In recent months, despite bleak forecasts, the global economy has shown remarkable resilience, maintaining steady growth. At the same time, inflation has steadily declined – albeit at a frustratingly slower pace than global consumers would prefer. Across the global economy, the last few years have been eventful, beginning with supply chain disruptions following the COVID-19 pandemic, an energy and food crisis spurred by Russia’s war on Ukraine, and a significant surge in inflation, all culminating in globally synchronised monetary policy tightening. In truth, this seemingly recent global resilience is not a new phenomenon by any means; the global economy has been steadily growing more resilient over decades thanks to key developments and structural improvements. These enhancements have strengthened the ability of economies around the world to absorb shocks, adapt to changing conditions, and recover more swiftly from disruptions.

Undoubtedly, technological advancements have played a pivotal role in this respect. The proliferation of digital technologies has enabled businesses to operate with enhanced flexibility and efficiency. Remote work, online commerce, and digital communication tools have allowed for uninterrupted economic activity, even in the face of physical disruptions, such as the COVID-19 pandemic. Furthermore, the advances in automation and artificial intelligence (AI) have significantly boosted productivity and operational efficiency across various sectors, reducing the reliance on human labour and increasing the ability to maintain production during crises. Over the past few decades, many countries have diversified their economies, reducing dependence on single industries or sectors. This diversification has helped mitigate the impact of sector-specific downturns. Countries have also broadened their trade and investment relationships, spreading risk and reducing their reliance on limited economic partners. This has been achieved despite the recent surge in nationalistic/anti-globalisation political rhetoric.

Global financial systems are also stronger than ever, providing a reassuring sense of stability, largely thanks to the post-2008 global financial crisis (GFC) reforms. Improved regulations, increased capital requirements for banks, and better risk management practices have made financial institutions more robust. Furthermore, the establishment and enhancement of global financial safety nets, such as those provided by the International Monetary Fund (IMF) and other international financial institutions, have given countries around the world critical support during financial crises. In recent years, this support has proved vital for economies across South America and Africa. Further, organisations such as the World Trade Organization (WTO) and the World Bank (along with the IMF) now facilitate international cooperation and provide frameworks for addressing global economic challenges.

Moreover, over the last few decades, governments and central banks across the globe have developed more effective tools and frameworks for responding to economic crises. For example, during the COVID-19 pandemic, many countries quickly implemented monetary and fiscal stimulus measures to support their economies. If anything, the global COVID-19 pandemic illustrated how important resilient supply chains are to the efficient functioning of global financial systems and economies. Since the pandemic, companies worldwide have invested in building more resilient supply chains by diversifying their suppliers, increasing inventory buffers, and localising production to reduce their dependency on single sources. Supply chain management technologies, such as blockchain and advanced analytics, have improved visibility and coordination, enabling quicker adjustments to disruptions.

Using more specific case studies, the global economy’s improved resilience was demonstrated during the COVID-19 pandemic and the 2008 GFC. During the pandemic, the rapid adaption to remote work, digital service delivery, and substantial government stimulus packages enabled many sectors to rebound quickly despite significant initial disruptions. Similarly, the coordinated global response to the 2008 GFC, which included monetary policy easing, fiscal stimulus, and regulatory reforms, helped stabilise the global financial system and set the stage for recovery, showcasing the effectiveness of enhanced financial safety nets and international cooperation.

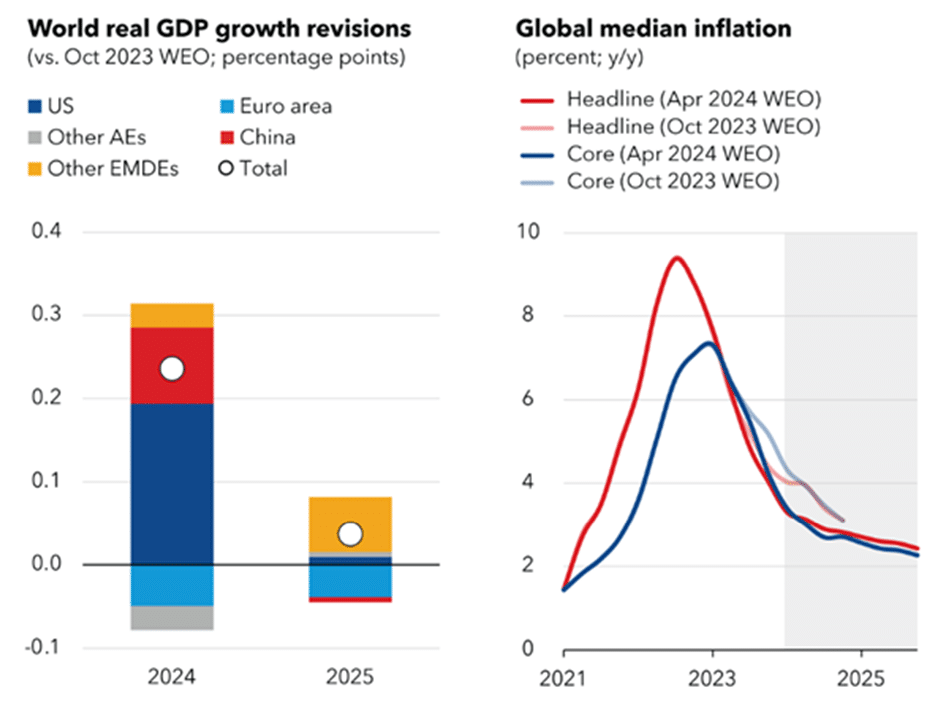

If one analyses more recent trends, global growth bottomed at the end of 2022 (at 2.3%), shortly after median global headline inflation peaked at 9.4%. According to the IMF’s latest projections, growth for this year and next will hold steady at 3.2%, with median headline inflation declining from 2.8% at the end of 2024 to 2.4% at the end of 2025. Most economic indicators point to a “soft-landing” scenario for the global economy, which is a complex process that aims to balance slowing economic growth and controlling inflation without triggering a recession.

Figure 1: IMF global growth and inflation forecasts

Source: IMF

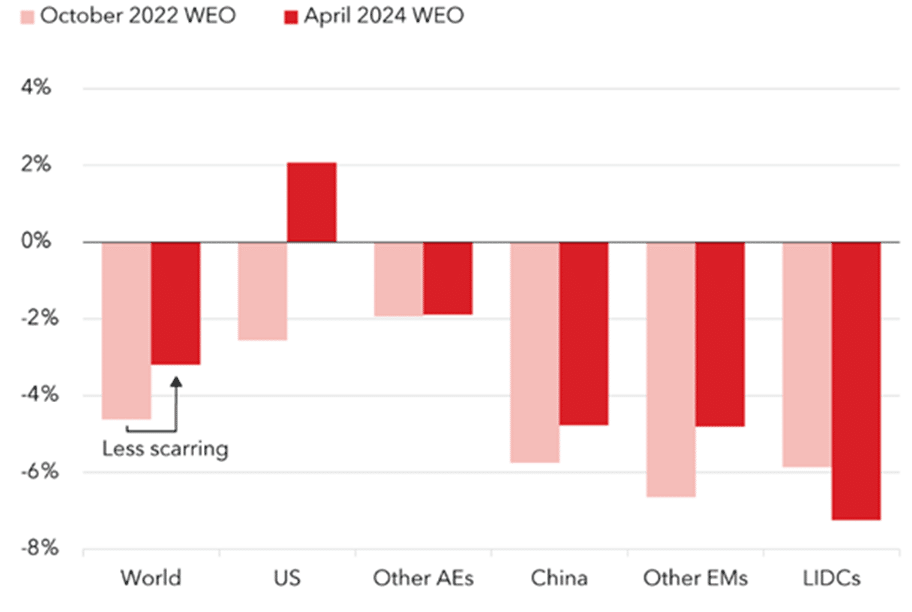

Interestingly, the IMF also forecasts less economic scarring from the crises of the past four years, although estimates vary across countries. The US economy has already exceeded its pre-pandemic trend. However, the IMF does estimate that low-income developing countries will experience more long-term damage, as many are still grappling with the aftermath of the pandemic and ongoing cost-of-living crises.

Figure 2: An improved global GDP growth outlook – the difference in the IMF’s projected GDP growth forecasts, 2020 vs 2024

Source: IMF World Economic Outlook (WEO)

Steady economic growth and a swift decline in inflation suggest positive supply-side trends, such as diminishing energy price disruptions and a notable increase in labour supply due to robust immigration in advanced economies. Monetary policy measures have successfully stabilised inflation expectations, although the prevalence of fixed-rate mortgages may have tempered their impact. Despite these encouraging trends, significant challenges persist, necessitating decisive actions from global fiscal and monetary authorities moving forward. Inflation risks remain. While current inflation trends are encouraging, they have, for the most part, not quite reached target levels. Progress towards inflation targets thus far has been driven by reductions in energy prices and goods inflation. Improvements in supply-chain logistics and lower Chinese export prices have contributed to the decline in goods inflation. However, recent geopolitical tensions have increased oil prices, and service sector inflation remains persistently elevated. Furthermore, additional trade restrictions on Chinese exports could further elevate goods inflation.

It is crucial to recognise that while the modern global economy appears more resilient, significant disparities exist between countries. Variations in economic cycles, where some nations have output exceeding potential and inflation surpassing targets, underscore the necessity for customised adjustments. The US’ recent strong economic performance has been driven by robust productivity and employment growth alongside solid demand in an overheated economy. This calls for a cautious approach to US Federal Reserve (Fed) easing, especially given concerns around the Fed’s fiscal stance’s short-term risks to disinflation and long-term fiscal and financial stability. In the euro area, growth is expected to rebound from low levels, hindered by past shocks and tight monetary policy, with high wage growth and persistent services inflation potentially delaying inflation target returns.

Elsewhere, China continues grappling with a property sector downturn, impacting domestic demand and possibly increasing external surpluses amidst trade tensions. On the other hand, many large emerging markets (EMs) are performing well, buoyed by shifts in global supply chains and heightened China-US trade tensions, enhancing their global economic influence. As such, moving forward, policymakers will have to prioritise measures that help preserve or even strengthen the global economy’s resilience.

Overall, the global economy’s increased resilience over the last few decades results from a combination of technological advancements, diversified economies, stronger financial systems, improved international cooperation, enhanced crisis response mechanisms, more resilient supply chains, and a focus on sustainable development. These factors collectively enable the global economy to better withstand and recover from shocks, contributing to a more stable and robust economic environment.