Over the past 24 hours, global media have reported an escalation in Russia-Ukraine tensions, with Russian troops conducting “military drills” in Ukraine and reports of bombings in Ukraine. Moscow has confirmed that it is targeting military facilities in Ukraine. G7 leaders will meet today (24 February) to discuss the implementation of more sanctions, while European Union (EU) leaders will use an emergency summit in Brussels today to decide how to react.

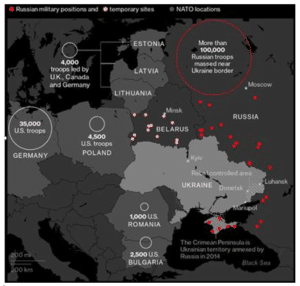

Figure 1: Forces in Europe (before today’s invasion)

Note that locations in Belarus include drills scheduled for 10-20 February.

Sources: Bloomberg, Belarus Defense Ministry, Rochan Consulting Janes, NATO.

What is the conflict about?

Russian President Vladimir Putin is unhappy about North Atlantic Treaty Organisation (NATO) forces encroaching on Russia’s western border, with Ukraine representing the last major buffer between NATO members and Russia. The Ukraine government is pushing for closer ties with the West.

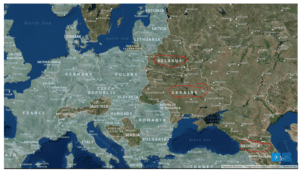

Figure 2: Ukraine, Belarus, and Georgia are Russia’s buffer between it and NATO members in Western Europe

Source: NATO, Anchor [Countries shaded in light green are NATO members]

- NATO is the security alliance founded in 1949 to protect Europe against Soviet attack during the Cold War. Membership has expanded from the original 12 members to 30 members currently (including the addition of more than a dozen former Eastern bloc countries allied to the former Soviet Republic).

- NATO has come to represent an underlying partnership between North America and Europe, based on shared political and economic values.

- Ukraine and Georgia have both applied to become NATO members, but NATO has also made it clear that having “unresolved external territorial disputes” weighs against being admitted, a consideration that gives Putin an edge, since Russian forces occupy internationally recognised parts of Georgia (Abkhazia and South Ossetia) and Ukraine (Crimea).

- Germany and France, in particular, insist that as long as Russian troops are in Ukraine, membership is not going to happen.

- The Kremlin wants Ukraine’s restive regions to gain autonomy that gives them an effective veto over major shifts in Ukraine’s orientation (namely the Western integration backed by a sizeable majority of its 41mn population).

This conflict also has broader geopolitical ramifications, given China’s similar dispute of its neighbours’ (Taiwan/Hong Kong) sovereignty. This was highlighted in comments made by Xi Jinping and Vladimir Putin after the leaders of China and Russia met at the recent 2022 Winter Olympics in Beijing:

- Putin and Xi closed ranks against the US and its allies on key security issues as they declared that there is no limit and “no forbidden zones” in the friendship between Russia and China.

- At their first in-person meeting in more than two years, Putin and Xi said in a joint statement that China “treats with understanding and supports” Russia’s demand for binding security guarantees from the US and NATO in the standoff over Ukraine, and backs Moscow in opposing expansion of the Western military alliance.

- Russia endorsed China’s policy on Taiwan, saying it opposed Taiwan’s independence “in any form.”

- The two powers also said that they were “seriously concerned” about the AUKUS security partnership formed by the US, Australia, and the UK, warning of the risk of an arms race in the Asia-Pacific region.

How significant are Russia and Ukraine’s economies?

Russia and Ukraine represent c. 2% of global economic activity and c. 2.4% of the global population, so their economies are not particularly material in the greater scheme of things. However, obviously to the extent that this conflict spills over into Europe and the US, and China becomes heavily involved in an armed conflict, that becomes more meaningful. We note that this is far from our base-case scenario.

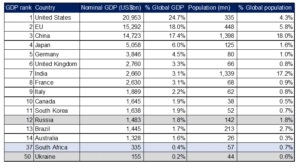

Figure 3: Russia and Ukraine are the 12th and 50th largest global economies, respectively

Source: Bloomberg, Anchor

Although small in global economic terms, Russia and Ukraine tend to punch above their weight in terms of their contribution to the supply of commodities.

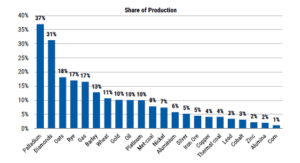

Figure 4: Russia represents a meaningful portion of global production for various commodities

Source: WBMS, IEA, Woodmac, Statista, OEC, Morgan Stanley Research.

Russia’s energy commodities also play a particularly meaningful role in the EU’s energy needs. Russia is the world’s third-biggest oil producer after the US and Saudi Arabia, producing 10mn barrels per day (bbl/day) or about 10% of the global oil supply.

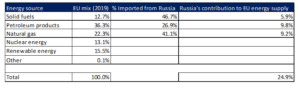

Figure 5: Russian commodities fuel c. 25% of European energy supply

Source: Eurostat, Anchor

Russia and Ukraine are also meaningful contributors to the global food chain, representing approximately:

- 25% of the total global trade in wheat;

- 20% of global corn sales; and

- 80% of all sunflower oil exports.

How have markets responded?

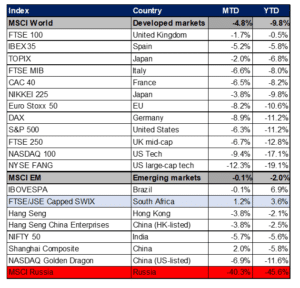

Global markets have had a tough start to 2022, with developed markets (DMs) down c. 10% YTD. However, the majority of this decline is unrelated to the conflict (UBS estimates that about 3%-5% of the S&P 500’s negative performance YTD is related to the conflict), with markets mostly selling-off on concerns around inflationary pressures and central banks tightening monetary policy in response to inflation. Russia’s equity market performance stands out, having lost c. half its value YTD, with investors expecting the impact of the conflict to be most acutely felt in Russia, with limited broader contagion.

Figure 6: The performance of various equity markets in 2022

Source: Bloomberg, Anchor

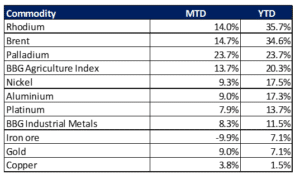

Global commodity prices have been drifting higher YTD as normalising economic activity, with easing pandemic restrictions, increases demand at a time when supply chains are still somewhat disrupted. Commodity price movements have been exacerbated by unusual weather patterns which have hampered crop production, particularly in South America, and an unusually cold Northern Hemisphere winter has increased demand for energy commodities. Unfortunately, many of the commodities already relatively expensive as a result of the COVID-19 pandemic and weather-related issues are those produced in Russia and Ukraine that are now susceptible to potential demand shocks.

Figure 7: The performance of commodity prices in 2022

Source: Bloomberg, Anchor

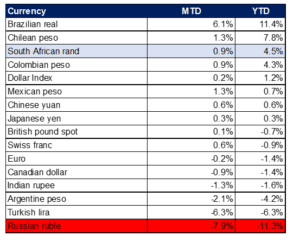

On the currency front, expectations for tighter monetary policy have had the biggest impact YTD, except for the Russian rouble, which has fallen by over 10% YTD.

Figure 8: The performance of various currencies in 2022

Source: Bloomberg, Anchor

What is the potential economic/market impact of the conflict?

We have looked at some of the companies which our clients are most likely to own and we have made the following conclusions on specific stocks:

JSE-listed companies:

- Prosus has 2 investments in Russia, representing c. 4% of its net asset value (NAV):

- It has a 27% stake in what was originally known as Mail.ru and is now rebranded as VK. This accounts for just 0.3% of Group NAV.

- A 100% stake in Avito, which comprises part of the Online Classifieds vertical within the Ecommerce division (the unlisted “rump” as most think about it!). The entire Ecommerce vertical makes up about 7% of NAV. Within that, Avito accounts for about 40% of revenue but over 100% of the trading profit, so c. 60% of the Ecommerce value, which would put Avito at about 3.5% of NAV.

- Earlier in the note, we mentioned China’s sympathy with Russia’s approach to its neighbours’ sovereignty. Chinese tech conglomerate, Tencent, accounts for c. 80% of the NAV of Naspers/Prosus and so if China were to do anything to show increasing support for Russia’s military intervention it may also risk being the subject of western sanctions, which would have a significantly bigger impact on Naspers/Prosus than the impact from exposure to direct investments in Russia. We note that this is definitely not our base case.

- Barloworld: About 27% of its operating profit comes from Russia/Mongolia.

- In Barloworld’s FY21 results, the management team said that they have an abundance of brownfield and greenfield projects in Russia and Mongolia, which would continue to drive good operational performance in both regions. We think that if there is violent conflict in the region, Barloworld could be impacted if some of these greenfield and brownfield projects are cancelled because of the ensuing conflict in the region. We suspect Barloworld’s Russian operations/projects will be more impacted than Mongolia, as Mongolia is slightly further away from Ukraine.

- British American Tobacco has approximately 7% of Group earnings coming from Russia/Ukraine.

- Russia is c. 5.3% of Group EBITDA.

- Ukraine is c. 1.6% of Group EBITDA.

- Richemont – Russians account for c. 2% of total global luxury goods spending.

- Mondi – has meaningful exposure to Russia, both for its production and its customer base.

- Russia makes up 12% of Mondi’s production.

- Mondi also generates 9% of its revenue from customers located in Russia.

- Sasol – is a significant beneficiary of the higher oil price.

- Anglo American Platinum, Impala, Northam, and Sibanye could all benefit from potentially higher platinum group metal (PGM) prices.

- Russia accounts for 14% of primary platinum supply and 44% of primary palladium supply.

- Russian supply of PGMs, particularly palladium, which remains in a deficit, could drive those metals further into deficits in the short term.

- South 32 – generates over 50% of its revenue and operating profit from bauxite, alumina, and aluminium.

- After reaching a 13-year high in 2021, the aluminium price has reached an all-time high in 2022.

- China, the world’s biggest producer, has seen restricted production as a result of energy issues and pollution fears.

- The Russian company, Rusal produces c. 6% of global supply. When the US placed sanctions on Rusal in 2018, aluminium prices rose by 30% in response. Sanctions on Rusal were later lifted in 2019.

Locally, the mining companies mentioned above are the biggest potential beneficiaries of the conflict in the near term. Barloworld and Mondi are the companies most likely to see a direct, material, negative impact on earnings. We do not think that any of the other companies mentioned above have earnings from the conflict regions that are likely to be materially negatively impacted. It is more likely that, in the near term, there could be immaterial impacts to reported currency earnings from currency movements, which are unlikely to have a meaningful impact on the fundamental value of these companies.

Globally listed companies

We estimate that most globally listed companies we have invested in have less than 1% of their revenue earned in Russia and Ukraine.

Clients who follow our offshore model equity portfolios may have c. 6.5% exposure to a note which we use to gain exposure to shares in emerging markets (EMs). This note has c. 15% exposure to Russian companies, so less than 1% overall exposure to Russian companies at the global portfolio level.

Inflation and rates

It is likely that concerns around energy supply from Russia will keep the prices of energy commodities elevated for the foreseeable future. We expect this to be somewhat mitigated by the release of strategic reserves by major global economies and we think that it is highly unlikely that sanctions will target companies exporting oil and gas from Russia. The Biden administration has stressed that it would not directly target Russian energy exports given the already tight demand-supply situation in energy markets.

Ultimately, we expect the supply response to normalise, and any headline inflation created to reverse in due course.

We also expect the conflict to avoid the critical agricultural production areas and the planting season to go ahead as normal in the coming months, with a limited impact on yields. Concerns around supply disruptions are likely to keep grain prices elevated in the near term, adding to headline inflationary pressures, but this too should be transitory and reverse in due course.

Given the transitory nature of these inflationary pressures, and the fact that central banks typically ignore food and energy inflation in setting monetary policy, we think it is highly unlikely that global central banks will add additional monetary policy tightening measures in response to the likely near-term inflationary impact of higher food and energy prices. On the contrary, we expect major central banks to potentially proceed in a more measured way, while the prospect of a military conflict weighs on sentiment and likely reduces some demand-pull inflationary pressure.

Previous responses to conflicts/turmoil

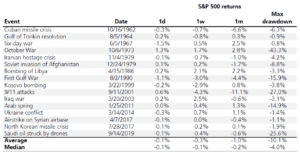

Figure 9 below from UBS gives an indication of the performance of global equity markets (as represented by the S&P 500) around geopolitical conflicts historically. We think it serves as a good indicator that, unless the conflict escalates into a major world war (very far from our base case), it is unlikely that investors will experience significant losses in companies not directly exposed to the conflict or related sanctions.

Figure 9: Equity market performance around previous geopolitical events

Source: UBS

We continue to monitor the unfolding geopolitical events but, for now, are comfortable that our investors are largely insulated against the impact of the conflict other than some short-term price fluctuations.