When it comes to investing in shares, be a pessimist in the short term, a realist in the medium term, and an optimist in the long term.

The financial media is constantly full of headlines imploring investors to sell some or all their shares to avoid an imminent market catastrophe. Bad news sells better than good news in the media. It is not impossible that one day, this impending doom view will come true. Theoretically, almost anything can go wrong with the world we live in.

The question is whether anyone can accurately forecast or predict when it will happen. Investors cannot constantly react to this type of negative newsflow. If we did, we would seldom be invested in the market. One rarely sees an article headline suggesting we should hold our portfolios for “steady, compounding gains over the next 20 years”. After all, this makes for boring journalism.

I believe being an optimist at heart makes for more successful investing over the long term.

“Optimistic – hopeful and confident about the future.” (Oxford Dictionary definition)

“Optimists see the positive side of things. They expect things to turn out well. They believe they have the skill and ability to make good things happen.” (kidshealth.org)

Here is my philosophy regarding investing in shares:

Short term – Be a pessimist. Be extremely careful what you invest in. Assume that whatever can go wrong in the short term probably will. This is particularly helpful when trying to invest in turnaround situations. Often, things get worse before they get better. Keep your expectations very low about possible short-term outcomes. Markets always feel like they are climbing a wall of worry in the near term.

Medium term – Be a realist. In the medium term, a mixture of things will go right and wrong with the shares in your portfolio. Some things will end up worse than you expected, and other things will turn out better. Often, the shares you thought would be your winners disappoint you. Conversely, the shares you expected the least from sometimes end up positively surprising you the most.

Long term – Be an optimist. Humanity is resourceful and has demonstrated an ability to successfully navigate change and find solutions to challenges. Many issues generally work out in the long term. We can look back at investments we made years ago and realise how futile our worries were at the time. This is especially true for broad macro issues. Most importantly, we invested in a portfolio of high-quality companies over the long term. Being an optimist also helps us grind through a few years where the market might have done nothing but move sideways or down.

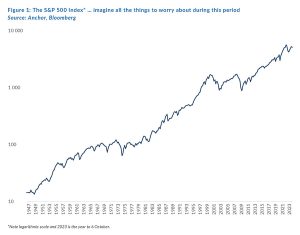

Figure 1 below shows the performance of the S&P 500 Index since the 1940s. Consider all the things to worry about over these many decades. Being optimistic that concerns and issues generally work themselves out, in the long run, would have given us the best chance of capturing this superb market performance over the years.

An exercise I like to do periodically is to go back and watch a few clips of market commentators from years ago. So many of their concerns back then are the same issues we worry about today. I recall recently watching a panel of US market experts discussing their worries about the overall market. I was struck by their timely, relevant, and insightful concerns. Only halfway through the clip did I discover that I was watching an interview conducted several years ago. The issues and concerns never really seem to change. Yet here we are in 2023, and the market has found a way to work through our perennial concerns.

In the moment, market pullbacks feel severe when we experience them. However, years later, looking back at that same sell-off on a long-term chart, it appears to be nothing more than a blip. That is when we look back and think, “Why were we so worried at the time?”. An optimist is best placed to use these periodic blips as long-term buying opportunities.

I would argue that the world’s highly successful businesspeople achieved what they did partly by being optimists at heart. Being an optimist does not mean we blindly invest in every supposed hot idea that crosses our path. Instead, it means we believe that hard work and application, coupled with a small dose of good fortune and taking some risk, will lead to good outcomes over the long term. Provided we do our part, things will typically work out in the long run.

The impact of good fortune is an underappreciated element of success. No matter how hard we work, we must be in the right place at the right time. However, I would suggest that if you are an optimist, you increase the chances of some good fortune coming your way many times over.

Being a pessimist leads us to make poor, long-term investment choices. It makes us reactive to short-term, negative newsflow. It also makes us more likely to sell our shares at a market low. A pessimist leans towards putting their money under the mattress, thereby missing out on overall market returns over the years. Inflation is enemy number one for our assets in the long run. Few things in life are assured. However, cash under the mattress is almost guaranteed to suffer the ravages of inflation over time, leading to poor investment outcomes.

The following is often true of market commentators or financial analysts. Being bullish makes us sound unwise, inexperienced, and possibly even gullible. However, being bearish makes us sound knowledgeable and wise. Yet the entire underlying thesis of equity investing is that markets rise over time, beating inflation. Why else would we invest in the market?

I heard the following quote from Nick Train (a UK fund manager) in a TV interview a while ago, and it struck a chord with me. I am sure he meant this somewhat tongue-in-cheek, but he nevertheless made a powerful point.

“I would rather give my money to a foolish optimist than a wise pessimist, for the optimist has history on their side” – Nick Train (Lindsell Train, UK fund manager)

Here is a view I often express to friends who ask for financial guidance while voicing their concerns about the uncertain future; “You cannot financially plan for World War III”. There is always a what-if scenario for which the best-laid plans cannot cater. Whether it is money under the mattress, a passive index fund, a value strategy or a property portfolio, there is always a scenario under which no investment strategy can come to our rescue. It is pointless dwelling on these types of extreme scenarios. Even if they happen, there will not be much we can do about it.

Instead, we must assume that the world as we know it will continue as a going concern for the foreseeable future. Furthermore, it helps to understand that humanity has an incredible ability to navigate and adapt to difficult circumstances. This gives us the best chance to succeed as a long-term investor. As a bonus, life is more enjoyable if we take an optimistic view.