Buying your first home has become increasingly challenging for young South Africans. While technology has made the world more connected and fast-moving, it has also contributed to higher living costs. Several structural and economic factors are now pushing the average age of first-time buyers in SA higher. According to BetterBond’s 2025 data, the average first-time buyer is now 37 years old, compared to 33 just a few years ago.

The hidden locks: What is keeping under-35s out of their first property?

SA’s youth face several proverbial locks on their front doors. The most pressing issue is the extraordinarily high youth unemployment levels, which have been steadily increasing over the past decade. This limits their earning power and delays their ability to enter the property market.

Looking at the latest trends within the South African labour force, as per Stats SA’s 2Q25 Quarterly Labour Force Survey (QLFS), the unemployment rate for those between 15 and 24 years old is currently at 58.5%. This represents a concerning increase of 5.1% from 3Q01. Similarly, for the age band between 25-34 years old, unemployment was reported at 38.4% in 2Q25, from 34.4% in 3Q01. These trends reflect more than difficult job prospects – they also highlight the growing issue of SA youth being unable to support themselves as they transition into adulthood, materially impacting their ability to enter the property market.

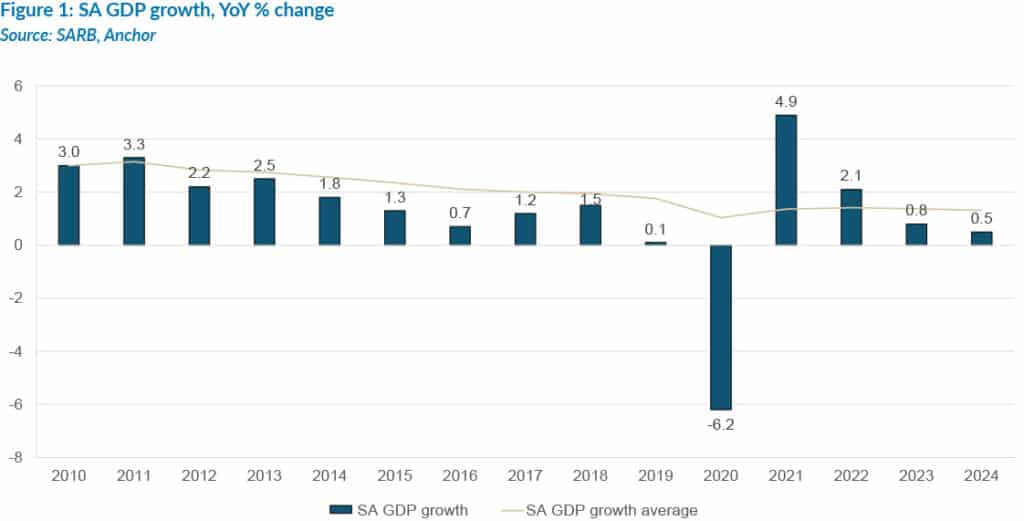

The alarmingly high youth unemployment problem in SA is multifaceted, being both structural and cyclical in nature and driven by the country’s poor economic performance. The domestic economy has not grown fast enough to reduce unemployment meaningfully. A helpful way to assess a country’s economic performance and size is by examining its real gross domestic product (GDP). Strong real GDP growth typically indicates a healthy economy with rising employment levels. The economic rule of thumb is that real GDP needs to grow by 3%-plus YoY to enable sustained job creation. Over the past 14 years, SA’s real GDP growth has averaged just 1.31% p.a.

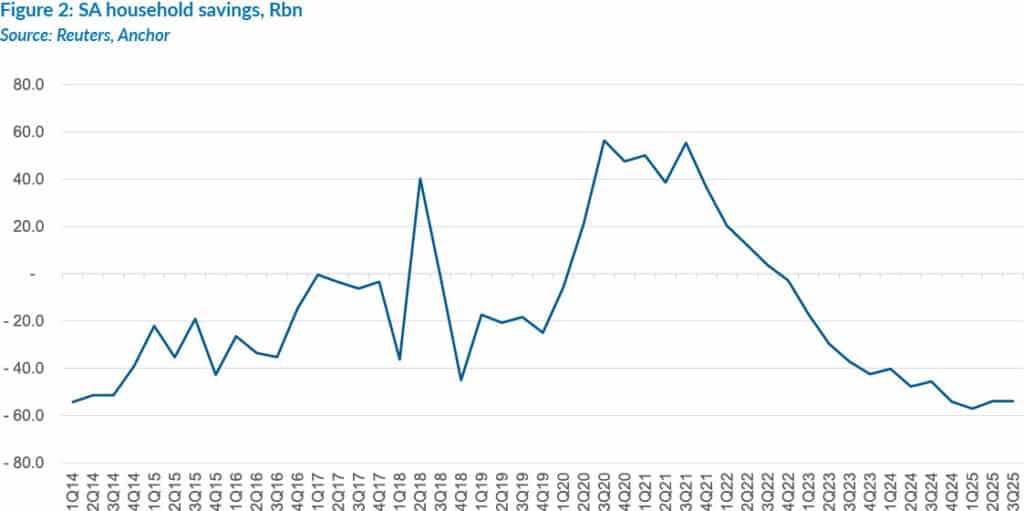

Naturally, SA’s sluggish economic backdrop impacts even those who are employed. Real earnings power is also under pressure. According to PayInc (formerly BankservAfrica) data, which aims to represent the average net pay adjusted for inflation through surveying the average salary of c. 4mn South Africans, from December 2011 to July 2025, real take-home pay declined by 7.04%. Household savings have barely improved over the past decade as consumers increasingly rely on debt to fill the gap left by the high cost of living and the subsequent decline of consumers’ real purchasing power.

Since 2014, the average SA household saving rate has, for the most part, been negative and is currently only 0.78% above the saving value published in 2014. Due to rising living costs, low wages, and accessible credit, the SA consumer is simply spending more than they earn, through the utilisation of debt or existing savings to supplement their lifestyles.

Beyond the bond: What under-35s are overlooking

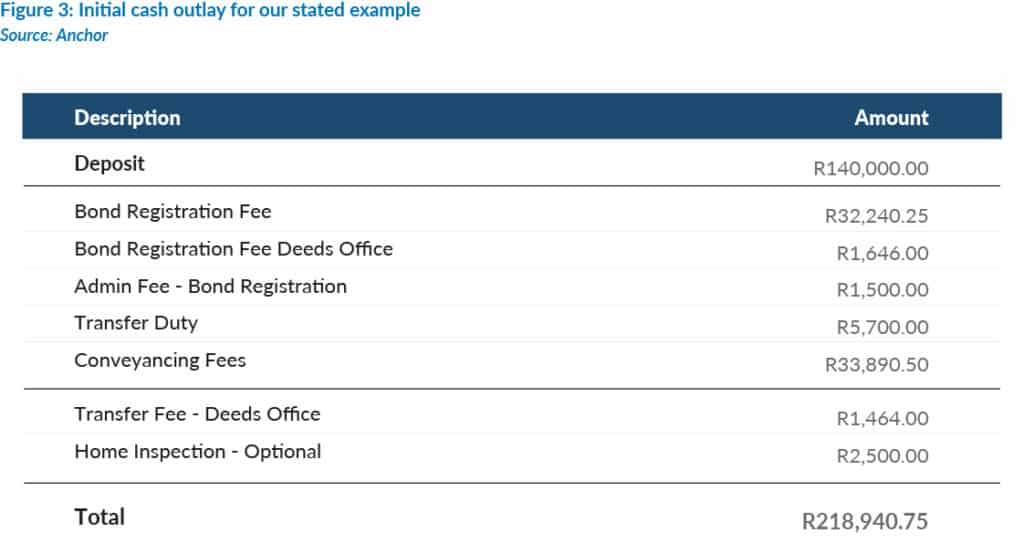

By outlining the key factors locking under-35s out of the property market, it becomes clear that several economic pressures weigh heavily on young buyers. However, for those fortunate enough to be able to afford to purchase their first home, this section presents a practical example of the often-overlooked costs beyond the monthly bond repayment. Using the example of a middle-income earner (c. R28,000/month) purchasing an estimated R1.4mn free-standing home, we note the following:

Initial upfront costs

- Deposit: The first step in purchasing a house usually involves a deposit. RE/Max Southern Africa, a leading property agent, states that an ideal deposit is usually 10%-20% of the seller’s asking price. For the sake of this example, a 10% deposit is used. This would require the purchaser to save R140,000 for the initial deposit (we note that a seller does not always require a deposit). Additionally, some financial institutions can provide 100% bonds to assist first-time buyers, but this depends on the affordability assessment conducted by the relevant lender.

- Bond registration fees: The Law Society of SA published a guideline on 1 August 2025 relating to bond registration fees. Based on that, one would be required to outlay R32,240.25 (VAT inclusive) on a bond amount of R1.26mn. Note that the fees published serve as a mere guideline and should be negotiated when registering a bond, as some lawyers will charge above the published rates.

- Credit life insurance: The lender may require the borrower to take out additional credit life insurance – a policy which will ensure that the bond is paid should the lender not be able to pay due to death, disability or sometimes retrenchment. If required, the maximum amount that can be levied on this life insurance policy is R2 per R1,000 of the amount outstanding on the bond (as per the Government Gazette dated 9 February 2017). This means that the maximum premium on the credit life insurance policy would amount to R2,800/month.

- Deeds Office registration: The bond will thereafter have to be registered with the Deeds Office. The Deeds Office publishes the cost of registering the bond, which, in this example, will be an amount of R1,646.

- Bank admin fees: The final costs of the bond may be administrative costs levied by the financial institution processing the buyer’s bond registration. This varies, but an assumed amount of R1,500 will be utilised.

- Transfer duty: Once the bond is registered and the sale is approved, the transfer will take place. This, too, comes with its own set of costs. Transfer duty will be levied on a sliding scale. In our example, transfer duty will be levied at 3% above the R1.21mn, resulting in an additional R5,700 being required.

- Conveyancing attorney fees: These fees (also calculated using a sliding scale) add further cash flow requirements. Conveyancing fees on a property of R1.4mn are c. R33,890.50 (VAT inclusive), further increasing the amount of funds required by the purchaser.

- Deeds Office transfer fee: Finally, the transfer will need to be registered with the Deeds Office, resulting in a further cost of R1,464 in our example.

- Home inspection: While optional, for a buyer’s peace of mind, it is recommended that the property be inspected to aid in identifying any unforeseen issues with the property. On average, home inspections in SA cost between R2,000 and R5,000, depending on factors such as property size, age, inspection scope, etc. For this example, we will use the lower band of this range of R2,500.

See a summary in the table in Figure 3 below, showing the initial cash outlay for the stated example.

Now, once all the above is complete, and the initial cash outlay of R218,940.75 has been paid, you will begin paying down your bond. However, many first-time homebuyers often overlook the additional (or ongoing monthly) costs that come with owning a property. These include:

- Municipal rates and taxes: You are required to pay rates to your local municipality, further decreasing your affordability monthly. The amount spent on rates varies substantially based on location and property size. It is crucial that all new entrants into the property market ensure that they can comfortably cover these costs alongside their bond repayment before even embarking on the purchasing journey, as this may have dire effects on the purchaser’s future financial well-being.

- Home and content insurance: Insuring your home and its contents could save you significantly in the long run. Insurance on a R1.4mn house and its contents would cost more than R1,500/month, depending on the risk factors identified by the insurer.

- Maintenance costs: Another cost that first-time buyers often overlook is the maintenance of their new house. Sotheby’s International Realty states that, if possible, one should set aside 1%-4% of one’s home’s value annually for maintenance. On the value of R1.4mn, this would then equate to between R14,000 and R56,000 p.a.

Combined with your monthly bond repayment and your regular monthly living expenses, these additional costs can materially change a buyer’s financial picture from what they originally envisioned.

Nevertheless, despite the economic headwinds, homeownership remains achievable – albeit not as quickly or easily as in the case of previous generations. The key for first-time buyers is to:

- Make sure you have a clear, detailed financial plan enabling you to save for the initial cash outflow required.

- Through an effective budget, you can ensure that you can cover unforeseen costs and not just the monthly bond repayment.

With disciplined financial planning and a committed savings strategy, purchasing your first home is well within reach. While it may take longer than in previous generations, the goal remains entirely achievable for today’s aspiring homeowners.