Eskom has again taken centre stage in local news following the unexpected return of loadshedding (over the weekend of 1-2 February) and the latest tariff hike announcement by the National Energy Regulator of South Africa (NERSA). The recurrence of power cuts was driven by boiler tube issues at the Matimba and Lethabo power stations, coupled with breakdowns at the Kendal and Kriel stations, leading to an unplanned disruption in electricity supply. Despite these challenges, Eskom assured the public that the loadshedding would be limited to the weekend as it worked to replenish reserves of open-cycle gas turbines and hydropower to stabilise the grid for the week ahead. However, concerns remain about the utility’s ability to maintain consistent power generation amid ongoing infrastructure failures.

Meanwhile, NERSA has approved a 12.7% electricity tariff increase for Eskom—significantly lower than the hike initially requested by the struggling state-owned entity. While providing some financial relief for the heavily indebted power provider, this increase falls short of the amount Eskom had hoped for as it attempts to improve its financial standing and address persistent operational inefficiencies. The tariff hike is expected to place additional strain on already burdened consumers, many of whom are grappling with the rising cost of living.

Eskom’s latest approved tariff adjustment represents only a fraction of the 36% increase it initially requested from NERSA. The regulator has sanctioned electricity price hikes over the next three financial years: 12.7% for the 2025/26 period, followed by increases of 5.36% in 2026/27 and 6.19% in 2027/28. Eskom had initially sought even steeper increases through its Multi-Year Price Determination (MYPD6) application, aiming for a cumulative 66% rise over three years. However, NERSA significantly reduced these requests, approving only 35% of Eskom’s proposed hikes.

Despite this reduction, the 12.7% increase for 2025 continues a long-standing trend of rising electricity costs for South Africans. The new tariffs will come into effect on 1 April 2025 for Eskom’s direct customers and on 1 July 2025 for those receiving electricity through municipalities, which typically impose additional surcharges to cover distribution costs. To put the financial impact into perspective, an Eskom customer using 800 kilowatt-hours (kWh) per month paid approximately R1,055 in 2014. In 2024, that usage now costs R2,948—a staggering 179.42% increase. With the upcoming tariff hike, the monthly bill is projected to climb to R3,324, nearly three times the cost from a decade ago.

Looking ahead, with further approved increases of 5.36% in 2026 and 6.19% in 2027, electricity costs will continue their sharp upward trajectory. By comparison, inflation over the past decade has risen just 67.8%, highlighting how electricity price hikes have far outpaced general cost-of-living increases. This relentless rise in tariffs is expected to put even greater financial strain on South African (SA) households and businesses already grappling with economic challenges.

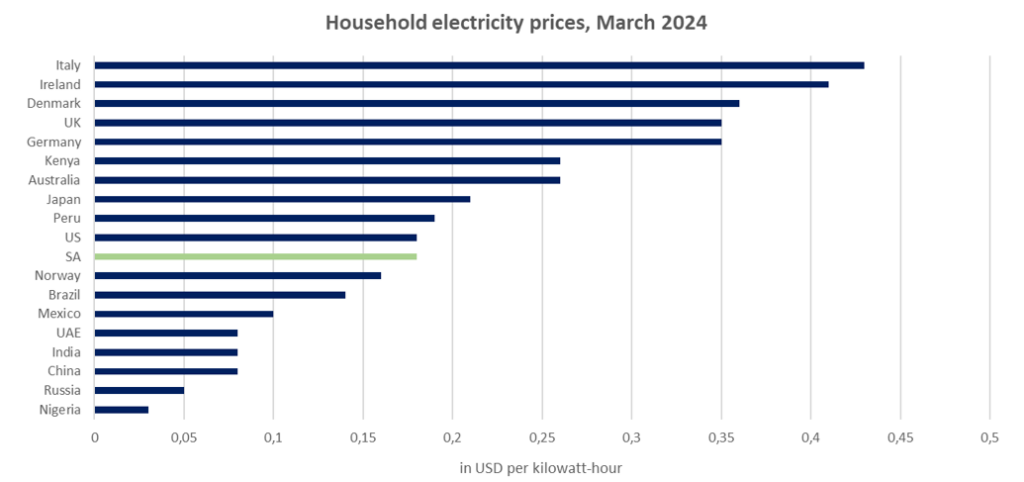

It is important to consider SA’s rising electricity costs within a broader global context, particularly in comparison to other developing and developed economies. When looking at average household electricity prices, SA sits in a mid-range position globally – higher than most developing nations but still lower than most developed countries.

This ranking has significant economic implications. While SA’s electricity prices remain more affordable than those in many advanced economies, they are becoming increasingly expensive for households relative to local income levels. Unlike wealthier nations where higher electricity costs are offset by stronger purchasing power and more robust social safety nets, SA consumers face rising energy costs in an environment of stagnant wage growth, high unemployment, and widespread economic inequality. Additionally, SA’s relatively high electricity costs compared to other developing nations put it at a competitive disadvantage, particularly in energy-intensive industries such as mining and manufacturing. While SA has not yet reached the electricity price levels seen in many advanced economies, its rapid cost escalation—combined with persistent energy supply challenges—increasingly makes electricity a major economic burden rather than a driver of industrial growth.

Figure 1: Household electricity prices worldwide in March 2024 by country

Source: Statista

While SA has maintained a stable electricity supply since March 2024, energy security remains a significant risk to the country’s economic outlook. Eskom’s strategic reduction in unplanned maintenance and increased investment in its maintenance programme has contributed to improved generation capacity and reduced reliance on costly diesel-powered generation. Concurrently, the renewable energy sector is experiencing substantial growth. In 2023, SA recorded unprecedented imports of renewable energy equipment, amounting to approximately US$840mn, highlighting the sector’s expanding momentum.

Additionally, there has been a notable increase in independent power producers (IPPs) entering the market, introducing a broader mix of energy sources, including solar, wind, gas, and hydropower. These technologies are pivotal in diversifying SA’s energy landscape and enhancing grid stability. This transition is not solely driven by sustainability goals but also serves as a critical intervention in bolstering energy security. As such, these developments illustrate how a more diversified and resilient energy mix can support long-term economic growth and reduce the country’s dependency on Eskom’s struggling infrastructure.

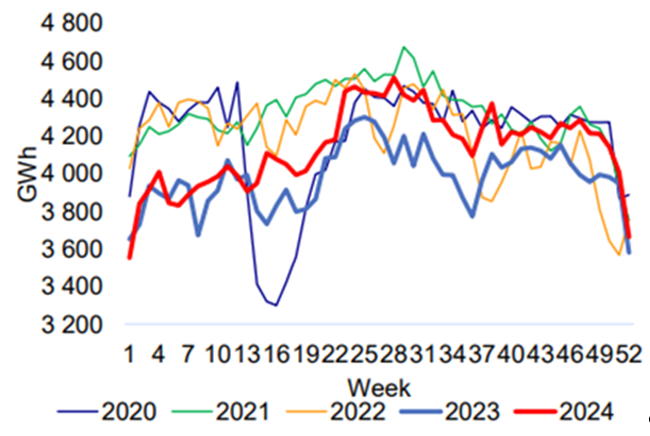

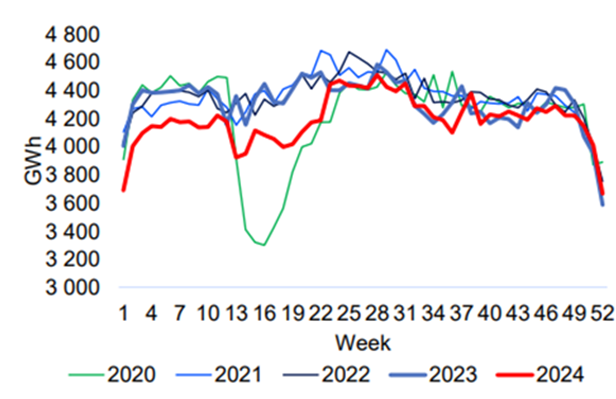

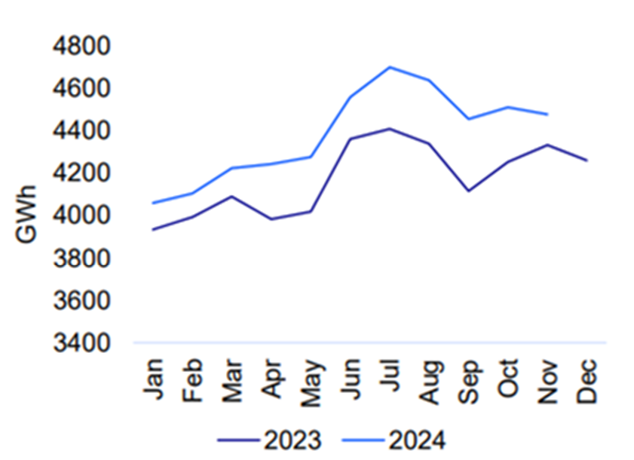

The sustained absence of loadshedding since 2Q24 has been driven by a combination of increased electricity supply from Eskom (see Figure 2) and a significant expansion in self-generation capacity. Eskom estimates that operational rooftop solar installations reached approximately 6GW by the end of 2024, contributing meaningfully to the country’s overall energy supply. As shown in the charts below, a decline in grid demand (Figure 3) initially played a role in reducing the electricity shortfall in early 2024. However, even as grid consumption rebounded in the second half of the year, loadshedding did not return, indicating that improved generation capacity, rather than suppressed demand, was the key factor behind supply stability. This is further confirmed by Figure 4, which illustrates a material increase in total electricity consumption throughout 2024, dispelling concerns that lower economic activity was responsible for the absence of power cuts.

While the risk of loadshedding cannot be entirely ruled out—particularly in the event of multiple significant plant breakdowns—this is not the base-case scenario currently reflected in market expectations. Furthermore, demand growth alone is not anticipated to create a supply shortfall, suggesting that SA’s energy landscape has become more resilient than in previous years.

Figure 2: Eskom energy supply, 2020-2024

Source: Standard Bank

Figure 3: Demand from Eskom grid

Source: Standard Bank

Figure 4: Total electricity consumption

Source: Standard Bank

A key positive development has been the successful reconnection of Koeberg’s second unit following an extensive refurbishment. This upgrade, part of a long-term life-extension project aimed at keeping the plant operational for an additional 20 years, involved replacing critical components such as steam generators and conducting comprehensive safety checks. With the unit now back online, it contributes 930MW to the national grid. Additionally, grid stability has been reinforced by the restoration of Kriel Unit 6, which has added 475MW to the system.

However, fundamental vulnerabilities remain unresolved. Major projects at Kusile have faced significant setbacks, including technical difficulties and construction delays. Notably, damage to flue ducts and chimneys has left Units 1, 2, and 3 inoperable, further limiting Eskom’s ability to ensure consistent supply. In the near term, grid stability remains fragile, dependent on continued operational improvements at Eskom, reduced sabotage and criminal activity, and further progress in integrating renewable energy sources. The current energy balance, driven by lower demand, disciplined maintenance, and incremental renewable contribution, remains fragile. While there is no immediate expectation of loadshedding, and the risk of even stage 1 outages remains low, the potential for disruption remains significant. Without further structural reforms and the completion of critical infrastructure projects, SA’s energy security will continue to face serious risks.

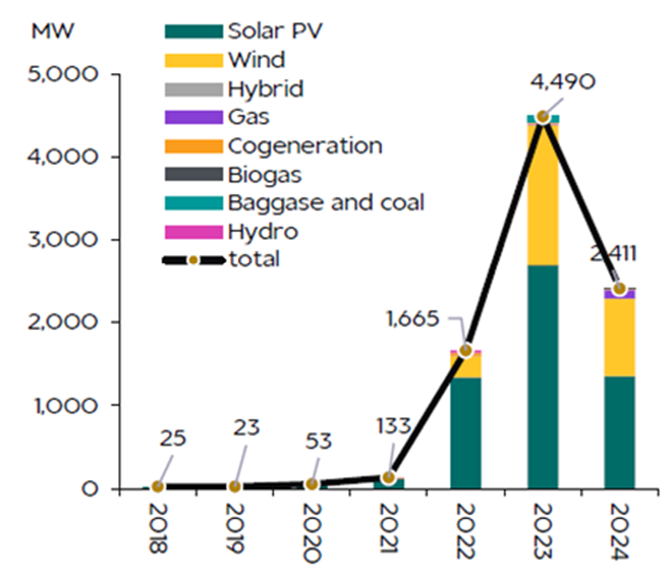

Figure 5: NERSA IPP registrations

Source: RMB

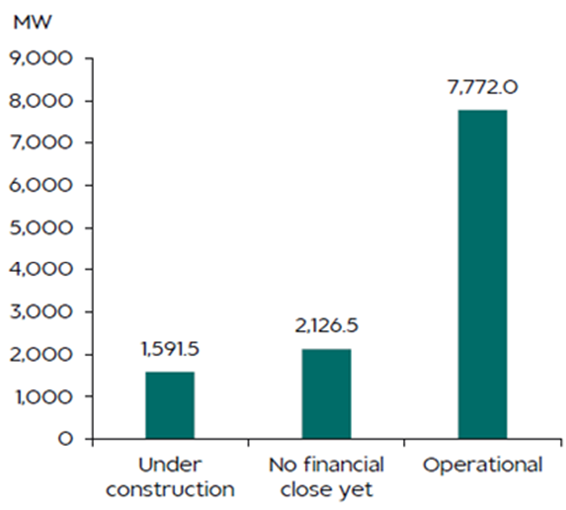

Figure 6: IPP project status by capacity

Source: RMB

Eskom’s debt relief and financial outlook remain a key concern for financial markets, particularly within the broader state-owned enterprise (SOE) crisis that continues to weigh on SA’s economy. Over the past 12 years, government bailouts for SOEs, excluding government guarantees, have totalled R659bn—including the February 2023 Eskom Debt Relief Package. This equates to nearly 1% of GDP p.a., highlighting the persistent fiscal strain imposed by struggling SOEs. During this period, the government’s contingent liabilities have expanded at an average annual rate of 8.5%, while government guarantees to SOEs have grown at an even higher rate of 9.2% p.a. Currently, contingent liabilities stand at 14.6% of GDP, further underscoring the risks posed to public finances. The largest contributors to SOE bailouts and rising contingent liabilities are Eskom and the offtake agreements with IPPs. As Eskom remains at the centre of SA’s energy crisis, its financial instability continues to present a significant fiscal risk, making structural reforms and improved financial sustainability critical to long-term economic stability.

The Eskom Debt Relief Act, initially signed in July 2023 and later amended in April 2024, allocates R254bn to cover debt servicing and repayments until 31 March 2026. While the disposal of Eskom Finance Company was not a major condition of the relief package, its failure to materialise led to an R2bn reduction in government transfers for 2024. The revised annual advances under the relief plan now stand at R76bn for FY24 (2023/24), R64bn for FY25, and R40bn for FY26. Additionally, R70bn of Eskom’s debt is expected to be transferred to the National Revenue Fund in 2026.

Eskom’s operational performance has shown improvement, and the utility currently faces no immediate refinancing risk. However, municipal debt continues to rise at an unsustainable pace (municipal debt owed to Eskom has now surpassed R100bn), further straining the utility’s financial position. At the same time, maintenance and capital expenditure demands place ongoing pressure on the utility’s financial position. Thus, Eskom’s long-term viability remains at risk unless decisive action is taken to reduce costs and address municipalities’ escalating payment arrears. Without meaningful intervention, the growing debt burden could undermine the utility’s financial recovery efforts and exacerbate broader fiscal pressures. As such, despite the relief package, Eskom will likely require interim financial support beyond 2026 until it returns to profitability.

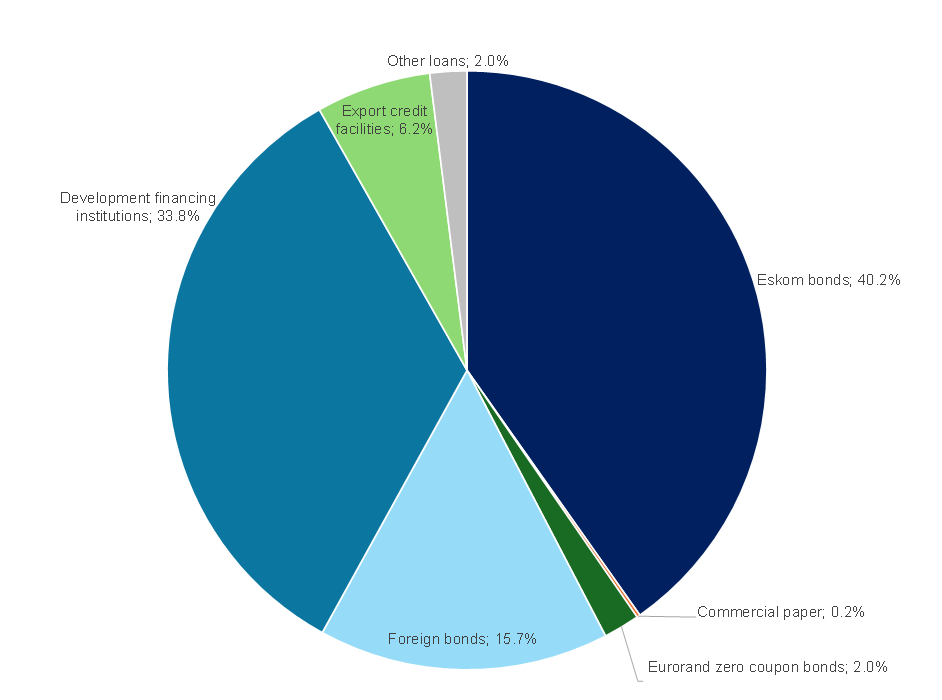

Figure 7: Eskom total debt profile, FY24

Source: Eskom, Anchor

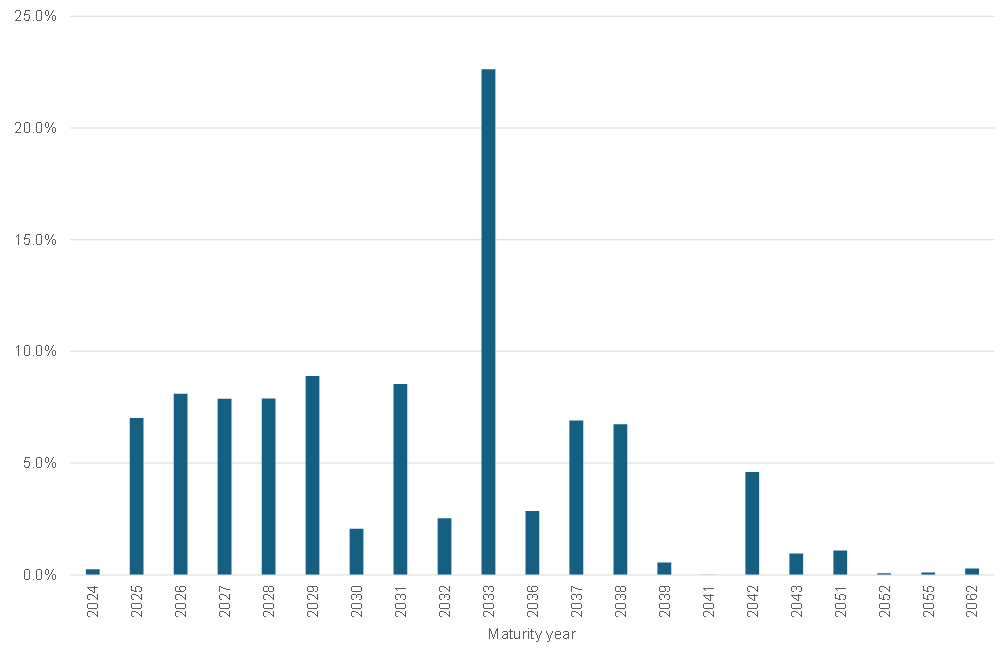

Figure 8: Eskom’s total debt maturity profile

Source: Eskom, Anchor

Eskom remains at the heart of SA’s economic and fiscal challenges, as ongoing operational inefficiencies, financial instability, and structural vulnerabilities continue to pose significant risks. While recent improvements in generation capacity and the expansion of renewable energy have contributed to a more stable electricity supply, the recent unexpected return of loadshedding is an unwelcome reminder of the underlying and persistent risks within the electricity sector. At the same time, rising electricity tariffs, mounting municipal debt, and the persistent need for government intervention underscore the broader fiscal strain Eskom places on the economy. Without comprehensive reforms, enhanced financial discipline, and further progress in diversifying the energy sector, SA’s energy security and economic resilience will remain under threat.