The African Growth and Opportunity Act (AGOA) is a critical piece of US legislation that has transformed trade relations between the US and Sub-Saharan African nations since its enactment in 2000. AGOA’s primary objective is to promote economic development and enhance trade ties by providing qualifying African countries preferential access to the US market. Through AGOA, eligible nations can export a wide range of products to the US duty-free, helping to foster economic growth, job creation, and poverty reduction across the African continent. This trade initiative has stimulated commerce and played a vital role in strengthening diplomatic relations between the US and its African partners. Currently, 35 countries enjoy AGOA trade preferences into the US. The original AGOA legislation provides the establishment of a United States-Sub-Saharan Africa Trade and Economic Cooperation Forum, with the 2023 forum being held in South Africa (SA) from 2-4 November – preceded by much contention around SA as the host country this year.

In recent months, SA’s ongoing eligibility for expanded duty-free access to US markets through AGOA has become uncertain. The potential challenge to SA’s AGOA participation during the next review hinges mainly on a specific provision within US law, stipulating that beneficiary countries should refrain from activities that could undermine US national security or foreign policy interests. As such, many senior US officials have been unhappy with how the SA government has positioned its geopolitical stance concerning Russia and the war in Ukraine – a situation primarily exacerbated by the recent Lady R debacle. In recent years, several countries have lost their eligibility for AGOA, primarily due to undemocratic political regime changes and human rights abuses. Burkina Faso faced removal in 2022 after a military coup, Cameroon was excluded in 2019 due to human rights violations by its security forces, Ethiopia lost eligibility in 2021 following the civil war in Tigray, and in the same year, both Mali and Guinea were removed from AGOA after experiencing military coups.

Figure 1: AGOA country eligibility, 2023

Source: Trade Law Centre NPC (tralac)

Notably, on Monday (30 October), US President Joe Biden announced his intent to end the designation of Gabon, Niger, Uganda and the Central African Republic as beneficiary countries of AGOA as a result of “gross violations” of internationally recognised human rights on the part of the Central African Republic and Uganda, and Niger and Gabon’s failure to establish or make continual progress toward the protection of political pluralism and the rule of law. As such, the formal termination of their designations will be effective as of 1 January 2024.

Looking specifically at SA, it is important to note that leading up to the 2015 extension of AGOA, there were already considerable deliberations focused on whether SA should maintain its AGOA benefits. Concerns largely centred around SA’s classification as a middle-income nation, which raised questions about the fairness of its beneficial access to the US market. At the time, it was widely believed that some US officials also employed this stance as a negotiating strategy to gain concessions from SA authorities, particularly concerning US exports such as poultry, beef, and pork. Furthermore, during the subsequent AGOA review in 2017, US officials expressed apprehensions about SA’s Copyright Amendment Bill. Thus, it is essential to remember that the current discourse on SA’s potential exclusion from AGOA in the upcoming review is centred around more factors than simply the country’s stance towards Russia.

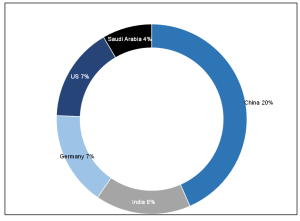

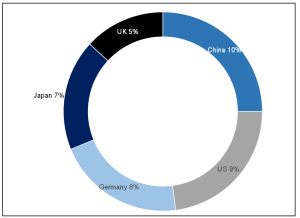

Regardless of the various dynamics, the US remains an important trade partner to SA. As of 2022, c. 7% of SA’s total imports came from the US, and c. 9% of the country’s exports were to the US. In both respects, the US features in the top percentile of SA’s overall trade partners.

Figure 2: Percentage share in SA imports – top-5 trade partners, 2022

Source: ITC Trade Map, Anchor

Figure 3: Percentage share in SA exports – top-5 trade partners, 2022

Source: ITC Trade Map, Anchor

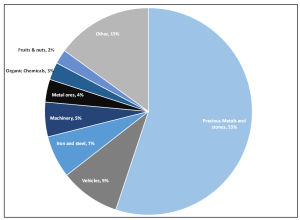

If one considers the latest trade data in a little more detail, it indicates that whilst SA’s exports to the US are quite diverse, they remain relatively concentrated in a few product lines. In 2022, for example, the US imported 2,143 products from SA, but only 346 products with a value of more than US$1mn and only 99 products with a value of more than US$10mn. In terms of value, over half of SA’s exports in 2022 were precious metals and stones. The three next most significant categories were vehicles, iron and steel and machinery.

Figure 4: SA Exports to US, 2022

Source: ITC Trade Map, Anchor

When analysing SA’s exports to the US, there are three relevant overlapping tariff regimes to bear in mind – not just AGOA. The broadest is actually the Most-Favoured Nation (MFN) status, negotiated in the General Agreement on Tariffs and Trade (GATT) via the World Trade Organization (WTO). Within the framework of MFN status, member countries (such as the US and SA) extend equal trade privileges to all trading partners encompassed by this arrangement. There are specific exceptions, such as offering preferential trade benefits to developing countries, regional free trade areas, or when implementing targeted trade measures like antidumping duties. Currently, all countries except Belarus, Cuba, North Korea, and Russia maintain MFN status with the US, although the G7 suspended Russia’s MFN status following its invasion of Ukraine.

The second most relevant tariff regime to consider is the US Generalized System of Preferences (GSP), which granted extended duty-free access to a wide range of product categories for 119 developing sovereign nations and a few non-sovereign territories. Unfortunately, the GSP regime expired worldwide in December 2020, and thus far, the US Congress has not renewed it, although negotiations in this regard appear to be progressing intermittently. Regardless, with the expiration of the GSP, unless a specific product qualifies for duty-free access under AGOA, the relevant import tariffs after 2020 will revert to the MFN rates. Third, there is AGOA, through which the 35 Sub-Saharan African member countries (including SA) benefit from additional tariff relief above what has been provided under the MFN and the now-expired GSP regimes. It is important to point out that many of SA’s most valuable exports to the US are already duty-free under the MFN regime, regardless of AGOA. Therefore, whilst AGOA offers sizeable export advantages through zero tariff rates, US tariff barriers are generally fairly small even under the MFN regime, which suggests limited benefit from AGOA’s tariff relief. Simply put, even if SA were to forfeit its AGOA privileges, the average tariff increase impacting local exports would remain modest. This is primarily because most SA exports already enter the US duty-free, even under MFN status. In cases where an MFN tariff is applicable, it is generally quite small. In fact, for SA, only a few of its agricultural and manufactured product lines have high tariffs under MFN but zero tariffs under AGOA.

When considering the debate around SA maintaining its AGOA member status, it is worth bearing in mind that the advantages not only lay in SA’s corner but there are also important considerations for the US. First, should SA’s AGOA eligibility be revoked, the overall trade volume within AGOA significantly contracts, reducing its standing as one of the US’ foremost economic and diplomatic instruments for maintaining relationships across Sub-Saharan Africa. Second, denying SA access to AGOA would adversely affect several smaller regional neighbours with strong ties to industries that derive the greatest benefits from SA’s AGOA exports, creating a ripple effect in the region – an issue raised in the 2015 review.

Overall, we believe that SA is more likely than not to maintain its AGOA eligibility at this stage should the policy extend beyond its current expiration date in 2025. As things stand, the US does not appear to have sufficient political will to expel SA from AGOA due to the Lady R saga. This means that the potential exclusion of SA would only become formalised in 2025. However, it is possible, even likely, that the preferential benefits provided to SA through AGOA will be reduced during the review period preceding a potential extension. Alternatively, US officials may impose additional requirements on the SA government to lessen trade barriers for certain US exports to SA to satisfy US officials advocating a tougher stance.

Whilst we believe that the risk of complete expulsion is small, even if SA lost its AGOA trade privileges, the overall direct macroeconomic impact would be limited as most of SA’s exports to the US already have a zero or nominal duty under the MFN regime. Furthermore, regarding the small subset of export lines with a significant disparity in duty costs between the MFN and AGOA arrangements, the actual export values are usually not extensive. Nevertheless, the removal from AGOA might bring about a more significant, indirect consequence by jeopardising trade support services and negatively affecting investor and business confidence.