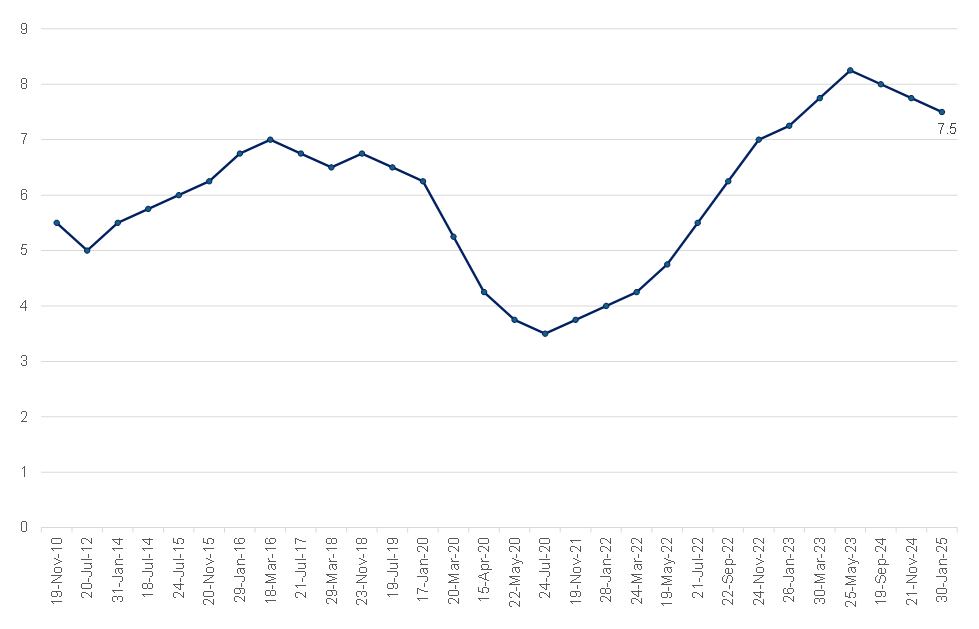

As widely anticipated, the South African Reserve Bank’s (SARB) Monetary Policy Committee (MPC) opted to lower the repo policy rate by a measured 25 bps to 7.5% p.a. at its meeting on 30 January. This decision brings the prime lending rate down to 11.0%. Notably, beyond the rate cut itself, the key takeaway from the MPC’s first meeting of 2025 was its broader tone and guidance, offering insights into the SARB’s outlook for the year ahead. Unsurprisingly, the committee maintained a cautious stance, emphasising its commitment to anchoring inflation expectations at 4.5% amid an increasingly dynamic and uncertain global economic environment.

Figure 1: The history of the SARB MPC’s repo rate changes, %

Source: SARB, Anchor

Since the previous MPC meeting on 21 November 2024, the rand has weakened by approximately 1.6% against the US dollar, while the oil price, in rand terms, has surged by c. 8%. This has translated into three consecutive months of local fuel price increases. Furthermore, the cost of white maize—an essential staple—has risen by more than 10% over the same period, adding to food price pressures. Compounding these inflationary concerns, heightened geopolitical uncertainty, particularly regarding US foreign policy under the Trump administration, has introduced further volatility into global financial markets. Additionally, the outlook for US monetary policy has evolved, with the US Federal Reserve (Fed) now facing limited room for rate cuts. Persistent core inflation and emerging inflation risks suggest that US monetary policy may remain tighter for longer. Given these complexities, it was unsurprising that the latest MPC decision did not result in a unanimous vote—four members supported the rate cut, and two preferred to hold rates steady.

Looking at the broader macroeconomic landscape, the SARB expects a recovery in South Africa’s (SA) economic growth in 4Q24, following a contraction in 3Q24. This rebound is projected to be supported by normalisation in agricultural output and resilient household spending. Contributing to this momentum are disinflationary tailwinds and the impact of the Two-Pot pension system withdrawals, which are likely to provide a boost to consumer expenditure. As a result, the SARB expects this anticipated recovery to close the output gap, positioning the local economy to operate closer to its potential from the current quarter (1Q25) onwards. Over the medium term, the central bank also projects potential growth to trend upward, reaching approximately 2% by 2027.

Headline inflation averaged 4.4% in 2024, aligning closely with the midpoint of the SARB’s target range. By December, inflation had decelerated to 3%, a notable decline from levels exceeding 5% at the beginning of 2024. This moderation was primarily driven by subdued goods-price inflation, with food inflation reaching a 15-year low alongside lower fuel costs. However, the SARB views these factors as largely transitory and forecasts that inflation will remain in the lower half of its target range through 1H25. Thereafter, inflation is expected to revert to around 4.5%, underpinned by core inflation, which is projected to remain stable at, or below, the midpoint of the target range over the forecast horizon.

Despite a shift in the SARB’s exchange rate assumptions towards a weaker rand, the overall impact on inflation projections has been contained. This is due, in part, to other inflation components coming in below prior estimates, effectively lowering the baseline for inflation forecasts. Furthermore, inflation expectations have now broadly aligned with the SARB’s 4.5% objective, as indicated by the most recent survey data. That said, the SARB continues to assess inflation risks as skewed to the upside. While inflation appears well-contained in the short term, the medium-term outlook remains more uncertain than usual, with potential headwinds stemming from the external environment and domestic cost pressures, including administered prices.

Looking ahead, while our baseline expectation remains for two 25-bp rate cuts over the course of 2025, the timing of the next move remains uncertain. Given the evolving global landscape, the SARB may opt to delay further rate reductions as it monitors external developments and their implications for domestic inflation dynamics. The MPC will likely maintain a cautious, data-dependent approach, retaining a somewhat hawkish tone to ensure inflation expectations remain firmly anchored at 4.5%.