I am a long-term investor at heart. Nothing excites me more than identifying a great company with solid earnings growth potential at a decent price. As long as markets have existed, the relationship between earnings growth and share price performance has remained steadfast. While fear and greed can drive short-term performance, over the long term, assets that can compound earnings growth consistently almost always produce the best returns. Owning equity in a company gives an investor the most direct exposure to its earnings growth potential and, therefore, tends to provide a higher return over time than bondholders of that same company can expect to receive.

I was too young to enjoy the fact that the JSE was the best-performing equity market in the world during the 20th century. In addition, the early 2000s were very profitable for South African equity investors. Between 2000 and 2015, a period which included the global financial crisis (GFC) of 2008/2009, the JSE recorded an impressive compound annual return of 11.9%. Unfortunately, the JSE’s return outcome since 2016 has been nothing short of dire until a few weeks ago. Between 2016 and May 2024, JSE-listed equities returned c. 6.7% p.a., which is very disappointing and well below SA inflation or a cash return over the same period. The macroeconomic issues facing the domestic economy are well known, but two of the most concerning problems, from an equity market perspective, are unemployment and SA’s anaemic GDP growth. Similar to the link between corporate earnings growth and share price performance, the link between economic growth and corporate earnings growth also holds true. For c. 50% of the largest (by market capitalisation) JSE-listed companies facing the SA consumer and economy, it has been incredibly challenging to grow their earnings consistently in the low-growth environment we have been in for many years.

It would be remiss of me not to mention, at this point, the inherent potential for JSE-listed equities should the economic backdrop and operating environment in SA improve materially and consistently over the next few years. Equity market valuations for SA Inc. shares (those companies whose earnings are predominantly linked to the local economy) have become very cheap over the past few years, even by EM standards. Consequently, these stocks can be compared to a coiled spring, i.e., ready to react quickly to any positive developments. The JSE’s rally over the past few weeks following the 2024 National and Provincial Elections (NPEs) feels like a minor prequel to the returns available to shareholders if the government of national unity (GNU), through sensible and market-friendly policy directives, can give the SA economy the kickstart it needs for robust economic growth.

South African investment managers are collectively underweight SA Inc. shares, and foreign investors, who can best be described as “growth tourists”, lost interest in the SA market years ago. As a result, the JSE now accounts for a mere 0.6% of the global investable equity universe. Capital is fickle; memories are short; low valuations and improving economic conditions are a potent cocktail to entice even the most sceptical investors back to the SA market. Consequently, the potential wave of money set to hit our shores will be a powerful driver of share prices over the short term.

Having said that, I am steadfast in the view that we are only likely to see a sustained continuation of positive equity market returns if the companies whose shares we own can grow their earnings consistently over the medium- to long-term. Unfortunately, that is impossible without a meaningful improvement in SA’s economic growth. As a portfolio manager, I (with the assistance of my investment team at Anchor) am responsible for producing consistent returns for my clients that meet their individual objectives in the long term. I believe that consistent returns are achieved primarily in two ways, namely:

1) Diversification across different asset classes and geographies: Regardless of the potential relative attractiveness of SA equities, it is crucial to remember that diversification is a key strategy for mitigating risk. Ignoring the other 99% of equities listed on exchanges globally would be irresponsible, as they can provide a buffer against an anaemic or volatile local market.

2) Never speculate: It is important to identify quality assets with decent growth potential and be prepared to buy and hold them through different market cycles. Although this strategy requires patience, it has proven to be a reliable way to weather market fluctuations and achieve long-term investment goals. It is important to remember that investing is a marathon, not a sprint. By staying the course and avoiding short-term speculation, investors can build a robust portfolio that stands the test of time.

I have mentioned the difficulty SA portfolio managers and equity investors have faced over the past eight years. Many of us have found alternative investment strategies for our clients to improve their returns and consistency. The most obvious of these strategies has been to invest a growing proportion of investable assets offshore, particularly in US equities that have been in a secular bull market since the GFC. Although the compound returns over that period have been stellar, the volatility of equity market returns over the last few years has tested the risk tolerance even for those investors with a very long investment horizon. The result is that many family offices globally invest a significant and growing proportion of their clients’ investable assets in alternative asset classes. Alternatives are those financial assets that do not belong to the conventional income, cash, or equity categories and include but are not limited to private equity, private credit, hedge funds, physical property, and structured products.

Select hedge funds have offered a compelling alternative to a long-term, buy-and-hold SA equity investment over the past few years for those SA investors who require a consistent rand return. As an asset class, hedge funds globally have been viewed by some investors with a fair degree of uncertainty and scepticism and, in my view, for a good reason. Many of these hedge funds have opaque investment strategies, are expensive and, most importantly, have been unable to live up to what their names suggest; these investments have failed to hedge investors during significant equity market turmoil.

Nevertheless, a well and often conservatively managed hedge fund should be able to capture two-thirds of the upside of a bull market and experience only one-third of the downside in a bear market. The investment toolkit available to hedge fund managers is also far broader than the one long-only managers have at their disposal. This toolkit allows hedge funds to extract returns in various market cycles by taking advantage of market dislocations as these present themselves. In my view, this is where the real opportunity has been in an equity market like the JSE, which has lacked any clear direction over the past several years, and the liquidity (or the volume of trade going through the market) has dropped significantly.

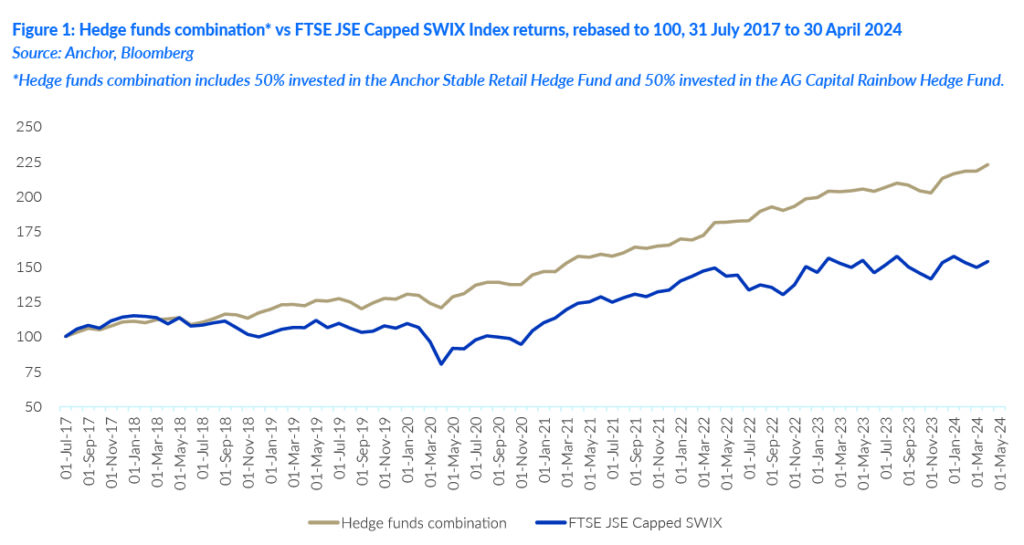

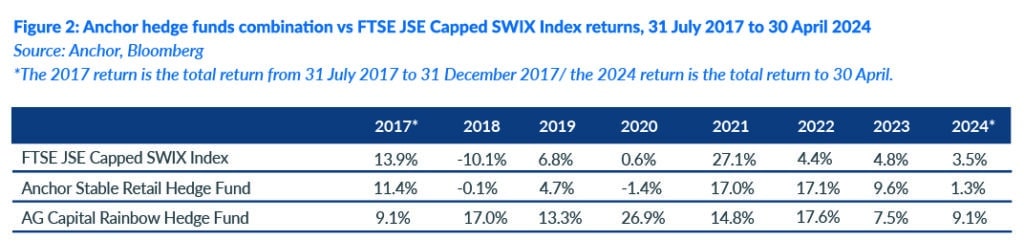

To evidence this, I have included Figure 1 below, which shows the cumulative return over the past seven years of an equally weighted allocation to two of the hedge funds available from Anchor. I have compared these funds to the local equity market as measured by the FTSE JSE Capped SWIX Index. While the return differential (130% vs 58%) stands out for the right reasons, the consistency of returns p.a. makes considering hedge fund strategies a potentially viable alternative to owning JSE-listed equities on a long-term, buy-and-hold basis.

In simple terms, a hedge fund is a structure that allows the investor to invest in various assets (equities, cash, bonds, listed property, etc.) and uses investment strategies to preserve the invested capital and achieve real above-inflation returns. An essential distinction between hedge funds and typical long-only investment portfolios is that a hedge fund can make money out of falling share prices as well as rising share prices due to its ability to short shares (i.e., sell shares these funds do not own) and hence profit from the subsequent price decline. Hedging techniques can protect capital during falling or volatile equity markets – in many instances, hedge funds can benefit/profit during market volatility. Anchor is at the forefront of this trend by providing access to products such as the Anchor Stable FR Retail Hedge Fund, the Anchor Accelerator FR Retail Hedge Fund and the AG Capital Rainbow Hedge Fund.

If you have any questions on hedge funds or require more information, please contact Darryl Hannington