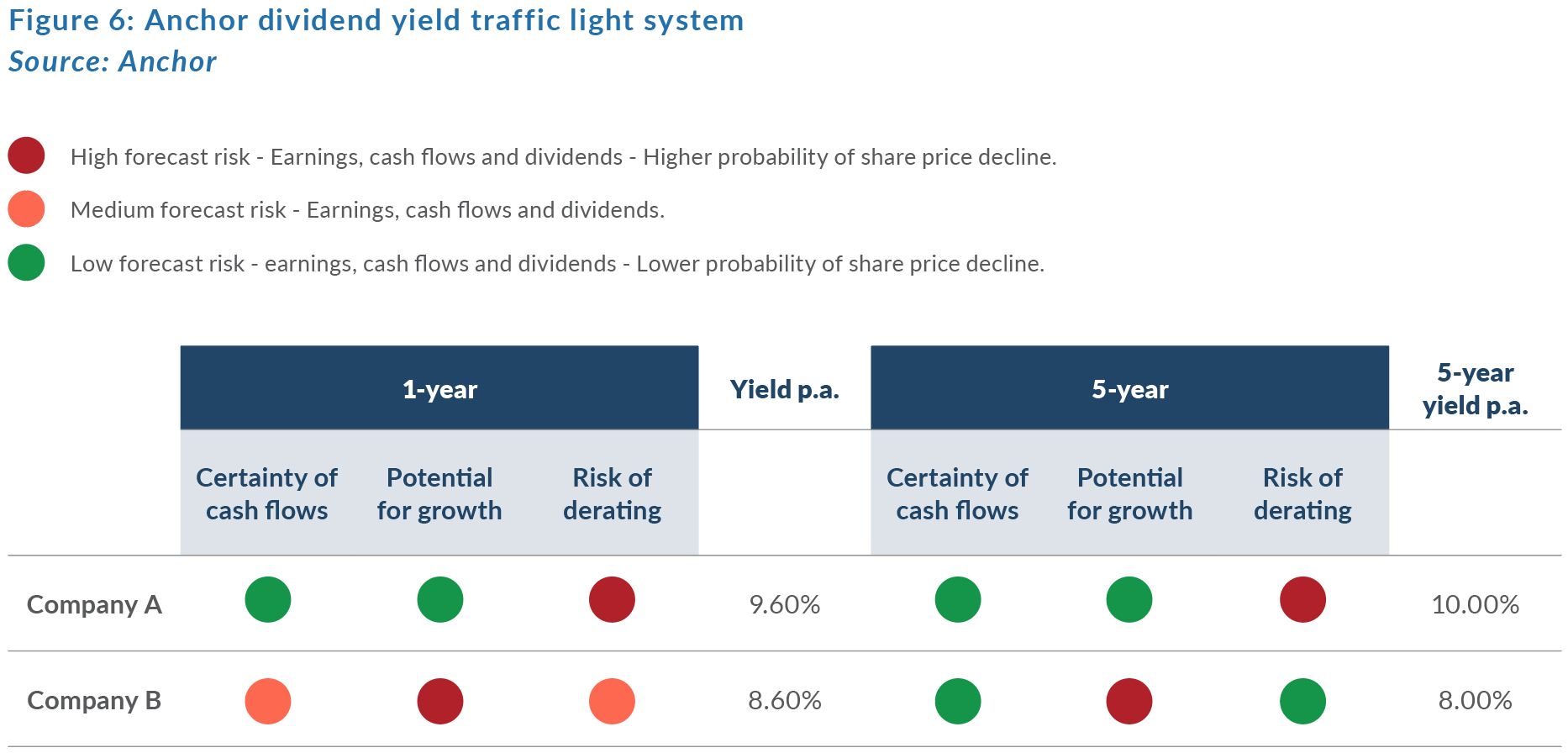

We believe that the pillars outlined earlier should be rated according to probabilities of occurrence. To measure this, we have a traffic light system of green, orange or red. A hypothetical example below shows that there is a difference between short-term and long-term time horizons for stocks. The current environments may either help or hinder a company’s ability to pay dividends and/or grow earnings over the next 12 months.

Nevertheless, high-quality, cash-generating companies should have an advantage over time, enabling these companies to pay sustainable dividends. This analysis is then overlaid with the more subjective factor of what the risks are of the company de-rating, which would in turn lead to share prices falling and a capital loss. This incorporates aspects such as cyclicality, industry prospects, and share price volatility.

It is also possible that both company A and company B could be included in a dividend- and yield-based portfolio. The target is to balance the dividends paid and the yield extracted over the next 12 months, whilst also understanding the company’s prospects over longer time periods.

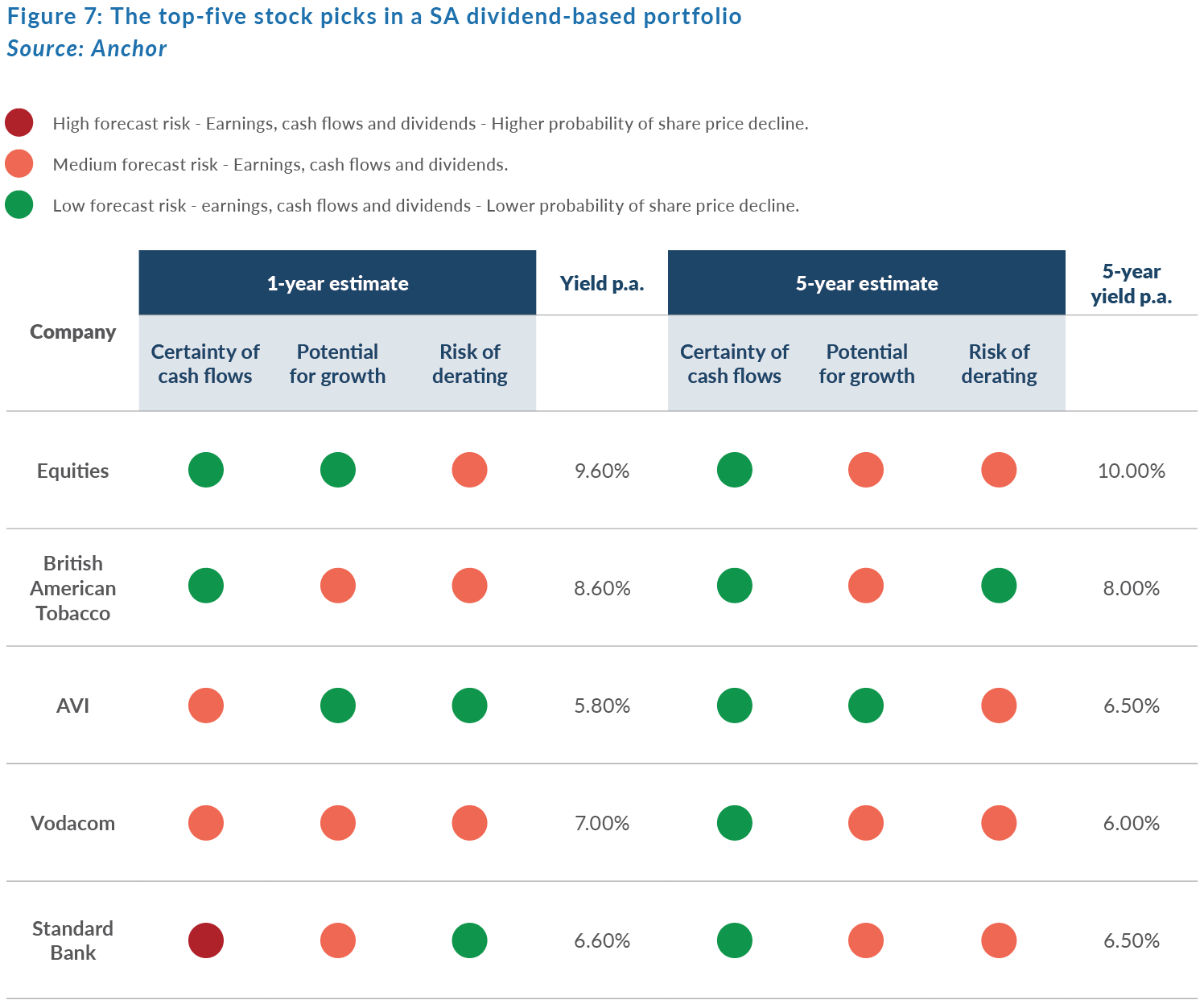

Based on this methodology, in Figure 7, we highlight our top-five share picks to be included in an SA dividend portfolio.

In our view, the following sectors should also be included in a dividend-focused portfolio:

- Resource sector stocks. This will be based on 12-month income and their respective weightings will also be lower.

- Financial services, non-banks: Asset managers, particularly those with large payout ratios. Again, lower weightings based on the impact of the cyclicality of markets on assets under management (AuM).

- Certain property stocks operating in niche sectors, where the loan-to-value (LTV) ratios are low and rental incomes are reasonably secure.