Over recent years, a notable shift has been observed in the global economic and cultural exchange trajectory, marking a departure from the rapid pace of globalisation towards what is increasingly termed ‘slowbalisation’ in economic literature. Slowbalisation is the perceived trend away from the rapid globalisation that characterised much of the late 20th and early 21st centuries towards a slower, more localised, and even regressive approach to economic and cultural exchange. This concept suggests weakening political support for open trade amid increasing geopolitical tensions – a shift from the intense interconnectedness and interdependence of global economies and societies towards a more measured, cautious, or localised approach.

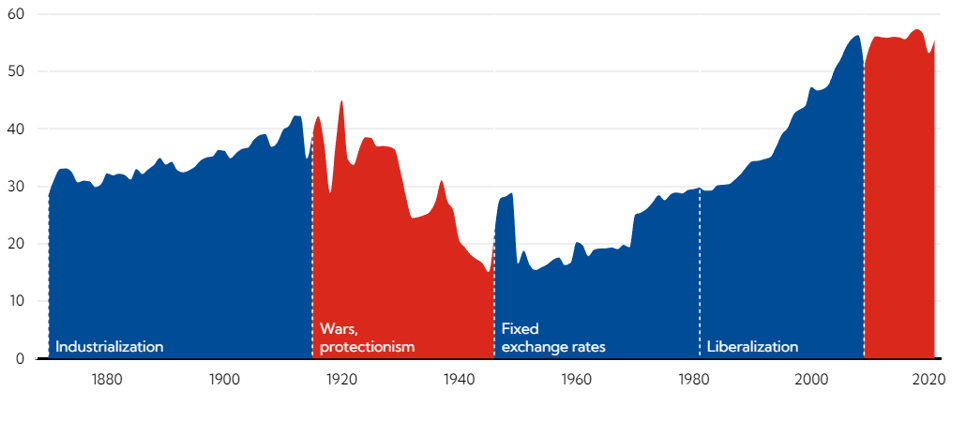

The recent era of relentless globalisation (characterised by unfettered cross-border trade, mass migration, and ubiquitous cultural homogenisation) has had ebbs and flows over the years. Looking back over a century and a half of data, the International Monetary Fund (IMF) argues that the main phases of globalisation are visible using the trade openness metric – the sum of exports and imports of all economies relative to global gross domestic product ([GDP] as illustrated in Figure 1).

Figure 1: Eras of globalisation – trade openness metric (sum of exports and imports as a percentage of GDP)

Source: IMF

As Figure 1 illustrates, the five periods were characterised by various configurations of economic and financial powers and different rules and mechanisms for economic and financial ties between countries. For example, the industrialisation era was a period when global trade (dominated by Argentina, Australia, Canada, Europe, and the US) was facilitated by the gold standard. It was primarily characterised by transportation advances that lowered trade costs and boosted trade volumes.

The interwar period, however, saw a dramatic reversal of globalisation due to international conflicts and the rise of protectionism. Despite the League of Nations’ advocacy for multilateral collaboration, trade increasingly shifted towards regionalisation due to the proliferation of trade barriers and the fragmentation of the gold standard into currency blocs.

During the Bretton Woods era, the US emerged as the primary global economic force, with the US dollar serving as the cornerstone of a system wherein other currencies were pegged to it while it was tethered to gold. The post-war period witnessed a surge in growth across Europe, Japan, and developing nations, spurred by economic recovery and trade liberalisation, prompting many countries to ease capital controls. However, the system became untenable due to expansive US fiscal and monetary policies driven by social and military expenditures. Consequently, the US terminated dollar-gold convertibility in the early 1970s, leading numerous countries to adopt floating exchange rates.

As a result, during the liberalisation era, trade barriers were gradually dismantled in China and other major emerging market (EM) economies, alongside unprecedented international economic collaboration, which included the integration of the former Soviet bloc. This period of liberalisation was primarily responsible for the substantial growth in trade volumes. Furthermore, by establishing the World Trade Organisation (WTO) in 1995, a new multilateral authority emerged overseeing trade agreements, negotiations, and dispute resolutions. Simultaneously, cross-border capital flows experienced a significant surge, contributing to the heightened complexity and interconnectedness of the global financial system.

As further illustrated by Figure 1, globalisation plateaued in the decade and a half since the global financial crisis (GFC) of 2008/2009. This latest era of slowbalisation that followed the GFC has been characterised by a prolonged slowdown in the pace of trade reform and weakening political support for open trade amid rising geopolitical tensions.One particularly prominent catalyst for slowbalisation has been the erosion of confidence in the traditional model of global interconnectedness. Increasing protectionism and trade tensions between major economies have prompted businesses to reassess the risks of relying on far-flung supply chains, leading to a renaissance of local manufacturing and sourcing. Companies increasingly prioritise resilience over efficiency, seeking to minimise exposure to geopolitical volatility and supply chain disruptions.

Moreover, the COVID-19 pandemic has acted as a catalyst, laying bare the vulnerabilities of hyper-globalisation. Border closures, travel restrictions, and supply chain bottlenecks have underscored the fragility of global systems and highlighted the importance of local self-sufficiency in essential goods and services. In parallel, there has been a growing recognition of the environmental costs associated with the carbon-intensive logistics of global trade. Concerns over climate change have spurred calls for a more sustainable approach, with consumers and businesses showing a greater appetite for locally sourced products and eco-friendly practices. Culturally, slowbalisation manifests in a resurgence of appreciation for local traditions, cuisines, and craftsmanship. As communities seek to reclaim their distinct identities in the face of cultural homogenisation, a renewed emphasis exists on preserving heritage and fostering grassroots cultural expression.

Overall, slowbalisation reflects a growing recognition of the complexities and challenges associated with unfettered globalisation and a re-evaluation of the pace and scale of global economic integration. While slowbalisation represents a departure from the hyper-globalised paradigm of the past, it is not a retreat into isolationism. Instead, it embodies a more nuanced understanding of interconnectedness that recognises the value of global cooperation and local resilience. As the world navigates an uncertain future marked by geopolitical tensions, environmental challenges, and socioeconomic disparities, slowbalisation offers a path towards a more sustainable, inclusive, and resilient global order.