Before Russia and Ukraine took us to the brink of World War III, investors were obsessing about inflation being the biggest threat to asset prices. As investors contemplate an investment world post-conflict, it appears that Russia’s invasion of Ukraine has added oil to the inflation fire (pun intended) via spiking food and energy costs and inflation is back as a big red flashing light for investors.

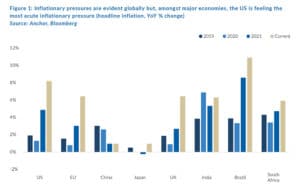

As far as global inflation is concerned, it is generally elevated across the board, but most acutely in the US.

In this article, we will focus on inflation dynamics in the US. The US is not only the poster child of the current spike in inflation, but the US economy is also the largest source of economic activity globally and, most importantly, the guardian of the world’s funding currency, the US dollar, which is the cornerstone from which we build most asset valuation models.

What causes inflation?

Inflation is a measure of how prices of goods and services change over time. Each country typically measures its inflation as the aggregate price change in a basket of goods and services, weighted in proportion to the typical spending allocation of the relevant country’s population.

At its heart, inflation is an indication that the demand for goods and services is expanding faster than the producers of these goods and services can supply them.

Inflation also has a psychological component in that when people are anticipating inflation, their behaviour will often cause the inflation they are expecting. For example, if landlords are anticipating 6% inflation, then they will include 6%-plus escalation clauses into their lease contracts, which will ensure that rental inflation is at 6%. The business renting a premises will need to increase the selling price of its goods and services to maintain its profitability in the face of increasing costs. Employees will negotiate for salary increases to allow them to continue to be able to afford the goods and services they need to purchase, which are now more expensive, and so the cycle perpetuates. It is this psychological component of inflation that makes it extremely tricky to forecast and which can cause higher inflation to become entrenched.

Is inflation bad?

A small, stable amount of inflation is generally considered desirable to the extent that it reflects an economy that is growing slightly quicker than the production of goods and services can keep up with. Over the years, economists in developed economies have gravitated towards a number of 2% p.a. as being the optimal rate of inflation.

Inflation running consistently below 2% is usually a sign of an economy operating below its potential. Inflation running meaningfully above 2% can act as a regressive tax, benefitting the rich (typically the owners of real assets which keep pace with inflation – they are also the most likely to have access to debt, which gets eroded by inflation) at the expense of the poor. Variable and unpredictable swings in inflation can make budgeting challenging and cause businesses and individuals to delay projects and capital spending, which will act as a drag on productivity.

Most central banks are tasked with explicitly targeting inflation at the desired level (2% for the US, EU, and Japan). Central banks try to control inflation by controlling demand. If inflation is too high or is expected to get too high, central banks will increase interest rates (thereby incentivising saving and disincentivising borrowing) to dampen demand and will decrease rates to stimulate demand. More recently, central banks have also started using their balance sheets to inject funds into the system (quantitative easing [QE] – printing money to buy bonds) to encourage spending and doing the opposite (quantitative tightening [QT] – selling bonds they own and withdrawing the cash proceeds from the system) to withdraw liquidity and discourage spending. The fortunes of investors are disproportionately influenced by the actions of central banks (particularly in the short- to medium-term), with higher interest rates and QT often acting as a headwind for asset prices.

The current inflation environment.

We will evaluate the current inflation environment from both a supply and demand side as both are contributing to the current elevated US inflation.

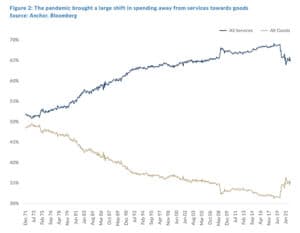

- Elevated demand: The pandemic saw two big shifts in consumer behaviour, which created a significant surge in demand.

- A shift in spending from services to goods, as pandemic-related movement restrictions curbed consumers’ ability to spend on many services (including travel, restaurants, and recreational services) and with consumers spending significantly more time in their homes, they increased their spending on furniture and home accessories and, in many cases, bought vehicles as they shifted their commuting patterns.

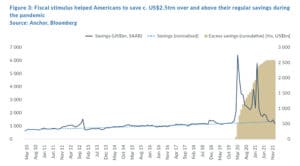

- Fiscal stimulus gave a significant boost to consumers’ financial health, as the US government mailed checks directly to its populace and significantly boosted unemployment benefits to avoid a humanitarian disaster for the c. 25mn people who had lost their jobs in the US at the start of the pandemic. As it turns out, jobs were recovered fairly quickly and, in its rush to act as fast as possible, the US government sent checks to many families who did not necessarily need them. All of this has resulted in a huge boost to American savings. Americans have saved at a rate of c. US$1bn p.a. over the course of the past decade, but the saving run-rate spiked dramatically during the pandemic. Our calculations suggest that Americans saved c. US$2.5trn over and above their regular savings during the pandemic.

To put these savings into context, Americans could spend 15% more than usual for a year with the excess savings.

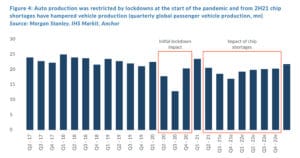

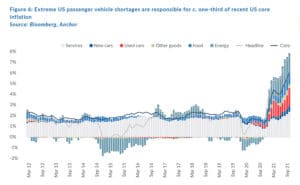

- Constrained supply: The pandemic introduced significant disruptions to manufacturing and logistics because of movement restrictions and worker illnesses. The bottlenecks caused by these disruptions have inhibited the supply of goods, with the vehicle market perhaps the biggest source of disruption. The growth in automation of vehicles has also increased the need for computer chips in the manufacture of vehicles, and this has been a key bottleneck in the supply of new vehicles.

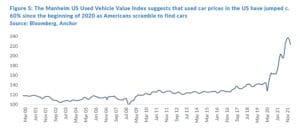

Global vehicle production for the three years from 2020–2022 is likely to end up being c. 25mn vehicles short of the pre-pandemic run rate, placing a huge burden on the second-hand passenger vehicle market. This demand shortfall has caused a significant spike in used car prices.

New and used vehicles account for c. 4% each of the US inflation basket. However, because of the extreme production shortages and resultant price inflation, they are currently contributing about one-third of US core inflation (e.g., in January, US core inflation would have been 3.8% YoY rather than 6.0% YoY if there had been no vehicle inflation).

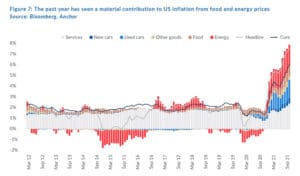

Food and energy prices are also contributing to the current elevated US inflation and have contributed more than 2% YoY to US headline inflation since April 2021.

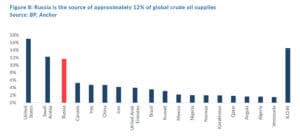

Energy prices have been inflated for the past year, at least partially because energy prices were recovering from extremely depressed levels during the start of the pandemic. While we were expecting this inflationary impulse to start normalising on a YoY basis going into 2Q22, the conflict in Ukraine has exacerbated the problem, at least in the short term. Russia is a significant source of oil and natural gas and the potential disruption to these supplies could have a material impact on energy prices.

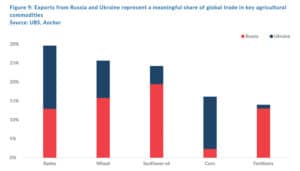

Russia and Ukraine also represent a material portion of the global trade in agricultural commodities, which is adding to the inflationary pressure in the food category.

The outlook for inflation.

We think the inflationary impulses will likely peak in early 2Q22, but YoY inflation may remain elevated for the remainder of 2022 before a deflationary impact is felt in 2023.

How will central banks respond?

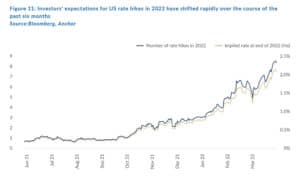

As US inflation started climbing steadily above 4% in 4Q21, and as doubts started to creep in about how “transitory” the elevated inflation would be, investors have rapidly shifted their expectations on how the US Fed will respond. Over the course of the past six months, interest rate derivative markets have gone from pricing for one US rate hike (of 0.25%) in 2022, to the current expectation for more than eight US rate hikes this year. The Fed meets eight times a year. It did not hike rates at its first meeting of 2022 and hiked rates by 0.25% at its second meeting in March, so markets are expecting it to hike at every remaining meeting in 2022, including hiking rates by 0.5% in at least one meeting.

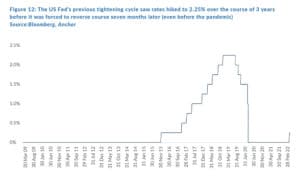

Investors then anticipate that the Fed will continue hiking in 2023, pushing rates towards 3% before needing to reverse course in 2024. Our expectation is that the Fed will be under the most extreme pressure to act over the next three- to six months, after which the inflationary impulse will start to fade, and the Fed is likely able to ease off on tightening monetary policy. We are sceptical that the Fed can hike rates towards 3%, given that during its last tightening cycle it took 3 years (from 2016 to 2018) to hike rates to 2.25% and within seven months (by August 2019, even before the pandemic had kicked in) the Fed had to reverse course and start cutting rates again.

In conclusion, we are definitely taking inflation more seriously and, while we remain hopeful that the inflationary impulses will start to fade into year-end, we are cognisant that the longer elevated inflation lingers, the higher the risk that the psychological impact converts these pressures into longer-term structurally higher inflation. While this is not our base case, it remains a risk. Our expectation is that for the next three- to six months, rapidly tightening monetary conditions and heightened inflation expectations will remain a source of uncertainty and asset price volatility before these headwinds start to fade into year-end.