South Africa (SA) voted on 29 May in the 2024 National and Provincial Elections (NPEs). Voter turnout plummeted (at 58.64% of the total 27.8mn registered voters vs 65.99% in 2019), likely reflecting the general disillusionment and disengagement of the South African populace with the country’s electoral process and political leadership. However, the most significant development was the African National Congress (ANC) losing its parliamentary majority for the first time in democratic history – going from 57.6% in 2019 to 40.2% of the vote in 2024. This seismic shift in SA politics has profound implications for the economy and investors. The emergence of ex-president Jacob Zuma’s new M.K. party decimated the ANC’s traditional voter base in KwaZulu-Natal (KZN) and eroded its support in Gauteng and Mpumalanga.

The outcome of the NPE has seen two weeks of non-stop negotiations to form complex, multi-faceted national coalitions to govern SA for the next five years. On 17 June, the intention to create a Government of National Unity (GNU) was announced. To surpass the 50% vote and form a government, the ANC has been forced to partner with other parties in a marriage of convenience, potentially impacting the country’s economic policies for the better. Initially, five parties signed the statement of intent to participate in the GNU, including the ANC, the Democratic Alliance (DA), the Inkatha Freedom Party (IFP), GOOD, and the Patriotic Alliance (PA). Collectively this grouping represented 273 seats in the National Assembly (NA) or 68% of total seats, rendering Julius Malema’s (EFF) mooted pre-election role as kingmaker irrelevant. However, the ANC has also invited other parties to join the GNU, saying that discussions “were ongoing.” In a press release on 22 June, the ANC announced that ten political parties had now signed the GNU statement of intent – late joiners such as the Freedom Front Plus (FF Plus), the United Democratic Movement (UDM), RISE Mansi, and Al Jama-ah. Parties that sign the GNU are bound by the foundational principles outlined in its statement of intent and must work together to pursue the GNU’s objectives.

Provincially, Malema’s EFF is the official opposition in three provinces and the fourth-largest party nationally (9.52% of the vote). Still, the EFF’s performance was disappointing relative to what some pollsters (and the party itself) had forecast, but it has refused to join the GNU because of the DA and FF Plus’ participation. Meanwhile, the ANC also lost its majority in the KZN, Gauteng, and Northern Cape provincial legislatures. Consequently, it had to seek coalition partnerships in these three provincial legislatures. Having locked in the DA and IFP in a GNU, the ANC, supported by these two parties, took KZN from M.K., with the leader of the IFP sworn in as premier of the province. The FF Plus has agreed to partner with the ANC in the Northern Cape and support its candidate for premier in exchange for recognition of the white Afrikaner settlement, Orania.

On 30 June 2024, President Cyril Ramaphosa finally announced his Cabinet and deputy minister appointments. In this note, we look at how the balance of power has shifted in each of SA’s provinces, highlight the NA seats those parties contesting the 2024 NPEs won, and discuss the individuals and parties that will make up Ramaphosa’s Cabinet and govern SA for the next five years.

Figure 1: Parties represented in the NA – total votes cast and seats

Source: IEC, Anchor

How did other parties perform in the 2024 NPE?

While the ANC performed dismally in the 2024 NPE, falling to 40.2% of the national vote, Zuma’s M.K. party devoured a large chunk of its voter base to become the third-biggest political party in the country. With an impressive 14.6% of the national vote, M.K. booted Julius Malema’s EFF (down from 10.8% nationally in 2019 to 9.52% in 2024) from its position as the country’s third-biggest party.

Which parties triumphed in each of SA’s nine provinces?

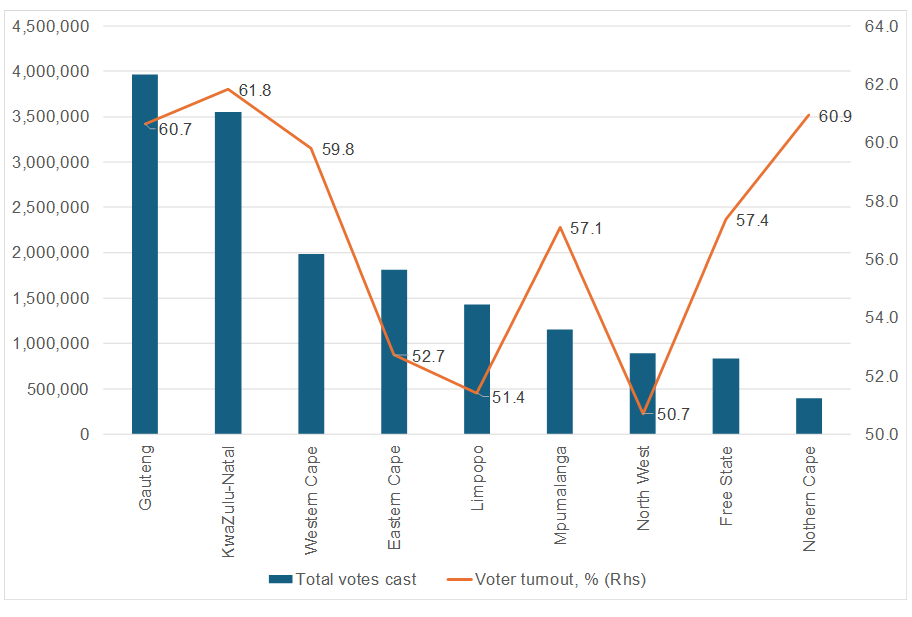

The ANC was the leading party in six of SA’s nine provinces. The DA managed an outright majority (53.1%) in the Western Cape, while the M.K. party received the most votes (45.9%) in KZN. There was no outright winner in the Northern Cape. Below, we highlight the provincial legislature seats of each party in SA’s nine provinces (the provinces are shown in order of the total number of votes cast).

Figure 2: Total votes cast in each province and voter turnout

Source: IEC, Anchor

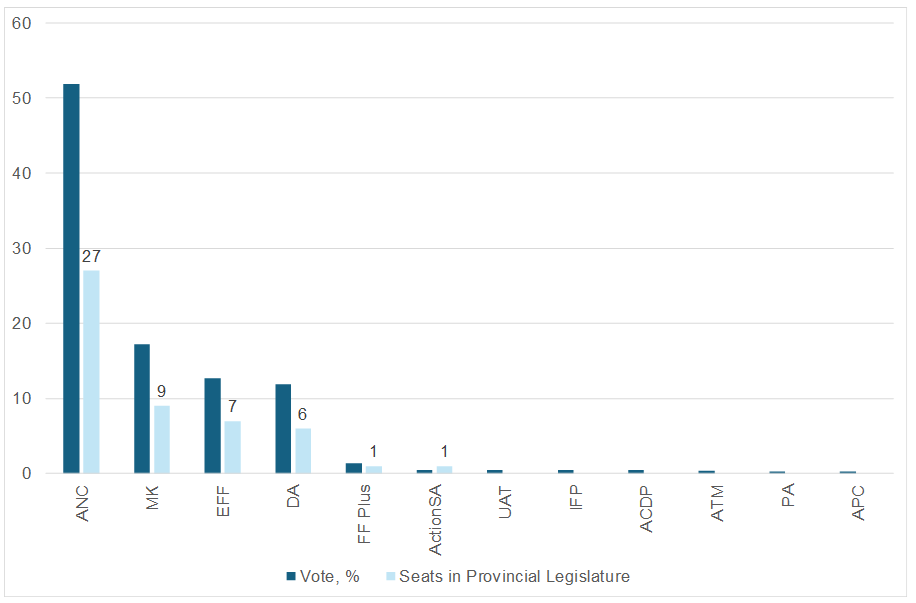

Gauteng: SA’s economic hub was the most closely contested province, with the ANC losing its majority with 36.47% of the total vote vs 53.2% in 2019. The DA followed it at 26.65% (from 24.53% in 2019) and the EFF at 12.46% (vs 13.53 in 2019). Nearly 4mn people voted in Gauteng, making it the largest voting block in the country.

Figure 3: Votes and seats in the Gauteng Provincial Legislature by the twelve biggest parties

Source: Anchor, IEC

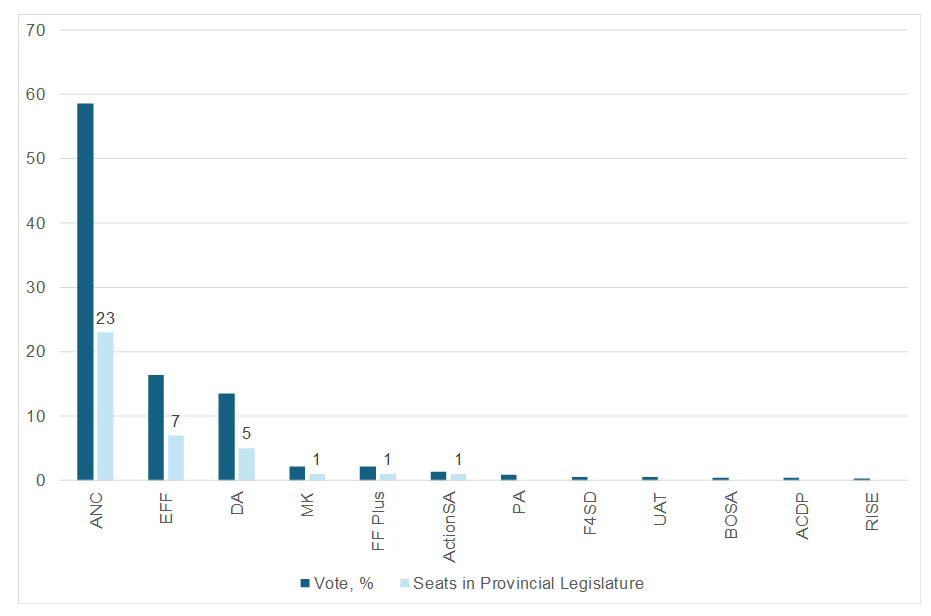

KZN: KZN is the second-biggest province in total votes cast – 3.5mn people voted. KZN entered an era of coalition politics; with no party receiving an outright majority, a Government of Provincial Unity (GPU) was formed under an ANC, DA, IFP, and NFP coalition. Still, Zuma’s M.K. party recorded impressive voter support in KZN, emerging as the largest party with 45.35% of the vote, with the IFP coming second (18.07% vs 14.58% in 2019). The ANC saw its most significant drop in KZN (to third place) as its support plummeted from 55.47% in 2019 to 17.62% in 2024.

Figure 4: Votes and seats in the KZN Provincial Legislature by the twelve biggest parties

Source: Anchor, IEC

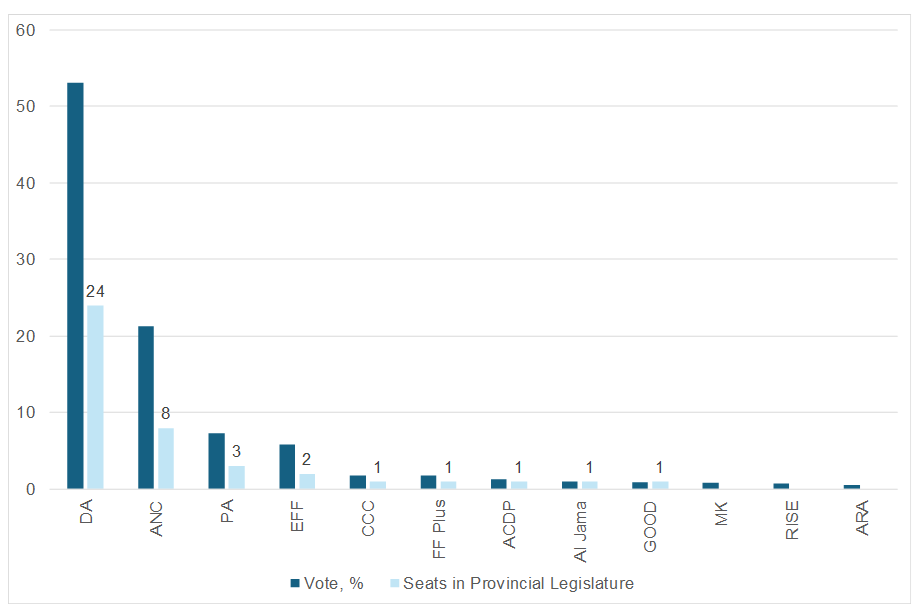

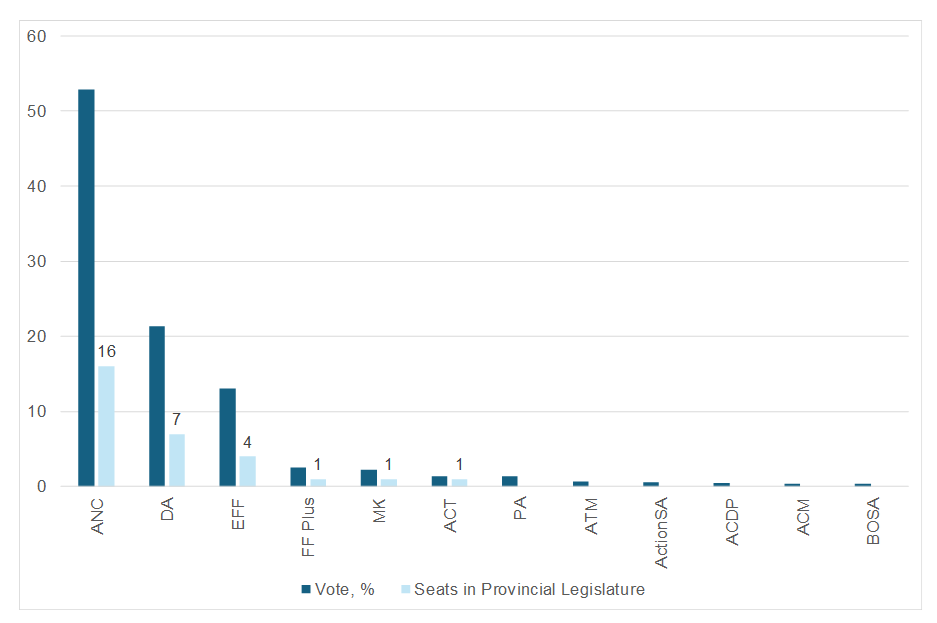

Western Cape: The DA held onto its outright majority in the Western Cape vote, with its support up slightly from 52.41% in 2019 to 53.05%. The ANC’s support in the Western Cape declined, dropping to 21.34% from 31.23% in 2019, but it maintained its position as the official opposition in the provincial legislature. The PA increased its support from 0.03% in 2019 to 7.33%, bumping the EFF (5.88%) to fourth place and becoming the third-largest party in that province.

Figure 5: Votes and seats in the Western Cape Provincial Legislature by the twelve biggest parties

Source: Anchor, IEC

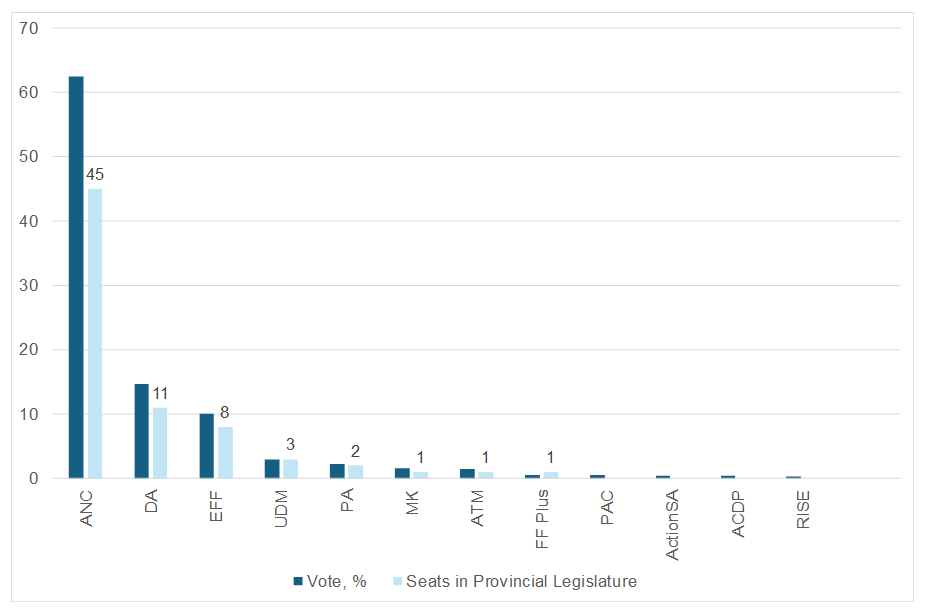

Eastern Cape: The ANC maintained its hold on the Eastern Cape, with 62.47% (vs 69.26% in 2019) of the provincial vote, followed by the DA, which received 14.62% and held its position as the official opposition. The EFF, UDM, and the PA all increased their share of the provincial vote.

Figure 6: Votes and seats in Eastern Cape Provincial Legislature for the twelve biggest parties

Source: Anchor, IEC

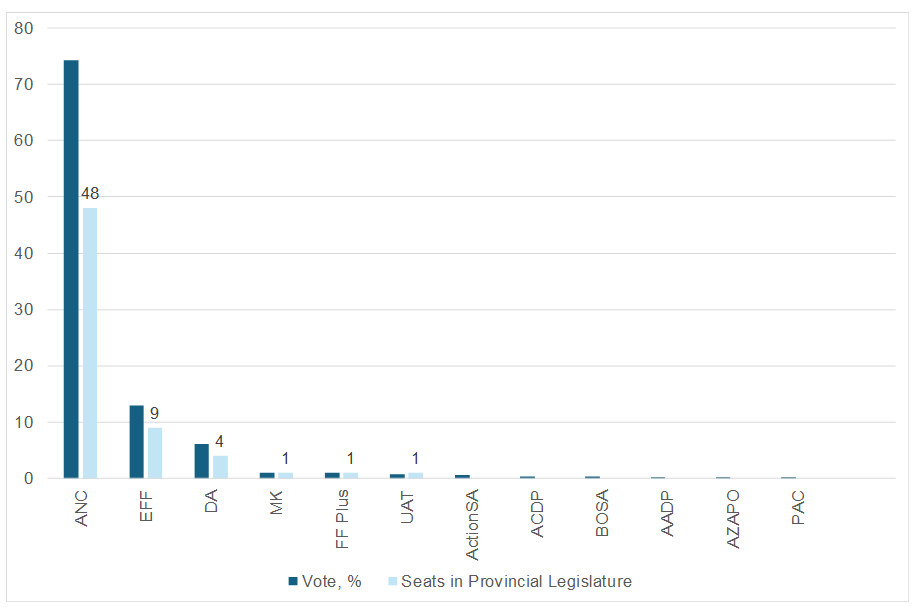

Limpopo: The ANC was also victorious in Limpopo, with 74.23% of the vote (although it was down slightly from the 77.00% it reached in 2019). The EFF was second with 12.97% (Limpopo is Malema’s home province), maintaining its position as the official opposition. The DA was up slightly to 6.08% of the total vote.

Figure 7: Votes and seats in Limpopo Provincial Legislature for the twelve biggest parties

Source: Anchor, IEC

Mpumalanga: The ANC holds a majority of 51.89% in Mpumalanga – down significantly from its 2019 percentage of 72.23%. The M.K. party was in second place with 17.24% of the vote, making it the official opposition. The EFF came third with 12.71% of the vote vs 11.51% in 2019. The DA’s support also increased from 9.12% in 2019 to 11.84% in 2024.

Figure 8: Votes and seats in Mpumalanga Provincial Legislature for the twelve biggest parties

Source: Anchor, IEC

North West: The ANC maintained its outright majority in the North West province, with 58.53% of the vote, but its performance was down from 63.69% in 2019. The official opposition in the province, the EFF, also recorded a dip in support with a 16.40% share of the vote, vs 17.09% in 2019. The DA was third, with 13.48% from 11.31% in 2019.

Figure 9: Votes and seats in North West Provincial Legislature for the twelve biggest parties

Source: Anchor, IEC

Free State: The ANC held onto its majority in the Free State, at 52.88%. This is, however, a double-digit decrease from 2019, when it received 62.94% of the vote. The DA grew from 17.05% in 2019 to 21.31% in 2024. The third-largest party, the EFF, posted marginal growth from 11.6% in 2019 to 13.09%.

Figure 10: Votes and seats in Free State Provincial Legislature for the twelve biggest parties

Source: Anchor, IEC

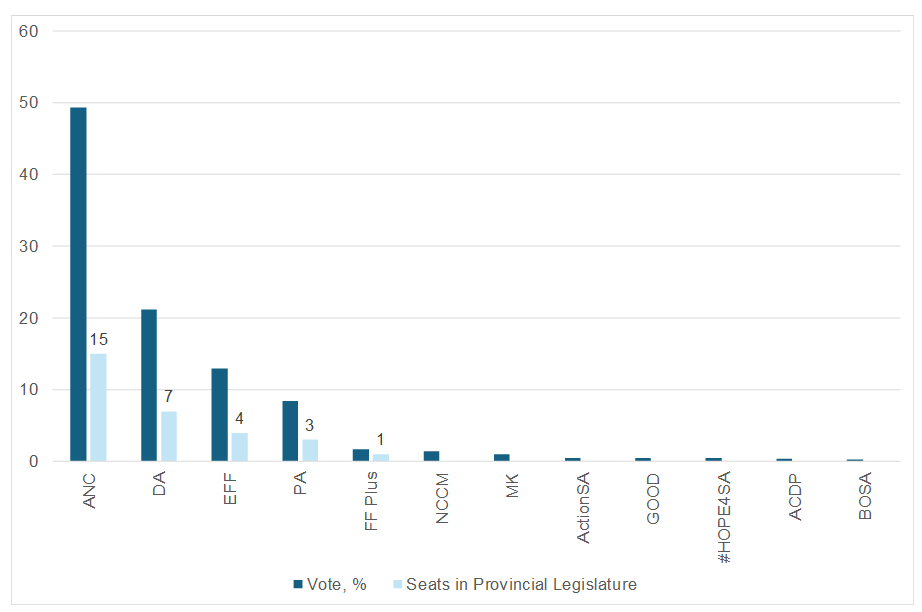

Northern Cape: This province also entered an era of coalitions despite the ANC maintaining its status as the largest party. However, the ANC lost its outright majority, falling just below the 50%-plus one mark at 49.30% (vs 58.23% in 2019). The DA received 21.22% (the official opposition) of the vote (down from 24.33% in 2019), followed by the EFF in third spot with 12.89% (up from 9.71% in 2019). The PA was fourth with 8.36% of the vote vs 0.02% in 2019.

Figure 11: Votes and seats in the Northern Cape Provincial Legislature for the twelve biggest parties

Source: Anchor, IEC

How does the NA look after the 2024 NPEs?

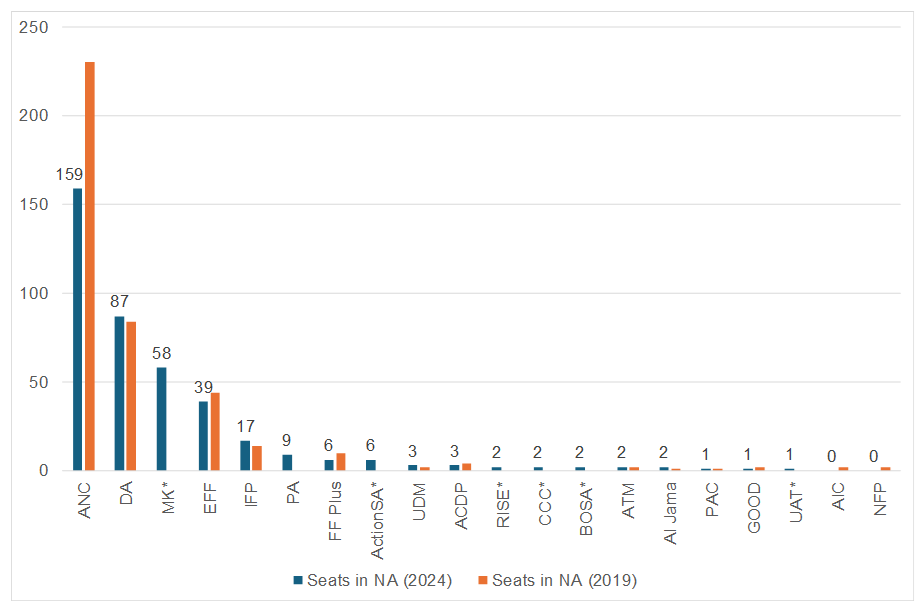

The 2024 NPEs have ushered in a new era in local politics – an era of coalitions. The 29 May election was a watershed moment for the country, with the ANC losing its majority – going from 62% and 57.6% of the vote in 2014 and 2019, respectively, to 40.2% in 2024. Regarding parliamentary seats, there were 400 up for grabs, with the ANC attaining 159 seats in the NA – down 30.9% or 71 seats from its previous 230 seats. We highlight that the top-5 parties (ANC, DA, M.K., EFF, and IFP) together received 360 seats, with the DA and the IFP gaining three seats each and the EFF losing five seats. M.K., which was formed in December 2023, has 58 seats. The NA now has 18 political parties represented. Figure 12 below shows the seats in Parliament that the top 20 political parties received in the 2019 NPEs, compared with the seats for the 2024 NPEs. According to the IEC, this year’s voters roll had 27.8mn registered voters, higher than in 2019 but indicating that 13mn-plus citizens of voting age have chosen not to register for this election. In addition, of the 27.8mn registered voters, only 16.3mn citizens decided to cast their votes.

Figure 12: Votes and seats in the NA by all parties represented, 2019 vs 2024

Source: Anchor, IEC. *Party formed after 2019 NPE.

Note – sorted according to the largest number of NA seats in 2024 by party.

The GNU cabinet announcement

On Sunday evening, 30 June 2024, Ramaphosa announced his Cabinet and deputy minister appointments – two weeks after his re-election as president. The much-delayed announcement came after weeks of tense negotiations between the ANC and the DA and with the other eight parties (although to a much lesser extent) joining the GNU. Balancing the interests of the ANC and maintaining the stability of the GNU was always going to be a delicate task. The Cabinet size was increased slightly from 30 to 32 ministers to include GNU members. Additionally, the number of deputy ministers rose from 36 to 43. Although Ramaphosa had, upon taking office in 2018, promised to reduce the size of his Cabinet, the current political climate has made this challenging.

The executive now consists of the president, the deputy president, 32 ministers, and 43 deputy ministers, with nine parties (ANC, DA, IFP, PA, FF Plus, PAC, GOOD, Al Jama-ah, UDM) represented. In terms of party representation, the ANC has 20 ministers and 33 deputy ministers; the DA has six ministers and six deputy ministers; the IFP has two ministers and two deputy ministers; the Freedom Front Plus, Pan Africanist Congress of Azania, GOOD, and Patriotic Alliance each have one minister; and the United Democratic Movement and Al Jama-ah each have one deputy minister. Notably, the size of the executive in the seventh administration is among the largest globally. SA’s Cabinet is one of the biggest in the world relative to its population size. Even the UK, which boasts one of the largest cabinets in the developed world with 31 ministers, has a smaller executive despite having c. 7mn more people than SA. Germany, Europe’s largest economy, has a population of over 83mn (or 20mn more people than SA) and a Cabinet consisting of just 16 federal ministers and the country’s chancellor.

Figure 13: SA’s new Cabinet

Source: The Presidency, Standard Bank, Anchor

For the formation of the new cabinet to be made possible, the president announced a reconfiguration of several ministries. The former Ministry of Agriculture, Land Reform and Rural Development has been split into two separate ministries, a logical move given the incoherent and misaligned policy that stemmed from the previous ministry as a function of its given structure. Similarly, the ministries of Higher Education, Science and Technology and Justice and Correctional Services have also been divided. The role of the Ministry in the Presidency responsible for Electricity has been expanded slightly to include the broader energy portfolio, while Mineral and Petroleum Resources remain separate. The Department of Public Enterprises has been dissolved, with its functions temporarily moving to the Presidency while a new shareholder model is developed. In the economic cluster, Ministers Enoch Godongwana and Gwede Mantashe return to their Finance and Mineral and Petroleum Resources portfolios, respectively, with other functions within the cluster being reconfigured.

With the Cabinet in place, the next significant challenge for the GNU is establishing a unified policy agenda and programme of action. The president has called for a national dialogue to facilitate this, providing a platform for all parties and other societal stakeholders to discuss the country’s challenges. The president is scheduled to deliver his Opening of Parliament address on 18 July 2024, when he will outline the new administration’s policy priorities.

Whilst it is still too early to draw any feasible conclusions around the effectiveness and efficiency of this new Cabinet, as it stands, the executive is now in a far stronger position to guide the country’s much-desired (and needed) reform course in key areas than it has been in many years. At the time of writing, the new Cabinet, on balance, has been viewed positively by financial markets. Bond investors have been particularly encouraged by the continuity in Finance, which remains committed to fiscal consolidation. The addition of a deputy minister is also viewed as supportive. The portfolios focused on priority areas for the policy reform agenda have seen several improvements and strong appointments, further bolstering our optimism regarding the positive impact of policy reforms supported by Operation Vulindlela, the policy implementation unit of The Presidency and National Treasury. Despite structural reforms’ complex and protracted nature, this continuity and focus on critical areas strengthen our confidence in the ongoing reform efforts.

The election outcome and GNU are steering SA politics toward the centre. The Radical Economic Transformation (RET) faction will be positioned to the left (or far right, depending on your perspective), libertarians to the right, and a pragmatic centre will advocate for social-democratic policies. This marks the most significant political realignment since 1994. Nonetheless, this new Cabinet is by no means a “silver bullet’’ for the domestic economy – the road ahead will be difficult, fraught with the usual politicking and disagreement amongst the various members of the GNU. Up until the announcement of the new Cabinet, investors had become increasingly concerned about the GNU potentially collapsing at its first major challenge. This, in turn, unfortunately, damaged confidence in the GNU itself and in its ability to positively influence SA’s economic and political direction. This moderation or correction in sentiment (think Ramaphoria 2.0) was necessary in some measure. Market sentiment now better reflects the complexities and risks inherent in SA’s evolving, dynamic coalition landscape.

Conclusion

With the GNU and his Cabinet announcement, Ramaphosa’s ‘repair’ scenario should maintain momentum. The president will likely be encouraged to steer ahead unfettered with his anti-corruption and growth agenda, hopefully at a faster pace than during his first term. A GNU that works should, in turn, be positive for the local economy. We are likely to see more inflows of foreign direct investment (FDI) and local investment as GNU policies are clarified, especially the more controversial issues of the past related to expropriation without compensation (EWC), nationalisation of the SA Reserve Bank (SARB), the National Health Insurance (NHI, which was signed into law just before the NPEs), cadre deployment etc. that have held the local economy for ransom. Overall, a more certain future where the balance of power does not rest exclusively with one party (the ANC) should boost JSE-listed equities (bar any external offshore factors) and see the rand strengthening (in June, the rand strengthened by 3.3% against the US dollar).

In terms of exposure to JSE-listed equities, we are overweight SA equities (shorter term). In our view, far more concrete pro-growth reforms are needed to get us to take a longer-term, more bullish view on domestic equities. We recommend exposure to SA Inc. shares, especially quality counters like the SA banks, retailers, and property counters. Nedbank, Absa, FirstRand, Standard Bank, Capitec, Bidvest, Shoprite, Clicks, local industrials and property shares are expected to do well following the NPE results. At the same time, more cyclical counters such as Motus, Imperial and Super Group could also rise materially as expectations of economic growth improve. Conversely, rand-hedge shares are likely to underperform with a strengthening currency.

While we are maintaining meaningful exposure to SA Inc. shares, we, as always, recommend that investors retain a diversified investment portfolio. Investors should be ready to react as the current SA political drama unfolds. SA has serious structural issues, and advances in solving these by implementing concrete steps to address these problems will be extremely beneficial for the country. However, investors should also bear in mind that many factors impacting equity markets are global in nature, and the SA political environment is just one of the many contributors.

Although we continue to have a positive stance on local equities, the future is uncertain. Being nimble is as essential as ever, and we will be quick to act in the best interests of our clients. Investors in the SA market have been on a rollercoaster ride for a while now, with worsening domestic economic data and news and an extremely difficult operating environment for businesses. Hence, sectoral exposure becomes increasingly important, and these could be materially differentiated over the coming months. Nevertheless, if successful, a GNU can lead to more certainty for investors (foreign and local) and more definitive policy measures, which are likely to boost SA’s flagging economy and, importantly, create a positive environment for economic growth that the country so desperately needs.